International Imbalances

An open economy is an economy that trades goods and services with other countries.

The United States is an open economy: an economy that trades goods and services with other countries. There have been times when that trade was more or less balanced—

A country runs a trade deficit when the value of goods and services bought from foreigners is more than the value of goods and services it sells to them. It runs a trade surplus when the value of goods and services bought from foreigners is less than the value of the goods and services it sells to them.

In 2013, the United States ran a big trade deficit—

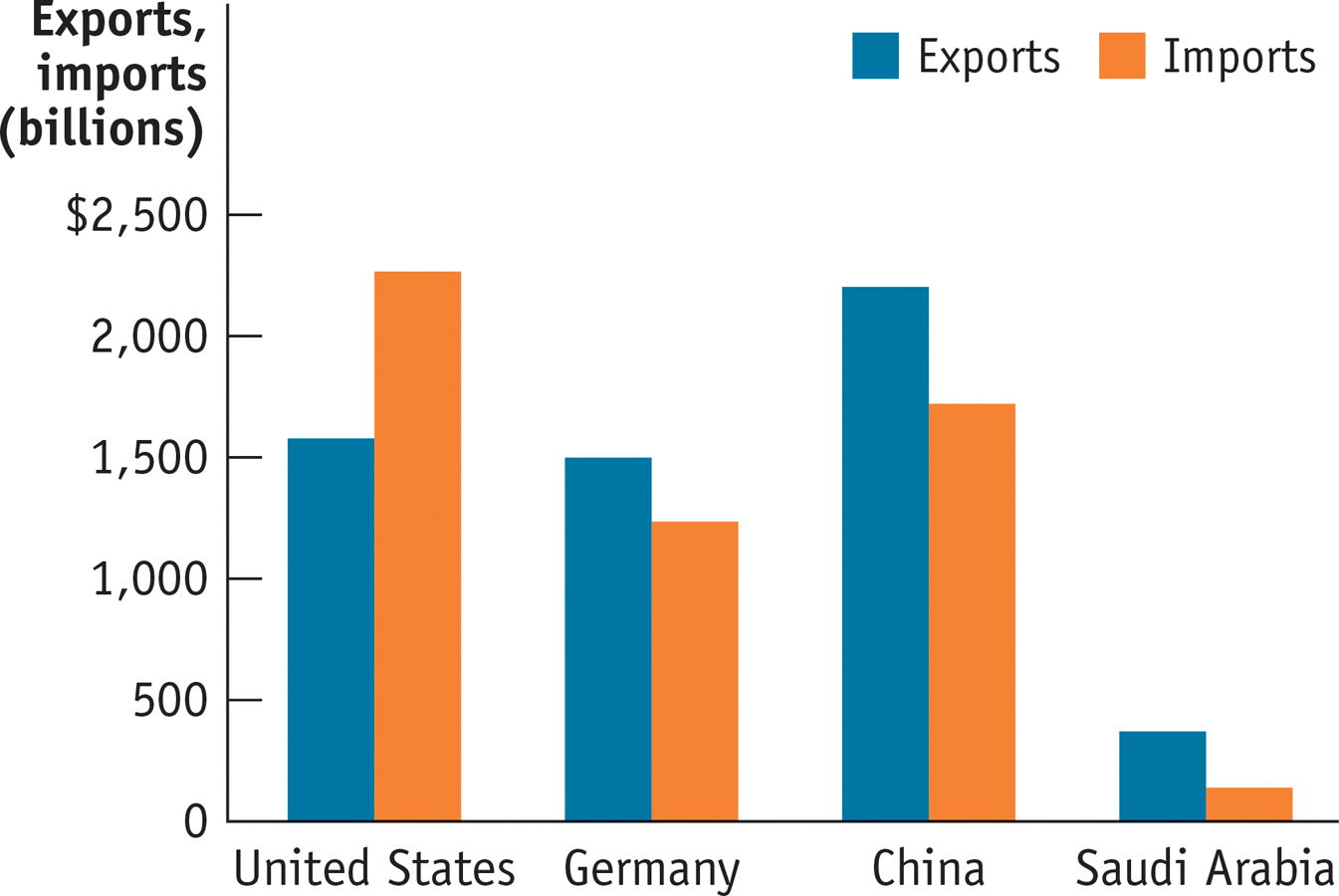

Figure 21-9 shows the exports and imports of goods for several important economies in 2013. As you can see, the United States imported much more than it exported, but Germany, China, and Saudi Arabia did the reverse: they each ran a trade surplus. A country runs a trade surplus when the value of the goods and services it buys from the rest of the world is smaller than the value of the goods and services it sells abroad. Was America’s trade deficit a sign that something was wrong with our economy—

