4.2 Price Ceilings

Rent control continues to exist to some degree in Ontario, Quebec, British Columbia, Manitoba, and Prince Edward Island. In Ontario, units that were built, or came onto the rental market, after November 1, 1991 are exempt from rent controls. Units on the market prior to that date tend to have rent increases tied to the growth rate of the consumer price index (CPI), but when a tenant moves out rents can be raised to whatever the market will bear. (The Ontario New Democratic Party (NDP) has recently proposed extending rent controls to all Ontario rental apartments.) In Quebec, rent increases are tied to landlord cost increases, but can be lower than these cost increases and, as in Ontario, once a unit is vacated the landlord has some ability to raise the rent. In British Columbia, provincial government guidelines cap rent increases at the growth rate of the CPI plus 2%. In Manitoba, the government mandated maximum rent increase is usually set below the growth rate of the CPI. In Prince Edward Island, maximum percent rent increases are set annually based on the type of dwelling.

Aside from rent control, there are other price ceilings in Canada today. Currently some form of price controls exists in Canadian markets for pharmaceutical drugs, electricity, basic residential phone services, and agricultural commodities (such as eggs, chicken, turkey, and dairy). In the case of patented prescription drug prices, there are two stages of control. The federal government grants monopoly rights to the patent holder to be the sole supplier of a particular drug formulation, but in return the government imposes a price ceiling that the supplier can’t exceed. The provincial and territorial governments, which are responsible for delivering health care services within their borders, use their market power as purchasers of large volumes of drugs to negotiate prices that can be well below the ceiling price.

At times, price ceilings have been widespread. They are typically imposed during crises—

Rent control in New York City is a legacy of World War II: it was imposed because wartime production produced an economic boom, which increased demand for apartments at a time when the labour and raw materials that might have been used to build them were being used to fight the war instead. Although most price controls were removed soon after the war ended, New York’s rent limits were retained and gradually extended to buildings not previously covered, leading to some very strange situations.

You can rent a one-

Aside from producing great deals for some renters, however, what are the broader consequences of New York’s rent-

Modelling a Price Ceiling

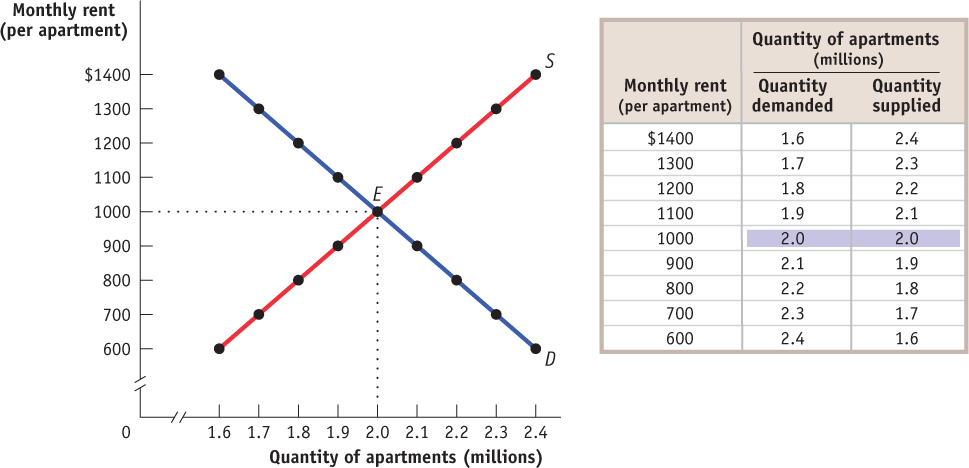

To see what can go wrong when a government imposes a price ceiling on an efficient market, consider Figure 4-1, which shows a simplified model of the market for apartments in a large city. For the sake of simplicity, we imagine that all apartments are exactly the same and so would rent for the same price in an unregulated market. The table in the figure shows the demand and supply schedules; the demand and supply curves are shown on the left. We show the quantity of apartments on the horizontal axis and the monthly rent per apartment on the vertical axis. You can see that in an unregulated market the equilibrium would be at point E: two million apartments would be rented for $1000 each per month.

