The Budget Balance

Headlines about the government’s budget tend to focus on just one point: whether the government is running a surplus or a deficit and, in either case, how big. People usually think of surpluses as good: when the federal government ran a record surplus in 2000, many people regarded it as a cause for celebration.

Conversely, people usually think of deficits as bad: when the U.S. federal government ran record deficits in 2009 and 2010, many people regarded it as a cause for concern.

How do surpluses and deficits fit into the analysis of fiscal policy? Are deficits ever a good thing and surpluses a bad thing? To answer those questions, let’s look at the causes and consequences of surpluses and deficits.

The Budget Balance as a Measure of Fiscal Policy

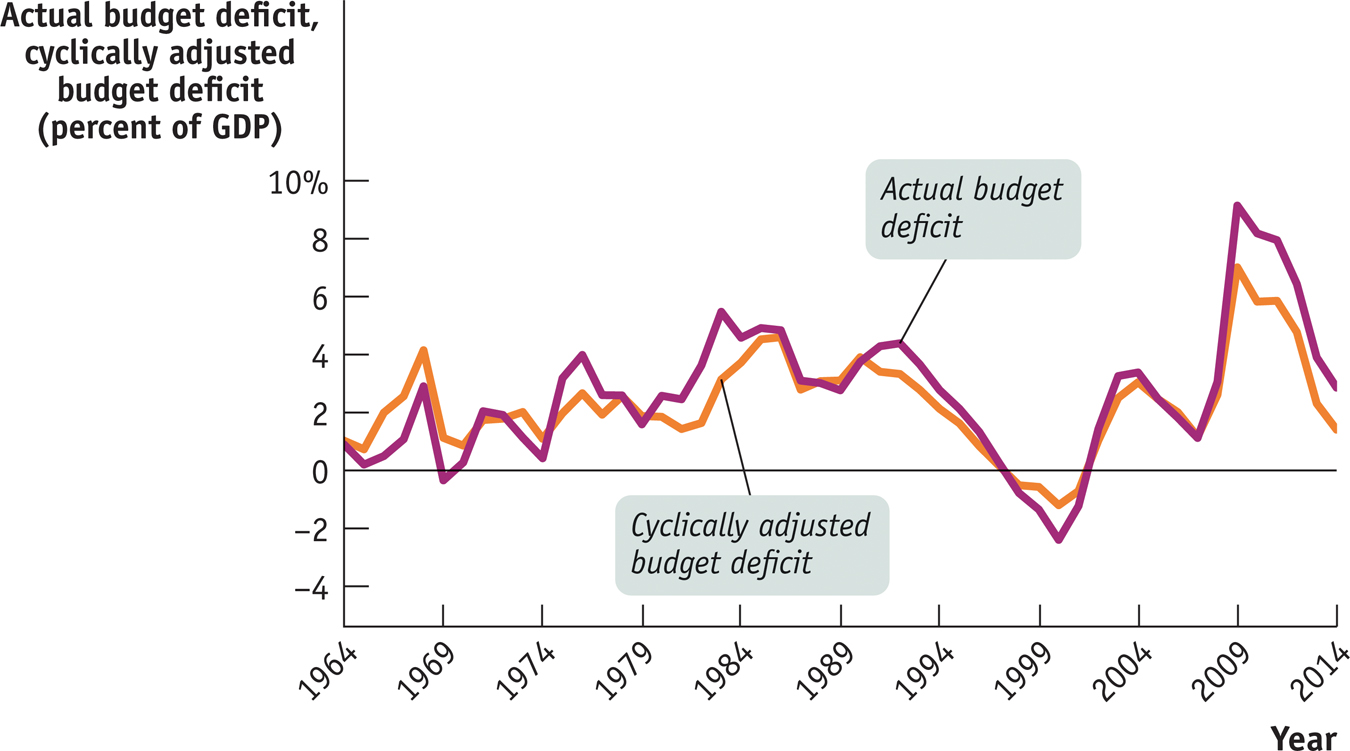

What do we mean by surpluses and deficits? The budget balance, which we defined in Chapter 10, is the difference between the government’s revenue, in the form of tax revenue, and its spending, both on goods and services and on government transfers, in a given year. That is, the budget balance—

where T is the value of tax revenues, G is government purchases of goods and services, and TR is the value of government transfers. As we learned in Chapter 10, a budget surplus is a positive budget balance and a budget deficit is a negative budget balance.

Other things equal, expansionary fiscal policies—

You might think this means that changes in the budget balance can be used to measure fiscal policy. In fact, economists often do just that: they use changes in the budget balance as a “quick-

Two different changes in fiscal policy that have equal-

sized effects on the budget balance may have quite unequal effects on the economy. As we have already seen, changes in government purchases of goods and services have a larger effect on real GDP than equal- sized changes in taxes and government transfers. Often, changes in the budget balance are themselves the result, not the cause, of fluctuations in the economy.

