Question 20.10

2. A basket of goods and services that costs $100 in the United States costs 800 pesos in Mexico, and the current nominal exchange rate is 10 pesos per U.S. dollar. Over the next five years, the cost of that market basket rises to $120 in the United States and to 1,200 pesos in Mexico, although the nominal exchange rate remains at 10 pesos per U.S. dollar. Calculate the following.

The real exchange rate now and five years from now, if today’s price index in both countries is 100

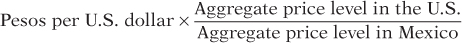

The real exchange rate equals

Today, the aggregate price levels in both countries are both equal to 100. The real exchange rate today is 10 × (100/100) = 10. The aggregate price level in five years in the U.S. will be 100 × (120/100) = 120, and in Mexico it will be 100 × (1,200/800) = 150. The real exchange rate in five years, assuming the nominal exchange rate does not change, will be 10 × (120/150) = 8.

Purchasing power parity today and five years from now

Today, a basket of goods and services that costs $100 costs 800 pesos, so the purchasing power parity is 8 pesos per U.S. dollar. In five years, a basket that costs $120 will cost 1,200 pesos, so the purchasing power parity will be 10 pesos per U.S. dollar.