The Federal Reserve System

A central bank is an institution that oversees and regulates the banking system and controls the monetary base.

Who’s in charge of ensuring that banks maintain enough reserves? Who decides how large the monetary base will be? The answer, in the United States, is an institution known as the Federal Reserve (or, informally, as “the Fed”). The Federal Reserve is a central bank—an institution that oversees and regulates the banking system and controls the monetary base. Other central banks include the Bank of England, the Bank of Japan, and the European Central Bank, or ECB. The ECB acts as a common central bank for 17 European countries: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The world’s oldest central bank, by the way, is Sweden’s Sveriges Rijksbank, which awards the Nobel Prize in economics.

The Structure of the Fed

The legal status of the Fed, which was created in 1913, is unusual: it is not exactly part of the U.S. government, but it is not really a private institution either. Strictly speaking, the Federal Reserve system consists of two parts: the Board of Governors and the 12 regional Federal Reserve Banks.

The Board of Governors, which oversees the entire system from its offices in Washington, D.C., is constituted like a government agency: its seven members are appointed by the president and must be approved by the Senate. However, they are appointed for 14-year terms, to insulate them from political pressure in their conduct of monetary policy. Although the chairman is appointed more frequently—every four years—it’s traditional for chairmen to be reappointed and serve much longer terms. For example, William McChesney Martin was chairman of the Fed from 1951 until 1970. Alan Greenspan, appointed in 1987, served as the Fed’s chairman until 2006.

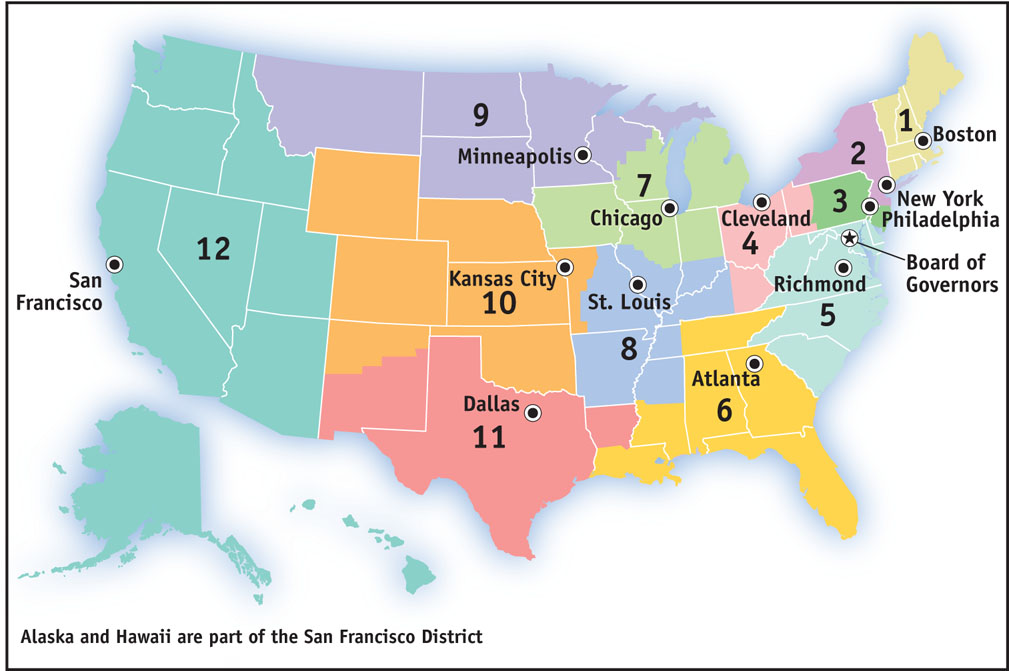

The 12 Federal Reserve Banks each serve a region of the country, providing various banking and supervisory services. One of their jobs, for example, is to audit the books of private-sector banks to ensure their financial health. Each regional bank is run by a board of directors chosen from the local banking and business community. The Federal Reserve Bank of New York plays a special role: it carries out open-market operations, usually the main tool of monetary policy. Figure 16-6 shows the 12 Federal Reserve districts and the city in which each regional Federal Reserve Bank is located.

