How to Become a Millionaire

If you think that the only way to become a millionaire is to win the lottery, think again! Thanks to the power of compounding interest it’s easy—

If you start saving and investing just $250 a month as soon as you get your first job, you could amass a million dollars by the time you’re in your 60s. But if you wait until you’re over 40 years old to get started and invest the same amount, you’d be close to 90 before becoming a millionaire!

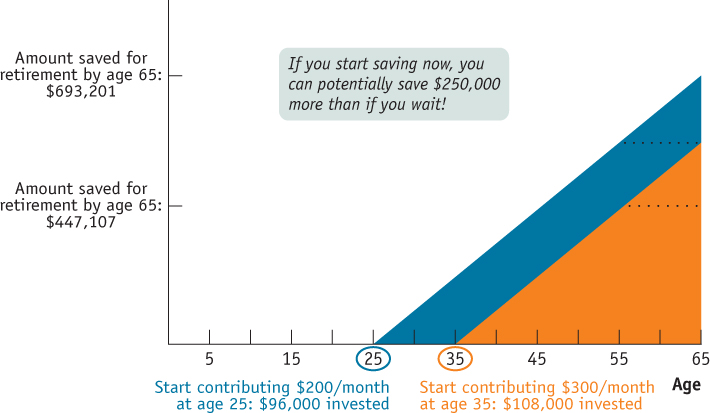

Millionaire Case Study

Steve and Jessica are both 25 years old and work for the same company. They have the same financial goal: to retire at age 65 with one million dollars in savings. Steve starts contributing to his company’s retirement plan right away, but Jessica waits 10 years, until she’s 35 years old, to begin investing. Here’s what happens: Steve can reach his million-

| Figure 1 | Saving To Be a Millionaire |

Table 3At What Age Could You Become a Millionaire?

| Age to begin saving | Amount to save each month (dollars) | Average APR (percent) | Years to become a millionaire | Age you’re a millionaire! |

| 18 | $250 | 7% | 46 | 64 |

| 20 | 250 | 7 | 46 | 66 |

| 25 | 250 | 7 | 45 | 70 |

| 30 | 250 | 7 | 45 | 75 |

| 40 | 250 | 7 | 45 | 86 |

You’ll notice that Steve only had to invest $192,000 over a 40-

The Power of SavingEarly Case Study

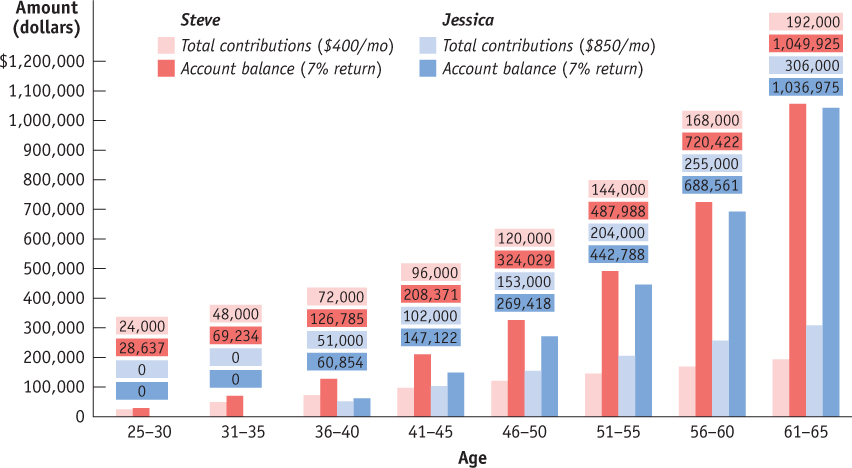

Sarah and Tom are both 25 years old, but they begin saving for retirement at different times. Sarah begins saving $200 per month right away, but Tom decides to buy a new car instead. Tom ends up delaying his retirement savings for 10 years. After his 35th birthday, he finally gets started and saves $300 per month. They both earn an average annual return of 8%.

Here’s what happens: When Tom reaches age 65, he has almost $450,000. But Sarah has amassed close to $700,000. The benefit of choosing to invest earlier, rather than later, really pays off for Sarah because she has $250,000 more than Tom to spend during retirement, as demonstrated in Figure 2 on the next page.

The sooner you start saving and investing, the more you will benefit from the power of compounding interest!

| Figure 2 | Saving for Retirement |