Is There a Catch?

New York’s Fulton Fish Market, now located in Hunts Point in the Bronx, has been in operation since 1822. One of the more popular fish sold at the market is whiting, a white fish that can end up in fast-food sandwiches or on a plate at your favorite sit-down seafood restaurant. Whiting are “boxed at sea,” that is, they are packaged on location. Consider the following hypothetical daily costs for a fisherman who runs a boat that fishes primarily for whiting. His quantity, or catch, is represented in boxes, approximately 60 pounds per box. Each day begins with the decision of whether to take out the boat, given the price he expects to receive at the fish market. Whether he goes out or not, he incurs fixed costs such as dockage, licensing, and mortgage on the boat. In addition to fixed costs, he incurs a variable cost for each box brought back to port. So, he must also decide how much to catch.

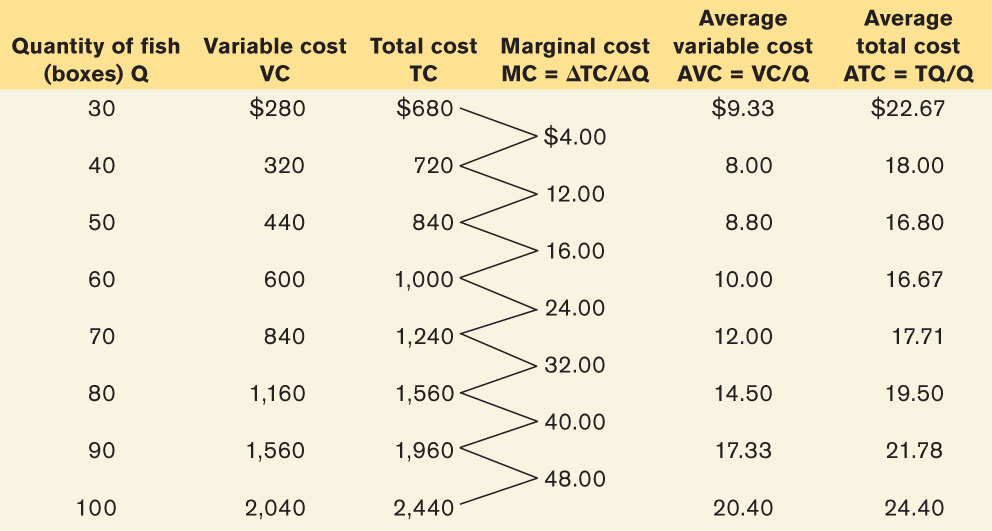

Using the following table, find the break-even price per box of fish. If the market price falls to $14.00 a box, how many boxes will the fisherman bring to market?

| Quantity of fish (boxes) Q | Variable cost VC | Total cost TC |

|---|---|---|

| 30 | $280 | $680 |

| 40 | 320 | 720 |

| 50 | 440 | 840 |

| 60 | 600 | 1,000 |

| 70 | 840 | 1,240 |

| 80 | 1,160 | 1,560 |

| 90 | 1,560 | 1,960 |

| 100 | 2,040 | 2,440 |

Find the average variable cost, average total cost, and marginal cost of a box of fish. You will need each of these costs in order to answer the question.

Read the section “Two Key Concepts: Marginal Cost and Average Cost” on pages 189–197 in Chapter 6. These costs are defined in Equations 6-3, 6-4, and 6-5.

The average variable cost is equal to the variable cost divided by the quantity (VC/Q), the average total cost is equal to the total cost divided by the quantity (TC/Q), and the marginal cost is the change in the total cost divided by the change in the quantity (ΔTC/ΔQ). These costs are calculated for each box in the following table.

Find the break-even price per box of fish.

Read the section “When Is Production Profitable?” on pages 216–219, and study Figure 7-2, including the caption.

To find the break-even price, we need to find the minimum average total cost of production. In the table, the minimum average total cost occurs at 60 boxes of fish. Thus, the break-even price is $16.67 per box of fish.

If the market price falls to $14.00 per box, how many boxes will be brought to market?

Read the section “Using Marginal Analysis to Choose the Profit-Maximizing Quantity of Output”on pages 214–216, and concentrate on the price-taking firm’s optimal output rule and the “Pitfalls” box on page 215.

In the case of the price-taking firm, the marginal revenue is equal to the market price. So, to find the optimal quantity, we need to find the point where P = MC. If there is not a point on the table at which P = MC, then the fisherman will want to produce the largest quantity for which P exceeds MC. Going from 40 to 50 boxes, the MC is $12.00, but going from 50 to 60 boxes, the MC is $16.00. Hence, the largest quantity for which P exceeds MC is 50 boxes. Although price is less than average total cost, he will still fish because the price is greater than his average variable cost.