FIGURE 16-6 The Federal Reserve System

Decisions about monetary policy are made by the Federal Open Market Committee, which consists of the Board of Governors plus five of the regional bank presidents. The president of the Federal Reserve Bank of New York is always on the committee, and the other four seats rotate among the 11 other regional bank presidents. The chairman of the Board of Governors normally also serves as the chairman of the Open Market Committee.

The effect of this complex structure is to create an institution that is ultimately accountable to the voting public because the Board of Governors is chosen by the president and confirmed by the Senate, all of whom are themselves elected officials. But the long terms served by board members, as well as the indirectness of their appointment process, largely insulate them from short-term political pressures.

What the Fed Does: Reserve Requirements and the Discount Rate

The Fed has three main policy tools at its disposal: reserve requirements, the discount rate, and, most importantly, open-market operations.

In our discussion of bank runs, we noted that the Fed sets a minimum reserve ratio requirement, currently equal to 10% for checkable bank deposits. Banks that fail to maintain at least the required reserve ratio on average over a two-week period face penalties.

The federal funds market allows banks that fall short of the reserve requirement to borrow funds from banks with excess reserves.

The federal funds rate is the interest rate determined in the federal funds market.

What does a bank do if it looks as if it has insufficient reserves to meet the Fed’s reserve requirement? Normally, it borrows additional reserves from other banks via the federal funds market, a financial market that allows banks that fall short of the reserve requirement to borrow reserves (usually just overnight) from banks that are holding excess reserves. The interest rate in this market is determined by supply and demand—but the supply and demand for bank reserves are both strongly affected by Federal Reserve actions. As we’ll see in the next chapter, the federal funds rate, the interest rate at which funds are borrowed and lent in the federal funds market, plays a key role in modern monetary policy.

The discount rate is the rate of interest the Fed charges on loans to banks.

Alternatively, banks in need of reserves can borrow from the Fed itself via the discount window. The discount rate is the rate of interest the Fed charges on those loans. Normally, the discount rate is set 1 percentage point above the federal funds rate in order to discourage banks from turning to the Fed when they are in need of reserves. Beginning in the fall of 2007, however, the Fed reduced the spread between the federal funds rate and the discount rate as part of its response to an ongoing financial crisis, described in the upcoming Economics in Action. As a result, by the spring of 2008 the discount rate was only 0.25 percentage point above the federal funds rate. And by January 2012 the discount rate was still only 0.65 percentage point above the federal funds rate.

In order to alter the money supply, the Fed can change reserve requirements, the discount rate, or both. If the Fed reduces reserve requirements, banks will lend a larger percentage of their deposits, leading to more loans and an increase in the money supply via the money multiplier. Alternatively, if the Fed increases reserve requirements, banks are forced to reduce their lending, leading to a fall in the money supply via the money multiplier. If the Fed reduces the spread between the discount rate and the federal funds rate, the cost to banks of being short of reserves falls; banks respond by increasing their lending, and the money supply increases via the money multiplier. If the Fed increases the spread between the discount rate and the federal funds rate, bank lending falls—and so will the money supply via the money multiplier.

Under current practice, however, the Fed doesn’t use changes in reserve requirements to actively manage the money supply. The last significant change in reserve requirements was in 1992. The Fed normally doesn’t use the discount rate either, although, as we mentioned earlier, there was a temporary surge in lending through the discount window beginning in 2007 in response to a financial crisis. Ordinarily, normal monetary policy is conducted almost exclusively using the Fed’s third policy tool: open-market operations.