Now suppose that the government imposes a price ceiling, limiting rents to a price below the equilibrium price—

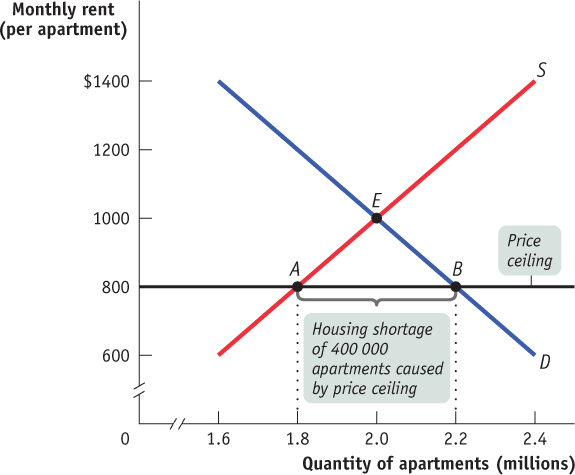

Figure 4-2 shows the effect of the price ceiling, represented by the line at $800. At the enforced rental rate of $800, landlords have less incentive to offer apartments, so they won’t be willing to supply as many as they would at the equilibrium rate of $1000. They will choose point A on the supply curve, offering only 1.8 million apartments for rent, 200 000 fewer than in the unregulated market. At the same time, more people will want to rent apartments at a price of $800 than at the equilibrium price of $1000; as shown at point B on the demand curve, at a monthly rent of $800 the quantity of apartments demanded rises to 2.2 million, 200 000 more than in the unregulated market and 400 000 more than are actually available at the price of $800. So there is now a persistent shortage of rental housing: at that price, 400 000 more people want to rent than are able to find apartments.

Do price ceilings always cause shortages? No. If a price ceiling is set at or above the equilibrium price, it won’t have any effect. Suppose that the equilibrium rental rate on apartments is $1000 per month and the city government sets a ceiling of $1200. Who cares? In this case, the price ceiling won’t be binding—it won’t actually constrain market behaviour—

Over time, a binding price ceiling can become non-

How a Price Ceiling Causes Inefficiency

The housing shortage shown in Figure 4-2 is not merely annoying: like any shortage induced by price controls, it can be seriously harmful because it leads to inefficiency. In other words, there are gains from trade that go unrealized. Rent control, like all price ceilings, creates inefficiency in at least four distinct ways. It reduces the quantity of apartments rented below the efficient level; it typically leads to misallocation of apartments among would-

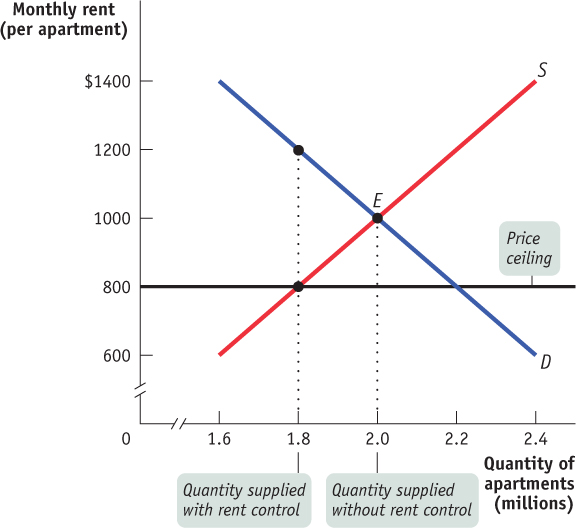

Inefficiently Low Quantity Because a price ceiling reduces the price of a good, it reduces the quantity that sellers are willing to supply. Buyers can’t buy more units of a good than sellers are willing to sell; a price ceiling reduces the quantity of a good bought and sold below the competitive or free market equilibrium quantity. Because rent control reduces the number of apartments supplied, it reduces the number of apartments rented, too. The low quantity sold is an inefficiency due to missed opportunities: price ceilings prevent mutually beneficial transactions from occurring, transactions that would benefit both buyers and sellers. Figure 4-3 shows the inefficiently low quantity of apartments supplied with rent control.

