Consumer Surplus and the Demand Curve

The market in used textbooks is a big business in terms of dollars and cents—approximately $2.9 billion in 2011. More importantly for us, it is a convenient starting point for developing the concepts of consumer and producer surplus. We’ll use the concepts of consumer and producer surplus to understand exactly how buyers and sellers benefit from a competitive market and how big those benefits are. In addition, these concepts play important roles in analyzing what happens when competitive markets don’t work well or there is interference in the market.

So let’s begin by looking at the market for used textbooks, starting with the buyers. The key point, as we’ll see in a minute, is that the demand curve is derived from their tastes or preferences—and that those same preferences also determine how much they gain from the opportunity to buy used books.

Willingness to Pay and the Demand Curve

A consumer’s willingness to pay for a good is the maximum price at which he or she would buy that good.

A used book is not as good as a new book—it will be battered and coffee-stained, may include someone else’s highlighting, and may not be completely up to date. How much this bothers you depends on your preferences. Some potential buyers would prefer to buy the used book even if it is only slightly cheaper than a new book, but others would buy the used book only if it is considerably cheaper. Let’s define a potential buyer’s willingness to pay as the maximum price at which he or she would buy a good, in this case a used textbook. An individual won’t buy the book if it costs more than this amount but is eager to do so if it costs less. If the price is just equal to an individual’s willingness to pay, he or she is indifferent between buying and not buying. For the sake of simplicity, we’ll assume that the individual buys the good in this case.

Table 4-1 shows five potential buyers of a used book that costs $100 new, listed in order of their willingness to pay. At one extreme is Aleisha, who will buy a second-hand book even if the price is as high as $59. Brad is less willing to have a used book and will buy one only if the price is $45 or less. Claudia is willing to pay only $35; Darren, only $25. And Edwina, who really doesn’t like the idea of a used book, will buy one only if it costs no more than $10.

TABLE 4-1 Consumer Surplus When the Price of a Used Textbook Is $30

| Potential buyer | Willingness to pay | Price paid | Individual consumer surplus = Willingness to pay − Price paid |

|---|---|---|---|

| Aleisha | $59 | $30 | $29 |

| Brad | 45 | 30 | 15 |

| Claudia | 35 | 30 | 5 |

| Darren | 25 | – | – |

| Edwina | 10 | – | – |

| All buyers | Total consumer surplus = $49 |

How many of these five students will actually buy a used book? It depends on the price. If the price of a used book is $55, only Aleisha buys one; if the price is $40, Aleisha and Brad both buy used books, and so on. So the information in the table on willingness to pay also defines the demand schedule for used textbooks.

Willingness to Pay and Consumer Surplus

Suppose that the campus bookstore makes used textbooks available at a price of $30. In that case Aleisha, Brad, and Claudia will buy books. Do they gain from their purchases, and if so, how much?

The answer, also shown in Table 4-1 is that each student who purchases a book does achieve a net gain but that the amount of the gain differs among students.

Aleisha would have been willing to pay $59, so her net gain is $59 — $30 = $29. Brad would have been willing to pay $45, so his net gain is $45 — $30 = $15. Claudia would have been willing to pay $35, so her net gain is $35 — $30 = $5. Darren and Edwina, however, won’t be willing to buy a used book at a price of $30, so they neither gain nor lose.

Individual consumer surplus is the net gain to an individual buyer from the purchase of a good. It is equal to the difference between the buyer’s willingness to pay and the price paid.

Total consumer surplus is the sum of the individual consumer surpluses of all the buyers of a good in a market.

The term consumer surplus is often used to refer to both individual and total consumer surplus.

The net gain that a buyer achieves from the purchase of a good is called that buyer’s individual consumer surplus. What we learn from this example is that whenever a buyer pays a price less than his or her willingness to pay, the buyer achieves some individual consumer surplus.

