The World’s Most Expensive City

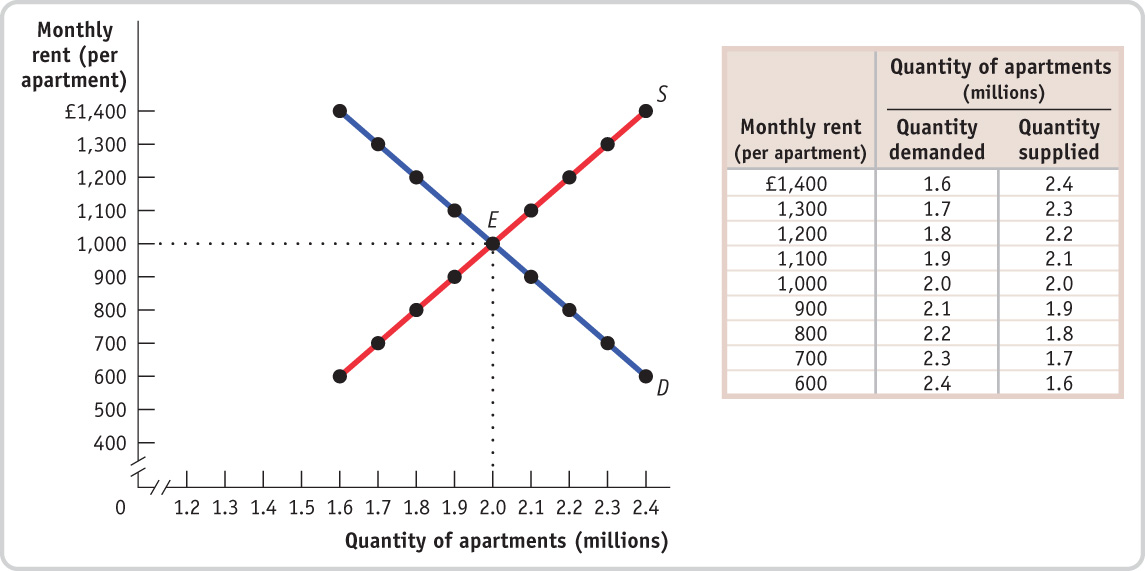

London is one of the most expensive places in the world to rent an apartment. If you have ever visited London, you might have noticed an area around the city known as the “Green Belt.” Zoning laws make it nearly impossible to build new residential housing on land designated as the Green Belt. Consider the following hypothetical market for apartments in London in the absence of zoning controls.

This figure should look familiar to you—it is Figure 4-6, but the currency is the British pound rather than the U.S. dollar. At the time of this writing, the British pound was worth about 1.6 dollars.

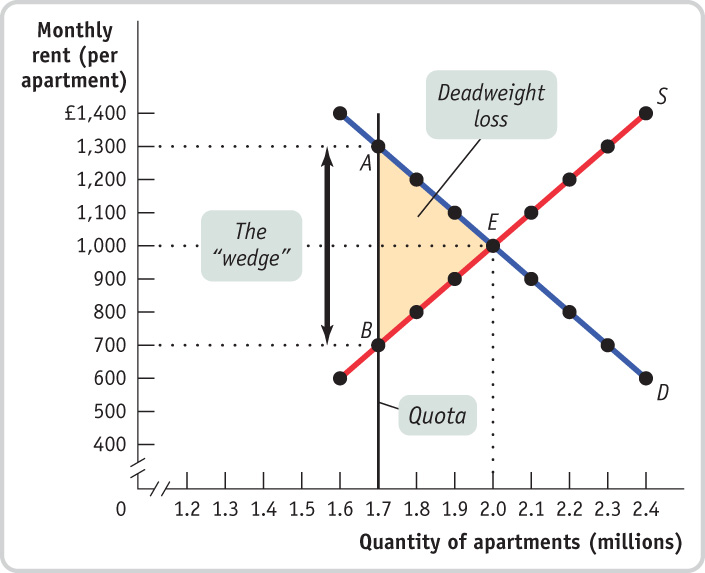

Now, let’s go back to the reality of zoning controls in the Green Belt. Use a diagram to show the effect of a quota of 1.7 million apartments. What is the quota rent, and who gets it?

Use a diagram to show the effect of a quota of 1.7 million apartments.

Review the section “The Anatomy of Quantity Controls” beginning on page 128. Study carefully Figure 4-14 on page 130.

In the following figure, the black vertical line represents the quota limit of 1.7 million apartments. Because the quantity of apartments is limited, consumers must be at point A on the demand curve. The demand price of 1.7 million apartments is £1,300 each. The supply price, corresponding to point B on the diagram, of 1.7 million apartments is only £700 each, creating a “wedge” of £1300 − £700 = £600.

What is the quota rent in this case, and who gets it?

Review the second half of the section “The Anatomy of Quantity Controls,” beginning on page 131.

In the case of taxis, the quota rent is the earnings that accrue to the license-holder from ownership of the right to sell the good. In the case of apartments inside the Green Belt in London, the quota rent is the “wedge” of £600 created by the difference in the demand price and the supply price. The wedge goes to current owners of property or flats in London. Current owners benefit from the strict application of zoning laws.