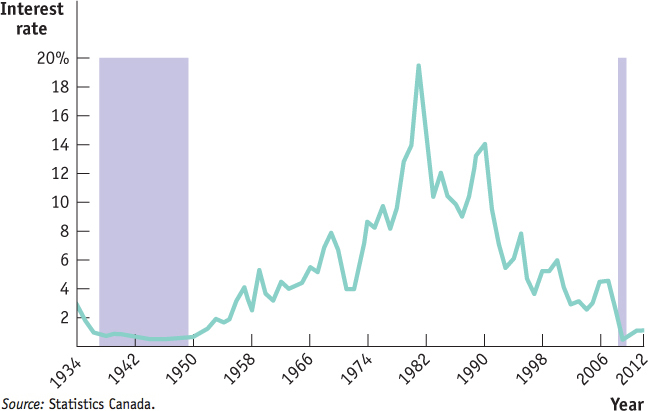

Figure16-13The Zero Bound in Canadian History: 3-Month T- Bill Yields, 1934–2012 This figure shows Canadian short- term interest rates, specifically the interest rate on three- month treasury bills, from 1934 to 2012. As shown by the shaded area on the left, for much of the 1930s and 1940s, interest rates were very close to zero, leaving little room for expansionary monetary policy. After World War II, persistent inflation generally kept interest rates well above zero. However, in late 2008 (the shaded area on the right), in the wake of the worldwide financial crisis caused by the bursting of the U.S. housing bubble, the interest rate on three- month treasury bills was again virtually zero.

Source: Statistics Canada.

Source: Statistics Canada.

[Leave] [Close]