Inefficient Allocation to Consumers Rent control doesn’t just lead to too few apartments being available. It can also lead to misallocation of the apartments that are available: people who badly need a place to live may not be able to find an apartment, but some apartments may be occupied by people with much less urgent needs.

In the case shown in Figure 4-2, 2.2 million people would like to rent an apartment at $800 per month, but only 1.8 million apartments are available. Of those 2.2 million who are seeking an apartment, some want an apartment badly and are willing to pay a high price to get one. Others have a less urgent need and are only willing to pay a low price, perhaps because they have alternative housing. An efficient allocation of apartments would reflect these differences: people who really want an apartment will get one and people who aren’t all that anxious to find an apartment won’t. In an inefficient distribution of apartments, the opposite will happen: some people who are not especially anxious to find an apartment will get one and others who are very anxious to find an apartment won’t.

Price ceilings often lead to inefficiency in the form of inefficient allocation to consumers: some people who want the good badly and are willing to pay a high price don’t get it, and some who care relatively little about the good and are only willing to pay a low price do get it.

Because people usually get apartments through luck or personal connections under rent control, it generally results in an inefficient allocation to consumers of the few apartments available.

To see the inefficiency involved, consider the plight of the Lees, a family with young children who have no alternative housing and would be willing to pay up to $1500 for an apartment—

This allocation of apartments—

Generally, if people who really want apartments could sublet them from people who are less eager to live there, both those who gain apartments and those who trade their occupancy for money would be better off. However, subletting is illegal under rent control because it would occur at prices above the price ceiling.

The fact that subletting is illegal doesn’t mean it never happens. In fact, chasing down illegal subletting is a major business for New York City private investigators. An article in the New York Times described how private investigators use hidden cameras and other tricks to prove that the legal tenants in rent-

Price ceilings typically lead to inefficiency in the form of wasted resources: people expend money, effort, and time to cope with the shortages caused by the price ceiling.

Wasted Resources Another reason a price ceiling causes inefficiency is that it leads to wasted resources: people expend money, effort, and time to cope with the shortages caused by the price ceiling. Back in 1979, U.S. price controls on gasoline led to shortages that forced millions of Americans to spend hours each week waiting in lines at gas stations. The opportunity cost of the time spent in gas lines—

Because of rent control, the Lees will spend all their spare time for several months searching for an apartment, time they would rather spend working or in family activities. That is, there is an opportunity cost to the Lee’s prolonged search for an apartment—

Indeed, in the long run, the time and resources that families like the Lees spend searching for a rental apartment might increase as the city population rises. All other things equal, a larger population increases the demand for rental apartments. Following an increase in demand, the shortage of units grows and renters find it more difficult to locate a rental unit. Also, it is often the case that the demand and supply curves become flatter over time (i.e., for a given price change, the quantity supplied or demanded changes more in the long run than it does in the short run). So in the long run, the size of a shortage caused by a price ceiling tends to grow—

Price ceilings often lead to inefficiency in that the goods being offered are of inefficiently low quality: sellers offer low-

Inefficiently Low Quality Yet another way a price ceiling creates inefficiency is by causing goods to be of inefficiently low quality. Inefficiently low quality means that sellers offer low-

Again, consider rent control. Landlords have no incentive to provide better conditions because they cannot raise rents to cover their repair costs but are able to find tenants easily. In many cases, tenants would be willing to pay much more for improved conditions than it would cost for the landlord to provide them—

RENT CONTROL, MUMBAI STYLE

How far would you go to keep a rent-

Not all of these tenants were desperately poor and lacking other options. One rent-

Although it’s a world away, the dynamics of rent control in Mumbai are a lot like those in North America (although Mumbai has clearly had a much more extreme experience). Rent control began in Mumbai in 1947, to address a critical shortage of housing caused by a flood of refugees fleeing conflict between Hindus and Muslims. Clearly intended to be a temporary measure, it was so popular politically that it has been extended 20 times and now applies to about 60% of the buildings in the city’s centre. Tenants pass apartments on to their heirs or sell the right to occupy to other tenants.

