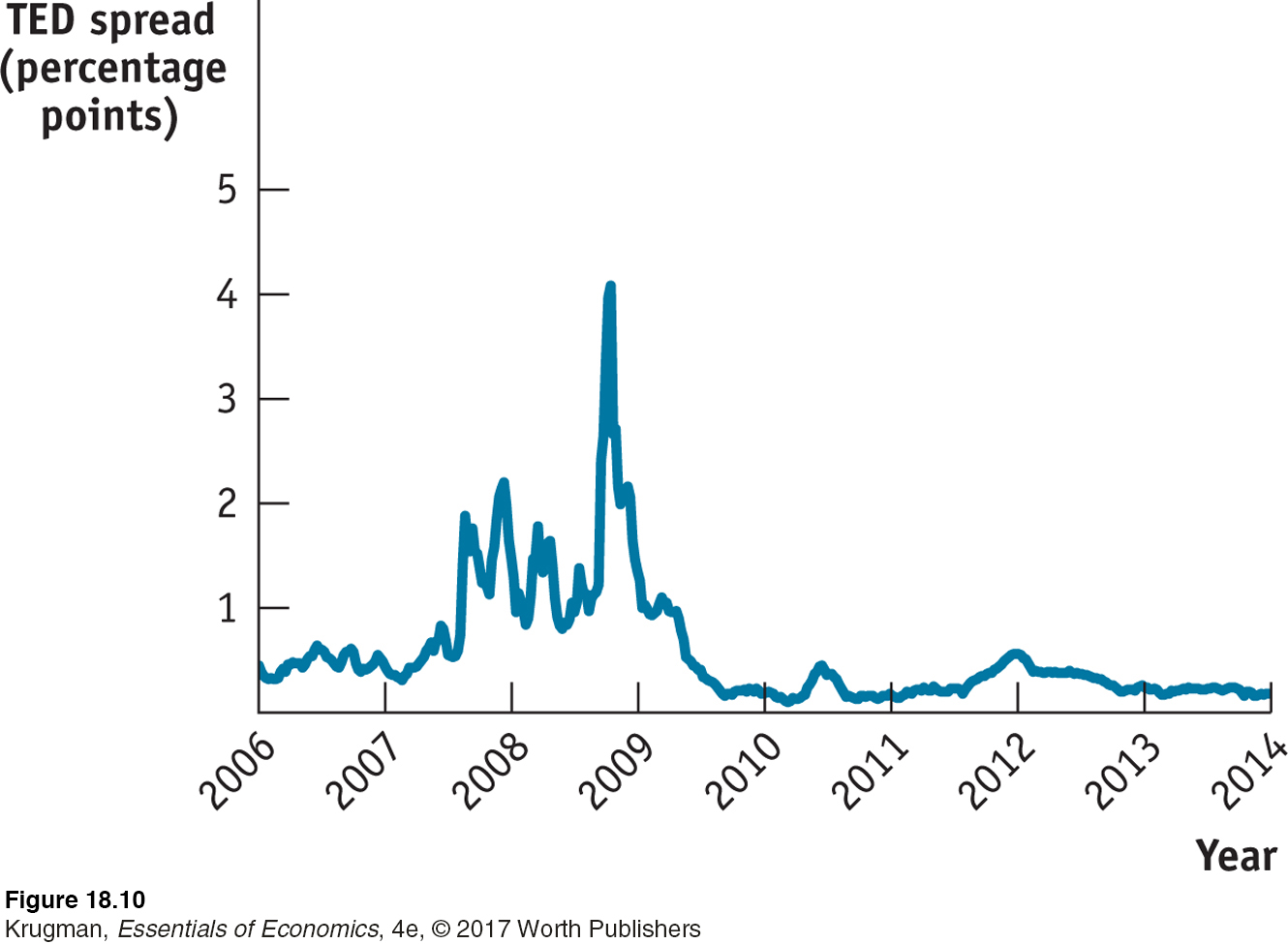

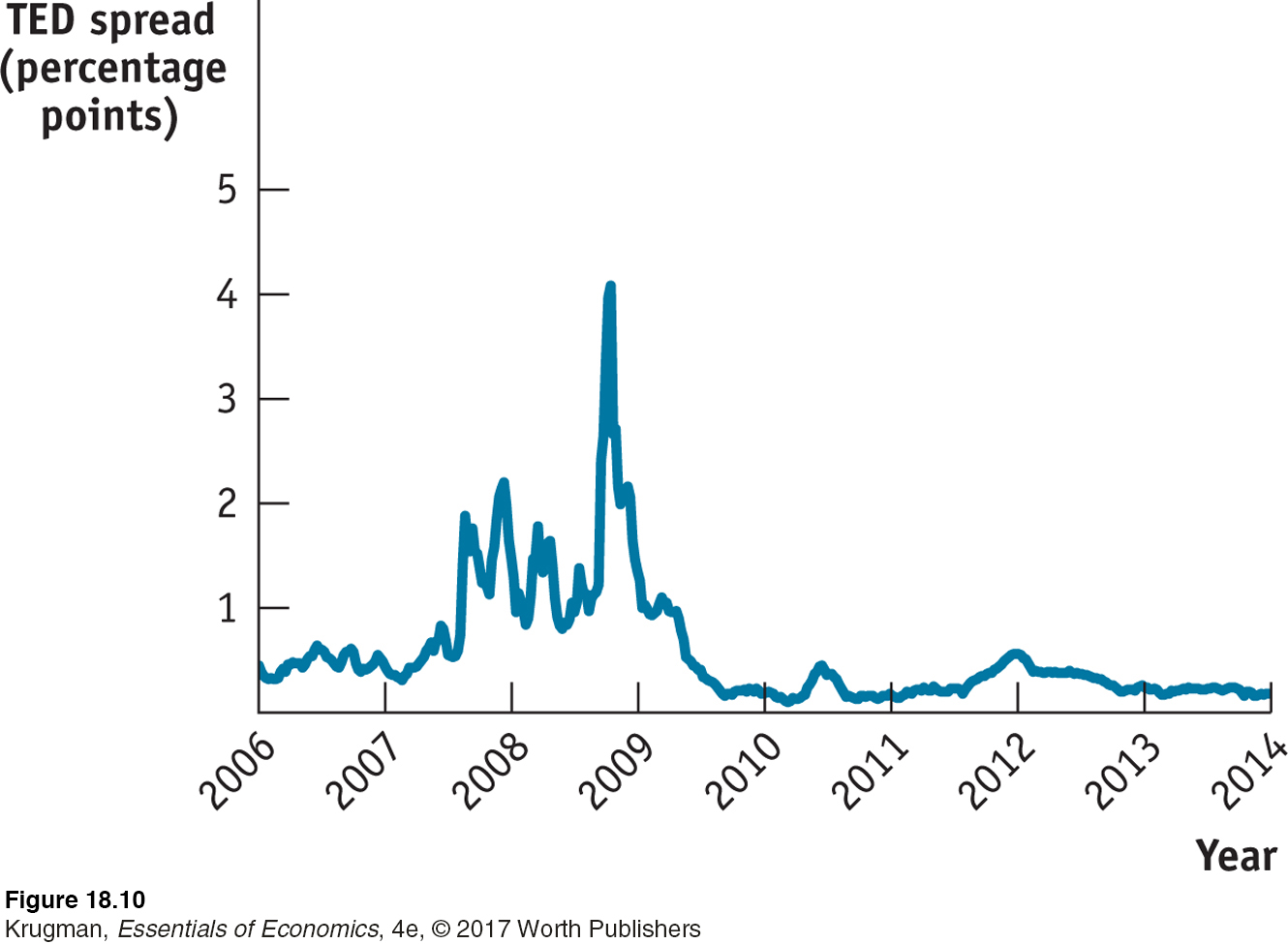

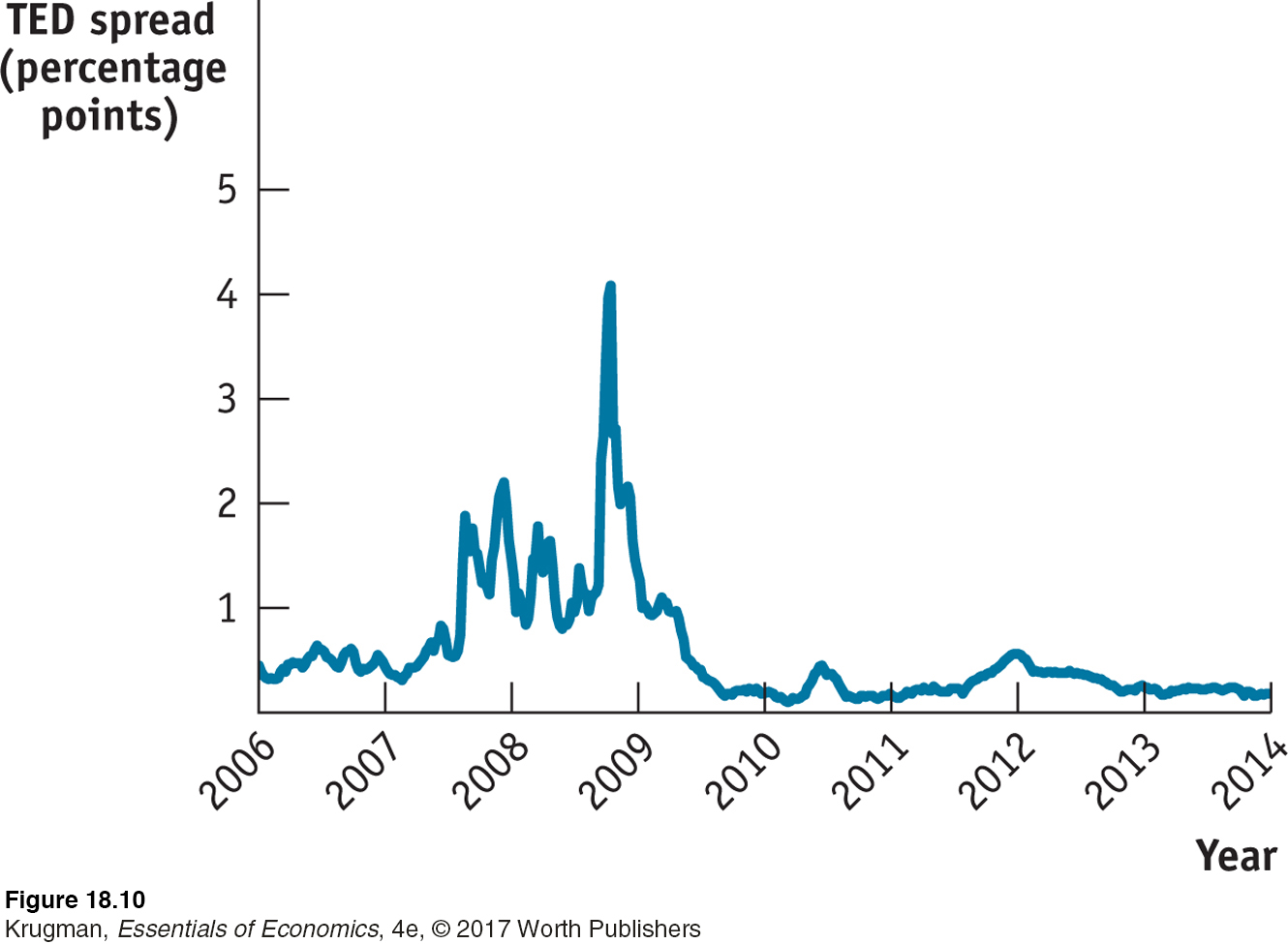

FIGURE 18-10 The TED Spread

The TED spread is the difference between the interest rate at which banks lend to each other and the interest rate on U.S. government debt. It’s widely used as a measure of financial stress. The TED spread soared as a result of the financial crisis of 2007–2008.

The TED spread is the difference between the interest rate at which banks lend to each other and the interest rate on U.S. government debt. It’s widely used as a measure of financial stress. The TED spread soared as a result of the financial crisis of 2007–2008.Data from: British Bankers’ Association; Federal Reserve Bank of St. Louis.