2.8 Business Case

BUSINESS CASE

BUSINESS CASE |

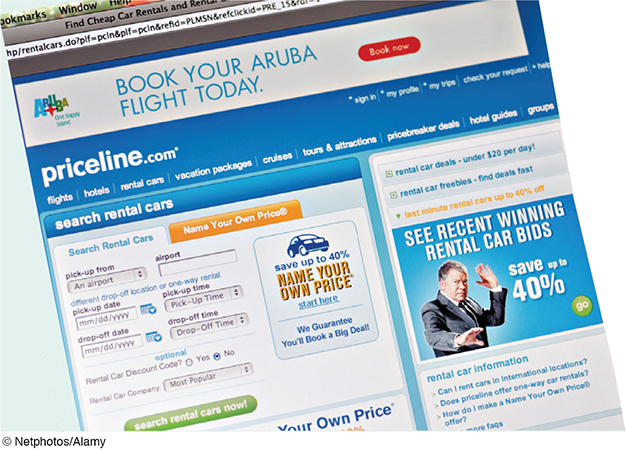

How Priceline.com Revolutionized the Travel Industry |

In 2001 and 2002, the travel industry was in deep trouble. After the terrorist attacks of September 11, 2001, many people simply stopped flying. As the economy went into a deep slump, airplanes sat empty on the tarmac and the airlines lost billions of dollars. When several major airlines spiraled toward bankruptcy, Congress passed a $15 billion aid package that was critical in stabilizing the airline industry.

This was also a particularly difficult time for Priceline.com, the online travel service. Just four years after its founding, Priceline.com was in danger of going under. The change in the company’s fortunes had been dramatic.

In 1999, one year after Priceline.com was formed, investors were so impressed by its potential for revolutionizing the travel industry that they valued the company at $9 billion dollars. But by 2002 investors had taken a decidedly dimmer view of the company, reducing its valuation by 95% to only $425 million.

To make matters worse, Priceline.com was losing several million dollars a year. Yet the company managed to survive and thrive; in 2014 it was valued by investors at over $63 billion.

So exactly how did Priceline.com bring such dramatic change to the travel industry? And what has allowed it to survive and prosper as a company in the face of dire economic conditions?

Priceline.com’s success lies in its ability to spot exploitable opportunities for itself and its customers. The company understood that when a plane departs with empty seats or a hotel has empty beds, it bears a cost—

Customers specify the price they are willing to pay for a given trip or hotel location, and then Priceline.com presents them with a list of options from airlines or hotels that are willing to accept that price, with the price typically declining as the date of the trip nears.

By bringing airlines and hotels with unsold capacity together with travelers who are willing to sacrifice some of their preferences for a lower price, Priceline.com made everyone better off—

Priceline.com was also quick on its feet when it saw its market challenged by newcomers Expedia and Orbitz. In response, it aggressively moved more of its business toward hotel bookings and into Europe, where the online travel industry was still quite small. Its network was particularly valuable in the European hotel market, with many more small hotels compared to the U.S. market, which is dominated by nationwide chains. The efforts paid off, and by 2003 Priceline.com had turned its first profit.

Priceline.com now operates within a network of more than 295,000 hotels in over 190 countries. As of 2014, its revenues had grown by at least 20% in each of the previous six years, even growing 34% during the 2008 recession.

Clearly, the travel industry will never be the same again.

QUESTION FOR THOUGHT

Explain how each of the twelve principles of economics is illustrated in this case study.

BUSINESS CASE

![]() Efficiency, Opportunity Cost, and the Logic of Lean Production

Efficiency, Opportunity Cost, and the Logic of Lean Production

In the summer and fall of 2010, workers were rearranging the furniture in Boeing’s final assembly plant in Everett, Washington, in preparation for the production of the Boeing 767. It was a difficult and time-

Lean manufacturing, pioneered by Toyota Motors of Japan, is based on the practice of having parts arrive on the factory floor just as they are needed for production. This reduces the amount of parts Boeing holds in inventory as well as the amount of the factory floor needed for production—

Boeing had adopted lean manufacturing in 1999 in the manufacture of the 737, the most popular commercial airplane. By 2005, after constant refinement, Boeing had achieved a 50% reduction in the time it takes to produce a plane and a nearly 60% reduction in parts inventory. An important feature is a continuously moving assembly line, moving products from one assembly team to the next at a steady pace and eliminating the need for workers to wander across the factory floor from task to task or in search of tools and parts.

Toyota’s lean production techniques have been the most widely adopted, revolutionizing manufacturing worldwide. In simple terms, lean production is focused on organization and communication. Workers and parts are organized so as to ensure a smooth and consistent workflow that minimizes wasted effort and materials. Lean production is also designed to be highly responsive to changes in the desired mix of output—

Toyota’s lean production methods were so successful that they transformed the global auto industry and severely threatened once-

QUESTIONS FOR THOUGHT

What is the opportunity cost associated with having a worker wander across the factory floor from task to task or in search of tools and parts?

Explain how lean manufacturing improves the economy’s efficiency in allocation.

Before lean manufacturing innovations, Japan mostly sold consumer electronics to the United States. How did lean manufacturing innovations alter Japan’s comparative advantage vis-

à-vis the United States? Predict how the shift in the location of Toyota’s production from Japan to the United States is likely to alter the pattern of comparative advantage in automaking between the two countries.