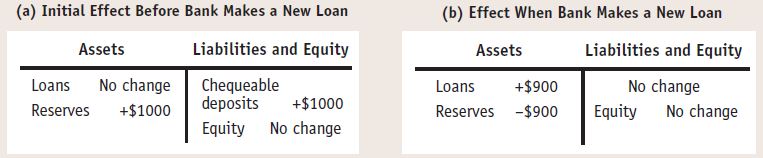

Figure14-5Effect on the Money Supply of Turning Cash into a Deposit at First Street Bank When Silas deposits $1000 (which had been stashed under his bed) into a chequeable bank account, there is initially no effect on the money supply: currency in circulation falls by $1000, but chequeable deposits rise by $1000. The corres- ponding entries on the bank’s T- account, depicted in panel (a), show deposits initially rising by $1000 and the bank’s reserves initially rising by $1000. In the second stage, depicted in panel (b), the bank holds 10% of Silas’s deposit ($100) as reserves and lends out the rest ($900) to Maya. As a result, its reserves fall by $900 and its loans increase by $900. Its liabilities, including Silas’s $1000 deposit, are unchanged. The money supply, the sum of chequeable deposits and currency in circulation, has now increased by $900—the $900 now held by Maya.

[Leave] [Close]