33: Macroeconomics: Events and Ideas

!arrow! What You Will Learn in This Chapter

Why classical macroeconomics was inadequate for the problems posed by the Great Depression

How Keynes and the experience of the Great Depression legitimized macroeconomic policy activism

What monetarism is and why monetarists claim there are limits to the use of discretionary monetary policy

How challenges led to a revision of Keynesian economics and the emergence of the new classical macroeconomics

Why the Great Moderation consensus was challenged by the 2008 financial crisis, leading to fierce debates among economists about the best use of fiscal and monetary policy during challenging economic times

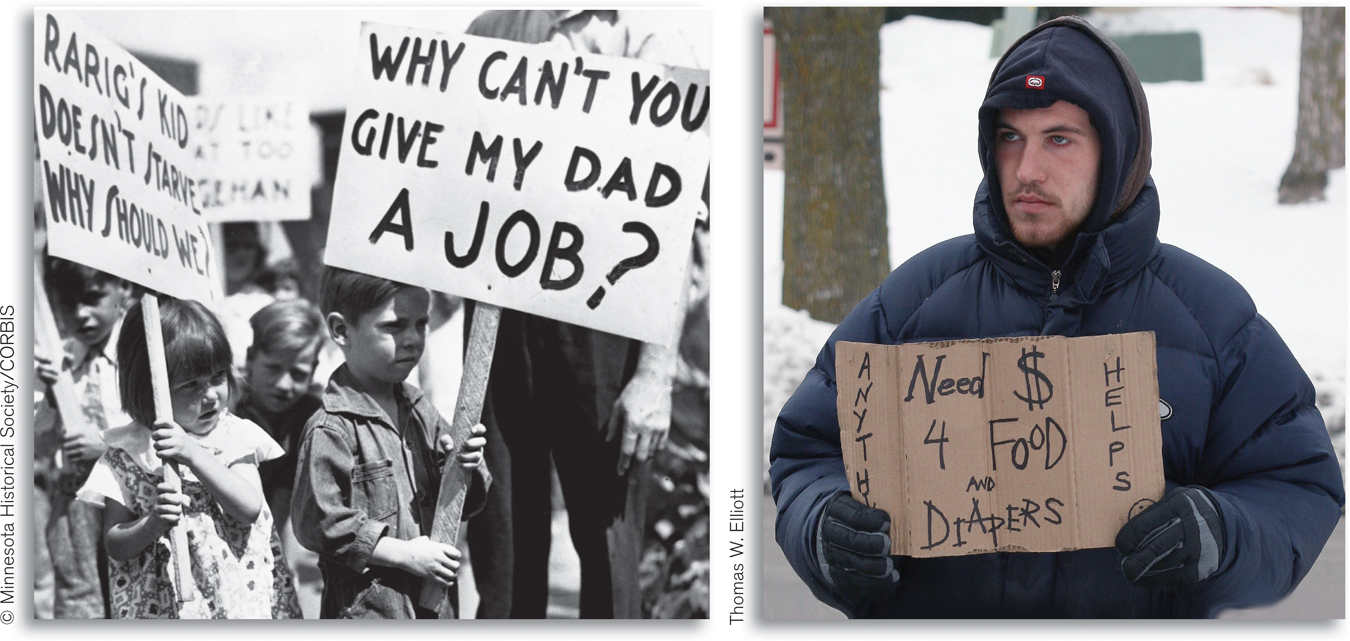

A TALE OF TWO SLUMPS

In November 2002, the Federal Reserve held a special conference to honor Milton Friedman on the occasion of his ninetieth birthday. Among those delivering tributes was Ben Bernanke, who had recently moved to the Fed from Princeton University and would later become the Fed’s chairman. In his tribute, Bernanke surveyed Friedman’s intellectual contributions, with particular focus on the argument made by Friedman and his collaborator Anna Schwartz that the Great Depression of the 1930s could have been avoided if only the Fed had done its job properly.

At the close of his talk, Bernanke directly addressed Friedman and Schwartz, who were sitting in the audience: “Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.”

Today, in the aftermath of a devastating financial crisis that was followed by many years of high unemployment, those words ring somewhat hollow. Avoiding severe economic downturns, it turned out, wasn’t as easy as Friedman, Schwartz, and Bernanke had believed. Yet, as bad as the Great Recession was, it was less devastating than the Great Depression. And it can be reasonably argued that some of the credit was due to the fact that macroeconomics had evolved greatly over the previous three generations. As a result, during the Great Recession policy makers knew more about the causes of depressions and how to fight them than they did during the Great Depression.

In this chapter we’ll trace the development of macroeconomic ideas over the past 85 years. As we’ll see, this development has been strongly influenced by economic events, from the Great Depression of the 1930s, to the stagflation of the 1970s, to the surprising period of economic stability achieved between 1985 and 2007. And as we’ll also see, the process continues, as the economic difficulties of the Great Recession have spurred many macroeconomists to rethink what they thought they knew.