Despite the fact that home prices in Mumbai surged more than 60% between 2007 and 2010, landlords of rent-

This whole situation is a missed opportunity—

A black market is a market in which goods or services are bought and sold illegally—

Black Markets And that leads us to a last aspect of price ceilings: the incentive they provide for illegal activities, specifically the emergence of black markets. We have already described one kind of black market activity—

What’s wrong with black markets? In general, it’s a bad thing if people break any law, because it encourages disrespect for the law in general. Worse yet, in this case illegal activity worsens the position of those who are honest. If the Lees are scrupulous about upholding the rent-

So Why Are There Price Ceilings?

We have seen three common results of price ceilings:

A persistent shortage of the good

Inefficiency arising from this persistent shortage in the form of inefficiently low quantity transacted, inefficient allocation of the good to consumers, resources wasted in searching for the good, and the inefficiently low quality of the good offered for sale

The emergence of illegal, black market activity

Given these unpleasant consequences, why do governments still sometimes impose price ceilings? Why does rent control, in particular, persist in New York City?

One answer is that although price ceilings may have adverse effects, they do benefit some people. In practice, New York’s rent-control rules—which are more complex than our simple model—hurt most residents but give a small minority of renters much cheaper housing than they would get in an unregulated market. And those who benefit from the controls are typically better organized and more vocal than those who are harmed by them.

Also, when price ceilings have been in effect for a long time, buyers may not have a realistic idea of what would happen without them. In our previous example, the rental rate in an unregulated market (Figure 4-1) would be only 25% higher than in the regulated market (Figure 4-2): $1000 instead of $800. But how would renters know that? Indeed, they might have heard about black market transactions at much higher prices—the Lees or some other family paying George $1200 or more—and would not realize that these black market prices are much higher than the price that would prevail in a fully unregulated market.

A last answer is that government officials often do not understand supply and demand analysis! It is a great mistake to suppose that economic policies in the real world are always sensible or well informed.

HUNGER AND PRICE CONTROLS IN VENEZUELA

Something was rotten in the state of Venezuela—specifically, more than 25 000 tonnes of decomposing food in Puerto Cabello in June 2010. The discovery was particularly embarrassing for the then president Hugo Chávez. He was elected in 1998 on a platform denouncing the country’s economic elite and promising policies favouring the poor and working classes. Among those policies were price controls on basic foodstuffs, which led to shortages that began in 2003 and had become severe by 2006.

Generous government policies led to higher spending by consumers and sharply rising prices for goods that weren’t subject to price controls or which were bought on the black market. The result was a big increase in the demand for price-controlled goods. But a sharp decline in the value of Venezuela’s currency led to a fall in imports of foreign food, and the result was empty shelves in the nation’s food stores.

As the shortages persisted and inflation of food prices worsened (in the first five months of 2010, the prices of food and drink rose by 21%), Chávez declared “economic war” on the private sector, berating it for “hoarding and smuggling.” The government expropriated farms, food manufacturers, and grocery stores, creating in their place government-owned ones, which were corrupt and inefficient—it was the government-owned food-distribution company, PDVAL, that left tens of thousands of tonnes of food to rot in Venezuelan ports. Food production also fell; Venezuela must now import 70% of its food.

Not surprisingly, the shelves have been far more bare in government-run grocery stores than in those still in private hands. The food shortages were so severe that they greatly diminished Chávez’s popularity among working-class Venezuelans and halted his expropriation plans. As an old Venezuelan saying has it, “Love with hunger doesn’t last.”

