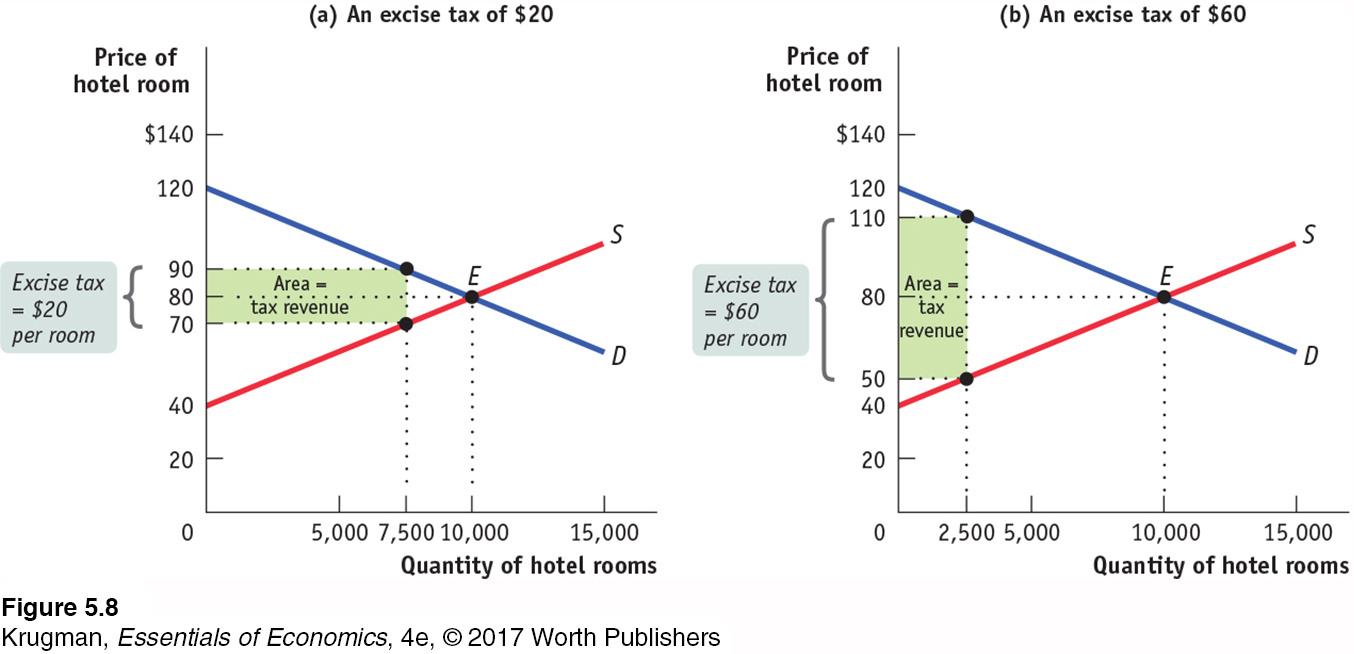

Figure 5.8: FIGURE 5-8 Tax Rates and Revenue

Figure 5.8: In general, doubling the excise tax rate on a good or service won’t double the amount of revenue collected, because the tax increase will reduce the quantity of the good or service bought and sold. And the relationship between the level of the tax and the amount of revenue collected may not even be positive. Panel (a) shows the revenue raised by a tax rate of $20 per room, only half the tax rate in Figure 5-7. The tax revenue raised, equal to the area of the shaded rectangle, is $150,000. That is 75% of $200,000, the revenue raised by a $40 tax rate. Panel (b) shows that the revenue raised by a $60 tax rate is also $150,000. So raising the tax rate from $40 to $60 actually reduces tax revenue.