16.5 Macroeconomic Policy

We’ve just seen that the economy is self-

This belief is the background to one of the most famous quotations in economics: John Maynard Keynes’s declaration, “In the long run we are all dead” (the remark is explained in the accompanying For Inquiring Minds).

FOR INQUIRING MINDSKeynes and the Long Run

The British economist Sir John Maynard Keynes (1883–1946), probably more than any other single economist, created the modern field of macroeconomics. One of his most lasting contributions was a famous quote on the meaning of the long run.

In 1923 Keynes published A Tract on Monetary Reform, a small book on the economic problems of Europe after World War I. In it he decried the tendency of many of his colleagues to focus on how things work out in the long run—

This long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the sea is flat again.

Stabilization policy is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions.

Economists usually interpret Keynes as having recommended that governments not wait for the economy to correct itself. Instead, it is argued by many economists, but not all, that the government should use monetary and fiscal policy to get the economy back to potential output in the aftermath of a shift of the aggregate demand curve. This is the rationale for an active stabilization policy, which is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions.

Can stabilization policy improve the economy’s performance? If we reexamine Figure 16-6, the answer certainly appears to be yes. Under active stabilization policy, the U.S. economy returned to potential output in 1996 after an approximately five-

Policy in the Face of Demand Shocks

Imagine that the economy experiences a negative demand shock, like the one shown in Figure 16-13. As we’ve discussed, monetary and fiscal policy shift the aggregate demand curve. If policy makers react quickly to the fall in aggregate demand, they can use monetary or fiscal policy to shift the aggregate demand curve back to the right. And if policy were able to perfectly anticipate shifts of the aggregate demand curve, it could short-

Why might a policy that short-

Does this mean that policy makers should always act to offset declines in aggregate demand? Not necessarily. Some policy measures to increase aggregate demand, especially those that increase budget deficits, may have long-

Should policy makers also try to offset positive shocks to aggregate demand? It may not seem obvious that they should. After all, even though inflation may be a bad thing, isn’t more output and lower unemployment a good thing? Not necessarily. Most economists now believe that any short-

But how should macroeconomic policy respond to supply shocks?

Responding to Supply Shocks

We’ve now come full circle to the story that began this chapter. We can now explain why FOMC committee members dread stagflation.

In panel (a) of Figure 16-11 we showed the effects of a negative supply shock: in the short run such a shock leads to lower aggregate output but a higher aggregate price level. As we’ve noted, policy makers can respond to a negative demand shock by using monetary and fiscal policy to return aggregate demand to its original level. But what can or should they do about a negative supply shock?

In contrast to the aggregate demand curve, there are no easy policies that shift the short-

And if you consider using monetary or fiscal policy to shift the aggregate demand curve in response to a supply shock, the right response isn’t obvious. Two bad things are happening simultaneously: a fall in aggregate output, leading to a rise in unemployment, and a rise in the aggregate price level. Any policy that shifts the aggregate demand curve helps one problem only by making the other worse. If the government acts to increase aggregate demand and limit the rise in unemployment, it reduces the decline in output but causes even more inflation. If it acts to reduce aggregate demand, it curbs inflation but causes a further rise in unemployment.

It’s a trade-

ECONOMICSin Action

Is Stabilization Policy Stabilizing?

| interactive activity

| interactive activity

We’ve described the theoretical rationale for stabilization policy as a way of responding to demand shocks. But does stabilization policy actually stabilize the economy? One way we might try to answer this question is to look at the long-

