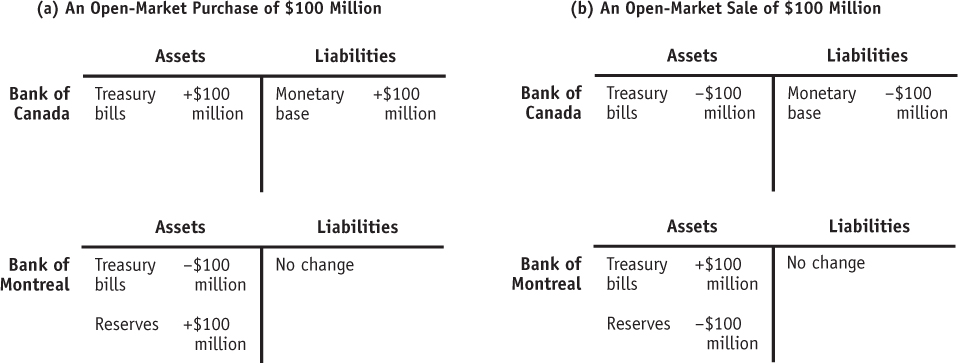

Figure14-9Open-Market Operations by the Bank of Canada In panel (a), the Bank of Canada increases the monetary base by purchasing treasury bills from the Bank of Montreal in an open- market operation. Here, a $100 million purchase of treasury bills by the Bank of Canada is paid for by a $100 million addition to private bank reserves, generating a $100 million increase in the monetary base. This will ultimately lead to an increase in the money supply via the money multiplier as banks lend out some of these new reserves. In panel (b), the Bank of Canada reduces the monetary base by selling treasury bills to the Bank of Montreal in an open- market operation. Here, a $100 million sale of treasury bills by the Bank of Canada leads to a $100 million reduction in private bank reserves, resulting in a $100 million decrease in the monetary base. This will ultimately lead to a fall in the money supply via the money multiplier as banks reduce their loans in response to a fall in their reserves.

[Leave] [Close]