To understand the second point, we need to examine the effects of the business cycle on the budget.

The Business Cycle and the Cyclically Adjusted Budget Balance

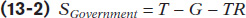

Historically there has been a strong relationship between the federal government’s budget balance and the business cycle. The budget tends to move into deficit when the economy experiences a recession, but deficits tend to get smaller or even turn into surpluses when the economy is expanding. Figure 13-8 shows the federal budget deficit as a percentage of GDP from 1964 to 2013. Shaded areas indicate recessions; unshaded areas indicate expansions. As you can see, the federal budget deficit increased around the time of each recession and usually declined during expansions. In fact, in the late stages of the long expansion from 1991 to 2000, the deficit actually became negative—

13-8

The U.S. Federal Budget Deficit and the Business Cycle, 1964–

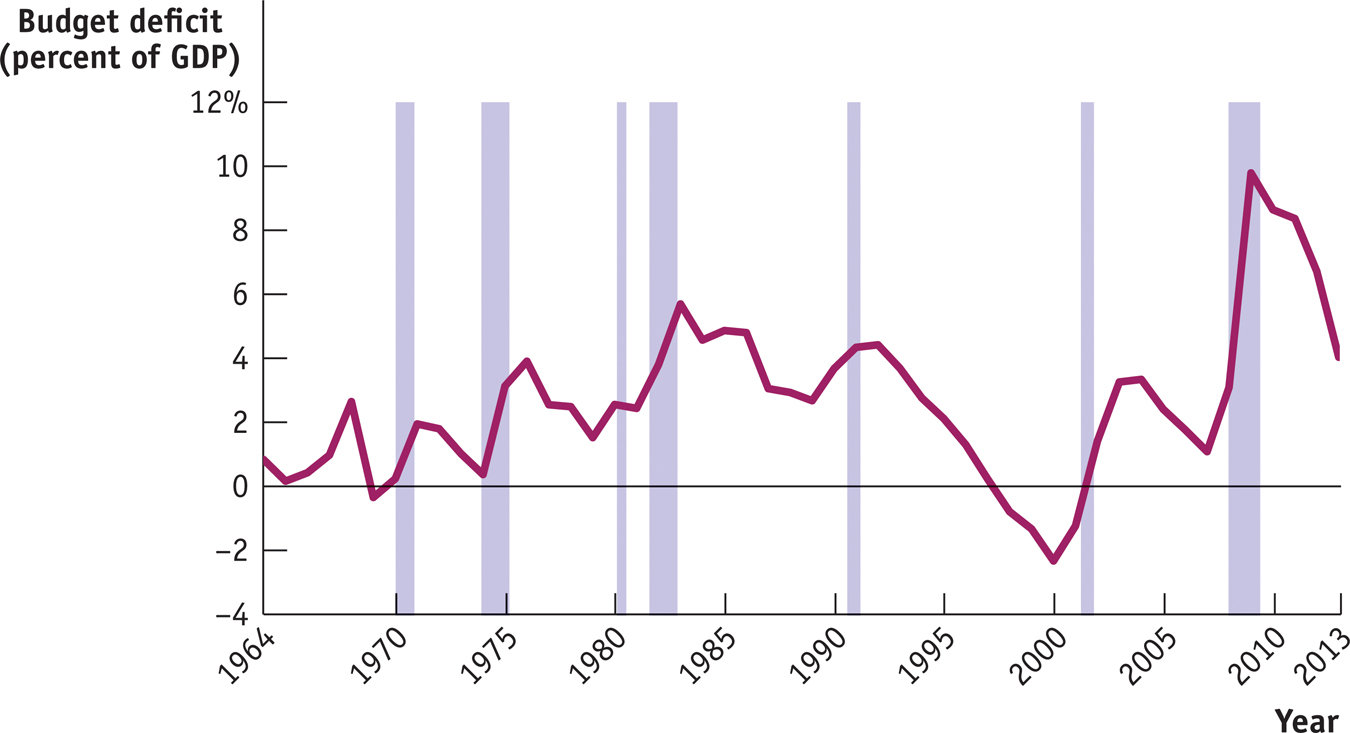

The relationship between the business cycle and the budget balance is even clearer if we compare the budget deficit as a percentage of GDP with the unemployment rate, as we do in Figure 13-9. The budget deficit almost always rises when the unemployment rate rises and falls when the unemployment rate falls.