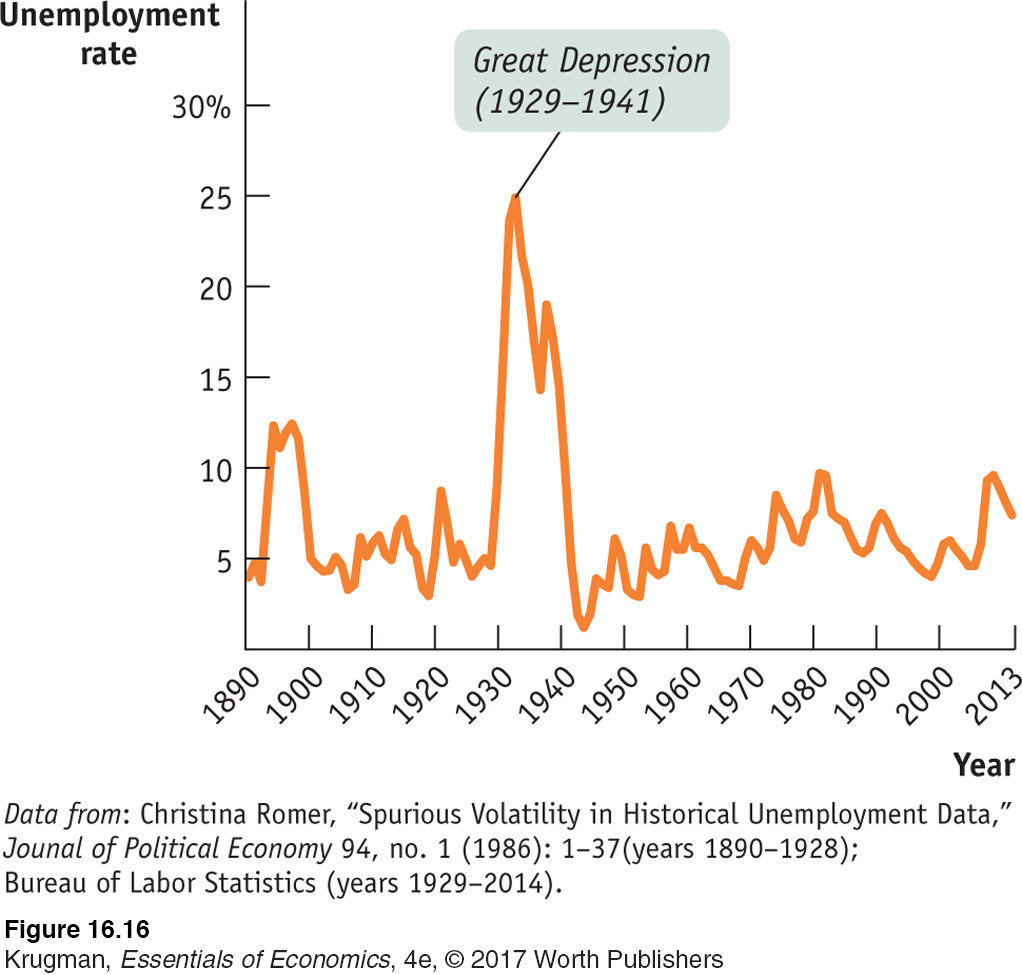

So here’s the question: has the economy actually become more stable since the government began trying to stabilize it? The answer is a qualified yes. It’s qualified for two reasons. One is that data from the pre–World War II era are less reliable than more modern data. The other is that the severe and protracted slump that began in 2007 has shaken confidence in the effectiveness of government policy. Still, there seems to have been a reduction in the size of fluctuations.

Figure 16-16 shows the number of unemployed as a percentage of the nonfarm labor force since 1890. (We focus on nonfarm workers because farmers, though they often suffer economic hardship, are rarely reported as unemployed.) Even ignoring the huge spike in unemployment during the Great Depression, unemployment seems to have varied a lot more before World War II than after. It’s also worth noticing that the peaks in postwar unemployment, in 1975, 1982, and to some extent in 2010 (as described in the earlier Global Comparison), corresponded to major supply shocks—

It’s possible that the greater stability of the economy reflects good luck rather than policy. But on the face of it, the evidence suggests that stabilization policy is indeed stabilizing.

Quick Review

Stabilization policy is the use of fiscal or monetary policy to offset demand shocks. There can be drawbacks, however. Such policies may lead to a long-

term rise in the budget deficit and lower long- run growth because of crowding out. And, due to incorrect predictions, a misguided policy can increase economic instability. Negative supply shocks pose a policy dilemma because fighting the slump in aggregate output worsens inflation and fighting inflation worsens the slump.

Check Your Understanding16-4

Question 16.6

1. Suppose someone says, “Using monetary or fiscal policy to pump up the economy is counterproductive—

Explain what this means in terms of the AD–AS model.

An economy is overstimulated when an inflationary gap is present. This will arise if an expansionary monetary or fiscal policy is implemented when the economy is currently in long-

run macroeconomic equilibrium. This shifts the aggregate demand curve to the right, in the short run raising the aggregate price level and aggregate output and creating an inflationary gap. Eventually nominal wages will rise and shift the short- run aggregate supply curve to the left, and aggregate output will fall back to potential output. This is the scenario envisaged by the speaker. Is this a valid argument against stabilization policy? Why or why not?

No, this is not a valid argument. When the economy is not currently in long-

run macroeconomic equilibrium, an expansionary monetary or fiscal policy does not lead to the outcome described above. Suppose a negative demand shock has shifted the aggregate demand curve to the left, resulting in a recessionary gap. An expansionary monetary or fiscal policy can shift the aggregate demand curve back to its original position in long- run macroeconomic equilibrium. In this way, the short- run fall in aggregate output and deflation caused by the original negative demand shock can be avoided. So, if used in response to demand shocks, fiscal or monetary policy is an effective policy tool.

Question 16.7

2. In 2008, in the aftermath of the collapse of the housing bubble and a sharp rise in the price of commodities, particularly oil, there was much internal disagreement within the Fed about how to respond, with some advocating lowering interest rates and others contending that this would set off a rise in inflation. Explain the reasoning behind each one of these views in terms of the AD–AS model.

Those within the Fed who advocated lowering interest rates were focused on boosting aggregate demand in order to counteract the negative demand shock caused by the collapse of the housing bubble. Lowering interest rates will result in a rightward shift of the aggregate demand curve, increasing aggregate output but raising the aggregate price level. Those within the Fed who advocated holding interest rates steady were focused on the fact that fighting the slump in aggregate demand in the face of a negative supply shock could result in a rise in inflation. Holding interest rates steady relies on the ability of the economy to self-

Solutions appear at back of book.