Policies Toward Pollution

Before 1970 there were no rules governing the amount of sulfur dioxide that power plants in the United States could emit—

In this section we’ll look at the policies governments use to deal with pollution and at how economic analysis has been used to improve those policies.

Environmental Standards

AP® Exam Tip

Environmental standards are generally not the most effective way to combat negative externalities caused by pollution because they are inflexible and don’t allow pollution reduction to occur in the least costly way.

Because the economy, and life itself, depend on a viable environment, external costs that threaten the environment—

Environmental standards are rules that protect the environment by specifying limits for or actions by producers and consumers.

How does a country protect its environment? At present the main policy tools are environmental standards, rules that protect the environment by specifying limits for or actions by producers and consumers. A familiar example is the law that requires almost all vehicles to have catalytic converters, which reduce the emission of chemicals that can cause smog and lead to health problems. Other rules require communities to treat their sewage, factories to limit their pollution emissions, and homes to be painted with lead-

Environmental standards came into widespread use in the 1960s and 1970s with considerable success. Since the United States passed the Clean Air Act in 1970, for example, the emission of air pollutants has fallen by more than a third, even though the population has grown by a third and the size of the economy has more than doubled. Even in Los Angeles, still famous for its smog, the air has improved dramatically: in 1992 ozone levels in the surrounding South Coast Air Basin exceeded federal standards on 143 days; in 2012, on only 12 days.

Despite these successes, economists believe that when regulators can control a polluter’s emissions directly, there are more efficient ways than environmental standards to deal with pollution. By using methods grounded in economic analysis, society can achieve a cleaner environment at lower cost. Most current environmental standards are inflexible and don’t allow reductions in pollution to be achieved at the lowest possible cost. For example, two power plants—

How does economic theory suggest that pollution should be controlled? We’ll examine two approaches: taxes and tradable permits. As we’ll see, either approach can achieve the efficient outcome at the minimum feasible cost.

Emissions Taxes

An emissions tax is a tax that depends on the amount of pollution a firm produces.

One way to deal with pollution directly is to charge polluters an emissions tax. Emissions taxes are taxes that depend on the amount of pollution a firm produces. For example, power plants might be charged $200 for every ton of sulfur dioxide they emit.

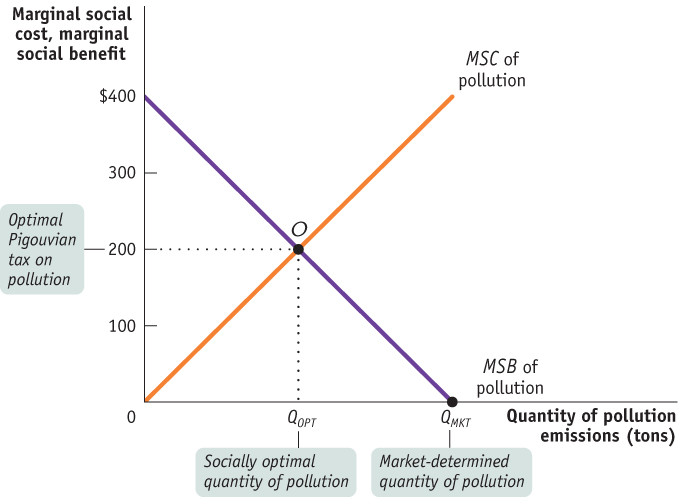

Consider the socially optimal quantity of pollution, QOPT, shown in Figure 75.1. At that quantity of pollution, the marginal social benefit and the marginal social cost of an additional ton of emissions are equal at $200. But in the absence of government intervention, power companies have no incentive to limit pollution to the socially optimal quantity QOPT; instead, they will push pollution up to the quantity QMKT, at which the marginal social benefit is zero.

| Figure 75.1 | In Pursuit of the Efficient Quantity of Pollution |

It’s now easy to see how an emissions tax can solve the problem. If power companies are required to pay a tax of $200 per ton of emissions, they face a marginal cost of $200 per ton and have an incentive to reduce emissions to QOPT, the socially optimal quantity. This illustrates a general result: an emissions tax equal to the marginal social cost at the socially optimal quantity of pollution induces polluters to internalize the externality—