After the death of President Chávez in March 2013, Vice President Nicolás Maduro took over before a special presidential election was held in April to pick a new president. Maduro promised to continue Chávez’s socialist revolution while the opposition candidate, Henrique Capriles, argued that this regime had put the country on the road to ruin. During the campaign, shortages of food and basic household items hit a five-year high, and partly as a result, Maduro barely won the election. In May 2013, monthly inflation peaked at 6.1%, the highest monthly rate in 17 years, contributing to an annual rate of inflation of 35.1%. However, according to the central bank, in May shortages were becoming less severe, as the “shortage indicator,” which measures the difficulties to obtain a basket of basic goods, declined from 21.3% to 20.5%. Regrettably, some of the decline in shortages may actually be due to the widespread existence and use of black markets. The inefficiency of the price ceilings continues.

Quick Review

Price controls take the form of either legal maximum prices—price ceilings—or legal minimum prices—price floors.

A price ceiling below the equilibrium price benefits successful buyers but causes predictable adverse effects such as persistent short-ages, which lead to four types of inefficiencies: inefficiently low quantity transacted, inefficient allocation to consumers, wasted resources, and inefficiently low quality.

Price ceilings also lead to black markets, as buyers and sellers attempt to evade the price controls.

Check Your Understanding 4-1

CHECK YOUR UNDERSTANDING 4-1

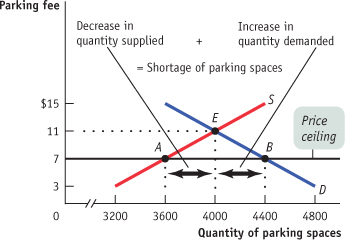

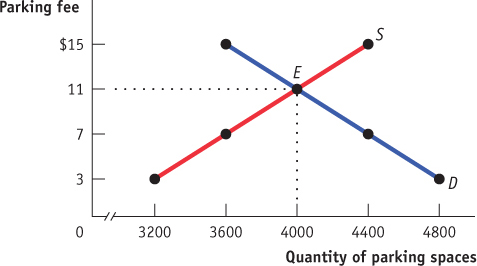

On game nights, homeowners near Middletown Arena used to rent parking spaces in their driveways to fans at a going rate of $11. A new town ordinance now sets a maximum parking fee of $7. Use the accompanying supply and demand diagram to explain how each of the following corresponds to a price-ceiling concept.

Some homeowners now think it’s not worth the hassle to rent out spaces.

Some fans who used to carpool to the game now drive alone.

Some fans can’t find parking and leave without seeing the game.

Explain how each of the following adverse effects arises from the price ceiling.

Some fans now arrive several hours early to find parking.

Friends of homeowners near the stadium regularly attend games, even if they aren’t big fans. But some serious fans have given up because of the parking situation.

Some homeowners rent spaces for more than $7 but pretend that the buyers are non-paying friends or family.

Fewer homeowners are willing to rent out their driveways because the price ceiling has reduced the payment they receive. This is an example of a fall in price leading to a fall in the quantity supplied. It is shown in the accompanying diagram by the movement from point E to point A along the supply curve, a reduction in quantity of 400 parking spaces.

The quantity demanded increases by 400 spaces as the price decreases. At a lower price, more fans are willing to drive and rent a parking space. It is shown in the diagram by the movement from point E to point B along the demand curve.

Under a price ceiling, the quantity demanded exceeds the quantity supplied; as a result, shortages arise.

In this case, there will be a shortage of 800 parking spaces. It is shown by the horizontal distance between points A and B.

Price ceilings result in wasted resources. The additional time fans spend to guarantee a parking space is wasted time.

Price ceilings lead to inefficient allocation of a good—here, the parking spaces—to consumers.

Price ceilings lead to black markets.

True or false? Explain your answer. A price ceiling below the equilibrium price of an otherwise efficient market does the following:

Increases quantity supplied

Makes some people who want to consume the good worse off

Makes all producers worse off

False. By lowering the price that producers receive, a price ceiling leads to a decrease in the quantity supplied.

True. A price ceiling leads to a lower quantity supplied than in an efficient, unregulated market. As a result, some people who would have been willing to pay the market price, and so would have gotten the good in an unregulated market, are unable to obtain it when a price ceiling is imposed.

True. Those producers who still sell the product now receive less for it and are therefore worse off. Other producers will no longer find it worthwhile to sell the product at all and so will also be made worse off.