SOLVED PROBLEM A Shocking Analysis

for interactive tutorials with step-by-step guidance on how to solve problems

for interactive tutorials with step-by-step guidance on how to solve problems

During the financial crisis in autumn 2008, the financial system delivered a sobering shock to the economy when the stock market lost about half of its value. Soon afterward, consumer spending came to a screeching halt. Within six months of the crash, GDP fell by 2.5% and the price level fell by 2.8%. Show how an analysis of aggregate demand and aggregate supply could have predicted this short-run effect on aggregate output and the aggregate price level. Assuming no government intervention, what would you have predicted in the long run?

Page 468

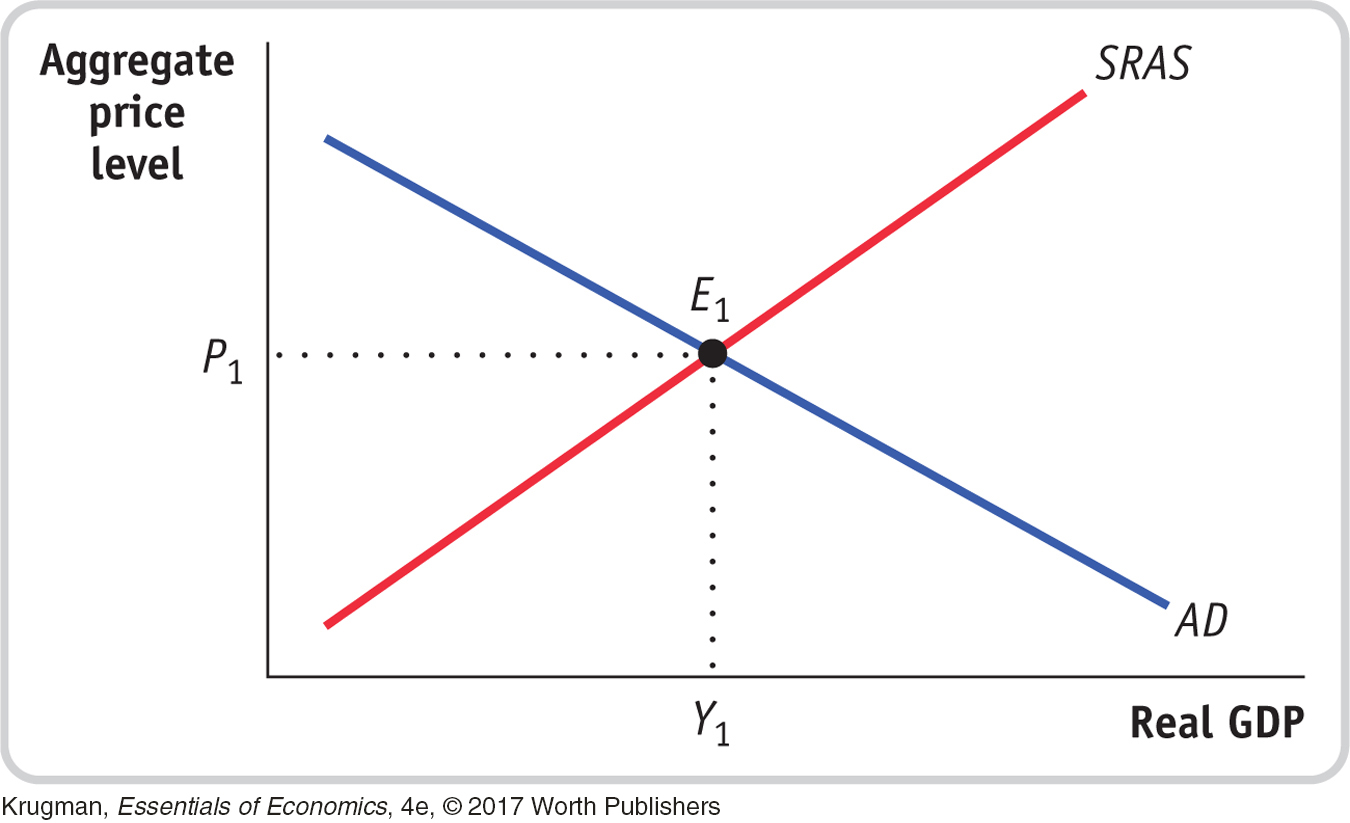

STEP | 1 Begin by drawing and labeling the aggregate demand curve. Then draw and label the short-run aggregate supply curve. Next, find the initial equilibrium price and output levels and label them on your graph as well.Read pages 457–458 and review Figure 16-9.