21-9

Unbalanced Trade

No, not really. Trade deficits and their opposite, trade surpluses, are macroeconomic phenomena. They’re the result of situations in which the whole is very different from the sum of its parts. You might think that countries with highly productive workers or widely desired products and services to sell run trade surpluses but countries with unproductive workers or poor-

Microeconomic analysis tells us why countries trade but not why they run trade surpluses or deficits. In Chapter 2 we learned that international trade is the result of comparative advantage: countries export goods they’re relatively good at producing and import goods they’re not as good at producing. That’s why the United States exports wheat and imports coffee. One important thing the concept of comparative advantage doesn’t explain, however, is why the value of a country’s imports is sometimes much larger than the value of its exports, or vice versa.

So what does determine whether a country runs a trade surplus or a trade deficit? In Chapter 34 we’ll learn the surprising answer: the determinants of the overall balance between exports and imports lie in decisions about savings and investment spending—

!worldview! ECONOMICS in Action: Spain’s Costly Surplus

Spain’s Costly Surplus

In 1999 Spain took a momentous step: it gave up its national currency, the peseta, in order to adopt the euro, a shared currency intended to promote closer economic and political union among the nations of Europe. How did this affect Spain’s international trade?

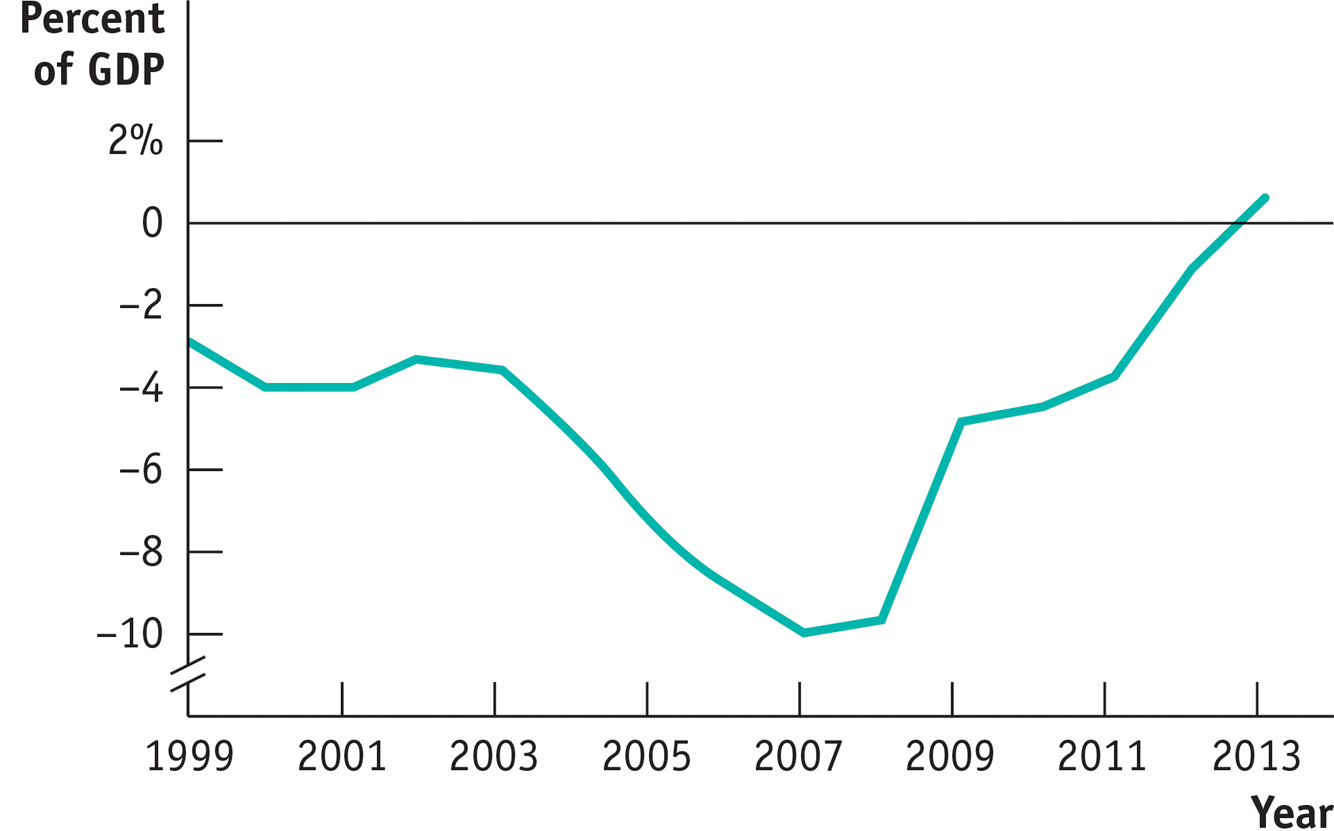

21-10

Spain’s Current Account Balance, 1999–

Figure 21-10 shows Spain’s current account balance—

Did this mean that Spain’s economy was doing badly in the mid-

Unfortunately, this epic boom eventually turned into an epic bust, and the inflows of foreign capital into Spain dried up. One consequence was that Spain could no longer run large trade deficits, and by 2013 was forced into running a surplus. Another consequence was a severe recession, leading to very high unemployment—