Open-Market Operations

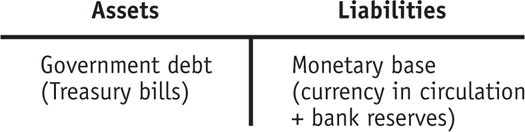

Like the banks it oversees, the Federal Reserve has assets and liabilities. The Fed’s assets normally consist of holdings of debt issued by the U.S. government, mainly short-term U.S. government bonds with a maturity of less than one year, known as U.S. Treasury bills. Remember, the Fed isn’t exactly part of the U.S. government, so U.S. Treasury bills held by the Fed are a liability of the government but an asset of the Fed. The Fed’s liabilities consist of currency in circulation and bank reserves. Figure 16-7 summarizes the normal assets and liabilities of the Fed in the form of a T-account.

FIGURE 16-7 The Federal Reserve’s Assets and Liabilities

An open-market operation is a purchase or sale of government debt by the Fed.

In an open-market operation the Federal Reserve buys or sells U.S. Treasury bills, normally through a transaction with commercial banks—banks that mainly make business loans, as opposed to home loans. The Fed never buys U.S. Treasury bills directly from the federal government. There’s a good reason for this: when a central bank buys government debt directly from the government, it is lending directly to the government—in effect, the central bank is printing money to finance the government’s budget deficit. This has historically been a formula for disastrously high levels of inflation.

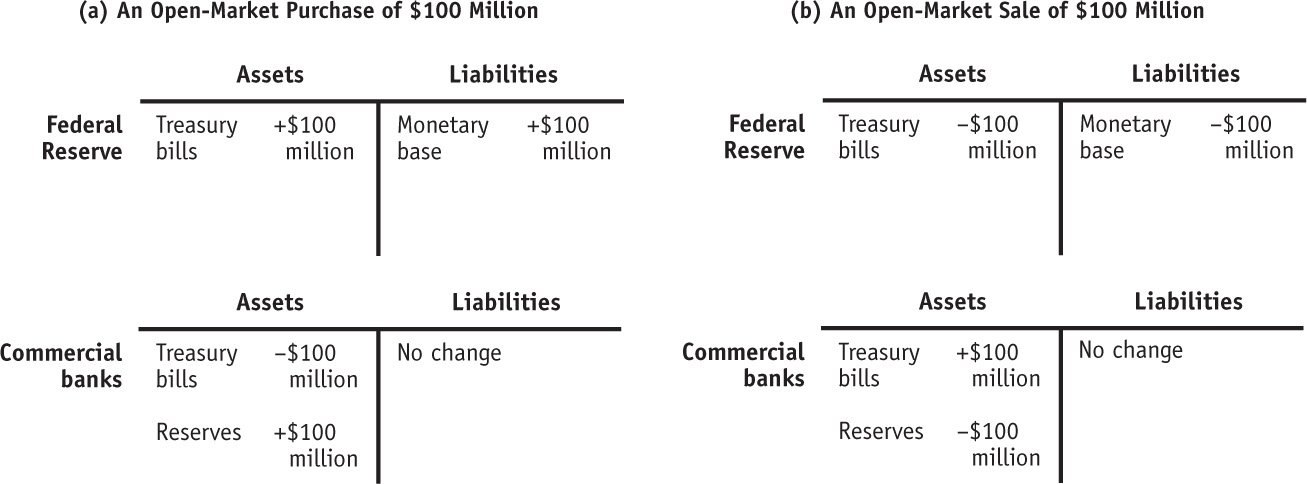

The two panels of Figure 16-8 show the changes in the financial position of both the Fed and commercial banks that result from open-market operations. When the Fed buys U.S. Treasury bills from a commercial bank, it pays by crediting the bank’s reserve account by an amount equal to the value of the Treasury bills. This is illustrated in panel (a): the Fed buys $100 million of U.S. Treasury bills from commercial banks, which increases the monetary base by $100 million because it increases bank reserves by $100 million. When the Fed sells U.S. Treasury bills to commercial banks, it debits the banks’ accounts, reducing their reserves. This is shown in panel (b), where the Fed sells $100 million of U.S. Treasury bills. Here, bank reserves and the monetary base decrease.

