7.8 Business Case

229

BUSINESS CASE

BUSINESS CASE

Kiva Systems’ Robots versus Humans: The Challenge of Holiday Order Fulfillment

For those who tend to procrastinate when it comes to holiday shopping, the rise of e-

E-

Behind these technological advances, however, lies an intense debate: people versus robots. Amazon has relied on a large staff of temporary human workers to get it through the previous holiday seasons, often quadrupling its staff and operating 24 hours a day. In contrast, CrateandBarrel.com only doubled its workforce, thanks to a cadre of orange robots that allows each worker to do the work of six people.

But Amazon is set to increase its robotic work force in the future. In 2012, Amazon bought Kiva Systems, the leader in order fulfillment robotics, for $775 million, with the hope of tailoring Kiva’s systems to fit Amazon’s warehouse and fulfillment needs.

Although many retailers—

As one industry analyst noted, an obstacle to the purchase of a robotic system for many e-

QUESTIONS FOR THOUGHT

Assume that a firm can sell a robot, but that the sale takes time and the firm is likely to get less than what it paid. Other things equal, which system, human-

based or robotic, will have a higher fixed cost? Which will have a higher variable cost? Explain. Predict the pattern of off-

holiday sales versus holiday sales that would induce a retailer to keep a human- based system. Predict the pattern that would induce a retailer to move to a robotic system. How would a “robot-

for- hire” program affect your answer to Question 2? Explain.

BUSINESS CASE

BUSINESS CASE

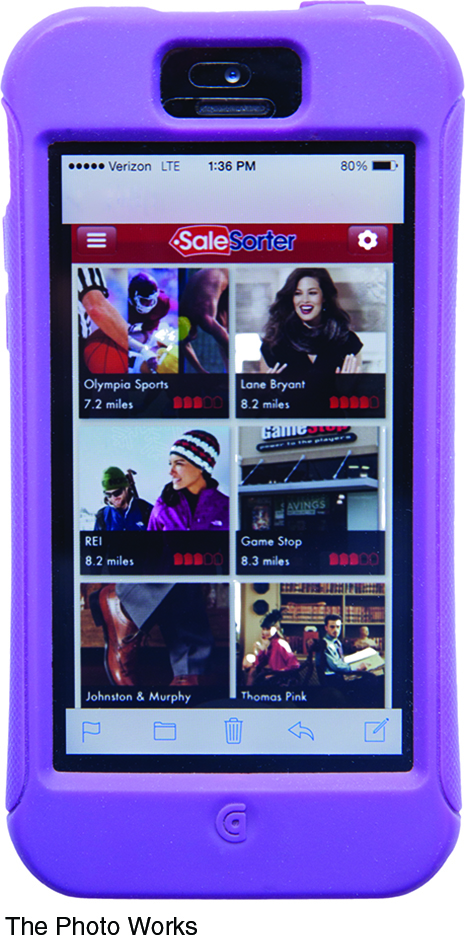

Shopping Apps, Showrooming, and the Challenges Facing Brick-

230

In a Sunnyvale, California Best Buy, Tri Trang found the perfect gift for his girlfriend, a $184.85 Garmin GPS. Before mobile shopping apps appeared, he would have purchased it there. Instead, Trang whipped out his smartphone to do a price comparison. Finding the same item on Amazon for $106.75 with free shipping, he bought it from Amazon on the spot.

For brick-

Before shopping apps, a traditional retailer could lure customers into its store with enticing specials and reasonably expect them to buy more profitable items with prompting from a salesperson. But those days are fast disappearing. The consulting firm Accenture found that 73% of customers with mobile devices preferred to shop with their phones rather than talk to a salesperson. In just four years, from 2010 to 2014, the use of mobile coupons has quadrupled from 12.3 million to 53.2 million.

But brick-

However, traditional retailers know that their survival rests on pricing. While prices on their websites tend to be lower than in the stores, these retailers are still struggling to compete with online sellers like Amazon. A recent study showed Amazon’s prices were about 9% lower than Walmart.com’s and 14% lower than Target.com’s. Best Buy now offers to match online prices for its best customers.

It’s clearly a race for survival. As one analyst said, “Only a couple of retailers can play the lowest-

QUESTIONS FOR THOUGHT

From the evidence in the case, what can you infer about whether or not the retail market for electronics satisfied the conditions for perfect competition before the advent of mobile-

device comparison price shopping? What was the most important impediment to competition? What effect is the introduction of mobile shopping apps having on competition in the retail market for electronics? On the profitability of brick-

and- mortar retailers like Best Buy? What, on average, will be the effect on the consumer surplus of purchasers of these items? Why are some retailers responding by having manufacturers make exclusive versions of products for them? Is this trend likely to increase or diminish?