Problems

- Which of the following are examples of debt overhang? Which examples are likely to lead to a cutback in spending? Explain.

Question

Your uncle starts a restaurant, borrowing to fund his investment. The restaurant fails, and your uncle must shut down but still must pay his debt.

Prob 18 1a. Your uncle starts a restaurant, borrowing to fund his investment. The restaurant fails, and your uncle must shut down but still must pay his debt.Question

Your parents take out a loan to buy a house. Your father is transferred to a new city, and now your parents must sell the house. The value of the house has gone up during the time your family has lived there.

Prob 18 1b. Your parents take out a loan to buy a house. Your father is transferred to a new city, and now your parents must sell the house. The value of the house has gone up during the time your family has lived there.Question

Your friend’s parents take out a loan to buy her a condo to live in while she is at college. Meanwhile, the housing market plummets. By the time your friend leaves college, the condo is worth significantly less than the value of the loan.

Prob 18 1c. Your friend’s parents take out a loan to buy her a condo to live in while she is at college. Meanwhile, the housing market plummets. By the time your friend leaves college, the condo is worth significantly less than the value of the loan.Question

You finish college with an honors degree in a field with many good job prospects and with $25,000 in student loans that you must repay.

Prob 18 1d. You finish college with an honors degree in a field with many good job prospects and with $25,000 in student loans that you must repay.

- Which of the following are not examples of a vicious cycle of deleveraging? Explain.

Question

Your university decides to sell several commercial buildings in the middle of town in order to upgrade buildings on campus.

Prob 18 2a. Your university decides to sell several commercial buildings in the middle of town in order to upgrade buildings on campus.Question

A company decides to sell its large and valuable art collection because other asset prices on its balance sheet have fallen below a critical level, forcing creditors to call in their loans to the company because of provisions written into the original loan contract.

Prob 18 2b. A company decides to sell its large and valuable art collection because other asset prices on its balance sheet have fallen below a critical level, forcing creditors to call in their loans to the company because of provisions written into the original loan contract.Question

A company decides to issue more stock in order to voluntarily pay off some of its debt.

Prob 18 2c. A company decides to issue more stock in order to voluntarily pay off some of its debt.Question

A shadow bank must sell its holdings of corporate bonds because falling asset prices have led to a default on the terms of its loans with some creditors.

Prob 18 2d. A shadow bank must sell its holdings of corporate bonds because falling asset prices have led to a default on the terms of its loans with some creditors.

Question

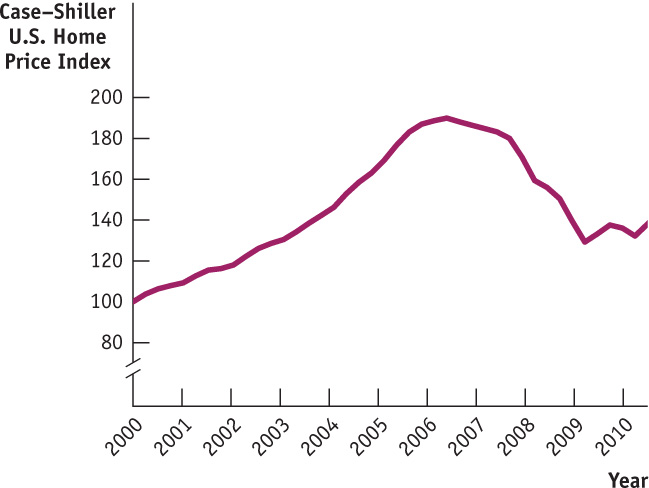

In the following figure showing the Case–Shiller U.S. Home Price Index from 2000 to 2010, did housing prices peak before or after the financial crisis in the United States? Explain your answer.

Source: Robert J. Shiller, Irrational Exuberance, 2nd ed. (Princeton, NJ: Princeton University Press, 2005); data retrieved from http://www.econ.yale.edu/~shiller/data.htm.Prob 18 3. In the following figure showing the Case–Shiller U.S. Home Price Index from 2000 to 2010, did housing prices peak before or after the financial crisis in the United States? Explain your answer.

Source: Robert J. Shiller, Irrational Exuberance, 2nd ed. (Princeton, NJ: Princeton University Press, 2005); data retrieved from http://www.econ.yale.edu/~shiller/data.htm.Prob 18 3. In the following figure showing the Case–Shiller U.S. Home Price Index from 2000 to 2010, did housing prices peak before or after the financial crisis in the United States? Explain your answer.- Figure 18-2 tracks the unemployment rate in the years before and after the Panic of 1893 in the United States and the banking crisis of 1991 in Sweden.

Question

In Figure 18-2, how many years after the Panic of 1893 did unemployment peak in the United States?

Prob 18 4a. In Figure 18-2, how many years after the Panic of 1893 did unemployment peak in the United States?Question

In Figure 18-2, how many years after the banking crisis of 1991 did unemployment peak in Sweden?

Prob 18 4b. In Figure 18-2, how many years after the banking crisis of 1991 did unemployment peak in Sweden?