13-9

The U.S. Federal Budget Deficit and the Unemployment Rate, 1964–

Is this relationship between the business cycle and the budget balance evidence that policy makers engage in discretionary fiscal policy, using expansionary fiscal policy during recessions and contractionary fiscal policy during expansions? Not necessarily. To a large extent the relationship in Figure 13-9 reflects automatic stabilizers at work. As we saw earlier in the discussion of automatic stabilizers, government tax revenue tends to rise and some government transfers, like unemployment benefit payments, tend to fall when the economy expands. Conversely, government tax revenue tends to fall and some government transfers tend to rise when the economy contracts. So the budget tends to move toward surplus during expansions and toward deficit during recessions even without any deliberate action on the part of policy makers.

In assessing budget policy, it’s often useful to separate movements in the budget balance due to the business cycle from movements due to discretionary fiscal policy changes. The former are affected by automatic stabilizers and the latter by deliberate changes in government purchases, government transfers, or taxes. It’s important to realize that business-

In other words, do the government’s tax policies yield enough revenue to fund its spending in the long run? As we’ll learn shortly, this is a fundamentally more important question than whether the government runs a budget surplus or deficit in the current year.

The cyclically adjusted budget balance is an estimate of what the budget balance would be if real GDP were exactly equal to potential output.

To separate the effect of the business cycle from the effects of other factors, many governments produce an estimate of what the budget balance would be if there were neither a recessionary nor an inflationary gap. The cyclically adjusted budget balance is an estimate of what the budget balance would be if real GDP were exactly equal to potential output. It takes into account the extra tax revenue the government would collect and the transfers it would save if a recessionary gap were eliminated—

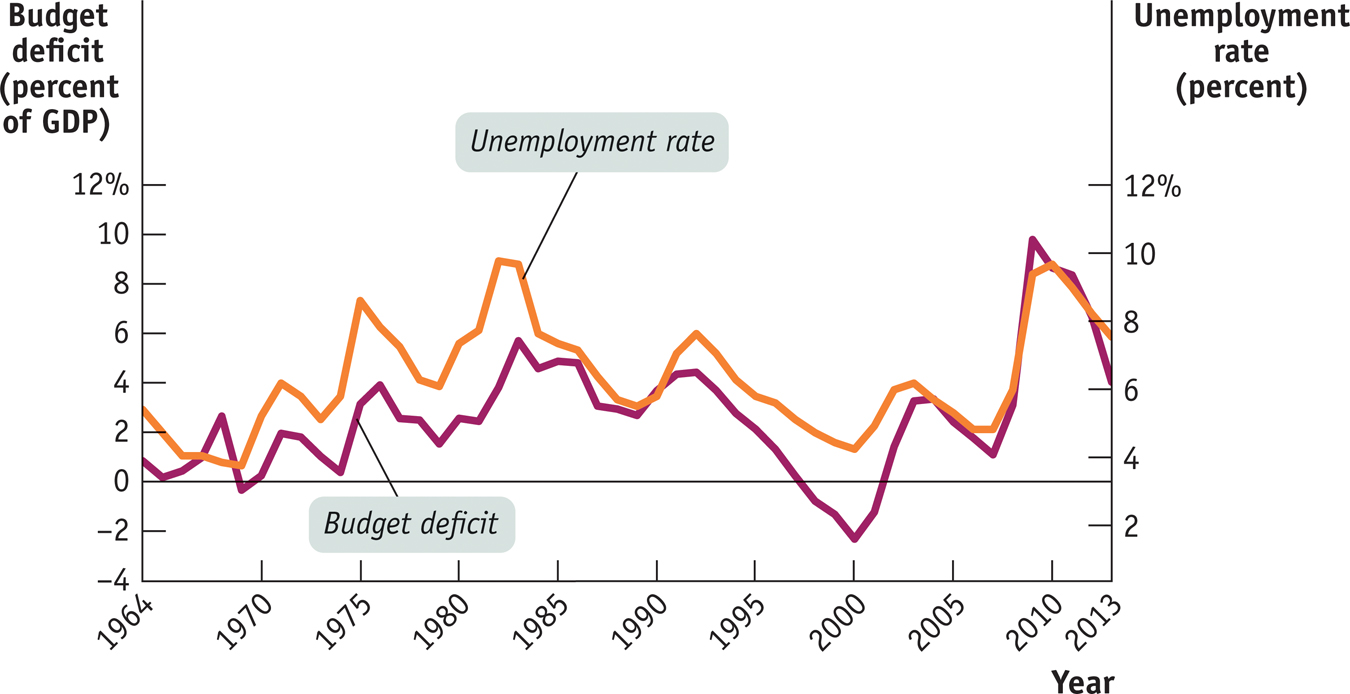

Figure 13-10 shows the actual budget deficit and the Congressional Budget Office estimate of the cyclically adjusted budget deficit, both as a percentage of GDP, from 1964 to 2014. As you can see, the cyclically adjusted budget deficit doesn’t fluctuate as much as the actual budget deficit. In particular, large actual deficits, such as those of 1975, 1983, and 2009, are usually caused in part by a depressed economy.

