The Meaning of Money

In everyday conversation, people often use the word money to mean “wealth.” If you ask, “How much money does Mark Zuckerberg have?” the answer will be something like, “Oh, $30 billion or so, but who’s counting?” That is, the number will include the value of the stocks, bonds, real estate, and other assets he owns.

But the economist’s definition of money doesn’t include all forms of wealth. The dollar bills in your wallet are money; other forms of wealth—

What Is Money?

Money is any asset that can easily be used to purchase goods and services.

Money is defined in terms of what it does: money is any asset that can easily be used to purchase goods and services. In Chapter 25 we defined an asset as liquid if it can easily be converted into cash. Money consists of cash itself, which is liquid by definition, as well as other assets that are highly liquid.

You can see the distinction between money and other assets by asking yourself how you pay for groceries. The person at the cash register will accept dollar bills in return for milk and frozen pizza—

Currency in circulation is cash held by the public.

Of course, many stores allow you to write a check on your bank account in payment for goods (or to pay with a debit card that is linked to your bank account). Does that make your bank account money, even if you haven’t converted it into cash? Yes. Currency in circulation—actual cash in the hands of the public—

Checkable bank deposits are bank accounts on which people can write checks.

The money supply is the total value of financial assets in the economy that are considered money.

Are currency and checkable bank deposits the only assets that are considered money? It depends. As we’ll see later, there are two widely used definitions of the money supply, the total value of financial assets in the economy that are considered money. The narrower definition considers only the most liquid assets to be money: currency in circulation, traveler’s checks, and checkable bank deposits. The broader definition includes these three categories plus other assets that are “almost” checkable, such as savings account deposits that can be transferred into a checking account with a phone call or a mouse click. Both definitions of the money supply, however, make a distinction between those assets that can easily be used to purchase goods and services and those that can’t.

Money plays a crucial role in generating gains from trade because it makes indirect exchange possible. Think of what happens when a cardiac surgeon buys a new refrigerator. The surgeon has valuable services to offer—

This is known as the problem of finding a double coincidence of wants: in a barter system, two parties can trade only when each wants what the other has to offer. Money solves this problem: individuals can trade what they have to offer for money and trade money for what they want.

Because the ability to make transactions with money rather than relying on bartering makes it easier to achieve gains from trade, the existence of money increases welfare, even though money does not directly produce anything. As Adam Smith put it, money “may very properly be compared to a highway, which, while it circulates and carries to market all the grass and corn of the country, produces itself not a single pile of either.”

Let’s take a closer look at the roles money plays in the economy.

Roles of Money

Money plays three main roles in any modern economy: it is a medium of exchange, a store of value, and a unit of account.

A medium of exchange is an asset that individuals acquire for the purpose of trading goods and services rather than for their own consumption.

1. Medium of Exchange Our cardiac surgeon/refrigerator example illustrates the role of money as a medium of exchange—an asset that individuals use to trade for goods and services rather than for consumption. People can’t eat dollar bills; rather, they use dollar bills to trade for edible goods and their accompanying services.

