Fluctuations and Economic Growth

Between 1985 and 1995, the economic climate in the United Kingdom, and especially in central London, fluctuated quite a bit. At the end of the 1980s, the economy was booming. People were purchasing closet-sized apartments in central London for outrageously expensive prices, and traffic in central London was impossible. The wait time for reservations at top restaurants could be three months or longer. However, that all changed by the early 1990s. Flats—the British word for apartments—were suddenly affordable again, traffic eased considerably, and it was very easy to get a table at those top restaurants—all signs of a troubled economy. But then the economic situation changed again. By 1995, London experienced another boom, with rapidly rising property prices, lots of traffic, and bustling restaurants.

By comparing the economy in the United Kingdom across time from 1985 to 1995, show that the change in the economic environment in London in the early 1990s reflected changes in the overall economic environment in the United Kingdom over the same period. What was the long-run growth rate in the United Kingdom during this 10-year period? At this growth rate, approximately how long should it take for GDP to double in the United Kingdom?

Compare the economy in the United Kingdom across time from 1985 to 1995. (Hint: the OECD Internet site http://stats.oecd.org provides statistics over time on real GDP per capita for various countries.)

Read the section “Comparing Economies Across Time and Space” beginning on page 378, and especially note the first paragraph under “Real GDP per Capita.” Go to the Internet site http://stats.oecd.org. On the menu labeled “Data by theme” on the left-hand side of the page, find and click on “National Accounts.” Then click on “Annual National Accounts,” then “Main Aggregates,” then “Gross Domestic Product.” Finally, click on the selection that starts with “GDP per head, US$, Constant Prices.” In the top, dark-blue section of the table, click on “Frequency,” choose “Select date range,” “Annual,” and then select 1985 for the first drop-down list and 1995 for the second. Click on “View Data.” Scroll down to the row “United Kingdom,” and copy the numbers from 1985 to 1995.

Real GDP per capita in the United Kingdom from the OECD site in constant U.S. dollars (reference year 2005) is as follows:

| Year | Real GDP per capita |

|---|---|

| 1985 | $20,073 |

| 1986 | 20,830 |

| 1987 | 21,734 |

| 1988 | 22,783 |

| 1989 | 23,237 |

| 1990 | 23,352 |

| 1991 | 22,947 |

| 1992 | 22,922 |

| 1993 | 23,379 |

| 1994 | 24,317 |

| 1995 | 24,987 |

Using the numbers in the table above, find the growth rate in real GDP in the United Kingdom for this same period, and discuss the difference in growth rates in the early 1990s with growth rates during other years.

Read carefully the Pitfalls box, “Change in Levels versus Rate of Change,” on page 380.

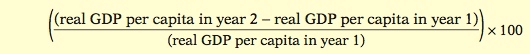

The rate of change, or growth rate, in real GDP per capita between year 1 and year 2 is calculated using the following formula:

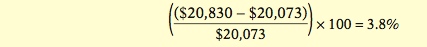

Thus, the growth rate below between 1985 and 1986 is calculated as follows:

| Year | Growth Rate |

|---|---|

| 1986 | 3.8% |

| 1987 | 4.3 |

| 1988 | 4.8 |

| 1989 | 2.0 |

| 1990 | 0.5 |

| 1991 | −1.7 |

| 1992 | −0.1 |

| 1993 | 2.0 |

| 1994 | 4.0 |

| 1995 | 2.8 |

As you can see from the numbers in this table, the United Kingdom experienced negative growth in 1991 and 1992, but strong and positive growth in most other years.

What was the average long-run growth rate during this period, and how long should it take for UK GDP to double if growth continues at this rate?

Read the section “Growth Rates,” beginning on page 380. Pay close attention to the Rule of 70 as stated in Equation 13-1.

Summing the above growth rates and then dividing by 10, we find an average growth rate of 2.2%. According to the Rule of 70, it would take 70/2.2 = 31.8 years for GDP to double in the United Kingdom at this growth rate.