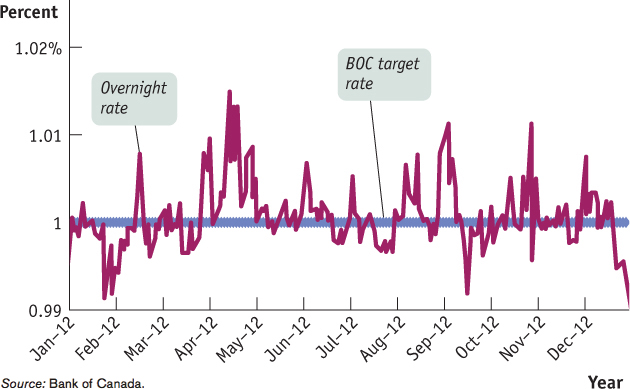

Figure14-12The Bank of Canada Target Rate and the Overnight Rate, January 3 to December 31, 2012 The Bank of Canada uses open-