FIGURE 16-8 Open-Market Operations by the Federal Reserve

You might wonder where the Fed gets the funds to purchase U.S. Treasury bills from banks. The answer is that it simply creates them with a stroke of the pen—or, these days, a click of the mouse—that credits the banks’ accounts with extra reserves. (The Fed prints money to pay for Treasury bills only when banks want the additional reserves in the form of currency.) Remember, the modern dollar is fiat money, which isn’t backed by anything. So the Fed can create additional monetary base at its own discretion.

The change in bank reserves caused by an open-market operation doesn’t directly affect the money supply. Instead, it starts the money multiplier in motion. After the $100 million increase in reserves shown in panel (a) of Figure 16-8, commercial banks would lend out their additional reserves, immediately increasing the money supply by $100 million. Some of those loans would be deposited back into the banking system, increasing reserves again and permitting a further round of loans, and so on, leading to a rise in the money supply. An open-market sale has the reverse effect: bank reserves fall, requiring banks to reduce their loans, leading to a fall in the money supply.

Who Gets the Interest on the Fed’s Assets?

As we’ve just learned, the Fed owns a lot of assets—Treasury bills—that it bought from commercial banks in exchange for monetary base in the form of credits to banks’ reserve accounts. These assets pay interest. Yet the Fed’s liabilities consist mainly of the monetary base, liabilities on which the Fed normally doesn’t pay interest. So the Fed is, in effect, an institution that has the privilege of borrowing funds at a zero interest rate and lending them out at a positive interest rate. That sounds like a pretty profitable business. Who gets the profits?

The answer is, you do—or rather, U.S. taxpayers do. The Fed keeps some of the interest it receives to finance its operations but turns most of it over to the U.S. Treasury. For example, in 2010 the Federal Reserve system received $79.301 billion in interest income (most of it in interest on its holdings of Treasury bills and on government-sponsored mortgage-backed securities), of which $79.268 billion was returned to the Treasury.

We can now finish the chapter’s opening story—the impact of those forged $100 bills allegedly printed in North Korea. When a fake $100 bill enters circulation, it has the same economic effect as a real $100 bill printed by the U.S. government. That is, as long as nobody catches the forgery, the fake bill serves, for all practical purposes, as part of the monetary base.

Meanwhile, the Fed decides on the size of the monetary base based on economic considerations—in particular, the Fed doesn’t let the monetary base get too large because that can cause higher inflation. So every fake $100 bill that enters circulation basically means that the Fed prints one less real $100 bill. When the Fed prints a $100 bill legally, however, it gets Treasury bills in return—and the interest on those bills helps pay for the U.S. government’s expenses. So a counterfeit $100 bill reduces the amount of Treasury bills the Fed can acquire and thereby reduces the interest payments going to the Fed and the U.S. Treasury. Taxpayers, then, bear the real cost of counterfeiting.

Economists often say, loosely, that the Fed controls the money supply—checkable deposits plus currency in circulation. In fact, it controls only the monetary base—bank reserves plus currency in circulation. But by increasing or reducing the monetary base, the Fed can exert a powerful influence on both the money supply and interest rates. This influence is the basis of monetary policy, the subject of our next chapter.

The European Central Bank

As we noted earlier, the Fed is only one of a number of central banks around the world, and it’s much younger than Sweden’s Sveriges Rijksbank and Britain’s Bank of England. In general, other central banks operate in much the same way as the Fed. That’s especially true of the only other central bank that rivals the Fed in terms of importance to the world economy: the European Central Bank.

The European Central Bank, known as the ECB, was created in January 1999 when 11 European nations abandoned their national currencies and adopted the euro as their common currency and placed their joint monetary policy in the ECB’s hands. (Six more countries have joined since 1999.) The ECB instantly became an extremely important institution: although no single European nation has an economy anywhere near as large as that of the United States, the combined economies of the eurozone, the group of countries that have adopted the euro as their currency, are roughly as big as the U.S. economy. As a result, the ECB and the Fed are the two giants of the monetary world.