The aggregate demand curve and the short-run aggregate supply curve are shown in the following diagram. The initial equilibrium point is labeled E1, the initial price level is labeled P1, and the initial output level is labeled Y1.

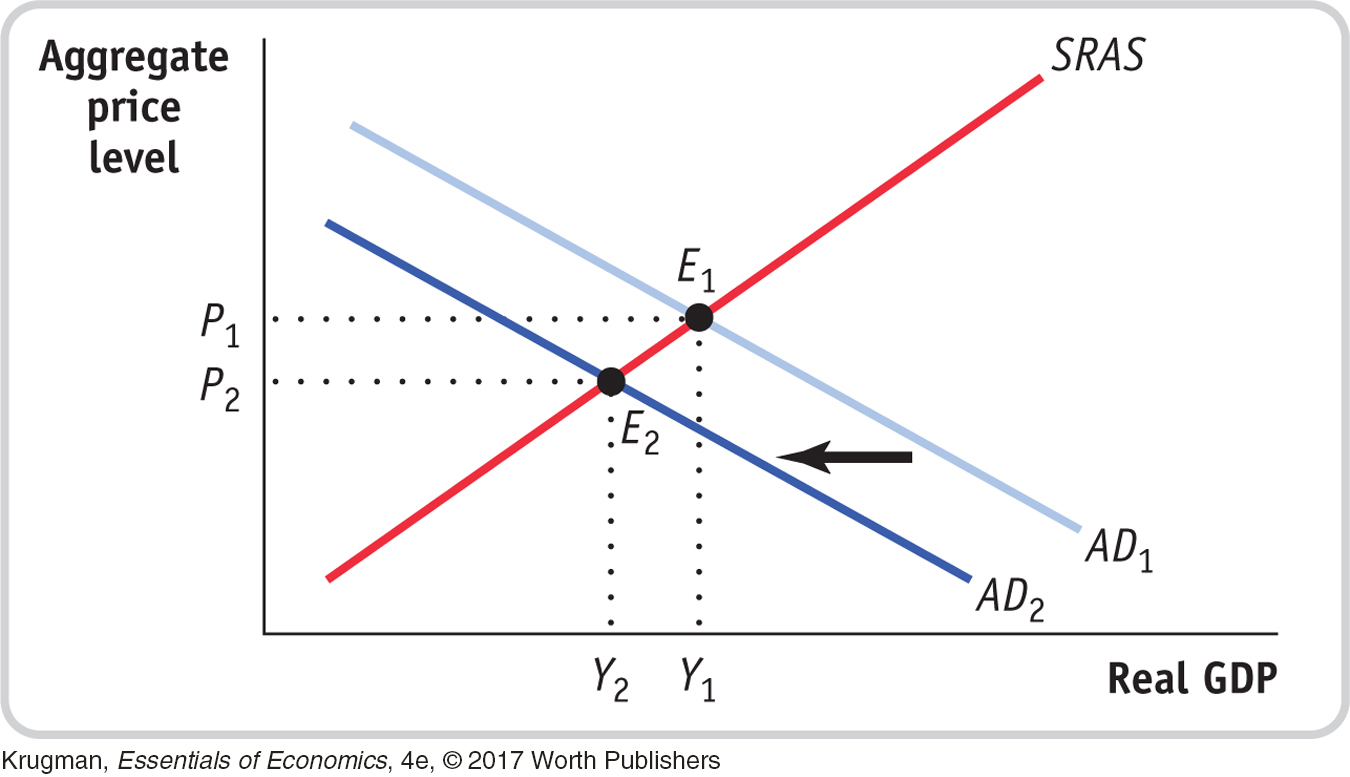

STEP | 2 Using your graph from Step 1, analyze the short-run effect of the stock market fall on aggregate demand and aggregate supply by drawing a new curve representing aggregate demand after the stock market fall.Read page 458 and review Figure 16-10, panel (a).

A decrease in household wealth will reduce consumer spending. Beginning at the equilibrium point, E1 in the diagram below, the aggregate demand curve will shift from AD1 to AD2. The economy will be in short-run macroeconomic equilibrium at point E2. The aggregate price level will be lower than at P1, and aggregate output will be lower than output at the original equilibrium point.

