14.2 The Monetary Role of Banks

Roughly 10% of M1, the narrowest definition of the money supply, consists of currency in circulation—

What Banks Do

As we learned in Chapter 10, a bank is a financial intermediary that uses liquid assets in the form of bank deposits to finance the illiquid investments of borrowers. Banks can create liquidity because it isn’t necessary for a bank to keep all of the funds deposited with it in the form of highly liquid assets. Except in the case of a bank run—which we’ll get to shortly—

Bank reserves are the currency banks hold in their vaults plus their deposits at the Bank of Canada.

Banks can’t, however, lend out all the funds placed in their hands by depositors because they have to satisfy any depositor who wants to withdraw his or her funds. In order to meet these demands, a bank must keep substantial quantities of liquid assets on hand. In the modern Canadian banking system, these assets take the form either of currency in the bank’s vault or deposits held in the bank’s own account at the Bank of Canada. As we’ll see shortly, the latter can be converted into currency more or less instantly. Currency in bank vaults and bank deposits held at the Bank of Canada are called bank reserves. Because bank reserves are in bank vaults and at the Bank of Canada and not held by the public, they are not part of currency in circulation.

A T-account is a tool for analyzing a business’s financial position by showing, in a single table, the business’s assets (on the left) and liabilities (on the right).

To understand the role of banks in determining the money supply, we start by introducing a simple tool for analyzing a bank’s financial position: a T-account. A business’s T-

Figure 14-2 shows the T-

Samantha’s Smoothies is an ordinary, non-

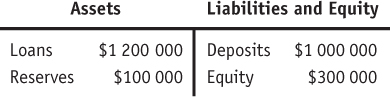

Figure 14-3 shows First Street Bank’s financial position. The loans First Street Bank has made are on the left side because they’re assets: they represent funds that those who have borrowed from the bank are expected to repay. The bank’s only other assets, in this simplified example, are its reserves, which, as we’ve learned, can take the form either of cash in the bank’s vault or deposits at the Bank of Canada. On the right side we show the bank’s liabilities and equity, which in this example consist entirely of deposits made by customers at First Street Bank. These are liabilities because they represent funds that must ultimately be repaid to depositors. First Street Bank’s assets are larger than its liabilities and the difference is shown as an equity of $300 000. That’s the way it’s supposed to be! In fact, we’ll see shortly, if the bank’s equity is low or turns negative, the bank will suffer a bank run.

The reserve ratio is the fraction of bank deposits that a bank holds as reserves.

In this example, First Street Bank holds reserves equal to 10% of its customers’ bank deposits. The fraction of bank deposits that a bank holds as reserves is its reserve ratio. At one time, the Bank of Canada required banks to maintain a certain minimum reserve ratio, but this requirement was phased out between 1992 and 1994. In our current system, banks maintain whatever reserve ratio they think is appropriate to avoid running out of cash. Running out of cash could have serious consequences, such as a banking panic or a bank run.

The Problem of Bank Runs

A bank can lend out most of the funds deposited in its care because in normal times only a small fraction of its depositors want to withdraw their funds on any given day. But what would happen if, for some reason, all or at least a large fraction of its depositors did try to withdraw their funds during a short period of time, such as a couple of days?

If a significant share of its depositors demand their money back at the same time, the bank wouldn’t be able to raise enough cash to meet those demands. The reason is that banks convert most of their depositors’ funds into loans made to borrowers; that’s how banks earn revenue—

Bank loans, however, are illiquid: they can’t easily be converted into cash on short notice. To see why, imagine that First Street Bank has lent $100 000 to Drive-

The upshot is that if a significant number of First Street Bank’s depositors suddenly decided to withdraw their funds, the bank’s efforts to raise the necessary cash quickly would force it to sell off its assets very cheaply. Inevitably, this leads to a bank failure: the bank would be unable to pay off its depositors in full.

What might start this whole process? That is, what might lead First Street Bank’s depositors to rush to pull their money out? A plausible answer is a spreading rumour that the bank is in financial trouble. Even if depositors aren’t sure the rumour is true, they are likely to play it safe and get their money out while they still can. And it gets worse: a depositor who simply thinks that other depositors are going to panic and try to get their money out will realize that this could “break the bank.” So he or she joins the rush. In other words, fear about a bank’s financial condition can be a self-

A bank run is a phenomenon in which many of a bank’s depositors try to withdraw their funds due to fears of a bank failure.

A bank run is a phenomenon in which many of a bank’s depositors try to withdraw their funds due to fears of a bank failure. Moreover, bank runs aren’t bad only for the bank in question and its depositors. Historically, they have often proved contagious, with a run on one bank leading to a loss of faith in other banks, causing additional bank runs. Canada has not had a major bank run in over a century, not even during the Great Depression. (Two small Western banks did collapse in the 1980s, but these failures had little effect on our banking system.) So we will look at the American experience instead. The upcoming Economics in Action describes a wave of bank runs that swept across the United States in the early 1930s. In response to that experience and similar experiences in other countries, Canada and most other modern governments have established a system of bank regulations that protect depositors and reduce the likelihood of bank runs. We’ll encounter bank runs again in Chapter 17, which contains an in-

Bank Regulation

Should you worry about losing money in Canada due to a bank run? No. Not only have banking crises been relatively rare in Canadian history and bank runs practically unheard of, but it looks as though that will continue to be the case. The World Economic Forum ranked our banking system as the safest in the world in recent years as our banks remain financially sound and stable in the wake of the Great Recession of 2008.