Why is an emissions tax an efficient way (that is, a cost-

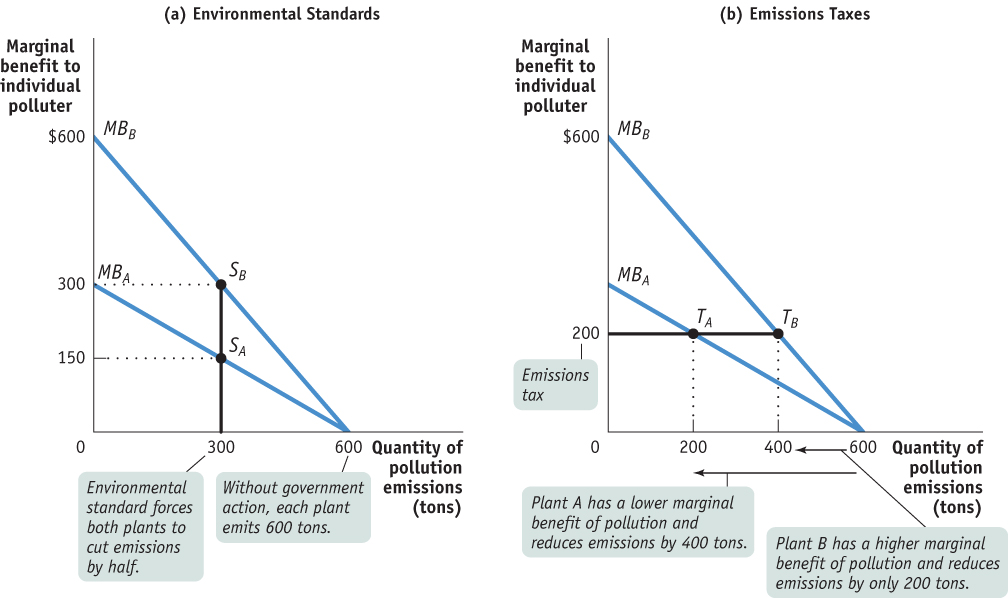

| Figure 75.2 | Environmental Standards Versus Emissions Taxes |

In the absence of government action, polluters will pollute until the marginal social benefit of an additional unit of emissions is equal to zero. Recall that the marginal social benefit of pollution is the cost savings, at the margin, to polluters of an additional unit of pollution. As a result, without government intervention each plant will pollute until its own marginal benefit of pollution is equal to zero. This corresponds to an emissions quantity of 600 tons each for plants A and B—

AP® Exam Tip

Emissions taxes can be more efficient than environmental standards, but it is difficult to determine the level of taxation that leads to the socially optimal level of emissions.

Now suppose that the government decides that overall pollution from this industry should be cut in half, from 1,200 tons to 600 tons. Panel (a) of Figure 75.2 shows how this might be achieved with an environmental standard that requires each plant to cut its emissions in half, from 600 to 300 tons. The standard has the desired effect of reducing overall emissions from 1,200 to 600 tons but accomplishes it in an inefficient way. As you can see from panel (a), the environmental standard leads plant A to produce at point SA, where its marginal benefit of pollution is $150, but plant B produces at point SB, where its marginal benefit of pollution is twice as high, $300.

This difference in marginal benefits between the two plants tells us that the same quantity of pollution can be achieved at lower total cost by allowing plant B to pollute more than 300 tons but inducing plant A to pollute less. In fact, the efficient way to reduce pollution is to ensure that at the industry-

We can see from panel (b) how an emissions tax achieves exactly that result. Suppose both plant A and plant B pay an emissions tax of $200 per ton so that the marginal cost of an additional ton of emissions to each plant is now $200 rather than zero. As a result, plant A produces at TA and plant B produces at TB. So plant A reduces its pollution more than it would under an inflexible environmental standard, cutting its emissions from 600 to 200 tons; meanwhile, plant B reduces its pollution less, going from 600 to 400 tons. In the end, total pollution—

Taxes designed to correct for the effects of external costs are known as Pigouvian taxes.

The term emissions tax may convey the misleading impression that taxes are a solution to only one kind of external cost, pollution. In fact, taxes can be used to discourage any activity that generates negative externalities, such as driving during rush hour or operating a noisy bar in a residential area. In general, taxes designed to correct for the effects of external costs are known as Pigouvian taxes, after the economist A. C. Pigou, who emphasized their usefulness in a classic 1920 book, The Economics of Welfare. Look again at Figure 75.1. In our example, the optimal Pigouvian tax is $200; as you can see from Figure 75.1, this tax causes power plants to internalize the external cost by paying the marginal social cost of pollution at the optimal output quantity, QOPT.

Are there any problems with emissions taxes? The main concern is that in practice government officials usually aren’t sure at what level the tax should be set. If they set the tax too low, there will be too little improvement in the environment; if they set it too high, emissions will be reduced by more than is efficient. This uncertainty cannot be eliminated, but the nature of the risks can be changed by using an alternative strategy, issuing tradable emissions permits.

