Question 20.5

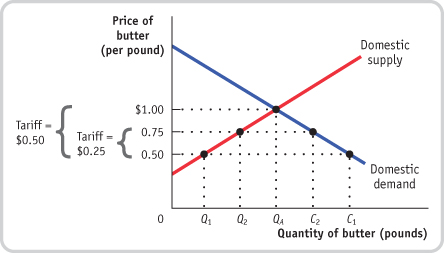

1. Suppose the world price of butter is $0.50 per pound and the domestic price in autarky is $1.00 per pound. Use a diagram similar to Figure 20-10 to show the following.

If there is free trade, domestic butter producers want the government to impose a tariff of no less than $0.50 per pound. Compare the outcome with a tariff of $0.25 per pound.

If the tariff is $0.50, the price paid by domestic consumers for a pound of imported butter is $0.50 + $0.50 = $1.00, the same price as a pound of domestic butter. Imported butter will no longer have a price advantage over domestic butter, imports will cease, and domestic producers will capture all the feasible sales to domestic consumers, selling amount QA in the accompanying figure. If the tariff is $0.25, the price paid by domestic consumers for a pound of imported butter is $0.50 + $0.25 = $0.75, $0.25 cheaper than a pound of domestic butter. American butter producers will gain sales in the amount of Q2 − Q1 as a result of the $0.25 tariff. But this is smaller than the amount they would have gained under the $0.50 tariff, the amount QA − Q1.

What happens if a tariff greater than $0.50 per pound is imposed?

As long as the tariff is at least $0.50, increasing it more has no effect. At a tariff of $0.50, all imports are effectively blocked.