Like the Fed, the ECB has a special status: it’s not a private institution, but it’s not exactly a government agency either. In fact, it can’t be a government agency because there is no pan-European government! Luckily for puzzled Americans, there are strong analogies between European central banking and the Federal Reserve system.

First of all, the ECB, which is located in the German city of Frankfurt, isn’t really the counterpart of the whole Federal Reserve system: it’s the equivalent of the Board of Governors in Washington. The European counterparts of the regional Federal Reserve Banks are Europe’s national central banks: the Bank of France, the Bank of Italy, and so on. Until 1999, each of these national banks was its country’s equivalent to the Fed. For example, the Bank of France controlled the French monetary base.

Today these national banks, like regional Feds, provide various financial services to local banks and businesses and conduct open-market operations, but the making of monetary policy has moved upstream to the ECB. Still, the various European national central banks aren’t small institutions: in total, they employ more than 50,000 people; in December 2010, the ECB employed only 1,607.

In the eurozone, each country chooses who runs its own national central bank. The ECB’s Executive Board is the counterpart of the Fed’s Board of Governors; its members are chosen by unanimous consent of the eurozone national governments. The counterpart of the Federal Open Market Committee is the ECB’s Governing Council. Just as the Fed’s Open Market Committee consists of the Board of Governors plus a rotating group of regional Fed presidents, the ECB’s Governing Council consists of the Executive Board plus the heads of the national central banks.

Like the Fed, the ECB is ultimately answerable to voters but given the fragmentation of political forces across national boundaries, it appears to be even more insulated than the Fed from short-term political pressures.

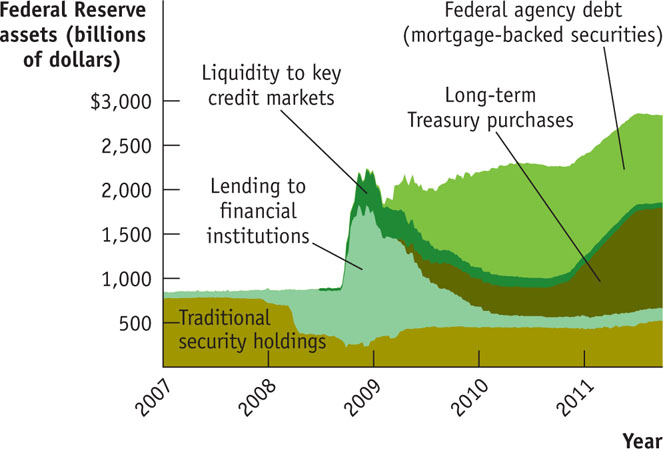

The Fed’s Balance Sheet, Normal and Abnormal

Figure 16-7 showed a simplified version of the Fed’s balance sheet. Here, liabilities consisted entirely of the monetary base and assets consisted entirely of Treasury bills. This is an oversimplification because the Fed’s operations are more complicated in reality and its balance sheet contains a number of additional things. But, in normal times, Figure 16-7 is a reasonable approximation: the monetary base typically accounts for 90% of the Fed’s liabilities, and 90% of its assets are in the form of claims on the U.S. Treasury (as in Treasury bills).

But in late 2007 it became painfully clear that we were no longer in normal times. The source of the turmoil was the bursting of a huge housing bubble, which led to massive losses for financial institutions that had made mortgage loans or held mortgage-related assets. This led to a widespread loss of confidence in the financial system.