The financial viability of the Canadian banking system is maintained, in part, through the Bank of Canada’s willingness to loan money to banks that are fundamentally sound but temporarily lack cash. The federal agency principally responsible for supervising all financial institutions (not just banks) is the Office of the Superintendent of Financial Institutions (OSFI). The OSFI’s role is to administer the regulatory framework—

Deposit insurance guarantees that a bank’s depositors will be paid even if the bank can’t come up with the funds, up to a maximum amount per account.

1. Deposit Insurance Almost every bank in Canada advertises itself as a “member of the CDIC”—the Canadian Deposit Insurance Corporation. The CDIC is a federal crown corporation created in 1967 to contribute to the stability of Canada’s financial system. As we saw in Chapter 10, the CDIC provides deposit insurance, a guarantee by the federal government that depositors will be paid even if the bank can’t come up with the funds, up to a maximum amount per account. As of 2006 the CDIC guarantees the first $100 000 of each account. It’s important to realize that deposit insurance doesn’t just protect depositors if a bank actually fails. The insurance also eliminates the main reason for bank runs: since depositors know their funds are safe even if a bank fails, they have no incentive to rush to pull them out because of a rumour that the bank is in trouble. Since the provision of deposit insurance greatly diminishes the possibility of bank runs, this also allows banks to keep their (voluntary) reserve ratio at low levels.

A government imposes capital requirements on a bank to ensure the bank holds more assets than the value of its deposits, thus reducing the possibility of a run on the bank.

2. Capital Requirements Deposit insurance does protect us against bank runs, but it also creates a big problem. Since depositors are protected from loss, they have no incentive to monitor their bank’s financial health. And, bank owners have an incentive to engage in overly risky investments, such as making speculative loans at high interest. If all goes well, the bank owners make large profits; if things go badly, the federal deposit insurance covers the losses. To reduce the incentive for taking excessive risk, there are capital requirements. Regulators require that bank owners hold substantially more assets than the value of their banks’ deposits. That way, a bank will still have assets greater than its deposits even if some of its loans go bad, and losses will be paid by the bank owners’ assets instead of by the government. The excess of a bank’s assets over its bank deposits and other liabilities is called the bank’s capital (or equity of the bank). In Canada, the OSFI requires that a bank’s capital is at least a minimum percentage of its assets. Figure 14-3 showed that First Street Bank has an equity of $300 000, or about 23% of its assets. In practice, a bank’s capital would be a smaller percent. The OSFI also recognizes that some capital is riskier than others, so it divides the banks’ capital into two categories: Tier 1 and Tier 2, with Tier 1 being the safer of the two. As of January 1, 2013, the minimum Tier 1 capital ratio was 4.5% and at least 3.5% of the Tier 1 capital ratio had to be in the form of common equity Tier 1 (CET1) capital. It is planned that by 2015, the percentage of capital requirements in the form of Tier 1 capital and CET1 capital will gradually increase to 6% and 4.5%, respectively. By increasing the Tier 1 capital ratio, the OSFI is increasing the financial strength of our banks. Assets that can be used to satisfy the capital requirements include common shareholders’ equity and non-

Reserve requirements are rules set by the central bank that determine the minimum reserve ratio for banks.

3. Reserve Ratios At one time, the federal government required Canada’s chartered banks to hold a minimum part of their assets as non-