The sum of the individual consumer surpluses achieved by all the buyers of a good is known as the total consumer surplus achieved in the market. In Table 4-1 the total consumer surplus is the sum of the individual consumer surpluses achieved by Aleisha, Brad, and Claudia: $29 + $15 + $5 = $49.

Economists often use the term consumer surplus to refer to both individual and total consumer surplus. We will follow this practice; it will always be clear in context whether we are referring to the consumer surplus achieved by an individual or by all buyers.

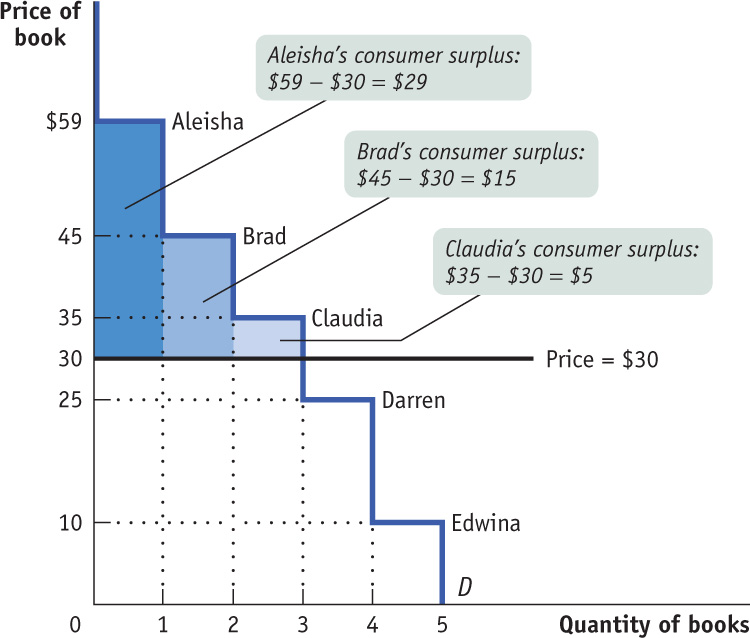

Total consumer surplus can be represented graphically. As we saw in Chapter 3, we can use the demand schedule to derive the market demand curve shown in Figure 4-1. Because we are considering only a small number of consumers, this curve doesn’t look like the smooth demand curves of Chapter 3, where markets contained hundreds or thousands of consumers. This demand curve is stepped, with alternating horizontal and vertical segments. Each horizontal segment—each step—corresponds to one potential buyer’s willingness to pay. Each step in that demand curve is one book wide and represents one consumer. For example, the height of Aleisha’s step is $59, her willingness to pay. This step forms the top of a rectangle, with $30—the price she actually pays for a book—forming the bottom. The area of Aleisha’s rectangle, ($59 — $30) × 1 = $29, is her consumer surplus from purchasing one book at $30. So the individual consumer surplus Aleisha gains is the area of the dark blue rectangle shown in Figure 4-1.

FIGURE 4-1 Consumer Surplus in the Used-Textbook Market

In addition to Aleisha, Brad and Claudia will also each buy a book when the price is $30. Like Aleisha, they benefit from their purchases, though not as much, because they each have a lower willingness to pay. Figure 4-1 also shows the consumer surplus gained by Brad and Claudia; again, this can be measured by the areas of the appropriate rectangles. Darren and Edwina, because they do not buy books at a price of $30, receive no consumer surplus.

The total consumer surplus achieved in this market is just the sum of the individual consumer surpluses received by Aleisha, Brad, and Claudia. So total consumer surplus is equal to the combined area of the three rectangles—the entire shaded area in Figure 4-1. Another way to say this is that total consumer surplus is equal to the area below the demand curve but above the price.

Figure 4-1 illustrates the following general principle: the total consumer surplus generated by purchases of a good at a given price is equal to the area below the demand curve but above that price. The same principle applies regardless of the number of consumers.