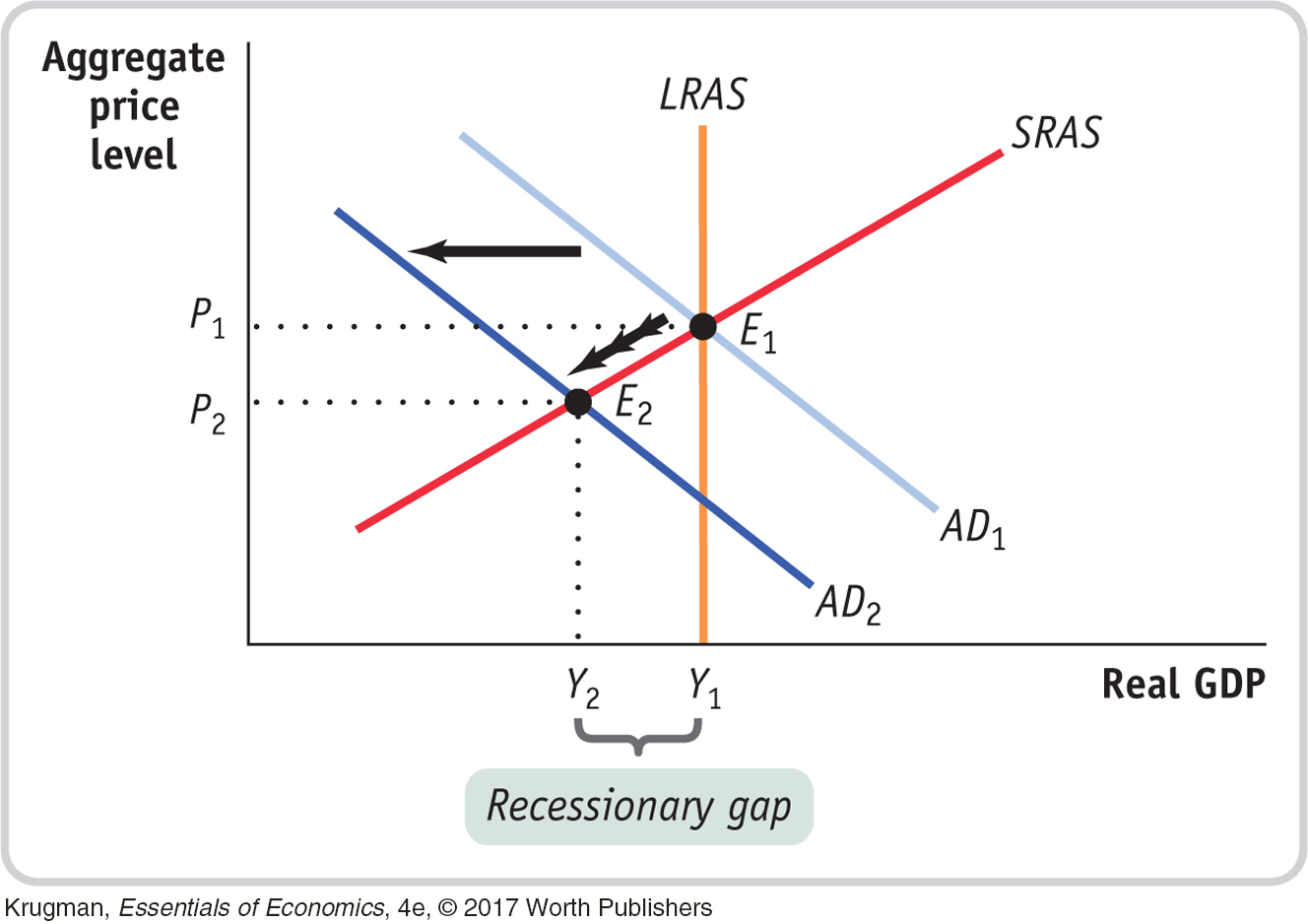

STEP | 3 Draw the long-run aggregate supply curve through the initial equilibrium point E1, and label the recessionary gap.Read pages 460–462 and review Figures 16-12 and 16-13.

The long-run aggregate supply curve is drawn in the following diagram. The economy now faces a recessionary gap between Y1 and Y2.