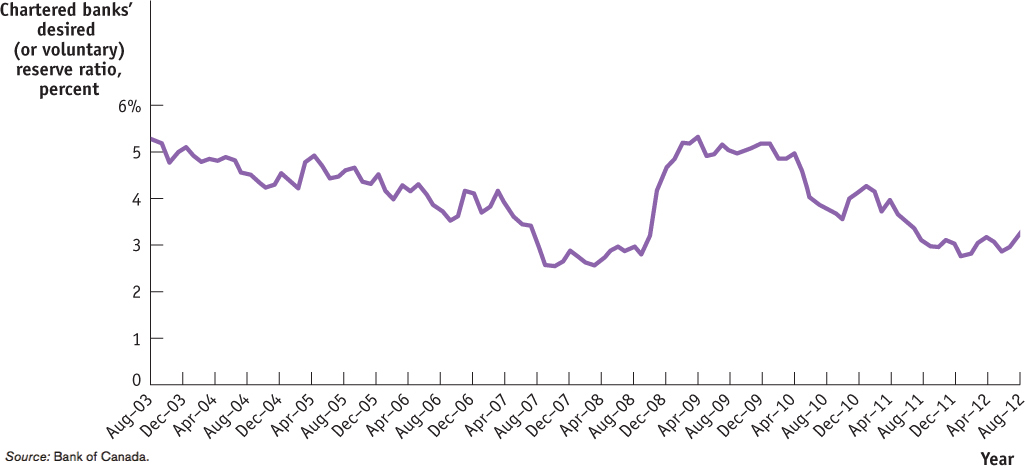

Although Canadian banks are no longer required to hold minimum reserves, they continue to do so voluntarily. In general, chartered banks maintain a relatively low desired (or voluntary) reserve ratio. Figure 14-4 shows Canada’s chartered banks’ desired reserves ratios from August 2003 to August 2012. Before 2008, the ratio was about 3.9%, but during the recession of 2008–2009 it rose to 4.9%. At this time, some of the largest financial institutions in the U.S. faced liquidity and solvency problems, so Canada’s chartered banks chose to hold more reserves to protect themselves against unexpected large withdrawals of deposits that might lead to a run. Once the recession was over, the reserve ratios fell back to pre-

The desired (or voluntary) reserve ratio is the fraction of deposits that banks want to hold as reserves.

IT’S A WONDERFUL BANKING SYSTEM

Next Christmastime, it’s a sure thing that at least one TV channel will show the 1946 film It’s a Wonderful Life, featuring Jimmy Stewart as George Bailey, a small-

When the movie was made, such scenes were still fresh in Americans’ memories. There was a wave of bank runs in late 1930, a second wave in the spring of 1931, and a third wave in early 1933. By the end, more than a third of the nation’s banks had failed. To bring the panic to an end, on March 6, 1933, the newly inaugurated president, Franklin Delano Roosevelt, declared a national “bank holiday,” closing all banks for a week to give bank regulators time to close unhealthy banks and certify healthy ones.

Since then, regulation has protected the United States and other wealthy countries against most bank runs. In fact, the scene in It’s a Wonderful Life was already out of date when the movie was made. But recent decades have seen several waves of bank runs in developing countries. For example, bank runs played a role in an economic crisis that swept Southeast Asia in 1997–1998 and in the severe economic crisis in Argentina that began in late 2001. And as will be explained in Chapter 17, a “panic” with strong resemblance to a wave of bank runs swept world financial markets in 2008.

Notice that we said “most bank runs.” There are some limits on deposit insurance; in particular, in the United States currently only the first US$250 000 of an individual depositor’s funds in an insured bank is covered. As a result, there can still be a run on a bank perceived as troubled. In fact, that’s exactly what happened to IndyMac in July 2008, a Pasadena-

Quick Review

A T-account is used to analyze a bank’s financial position. A bank holds bank reserves—currency in its vaults plus deposits held in its account at the Bank of Canada. The reserve ratio is the ratio of bank reserves to customers’ bank deposits.

Because bank loans are illiquid, but a bank is obligated to return depositors’ funds on demand, bank runs are a potential problem. Canada has not had a serious problem with bank runs, but other countries have. For example, thousands of U.S. banks failed in the 1930s, owing to massive runs. And although Canada did phase out mandatory reserve requirements in 1994, policy-

makers took other measures to strengthen our banking sector and to avoid potential bank runs. These measures include providing deposit insurance to depositors and imposing minimum capital requirements. While Canadian chartered banks are not required to hold reserves at the Bank of Canada, they do maintain a desired (or voluntary) reserve ratio.

Check Your Understanding 14-2

CHECK YOUR UNDERSTANDING 14-2

Suppose you are a depositor at First Street Bank. You hear a rumour that the bank has suffered serious losses on its loans. Every depositor knows that the rumour isn’t true, but each thinks that most other depositors believe the rumour. Why, in the absence of deposit insurance, could this lead to a bank run? How does deposit insurance change the situation?

Even though you know that the rumour about the bank is not true, you are concerned about other depositors pulling their money out of the bank. And you know that if enough other depositors pull their money out, the bank will fail. In that case, it is rational for you to pull your money out before the bank fails. All depositors will think like this, so even if they all know that the rumour is false, they may still rationally pull their money out, leading to a bank run. Deposit insurance leads depositors to worry less about the possibility of a bank run. Even if a bank fails, the CDIC will currently pay each depositor up to $100 000 per account. This will make you much less likely to pull your money out in response to a rumour. Since other depositors will think the same, there will be no bank run.

A con artist has a great idea: he’ll open a bank without investing any capital and lend all the deposits at high interest rates to real estate developers. If the real estate market booms, the loans will be repaid and he’ll make high profits. If the real estate market goes bust, the loans won’t be repaid and the bank will fail—

but he will not lose any of his own wealth. How would modern bank regulation frustrate his scheme?

The aspects of modern bank regulation that would frustrate this scheme are capital requirements and reserve requirements. (In Canada, banks are no longer required to hold minimum reserves). Capital requirements mean that a bank has to have a certain amount of capital—