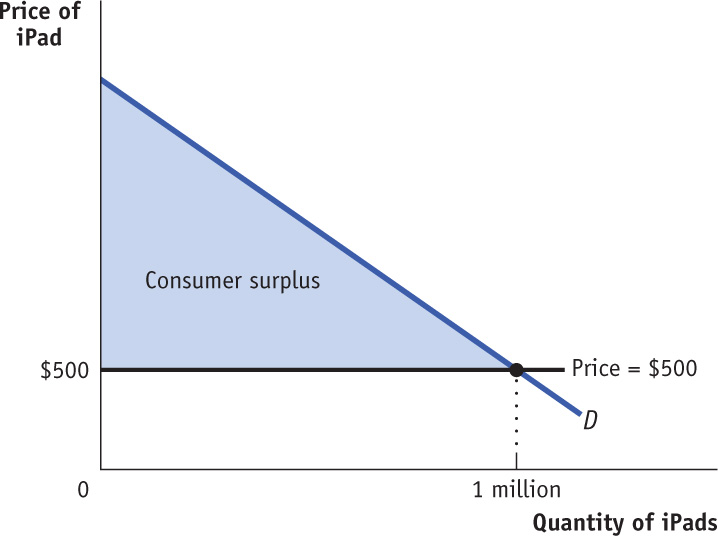

When we consider large markets, this graphical representation becomes extremely helPFul. Consider, for example, the sales of iPads to millions of potential buyers. Each potential buyer has a maximum price that he or she is willing to pay. With so many potential buyers, the demand curve will be smooth, like the one shown in Figure 4-2.

FIGURE 4-2 Consumer Surplus

Suppose that at a price of $500, a total of 1 million iPads are purchased. How much do consumers gain from being able to buy those 1 million iPads? We could answer that question by calculating the consumer surplus of each individual buyer and then adding these numbers up to arrive at a total. But it is much easier just to look at Figure 4-2 and use the fact that the total consumer surplus is equal to the shaded area. As in our original example, consumer surplus is equal to the area below the demand curve but above the price. (You can refresh your memory on how to calculate the area of a right triangle by reviewing the appendix to Chapter 2.)

A Matter of Life and Death

In 2010, over 3,900 people in the United States died while waiting for a kidney transplant. In early 2011, almost 90,000 were wait-listed. Since the number of those in need of a kidney far exceeds availability, what is the best way to allocate available organs? A market isn’t feasible. For understandable reasons, the sale of human body parts is illegal in this country. So the task of establishing a protocol for these situations has fallen to the nonprofit group United Network for Organ Sharing (UNOS).

Under current UNOS guidelines, a donated kidney goes to the person who has been waiting the longest. According to this system, an available kidney would go to a 75-year-old who has been waiting for 2 years instead of to a 25-year-old who has been waiting 6 months, even though the 25-year-old will likely live longer and benefit from the transplanted organ for a longer period of time.

To address this issue, UNOS is devising a new set of guidelines based on a concept it calls “net benefit.” According to these new guidelines, kidneys would be allocated on the basis of who will receive the greatest net benefit, where net benefit is measured as the expected increase in lifespan from the transplant. And age is by far the biggest predictor of how long someone will live after a transplant. For example, a typical 25-year-old diabetic will gain an extra 8.7 years of life from a transplant, but a typical 55-year-old diabetic will gain only 3.6 extra years.

Under the current system, based on waiting times, transplants lead to about 44,000 extra years of life for recipients; under the new system, that number would jump to 55,000 extra years. The share of kidneys going to those in their 20s would triple; the share going to those 60 and older would be halved.

What does this have to do with consumer surplus? As you may have guessed, the UNOS concept of “net benefit” is a lot like individual consumer surplus—the individual consumer surplus generated from getting a new kidney. In essence, UNOS has devised a system that allocates donated kidneys according to who gets the greatest individual consumer surplus. In terms of results, then, its proposed “net benefit” system operates a lot like a competitive market.