13-10

The Actual Budget Deficit Versus the Cyclically Adjusted Budget Deficit

Should the Budget Be Balanced?

As we’ll see in the next section, persistent budget deficits can cause problems for both the government and the economy. Yet politicians are always tempted to run deficits because this allows them to cater to voters by cutting taxes without cutting spending or by increasing spending without increasing taxes. As a result, there are occasional attempts by policy makers to force fiscal discipline by introducing legislation—

Most economists don’t think so. They believe that the government should only balance its budget on average—

As we learned earlier in this chapter, the tendency of tax revenue to fall and transfers to rise when the economy contracts helps to limit the size of recessions. But falling tax revenue and rising transfer payments generated by a downturn in the economy push the budget toward deficit. If constrained by a balanced-

Yet policy makers concerned about excessive deficits sometimes feel that rigid rules prohibiting—

!worldview! ECONOMICS in Action: Europe’s Search for a Fiscal Rule

Europe’s Search for a Fiscal Rule

In 1999 a group of European nations took a momentous step when they adopted a common currency, the euro, to replace their various national currencies, such as the French franc, the German mark, and the Italian lira. Along with the introduction of the euro came the creation of the European Central Bank, which sets monetary policy for the whole region.

As part of the agreement creating the new currency, governments of member countries signed on to the European “stability pact.” This agreement required each government to keep its budget deficit—

The stability pact, however, had a serious downside: in principle, it would force countries to slash spending and/or raise taxes whenever an economic downturn pushed their deficits above the critical level. This would turn fiscal policy into a force that worsens recessions instead of fighting them.

Nonetheless, the stability pact proved impossible to enforce: European nations, including France and even Germany, with its reputation for fiscal probity, simply ignored the rule during the 2001 recession and its aftermath.

In 2011 the Europeans tried again, this time against the background of a severe debt crisis. In the wake of the 2008 financial crisis, Greece, Ireland, Portugal, Spain, and Italy all lost the confidence of investors, who were worried about their ability and/or willingness to repay all their debt—

So the agreement reached in December 2011 was framed in terms of the “structural” budget balance, more or less corresponding to the cyclically adjusted budget balance as we defined it. According to the new rule, the structural budget balance of each country should be very nearly zero, with deficits not to exceed 0.5% of GDP. This seemed like a much better rule than the old stability pact.

Yet big problems remained. One was the question of how reliable were the estimates of the structural budget balances. Also, the new rule seemed to ban any use of discretionary fiscal policy, under any circumstances. By early 2015 it was clear that this fiscal straight-

Before patting themselves on the back over the superiority of their own fiscal rules, Americans should note that the United States has its own version of the original, flawed European stability pact. The federal government’s budget acts as an automatic stabilizer, but 49 of the 50 states are required by their state constitutions to balance their budgets every year. When recession struck in 2008, most states were forced to—

Quick Review

The budget deficit tends to rise during recessions and fall during expansions. This reflects the effect of the business cycle on the budget balance.

The cyclically adjusted budget balance is an estimate of what the budget balance would be if the economy were at potential output. It varies less than the actual budget deficit.

Most economists believe that governments should run budget deficits in bad years and budget surpluses in good years. A rule requiring a balanced budget would undermine the role of automatic stabilizers.

13-3

Question 13.7

Why is the cyclically adjusted budget balance a better measure of whether government policies are sustainable in the long run than the actual budget balance?

The actual budget balance takes into account the effects of the business cycle on the budget deficit. During recessionary gaps, it incorporates the effect of lower tax revenues and higher transfers on the budget balance; during inflationary gaps, it incorporates the effect of higher tax revenues and reduced transfers. In contrast, the cyclically adjusted budget balance factors out the effects of the business cycle and assumes that real GDP is at potential output. Since, in the long run, real GDP tends to potential output, the cyclically adjusted budget balance is a better measure of the long-run sustainability of government policies.

Question 13.8

Explain why states required by their constitutions to balance their budgets are likely to experience more severe economic fluctuations than states not held to that requirement.

In recessions, real GDP falls. This implies that consumers’ incomes, consumer spending, and producers’ profits also fall. So in recessions, states’ tax revenue (which depends in large part on consumers’ incomes, consumer spending, and producers’ profits) falls. In order to balance the state budget, states have to cut spending or raise taxes. But that deepens the recession. Without a balanced-budget requirement, states could use expansionary fiscal policy during a recession to lessen the fall in real GDP.

Solutions appear at back of book.