In normal times, the official money of a given country—

| The Big Moneys |

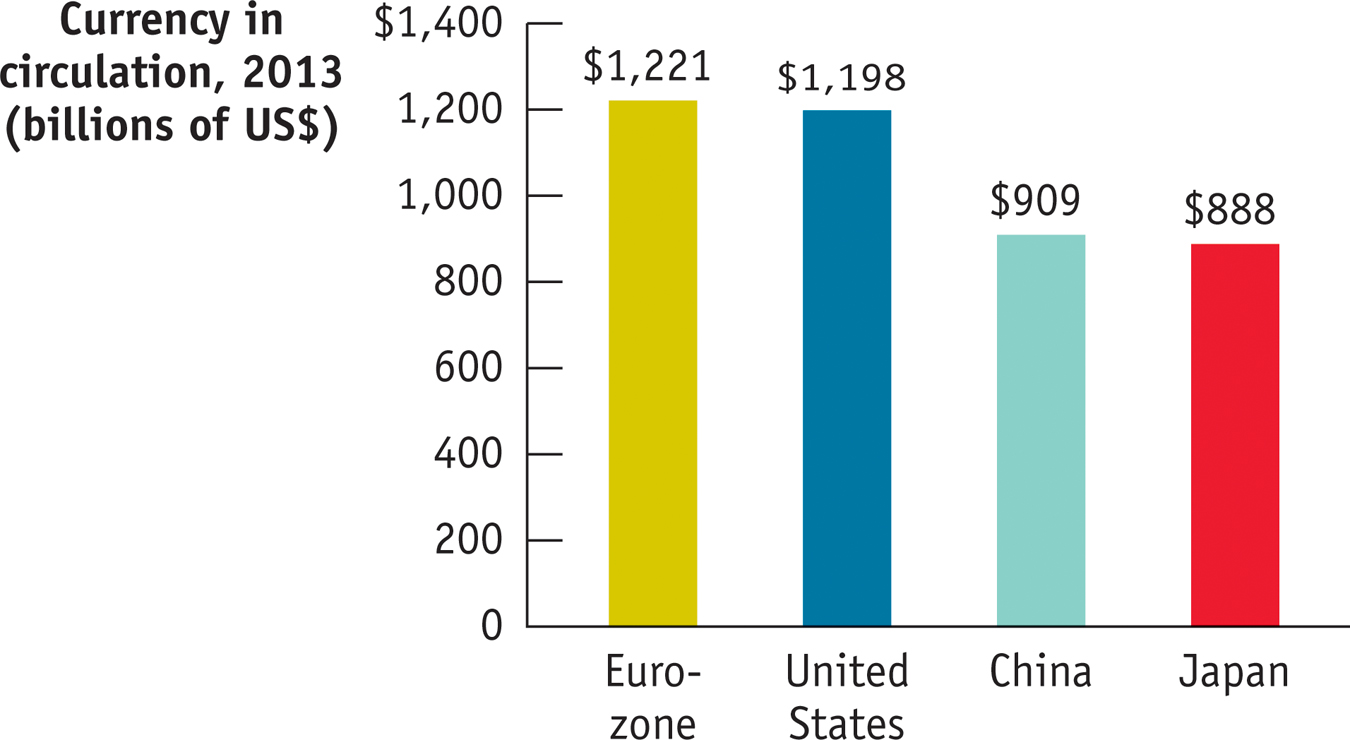

Americans tend to think of the dollar as the world’s leading currency—

Sources: Federal Reserve Bank of St. Louis; European Central Bank; Bank of Japan; The People’s Bank of China.

A store of value is a means of holding purchasing power over time.

2. Store of Value In order to act as a medium of exchange, money must also be a store of value—a means of holding purchasing power over time. To see why this is necessary, imagine trying to operate an economy in which ice-

A unit of account is a measure used to set prices and make economic calculations.

3. Unit of Account Finally, money normally serves as the unit of account—the commonly accepted measure individuals use to set prices and make economic calculations. To understand the importance of this role, consider a historical fact: during the Middle Ages, peasants typically were required to provide landowners with goods and labor rather than money. A peasant might, for example, be required to work on the lord’s land one day a week and hand over one-

Today, rents, like other prices, are almost always specified in money terms. That makes things much clearer: imagine how hard it would be to decide which apartment to rent if modern landlords followed medieval practice. Suppose, for example, that Mr. Smith says he’ll let you have a place if you clean his house twice a week and bring him a pound of steak every day, whereas Ms. Jones wants you to clean her house just once a week but wants four pounds of chicken every day. Who’s offering the better deal? It’s hard to say. If, instead, Smith wants $600 a month and Jones wants $700, the comparison is easy. In other words, without a commonly accepted measure, the terms of a transaction are harder to determine, making it more difficult to make transactions and achieve gains from trade.

Types of Money

Commodity money is a good used as a medium of exchange that has intrinsic value in other uses.

In some form or another, money has been in use for thousands of years. For most of that period, people used commodity money: the medium of exchange was a good, normally gold or silver, that had intrinsic value in other uses. These alternative uses gave commodity money value independent of its role as a medium of exchange. For example, cigarettes, which served as money in World War II prisoner-

Commodity-

By 1776, the year in which the United States declared independence and Adam Smith published The Wealth of Nations, there was widespread use of paper money in addition to gold or silver coins. Unlike modern dollar bills, however, this paper money consisted of notes issued by private banks, which promised to exchange their notes for gold or silver coins on demand. So the paper currency that initially replaced commodity money was commodity-

The big advantage of commodity-

In a famous passage in The Wealth of Nations, Adam Smith described paper money as a “waggon-

Fiat money is a medium of exchange whose value derives entirely from its official status as a means of payment.

At this point you may ask: why make any use at all of gold and silver in the monetary system, even to back paper money? In fact, today’s monetary system goes even further than the system Smith admired, having eliminated any role for gold and silver. A U.S. dollar bill isn’t commodity money, and it isn’t even commodity-

Fiat money has two major advantages over commodity-

Fiat money, though, poses some risks. In this chapter’s opening story, we described one such risk—

The larger risk is that governments that can create money whenever they feel like it will be tempted to abuse the privilege. In Chapter 31 we’ll learn how governments sometimes rely too heavily on printing money to pay their bills, leading to high inflation. In this chapter, however, we’ll stay focused on the question of what money is and how it is managed.

Measuring the Money Supply

A monetary aggregate is an overall measure of the money supply.

