The Importance of an Efficient Financial System

Financial markets are the markets (banking, stock, and bond) that channel private saving into investment spending.

A well-

The Purpose of the Banking System

Maturity transformation is the conversion of short-

Banks and other depository institutions are financial intermediaries that use liquid assets in the form of deposits to finance the illiquid investments of borrowers. When individuals deposit their savings in a depository institution, they are providing that institution with a short-

A shadow bank is a financial institution that engages in maturity transformation but does not accept deposits.

Other financial institutions also engage in maturity transformation and are part of the banking system. But instead of taking deposits, these institutions—

You may recall seeing the maturity transformation function of financial markets in the circular-

Risks of the Banking System: Banking Crises

Because a well-

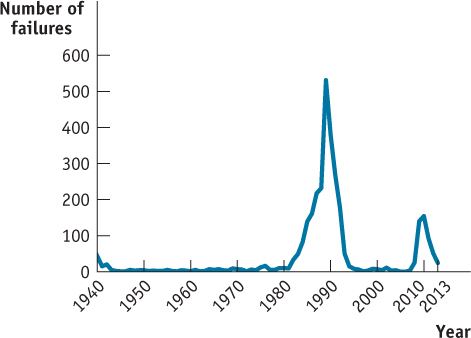

| Figure A.1 | Bank Failures |

Fears of a bank failure can lead many depositors to panic and attempt to withdraw their funds at the same time, a phenomenon described in Module 25 as a bank run. The U.S. economy has experienced two periods of widespread bank failures: the National Banking era and the Great Depression. Table A-1 shows the number of failures that occurred during each of those periods of panic. Current banking regulations protect U.S. depositors and the economy as a whole against bank runs. So modern bank failures generally take place through an orderly process overseen by regulators and often go largely unnoticed by depositors or the general public.

Table A.1Bank Failures during the National Banking Era and the Great Depression

| National Banking era (1883– |

Great Depression (1929– |

||

|---|---|---|---|

| Panic dates | Number of failures | Panic dates | Number of failures |

| September 1873 | 101 | November– |

806 |

| May 1884 | 42 | April– |

573 |

| November 1890 | 18 | September– |

827 |

| May– |

503 | June– |

283 |

| October– |

73* | February– |

Bank Holiday |

| *This underestimates the scale of the 1907 crisis because it doesn’t take into account the role of trusts. | |||

A banking crisis occurs when a large part of the banking system fails.

A banking crisis is much less common, and far more dangerous to the economy, than individual bank failures. A banking crisis occurs when a large part of the banking sector, either depository institutions or shadow banks, fails or threatens to fail. Banking crises that involve large segments of the banking system are comparatively rare. The failure of a large number of banks at the same time can occur either because many institutions make the same mistake or because mistakes from one institution spread to others through links in the financial system.

In an asset bubble, the price of an asset increases to a high level due to expectations of future price gains.

Banking crises often occur as a result of asset bubbles. In an asset bubble, the price of an asset, such as housing, is pushed above a reasonable level by investor expectations of future price increases. Eventually the market runs out of new buyers, the future price increases do not materialize, and the bubble bursts, leading to a decrease in the asset price. People who borrowed money to purchase the asset based on the expectation that prices would rise end up with a large debt when prices decrease instead. For example, individuals who borrow to purchase a house may find themselves “underwater,” meaning that the value of their house is below the amount borrowed to purchase it.

Imagine that you purchase a house valued at $100,000 and pay for it with a $95,000 mortgage and a $5,000 down payment. At first, the value of your house increases, because investors demand more houses to resell at a profit after housing prices increase. In a few years, you have paid off some of your mortgage and you find yourself with a $93,000 mortgage on the same house; however, it is now worth $120,000! You have a more expensive house, but you didn’t have to pay any more for it. You now have $27,000 of equity in your house. A few years later, the price increases that investors counted on for their profits end, so they stop buying houses. Demand in the housing market falls, and, with it, the value of your house. Now you find yourself living in the same house, but it is worth only $80,000. You have paid off more of your mortgage, but you still owe $90,000. You find yourself with a $90,000 mortgage on a house that is now worth $80,000. Your mortgage is underwater. If you stay in your house and continue to make your mortgage payments, being underwater may not make much difference to you. However, if you want or need to sell your house, it can become a real problem. The amount you would receive in the sale would not be enough to pay off your mortgage. You would actually have to pay to sell your house.

The fall in asset prices from a bursting asset bubble exposes financial institutions to losses that can affect confidence in the financial system as a whole. For example, an economic downturn can cause people with underwater mortgages to default on them and abandon their houses rather than paying to sell them. When default rates on mortgages increase, financial institutions experience losses that undermine confidence in the financial system. If the loss in confidence is sufficiently severe, it can lead to an economy-

A financial institution engages in leverage when it finances its investments with borrowed funds.

In an especially severe banking crisis, links in the financial system can increase the odds of even more bank failures. Bank failures can lead to a downward spiral, as each failure increases rumors and fears, thereby creating more bank failures. For example, when financial institutions have engaged in leverage by financing investments with borrowed funds, the institutions that loaned the funds may recall their loans if they are worried about default from failure of the borrowing institution. In addition, when financial institutions are in trouble, they try to reduce debt and raise cash by selling assets. When many banks try to sell similar assets at the same time, prices fall. The decrease in asset prices further hurts the financial position of banks, reinforcing the downward spiral in the banking system. Institutions in financial markets are linked to each other through their mutual dependence on confidence in the banking system and the value of long-

As we have discussed, a well-