22-1

An Expanded Circula

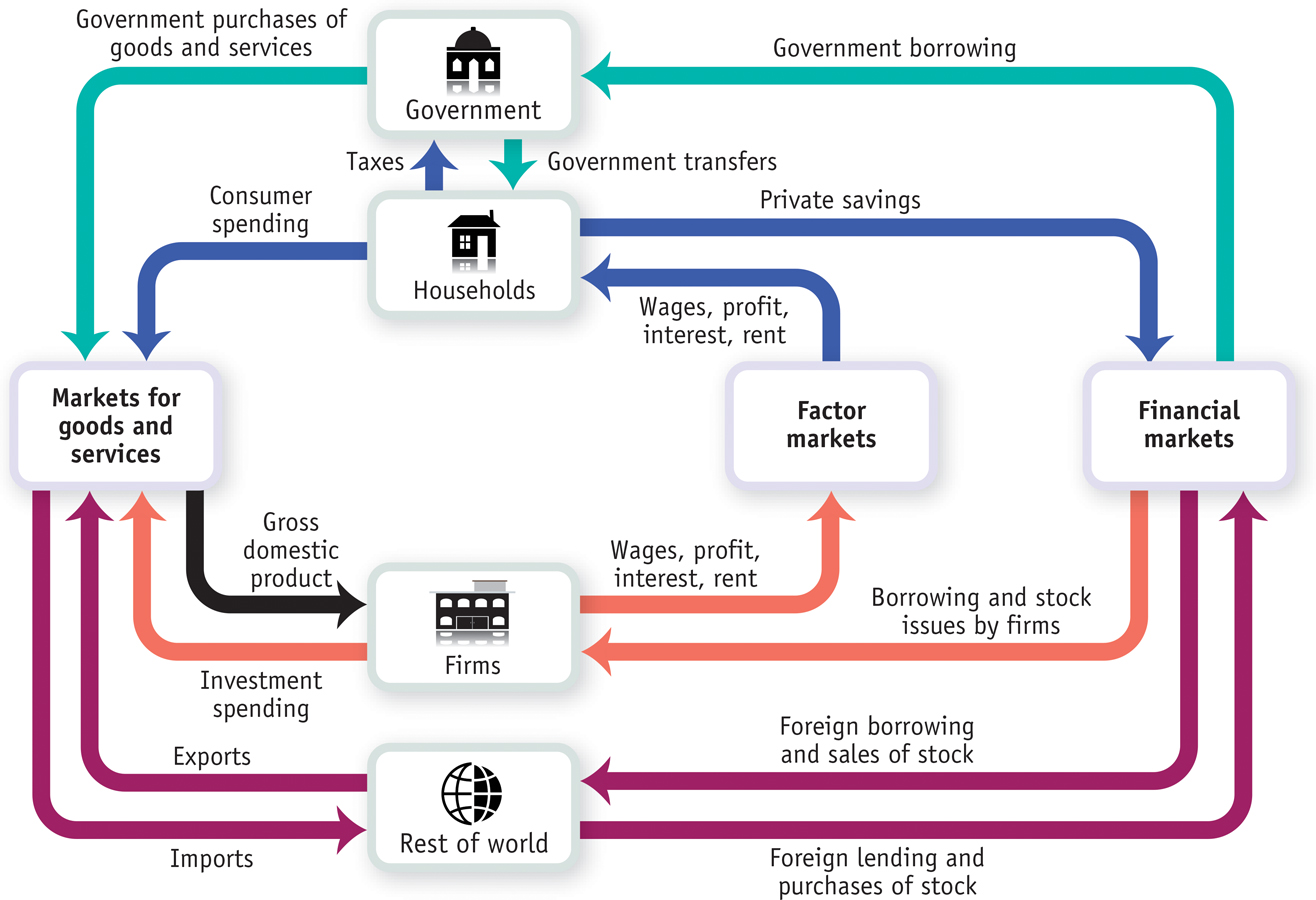

An Expanded Circular- Flow Diagram: The Flows of Money Through the Economy A circular flow of funds connects the four sectors of the economy— households, firms, government, and the rest of the world— via three types of markets: the factor markets, the markets for goods and services, and the financial markets. Funds flow from firms to households in the form of wages, profit, interest, and rent through the factor markets. After paying taxes to the government and receiving government transfers, households allocate the remaining income— disposable income— s— that is, the gross domestic product of the economy.