The Interest Rate in the Long Run

In the short run an increase in the money supply leads to a fall in the interest rate, and a decrease in the money supply leads to a rise in the interest rate. In the long run, however, changes in the money supply don’t affect the interest rate.

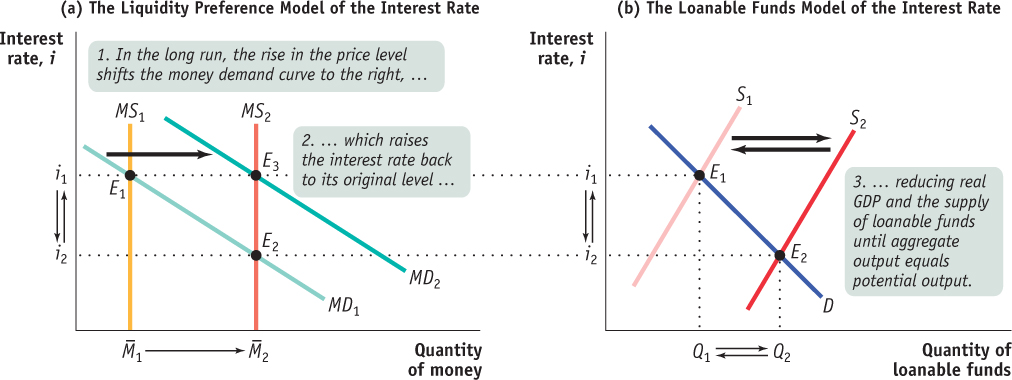

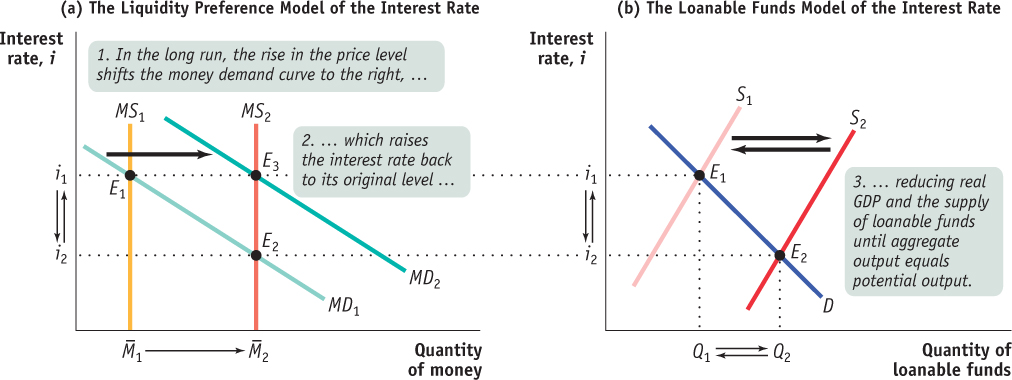

Figure 15A-2 shows why. As in Figure 15A-1, panel (a) shows the liquidity preference model of the interest rate and panel (b) shows the supply and demand for loanable funds. We assume that in both panels the economy is initially at E1, in long-run macroeconomic equilibrium at potential output with the money supply equal to  . The demand curve for loanable funds is D, and the initial supply curve for loanable funds is S1. The initial equilibrium interest rate in both markets is i1.

. The demand curve for loanable funds is D, and the initial supply curve for loanable funds is S1. The initial equilibrium interest rate in both markets is i1.

Now suppose the money supply rises from  to

to  . As in Figure 15A-1, this initially reduces the interest rate to i2. According to the neutrality of money, in the long run the aggregate price level rises by the same proportion as the increase in the money supply. And we also know that a rise in the aggregate price level increases money demand by the same proportion. So in the long run the money demand curve shifts out to MD2 as money demand responds to higher prices, and moving the equilibrium interest rate rises back to its original level, i1.

