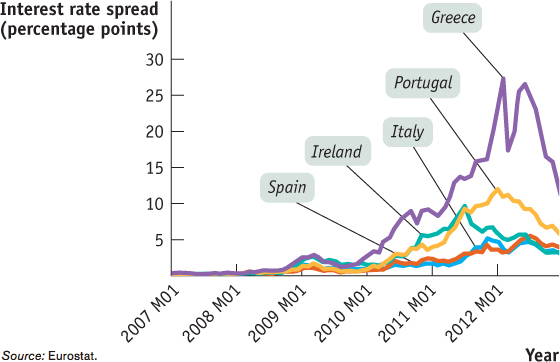

Figure17-8Interest Spread Against German 10-Year Bonds One indicator of investors’ perceptions of the risk of government default is the spread of interest rates on government bonds between that country and a country that is perceived as a safe investment. The spread of the interest rates on 10-year government bonds for Italy, Spain, Ireland, Greece, and Portugal, measured against the interest rate on German bonds, rose as investors’ fears of default by these countries increased. Source: Eurostat.

[Leave] [Close]