Question

In 2007–2009, the Federal Reserve, acting as a lender of last resort, stepped in to provide funds when private markets were unable to do so. The Fed also took over many banks. In 2007, it seized 3 banks; in 2008, it seized 25 banks; and in 2009, it seized 140 banks. Go to www.fdic.gov; under “Bank Closing Information,” click on “Complete Failed Bank List.” Then count the number of banks that the Federal Reserve has seized so far this year. Have bank failures decreased since the crisis in 2008?

Prob 18 5. In 2007–2009, the Federal Reserve, acting as a lender of last resort, stepped in to provide funds when private markets were unable to do so. The Fed also took over many banks. In 2007, it seized 3 banks; in 2008, it seized 25 banks; and in 2009, it seized 140 banks. Go to www.fdic.gov; under “Bank Closing Information,” click on “Complete Failed Bank List.” Then count the number of banks that the Federal Reserve has seized so far this year. Have bank failures decreased since the crisis in 2008?- During the financial crisis in October 2008, the federal government could borrow at a rate of 2.73% (the yield on five-year Treasury securities). During October 2008, though, Baa borrowers (corporate borrowers rated by Moody’s as not being completely reliable) had to pay 8.88%.

Question

What was the difference in borrowing costs for these corporate borrowers and the federal government?

Prob 18 6a. What was the difference in borrowing costs for these corporate borrowers and the federal government?Question

Go to www.research.stlouisfed.org/fred2/categories/22. Click on the link for “Treasury constant maturity” and find the most recent interest rate on 10-year U.S. Treasury bonds. Then go back to the original web page and click on the link for “Corporate bonds” and find the rate for Baa corporate bonds. What is the current difference in borrowing costs between corporate borrowers and the U.S. government?

Prob 18 6b. Go to www.research.stlouisfed.org/fred2/categories/22. Click on the link for “Treasury constant maturity” and find the most recent interest rate on 10-year U.S. Treasury bonds. Then go back to the original web page and click on the link for “Corporate bonds” and find the rate for Baa corporate bonds. What is the current difference in borrowing costs between corporate borrowers and the U.S. government?Question

Has this difference in borrowing costs increased or decreased since the height of the financial crisis in October of 2008? Why?

Prob 18 6c. Has this difference in borrowing costs increased or decreased since the height of the financial crisis in October of 2008? Why?

- Go to www.federalreserve.gov and click on the tab “Banking Information & Regulation.” Then select the links “Banking Data” followed by “Large Commercial Banks.” Once there, choose the latest release of quarterly data.

Question

Which bank has the largest consolidated assets?

Prob 18 7a. Which bank has the largest consolidated assets?Question

Which bank has the largest domestic assets?

Prob 18 7b. Which bank has the largest domestic assets?Question

What percent of U.S. GDP are the domestic assets of the bank listed in part b? (Hint: You can find U.S. GDP at http://research.stlouisfed.org/fred2/series/GDP?cid=106 using the links “Gross Domestic Product (GDP)” and then “Current-dollar and ‘real’ GDP.”)

Prob 18 7c. What percent of U.S. GDP are the domestic assets of the bank listed in part b? (Hint: You can find U.S. GDP at http://research.stlouisfed.org/fred2/series/GDP?cid=106 using the links “Gross Domestic Product (GDP)” and then “Current-dollar and ‘real’ GDP.”)

- Go to www.fdic.gov and click on the tab “Industry Analysis” and then on the link “Research & Analysis.” Under “Historical Perspectives,” select “The First Fifty Years: A History of the FDIC 1933–1983.” Open Chapter 3, “Establishment of the FDIC,” and scroll down to the section entitled “The Banking Crisis of 1933” and the section entitled “Federal Deposit Insurance Legislation.” Read the section and then answer these questions.Page 566

Question

President Roosevelt was sworn in on March 4, 1933. What was one of his first official acts in response to the banking crisis?

Prob 18 8a. President Roosevelt was sworn in on March 4, 1933. What was one of his first official acts in response to the banking crisis?Question

How many banks suspended operations during 1933?

Prob 18 8b. How many banks suspended operations during 1933?Question

Who was the chief proponent of federal deposit insurance in Congress?

Prob 18 8c. Who was the chief proponent of federal deposit insurance in Congress?Question

How much coverage did the temporary fund for federal deposit insurance provide?

Prob 18 8d. How much coverage did the temporary fund for federal deposit insurance provide?

- The U.S. Government Accountability Office (GAO) does research to support congressional decision making. After the Long-Term Capital Management (LTCM) crisis, the GAO produced a summary of the events of the crisis located at http://www.gao.gov/products/GGD-00-3. Read the summary and then answer the following questions.

Question

How much of its capital did LTCM lose in 1998?

Prob 18 9a. How much of its capital did LTCM lose in 1998?Question

Why did the GAO conclude that LTCM was able to establish leveraged trading positions of a size that posed systemic risk to the banking system?

Prob 18 9b. Why did the GAO conclude that LTCM was able to establish leveraged trading positions of a size that posed systemic risk to the banking system?Question

What was the recommendation of the President’s Working Group regarding the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)?

Prob 18 9c. What was the recommendation of the President’s Working Group regarding the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)?