. As in Figure 15A-1, this initially reduces the interest rate to i2. According to the neutrality of money, in the long run the aggregate price level rises by the same proportion as the increase in the money supply. And we also know that a rise in the aggregate price level increases money demand by the same proportion. So in the long run the money demand curve shifts out to MD2 as money demand responds to higher prices, and moving the equilibrium interest rate rises back to its original level, i1.

Figure15A-2The Long-Run Determination of the Interest Rate Panel (a) shows the liquidity preference model long-run adjustment to an increase in the money supply from  to

to  ; panel (b) shows the corresponding long-run adjustment in the loanable funds market. Both panels start from E1, a long-run macroeconomic equilibrium at potential output and with interest rate i1. As we discussed in Figure 15A-1, the increase in the money supply reduces the interest rate from i1 to i2, increases real GDP, and increases savings in the short run. This is shown in panel (a) and panel (b) as the movement from E1 to E2. In the long run, however, the increase in the money supply raises wages and other nominal prices. This shifts the money demand curve in panel (a) from MD1 to MD2, leading to an increase in the interest rate from i2 to i1 as the economy moves from E2 to E3. The rise in the interest rate causes a fall in real GDP and a fall in savings, shifting the loanable funds supply curve back to S1 from S2 and moving the loanable funds market from E2 back to E1. In the long run, the equilibrium interest rate is determined by matching the supply and demand for loanable funds that arises when real GDP equals potential output.

; panel (b) shows the corresponding long-run adjustment in the loanable funds market. Both panels start from E1, a long-run macroeconomic equilibrium at potential output and with interest rate i1. As we discussed in Figure 15A-1, the increase in the money supply reduces the interest rate from i1 to i2, increases real GDP, and increases savings in the short run. This is shown in panel (a) and panel (b) as the movement from E1 to E2. In the long run, however, the increase in the money supply raises wages and other nominal prices. This shifts the money demand curve in panel (a) from MD1 to MD2, leading to an increase in the interest rate from i2 to i1 as the economy moves from E2 to E3. The rise in the interest rate causes a fall in real GDP and a fall in savings, shifting the loanable funds supply curve back to S1 from S2 and moving the loanable funds market from E2 back to E1. In the long run, the equilibrium interest rate is determined by matching the supply and demand for loanable funds that arises when real GDP equals potential output.

Panel (b) of Figure 15A-2 shows what happens in the market for loanable funds. As before, an increase in the money supply leads to a short-run rise in real GDP, and this shifts the supply of loanable funds rightward from S1 to S2. In the long run, however, real GDP falls back to its original level as wages and other nominal prices rise. As a result, the supply of loanable funds, S, which initially shifted from S1 to S2, shifts back to S1.

In the long run, then, changes in the money supply do not affect the interest rate. So what determines the interest rate in the long run—i1 in Figure 15A-2? The answer is the supply and demand for loanable funds. More specifically, in the long run the equilibrium interest rate matches the supply and demand for loanable funds that arise at potential output.

. The demand curve for loanable funds is D, and the initial supply curve for loanable funds is S1. The initial equilibrium interest rate in both markets is i1.

. The demand curve for loanable funds is D, and the initial supply curve for loanable funds is S1. The initial equilibrium interest rate in both markets is i1. to

to  . As in Figure 15A-1, this initially reduces the interest rate to i2. According to the neutrality of money, in the long run the aggregate price level rises by the same proportion as the increase in the money supply. And we also know that a rise in the aggregate price level increases money demand by the same proportion. So in the long run the money demand curve shifts out to MD2 as money demand responds to higher prices, and moving the equilibrium interest rate rises back to its original level, i1.

. As in Figure 15A-1, this initially reduces the interest rate to i2. According to the neutrality of money, in the long run the aggregate price level rises by the same proportion as the increase in the money supply. And we also know that a rise in the aggregate price level increases money demand by the same proportion. So in the long run the money demand curve shifts out to MD2 as money demand responds to higher prices, and moving the equilibrium interest rate rises back to its original level, i1.

to

to  ; panel (b) shows the corresponding long-

; panel (b) shows the corresponding long-