As we’ll describe in more detail in the next section, not only standard deposit-taking banks were in trouble, but also non-depository financial institutions—financial institutions that did not accept customer deposits. Because they carried a lot of debt, faced huge losses from the collapse of the housing bubble, and held illiquid assets, panic hit these “nonbank banks.” Within hours the financial system was frozen as financial institutions experienced what were essentially bank runs. For example, in 2008, many investors became worried about the health of Bear Stearns, a Wall Street non-depository financial institution that engaged in complex financial deals, buying and selling financial assets with borrowed funds. When confidence in Bear Stearns dried up, the firm found itself unable to raise the funds it needed to deliver on its end of these deals and it quickly spiraled into collapse.

The Fed sprang into action to contain what was becoming a meltdown across the entire financial sector. It greatly expanded its discount window—making huge loans to deposit-taking banks as well as non-depository financial institutions such as Wall Street financial firms. This gave financial institutions the liquidity that the financial market had now denied them. And as these firms took advantage of the ability to borrow cheaply from the Fed, they pledged their assets on hand as collateral—a motley collection of real estate loans, business loans, and so on.

Examining Figure 16-9, we see that starting in mid-2008, the Fed sharply reduced its holdings of traditional securities like Treasury bills, as its lending to financial institutions skyrocketed. “Lending to financial institutions” refers to discount window lending, but also loans the Fed made directly to firms like Bear Stearns. “Liquidity to key credit markets” covers purchases by the Fed of assets like corporate bonds, which was necessary to keep interest rates on loans to firms from soaring. Finally, “Federal agency debt” is the debt of Fannie Mae and Freddie Mac, the government-sponsored home mortgage agencies, which the Fed was also compelled to buy in order to prevent collapse in the mortgage market.

FIGURE 16-9 The Federal Reserve’s Assets

As the crisis subsided in late 2009, the Fed didn’t return to its traditional asset holdings. Instead, it shifted into long-term Treasury bills and increased its purchases of Federal agency debt. The whole episode was very unusual—a major departure from the way in which the Fed normally conducts business, but one that it deemed necessary to stave off financial and economic collapse. It was also a graphic illustration of the fact that the Fed does much more than just determine the size of the monetary base.

Quick Review

- The Federal Reserve is America’s central bank, overseeing banking and making monetary policy.

- The Fed sets the required reserve ratio. Banks borrow and lend reserves in the federal funds market. The interest rate determined in this market is the federal funds rate. Banks can also borrow from the Fed at the discount rate.

- Although the Fed can change reserve requirements or the discount rate, in practice, monetary policy is conducted using open-market operations.

- An open-market purchase of Treasury bills increases the monetary base and therefore the money supply. An open-market sale reduces the monetary base and the money supply.

Check Your Understanding 16-4

Question

Assume that any money lent by a bank is always deposited back in the banking system as a checkable deposit and that the reserve ratio is 10%. Trace out the effects of a $100 million open-market purchase of U.S. Treasury bills by the Fed on the value of checkable bank deposits. What is the size of the money multiplier?

A. B. C. D. An open market purchase of $100 million by the Fed increases banks' reserves by $100 million as the Fed credits their accounts with additional reserves. In other words, this open-market purchase increases the monetary base (currency in circulation plus bank reserves) by $100 million. Banks lend out the additional $100 million. Whoever borrows the money puts it back into the banking system in the form of deposits. Of these deposits, banks lend out $100 million x (1 - rr) = $100 million x 0.9 = $90 million. Whoever borrows the money deposits it back into the banking system. And banks lend out $90 million x 0.9 = $81 million, and so on. As a result, bank deposits increase by $100 million + 90 million + $81 million . . . = $100 million/rr = $100 million/0.1 = $1,000 million = $1 billion. Since in this simplified example all money lent out is deposited back into the banking system, there is no increase of currency in circulation, so the increase in bank deposits is equal to the increase in the money supply. In other words, the money supply increases by $1 billion. This is greater than the increase in the monetary base by a factor of 10: in this simplified model in which deposits are the only component of the money supply and in which banks hold no excess reserves, the money multiplier is 1/rr = 10.

Solution appears at back of book.