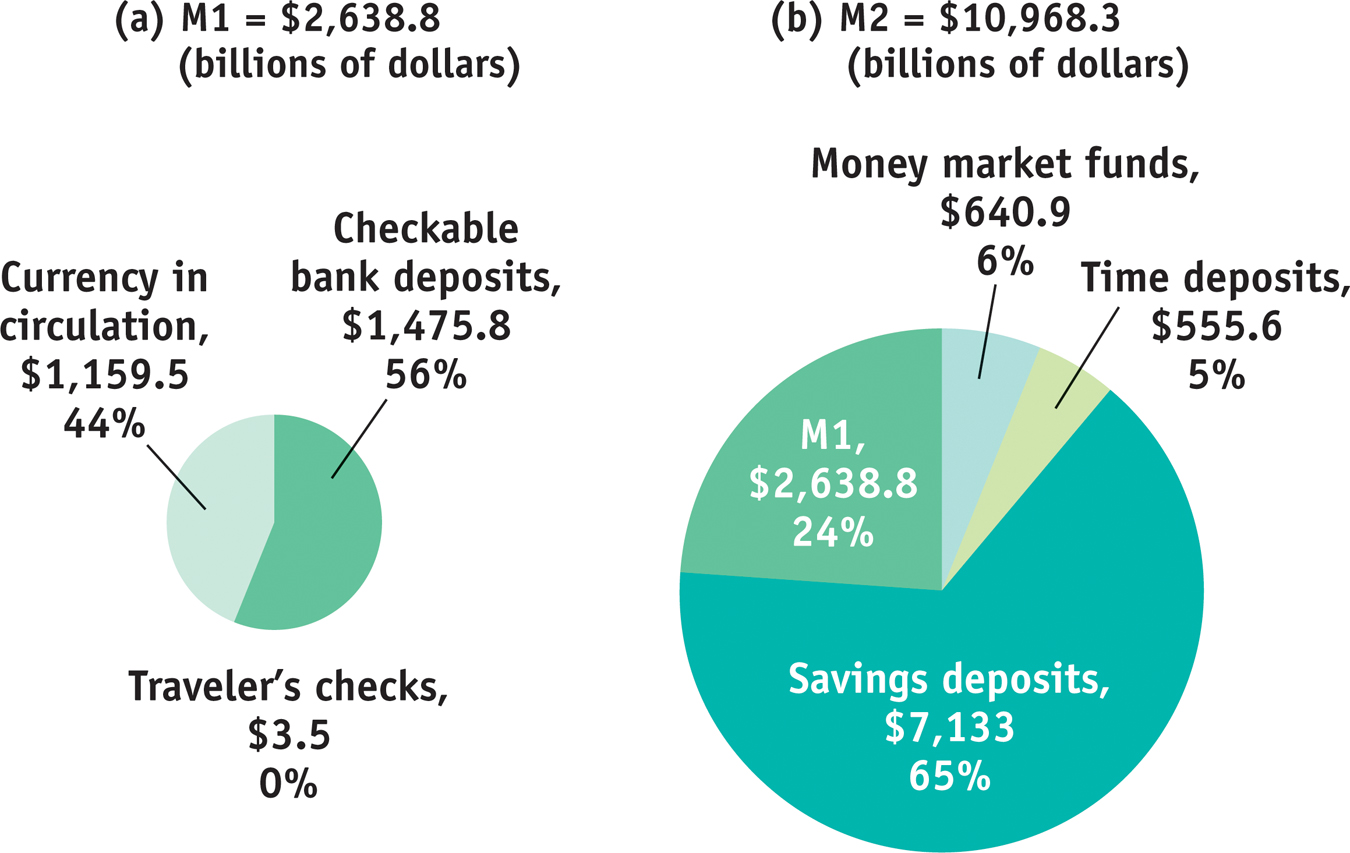

The Federal Reserve calculates the size of two monetary aggregates, overall measures of the money supply, which differ in how strictly money is defined. The two aggregates are known, rather cryptically, as M1 and M2. (There used to be a third aggregate named—

Near-

M1, the narrowest definition, contains only currency in circulation (also known as cash), traveler’s checks, and checkable bank deposits. M2 adds several other kinds of assets, often referred to as near-

PITFALLS: WHAT’S NOT IN THE MONEY SUPPLY

WHAT’S NOT IN THE MONEY SUPPLY

Are financial assets like stocks and bonds part of the money supply? No, not under any definition, because they’re not liquid enough.

M1 consists, roughly speaking, of assets you can use to buy groceries: currency, traveler’s checks, and checkable deposits (which work as long as your grocery store accepts either checks or debit cards). M2 is broader, because it includes things like savings accounts that can easily and quickly be converted into M1. Normally, for example, you can switch funds between your savings and checking accounts with a click of a mouse or a call to an automated phone service.