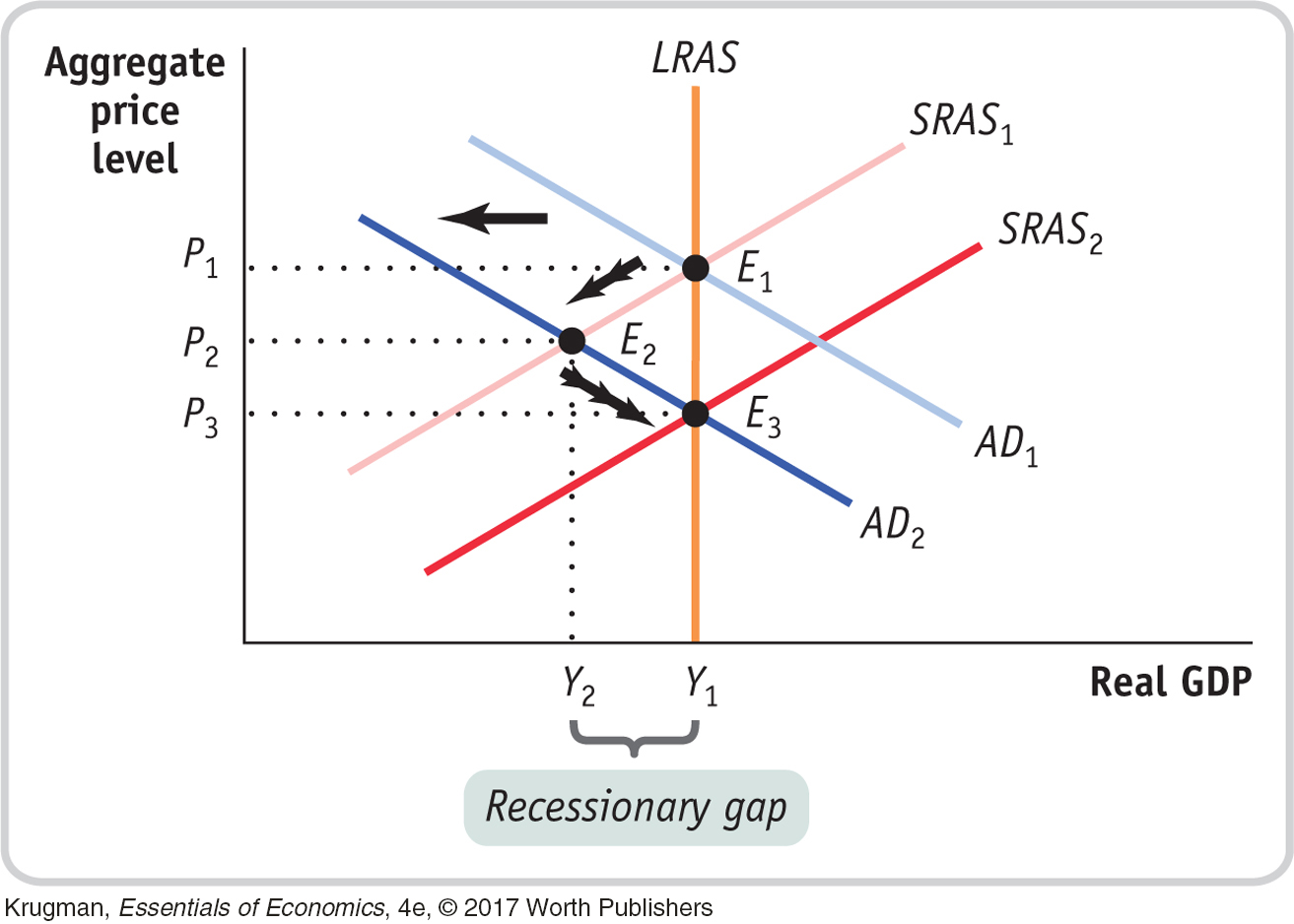

STEP | 4 What would you predict in the long run?Read pages 460–462 and review Figure 16-13.

As wage contracts are renegotiated, nominal wages will fall and the short-run aggregate supply curve will shift gradually to the right over time until it reaches SRAS2 and intersects AD2 at point E3. At E3, the economy is back at its potential output but at a much lower aggregate price level, as shown in the following diagram.

for interactive tutorials with step-

for interactive tutorials with step-