Quick Review

Comparative advantage can explain why an open economy exports some goods and services and imports others, but it can’t explain why a country imports more than it exports, or vice versa.

Trade deficits and trade surpluses are macroeconomic phenomena, determined by decisions about investment spending and savings.

21-5

Question 6.8

Which of the following reflect comparative advantage, and which reflect macroeconomic forces?

Thanks to the development of huge oil sands in the province of Alberta, Canada has become an exporter of oil and an importer of manufactured goods.

This situation reflects comparative advantage. Canada’s comparative advantage results from the development of oil—Canada now has an abundance of oil.

Like many consumer goods, the Apple iPod is assembled in China, although many of the components are made in other countries.

This situation reflects comparative advantage. China’s comparative advantage results from an abundance of labor; China is good at labor-intensive activities such as assembly.

Since 2002, Germany has been running huge trade surpluses, exporting much more than it imports.

This situation reflects macroeconomic forces. Germany has been running a huge trade surplus because of underlying decisions regarding savings and investment spending with its savings in excess of its investment spending.

The United States, which had roughly balanced trade in the early 1990s, began running large trade deficits later in the decade, as the technology boom took off.

This situation reflects macroeconomic forces. The United States was able to begin running a large trade deficit because the technology boom made the United States an attractive place to invest, with investment spending outstripping U.S. savings.

Solutions appear at back of book.