Tradable Emissions Permits

Tradable emissions permits are licenses to emit limited quantities of pollutants that can be bought and sold by polluters.

Tradable emissions permits are licenses to emit limited quantities of pollutants that can be bought and sold by polluters. They are usually issued to polluting firms according to some formula reflecting their history. For example, each power plant might be issued permits equal to 50% of its emissions before the system went into effect. The more important point, however, is that these permits are tradable. Firms with differing costs of reducing pollution can now engage in mutually beneficial transactions: those that find it easier to reduce pollution will sell some of their permits to those that find it more difficult. In other words, firms will use transactions in permits to reallocate pollution reduction among themselves, so that in the end those with the lowest cost will reduce their pollution the most and those with the highest cost will reduce their pollution the least. Assume that the government issues 300 permits each to plant A and plant B, where one permit allows the emission of one ton of pollution. Under a system of tradable emissions permits, commonly known as a cap and trade program, plant A will find it profitable to sell 100 of its 300 government-

AP® Exam Tip

Cap and trade programs reward producers who reduce emissions with the ability to create revenue for the firm by selling the emissions permits they no longer need.

Just like emissions taxes, tradable permits provide polluters with an incentive to take the marginal social cost of pollution into account. To see why, suppose that the market price of a permit to emit one ton of sulfur dioxide is $200. Then every plant has an incentive to limit its emissions of sulfur dioxide to the point where its marginal benefit of emitting another ton of pollution is $200. This is obvious for plants that buy rights to pollute: if a plant must pay $200 for the right to emit an additional ton of sulfur dioxide, it faces the same incentives as a plant facing an emissions tax of $200 per ton. But it’s equally true for plants that have more permits than they plan to use: by not emitting a ton of sulfur dioxide, a plant frees up a permit that it can sell for $200, so the opportunity cost of a ton of emissions to the plant’s owner is $200.

In short, tradable emissions permits have the same cost-

It’s important to realize that emissions taxes and tradable permits do more than induce polluting industries to reduce their output. Unlike rigid environmental standards, emissions taxes and tradable permits provide incentives to create and use technology that emits less pollution—

The main problem with tradable emissions permits is the flip-

After first relying on environmental standards, the U.S. government has turned to a system of tradable permits to control acid rain. Current proposals would extend the system to other major sources of pollution. And in 2005 the European Union created an emissions-

Cap and Trade

Cap and Trade

The tradable emissions permit systems for both acid rain in the United States and greenhouse gases in the European Union are examples of cap and trade programs: the government sets a cap (a total amount of pollution that can be emitted), issues tradable emissions permits, and enforces a yearly rule that a polluter must hold a number of permits equal to the amount of pollution emitted. The goal is to set the cap low enough to generate environmental benefits and, at the same time, to give polluters flexibility in meeting environmental standards and motivate them to adopt new technologies that will lower the cost of reducing pollution.

In 1994 the United States began a cap and trade system for the sulfur dioxide emissions that cause acid rain by issuing permits to power plants based on their historical consumption of coal. The cap of 8.95 million tons set for 2010 and beyond is about half the level of sulfur dioxide emissions in 1980. Economists who have analyzed the sulfur dioxide cap and trade system point to another reason for its success: it would have been a lot more expensive—

The European Union cap and trade scheme is the world’s only mandatory trading scheme for greenhouse gases and covers all 27 member nations of the European Union. Available data indicate that within the system, 3,093 metric tons of emissions were transacted in 2008 and 6,326 metric tons in 2009, an astonishing increase of 105%. The U.S. Congress was suitably impressed by the results in the European Union to consider an American cap and trade system for greenhouse gases. The American Clean Energy and Security Act of 2009 and the American Power Act of 2010 contained cap and trade provisions, although no such act has become law at the time of this writing.

Despite the promising news from Europe, however, cap and trade systems are not silver bullets for the world’s pollution problems. While they are appropriate for pollution that’s geographically dispersed, like sulfur dioxide and greenhouse gases, they don’t work for pollution that’s localized, like mercury or lead contamination. In addition, the amount of overall reduction in pollution depends on the level of the cap. Under industry pressure, regulators run the risk of issuing too many permits, effectively eliminating the cap. Finally, there must be vigilant monitoring of compliance if the system is to work. Without oversight of how much a polluter is actually emitting, there is no way to know for sure that the rules are being followed.