Monetary Policy

15

What the money demand curve is

Why the liquidity preference model determines the interest rate in the short run

How the Bank of Canada implements monetary policy, moving the interest rate to affect aggregate output

Why monetary policy is the main tool for stabilizing the economic conditions in a market economy

How the behaviour of the Bank of Canada compares to that of other central banks

Why economists believe in monetary neutrality—that monetary policy affects only the price level, not aggregate output, in the long run

Why the Bank of Canada pursues inflation targeting and how it uses monetary policy to achieve the inflation target

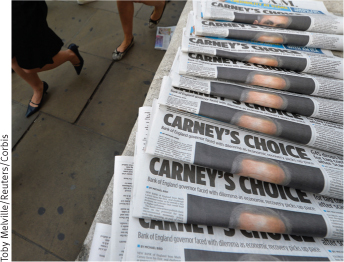

2012 CANADIAN OF THE YEAR

MARK CARNEY, FROM TINY FORT Smith, Northwest Territories, is a popular and well-

On November 26, 2012, Carney made news headlines by announcing he would leave his current position, as governor of the Bank of Canada, so that he could cross the Atlantic to head up the Bank of England in July 2013. Why does this man generate so much news? The answer is that the governor of the Bank of Canada (BOC) is the head of the organization that controls our country’s monetary policy.

Since becoming the governor of the BOC in 2008, Mark Carney has gained considerable popularity and respect, and has been called one of the best central bankers of our generation. His performance at the BOC was so spectacular and impeccable that the Bank of England offered him its top position. The British chancellor of the exchequer, George Osborne, said about Carney, “he is quite simply the best, most experienced and most qualified person in the world to be the next Governor of the Bank of England.” In accepting the offer, Carney becomes the first non-

People sometimes say that the governor of the Bank of Canada decides how much money to print. That’s not quite true: for one thing, the Bank of Canada doesn’t literally print money, and beyond that, monetary decisions are actually made by a governing council rather than by one person. But as we learned in Chapter 14, the BOC can use actions such as open-

And these actions matter a lot. Of the three recessions Canada has experienced in the past 50 years, two of them were in part either worsened or caused by the decisions of the Bank of Canada to tighten monetary policy conditions to fight inflation.1 Yet, in a number of other cases, the BOC has played a key role in fighting slumps and promoting recovery. The 2008–2009 recession put the BOC at centre stage. Carney’s aggressive response to the recession, which, as we saw in Chapter 14, included lowering its key policy interest rate to a historically low level, inspired both praise (for alleviating the length and the magnitude of the recession) and condemnation (for further inflating the housing bubble and increasing household debt).

In this chapter we’ll learn how monetary policy works, that is, how actions by the Bank of Canada can have a powerful effect on the nation’s economy. We’ll start by looking at the demand for money from households and firms. Then we’ll see how the BOC’s ability to change the supply of money allows it to move interest rates in the short run and thereby affect real GDP. We’ll look at Canada’s monetary policy in practice and compare it to the monetary policies of other central banks. We’ll conclude by examining the long-