The Business Cycle and the Decline of Montgomery Ward

Before there was the internet, there was mail order, and for rural and small-

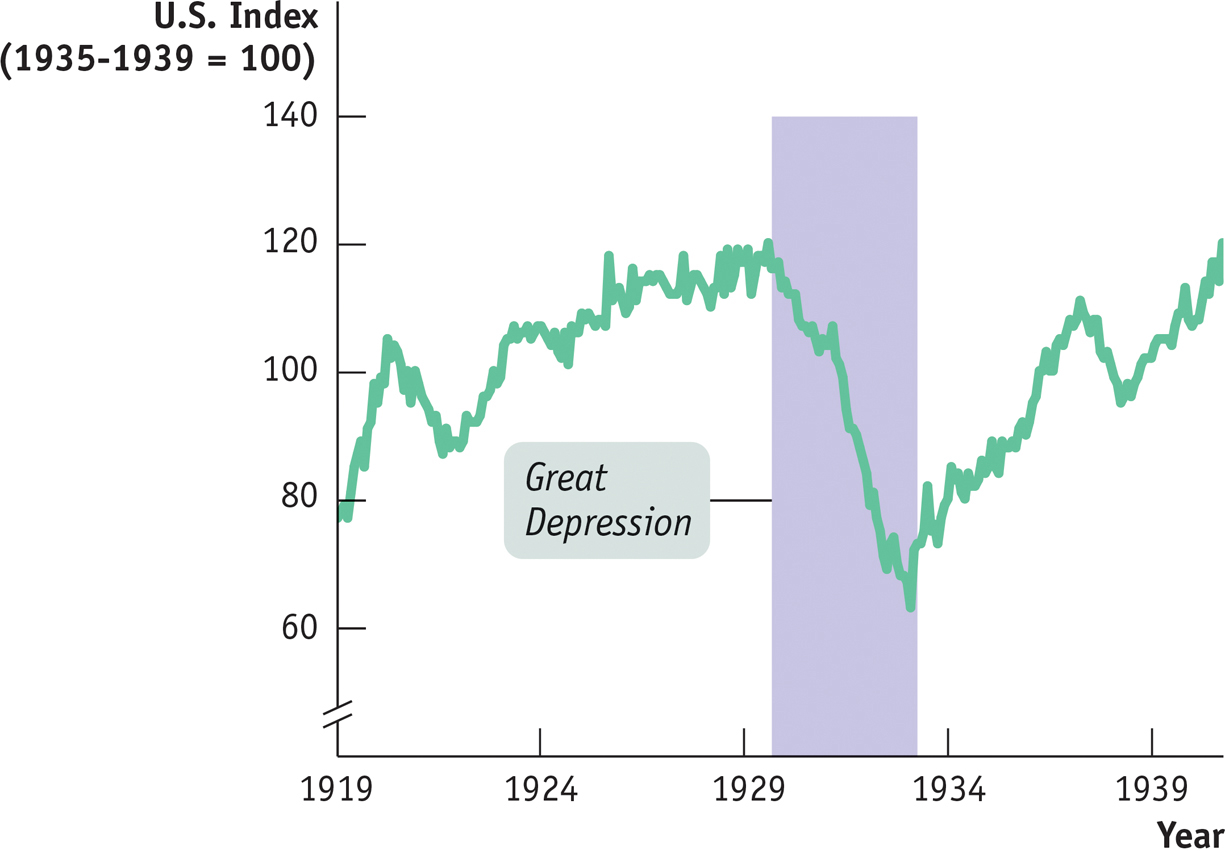

Why did Montgomery Ward falter? One key factor was that its management misjudged postwar prospects. The 1930s were a difficult time for retailers in general because of the catastrophic economic impact wrought by the Great Depression. Figure 21-11 shows an index of department store sales, which plunged after 1930 and hadn’t fully recovered by 1940. Montgomery Ward coped with this tough environment by cutting back: it closed some of its stores, cut costs, and accumulated a large hoard of cash. This strategy served the company well, restoring profitability and putting it in a very strong financial position.

21-11

Department Store Sales Index, 1919–

Unfortunately for the company, it made the mistake of returning to this strategy after World War II—

Nothing in business is forever. Eventually Sears too entered a long, slow decline. First it was overtaken by newer retailers like Walmart, whose “big box” stores didn’t sell large appliances but generally sold other goods more cheaply than Sears, in part because Walmart used information technology to hold costs down. More recently, the rise of internet sales has hurt traditional retailers of all kinds. But Montgomery Ward’s self-

QUESTIONS FOR THOUGHT

Question 6.9

What caused the steep decline in department store sales in the 1930s?

What caused the steep decline in department store sales in the 1930s?Question 6.10

In terms of macroeconomics, what was the management of Montgomery Ward betting would happen after World War II?

In terms of macroeconomics, what was the management of Montgomery Ward betting would happen after World War II?Question 6.11

Economists believe that improvements in our macroeconomic understanding over the course of the 1930s led to better policies thereafter. If this is true, how did better policies after World War II end up hurting Montgomery Ward?

Economists believe that improvements in our macroeconomic understanding over the course of the 1930s led to better policies thereafter. If this is true, how did better policies after World War II end up hurting Montgomery Ward?