How to Maintain a Checking Account

It’s important to maintain your checking account on a regular basis so you know exactly how much money you have at all times. You should reconcile each monthly statement’s ending balance against your records so you never miss a transaction, such as an unexpected fee. Never write checks or make debit card purchases that exceed your balance.

Using ATM and Debit Cards

An ATM card allows you to use ATMs to make deposits, check your account balance, transfer funds between accounts, and make cash withdrawals 24 hours a day. You typically have to pay a fee for each ATM cash withdrawal at banks other than your own—

What Is a Prepaid Card?

What Is a Prepaid Card?

A prepaid card may look like a debit or credit card, but it isn’t linked to a bank or credit account. Prepaid cards may come loaded with a set value or may require you to add money to the card. The card value goes down each time you make a purchase. Prepaid cards have many fees—

A debit card, also known as a check card, looks like a credit card because it typically has a MasterCard or VISA logo. A debit card can be used just like an ATM card or to make purchases where accepted by merchants. When you use a debit card, money is deducted immediately from your bank account and credited to the merchant’s account. This reduces your available balance.

If you make a debit card purchase for more than your available balance, your transaction will be declined. However, if you enroll in overdraft protection, you authorize your bank to cover your transaction—

Writing Checks

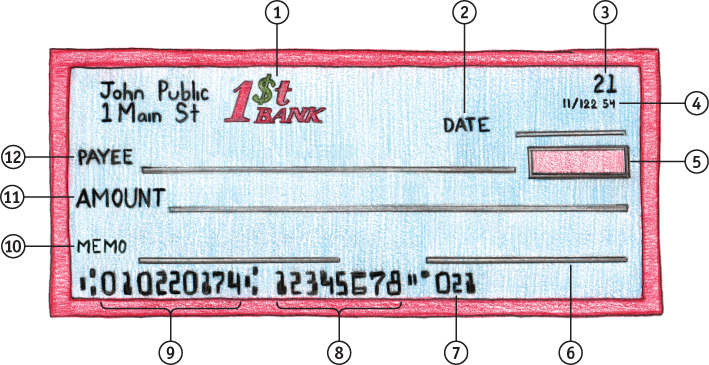

With the popularity of debit cards and online banking, people don’t use paper checks as much anymore. However, if you need to write one, it’s easy to fill in the blanks. Always write clearly using dark ink and never cross out a mistake—

Reconciling Your Checking Account

Each month you’ll receive a statement that shows activity in your account. The statement should include a reconciliation worksheet that you can follow. Reconciling or balancing your account is the process of making sure the information on the bank statement matches your records. Always keep track of your deposits, checks, debit card purchases, ATM withdrawals, and fees. You can use a paper or digital check register. Most financial software programs allow you to automatically download bank and credit card account transactions. Not having to enter each of your transactions manually saves time and makes account reconciliation simple.

Bank name: This may be preprinted on each check.

Date: Enter the month, day, and year.

Check number: If your checks don’t have preprinted numbers, label them with consecutive numbers.

Bank ID numbers: This may be preprinted on each check.

Amount: Enter the amount to pay in figures.

Signature: Sign your name exactly as you signed it on documents you completed when you opened the account.

Check number: This may be preprinted on each check.

Account number: This should be preprinted on each check.

Bank routing number: This should be preprinted on each check to identify your bank’s unique routing number.

Memo: Write a quick note to remind yourself of the reason for the check.

Amount: Enter the amount to pay in words and draw a line over unused space so nothing can be added later.

Payee: Enter the person or company to pay.

Tips for Secure Mobile Banking

Tips for Secure Mobile Banking

Online and mobile banking isn’t particularly risky but it is important to be careful when making online transactions. Use these tips to avoid risk when you’re making purchases or banking using a mobile device:

Use a secured network instead of public Wi-

Fi so your personal information can’t be exposed to a criminal. The web address of a secured network begins with “https” instead of “http.” Guard your mobile device like your wallet, because it may contain information to access your accounts if it were lost or stolen.

Create strong passwords for your devices (to turn them on or wake them from sleep mode) and for your online accounts that are at least 8 characters long and use a combination of letters, numbers, and symbols.

Don’t lend your mobile devices or share your passwords with anyone you don’t know or trust.

Log off from financial accounts and close the browser window or app when you finish using them.

Only download trusted apps from sources like your bank or other legitimate financial institutions.

Delete text messages from your bank once you’ve read them.

Don’t divulge personal information such as your social security number or account number. A financial institution or authorized agency will never ask you for personal information over the Internet or even on the phone.

Overdraft Protection

Having overdraft protection means your debit card purchases and ATM withdrawals will be processed, even if your bank account balance isn’t high enough to cover them. You must give written permission for overdraft protection because using it comes with expensive nonsufficient funds (NSF) fees. However, you can opt out of overdraft protection and avoid the potential charges. This means that if you try to use your debit card and your account balance is too low, you will not be permitted to make the purchase.