31-12

The NAIRU and the Lon

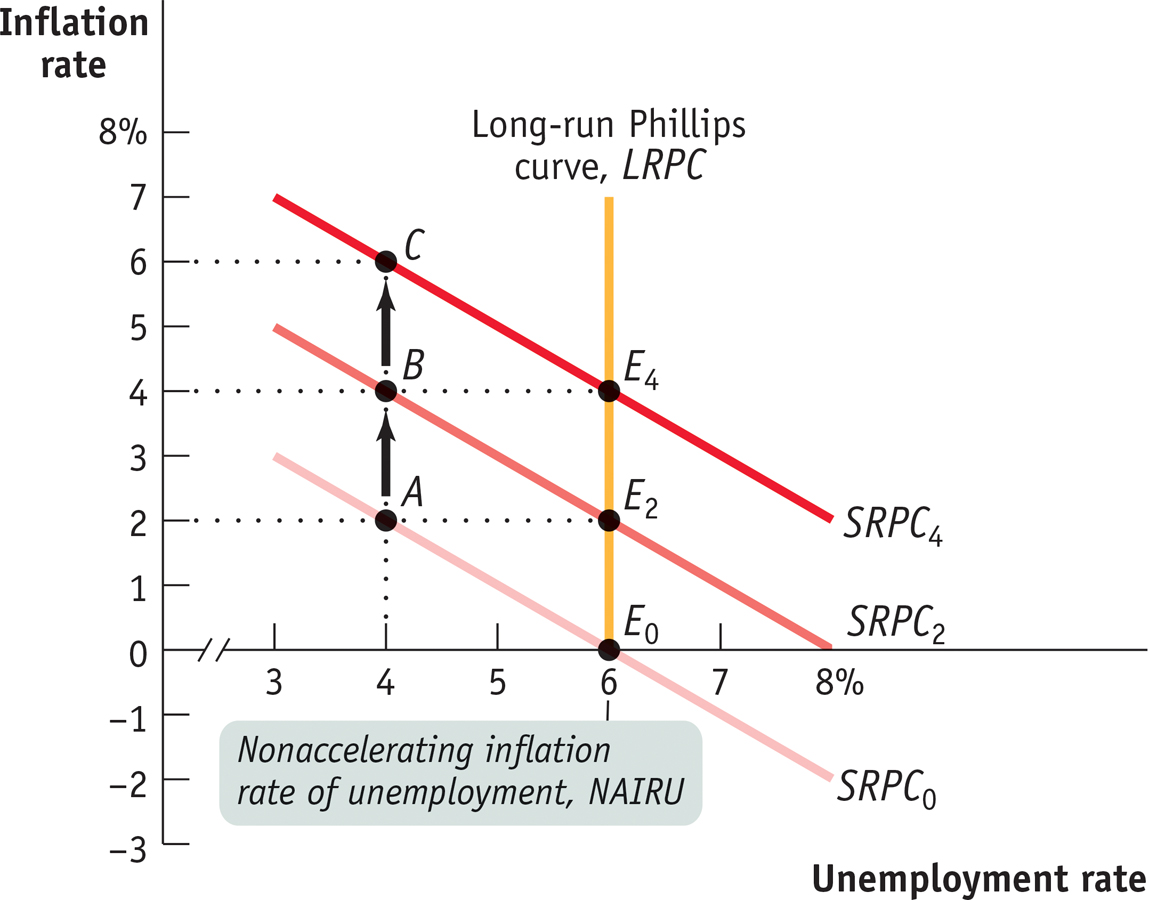

The NAIRU and the Long- Run Phillips Curve SRPC0 is the short- run Phillips curve when the expected inflation rate is 0%. At a 4% unemployment rate, the economy is at point A with an actual inflation rate of 2%. The higher inflation rate will be incorporated into expectations, and the SRPC will shift upward to SRPC2. If policy makers act to keep the unemployment rate at 4%, the economy will be at B and the actual inflation rate will rise to 4%. Inflationary expectations will be revised upward again, and SRPC will shift to SRPC4. At a 4% unemployment rate, the economy will be at C and the actual inflation rate will rise to 6%. Here, an unemployment rate of 6% is the NAIRU, or nonaccelerating inflation rate of unemployment. As long as unemployment is at the NAIRU, the actual inflation rate will match expectations and remain constant. An unemployment rate below 6% requires ever- accelerating inflation. The long- run Phillips curve, LRPC, which passes through E0, E2, and E4, is vertical: no long- run trade- off between unemployment and inflation exists.