By contrast, converting a stock or a bond into cash requires selling the stock or bond—

Figure 29-1 shows the actual composition of M1 and M2 in December 2013, in billions of dollars. M1 was valued at $2,639 billion, with about 44% accounted for by currency in circulation, almost all the rest accounted for by checkable bank deposits, and a tiny slice accounted for by traveler’s checks. In turn, M1 made up 24% of M2, valued at $10,969 billion. M2 consists of M1 plus other types of assets: two types of bank deposits, known as savings deposits and time deposits, both of which are considered noncheckable, plus money market funds, which are mutual funds that invest only in liquid assets and bear a close resemblance to bank deposits. These near-

29-1

Monetary Aggregates, September 2013

What’s with All the Currency?

Alert readers may be a bit startled at one of the numbers in the money supply: more than $1 trillion of currency in circulation. That’s over $3,000 in cash for every man, woman, and child in the United States. How many people do you know who carry $3,000 in their wallets? Not many. So where is all that cash?

Part of the answer is that it isn’t in individuals’ wallets—

Economists believe that cash also plays an important role in transactions that people want to keep hidden. Small businesses and the self-

The most important reason for those huge currency holdings, however, is foreign use of dollars. The Federal Reserve estimates that 60% of U.S. currency is actually held outside the United States—

!worldview! ECONOMICS in Action: The History of the Dollar

The History of the Dollar

U.S. dollar bills are pure fiat money: they have no intrinsic value, and they are not backed by anything that does. But American money wasn’t always like that. In the early days of European settlement, the colonies that would become the United States used commodity money, partly consisting of gold and silver coins minted in Europe. But such coins were scarce on this side of the Atlantic, so the colonists relied on a variety of other forms of commodity money. For example, settlers in Virginia used tobacco as money and settlers in the Northeast used “wampum,” a type of clamshell.

Later in American history, commodity-

A curious legacy of that time was notes issued by the Citizens’ Bank of Louisiana, based in New Orleans, that became among the most widely used bank notes in the southern states. These notes were printed in English on one side and French on the other. (At the time, many people in New Orleans, originally a colony of France, spoke French.) Thus, the $10 bill read Ten on one side and Dix, the French word for “ten,” on the other. These $10 bills became known as “dixies,” probably the source of the nickname of the U.S. South.

The U.S. government began issuing official paper money, called “greenbacks,” in 1862 as a way to pay for the ongoing Civil War. At first greenbacks had no fixed value in terms of commodities. After 1873, the U.S. government guaranteed the value of a dollar in terms of gold, effectively turning dollars into commodity-

In 1933, when President Franklin D. Roosevelt broke the link between dollars and gold, his own federal budget director—

Quick Review

Money is any asset that can easily be used to purchase goods and services. Currency in circulation and checkable bank deposits are both part of the money supply.

Money plays three roles: a medium of exchange, a store of value, and a unit of account.

Historically, money took the form first of commodity money, then of commodity-

backed money . Today the dollar is pure fiat money.The money supply is measured by two monetary aggregates: M1 and M2. M1 consists of currency in circulation, checkable bank deposits, and traveler’s checks. M2 consists of M1 plus various kinds of near-

moneys .

29-1

Question 14.1

Suppose you hold a gift card, good for certain products at participating stores. Is this gift card money? Why or why not?

The defining characteristic of money is its liquidity: how easily it can be used to purchase goods and services. Although a gift card can easily be used to purchase a very defined set of goods or services (the goods or services available at the store issuing the gift card), it cannot be used to purchase any other goods or services. A gift card is therefore not money, since it cannot easily be used to purchase all goods and services.

Question 14.2

Although most bank accounts pay some interest, depositors can get a higher interest rate by buying a certificate of deposit, or CD. The difference between a CD and a checking account is that the depositor pays a penalty for withdrawing the money before the CD comes due—

a period of months or even years. Small CDs are counted in M2 but not in M1. Explain why they are not part of M1. Again, the important characteristic of money is its liquidity: how easily it can be used to purchase goods and services. M1, the narrowest definition of the money supply, contains only currency in circulation, traveler’s checks, and checkable bank deposits. CDs aren’t checkable—and they can’t be made checkable without incurring a cost because there’s a penalty for early withdrawal. This makes them less liquid than the assets counted in M1.

Question 14.3

Explain why a system of commodity-

backed money uses resources more efficiently than a system of commodity money. Commodity-backed money uses resources more efficiently than simple commodity money, like gold and silver coins, because commodity-backed money ties up fewer valuable resources. Although a bank must keep some of the commodity—generally gold and silver—on hand, it only has to keep enough to satisfy demand for redemptions. It can then lend out the remaining gold and silver, which allows society to use these resources for other purposes, with no loss in the ability to achieve gains from trade.

Solutions appear at back of book.