25-7

The Fisher Effect

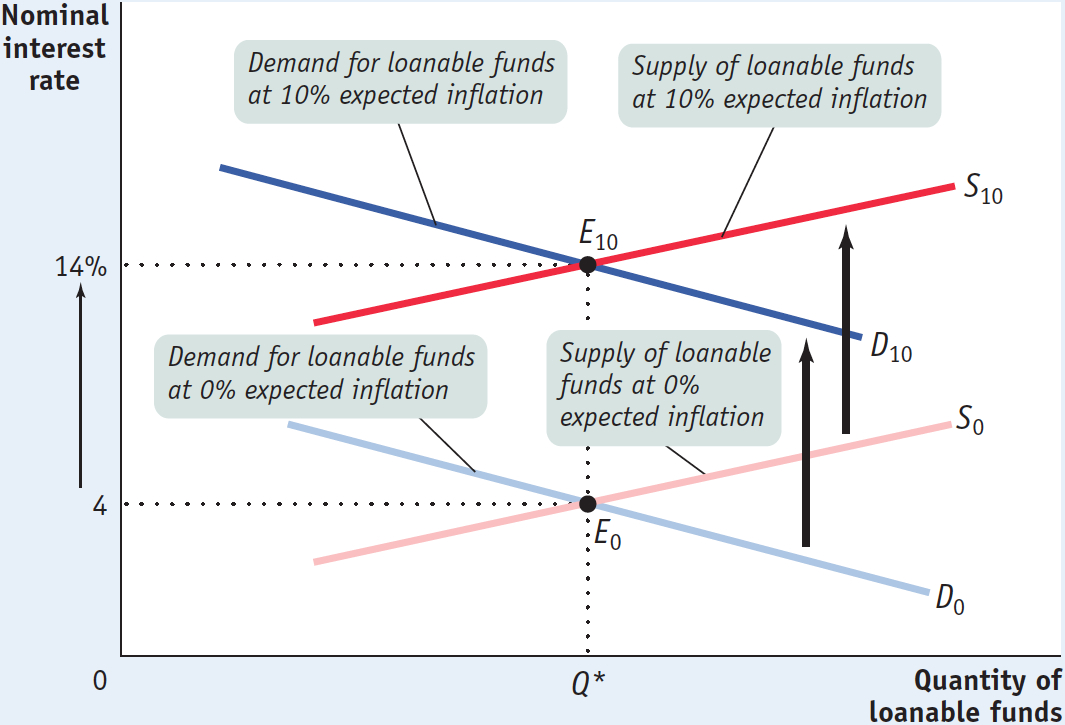

The Fisher Effect D0 and S0 are the demand and supply curves for loanable funds when the expected future inflation rate is 0%. At an expected inflation rate of 0%, the equilibrium nominal interest rate is 4%. An increase in expected future inflation pushes both the demand and supply curves upward by 1 percentage point for every percentage point increase in expected future inflation. D10 and S10 are the demand and supply curves for loanable funds when the expected future inflation rate is 10%. The 10 percentage point increase in expected future inflation raises the equilibrium nominal interest rate to 14%. The expected real interest rate remains at 4%, and the equilibrium quantity of loanable funds also remains unchanged.