Monetary Policy

15

What You Will Learn in This Chapter

What You Will Learn in This Chapter

What the money demand curve is

Why the liquidity preference model determines the interest rate in the short run

How the Federal Reserve implements monetary policy, moving the interest rate to affect aggregate output

Why monetary policy is the main tool for stabilizing the economy

How the behavior of the Federal Reserve compares to that of other central banks

Why economists believe in monetary neutrality—

that monetary policy affects only the price level, not aggregate output, in the long run

THE MOST POWERFUL PERSON IN GOVERNMENT

In 2014 Nicholas Lemann, a reporter for the New Yorker, visited the trading floor of the Federal Reserve Bank of New York. He found it oddly unimpressive—

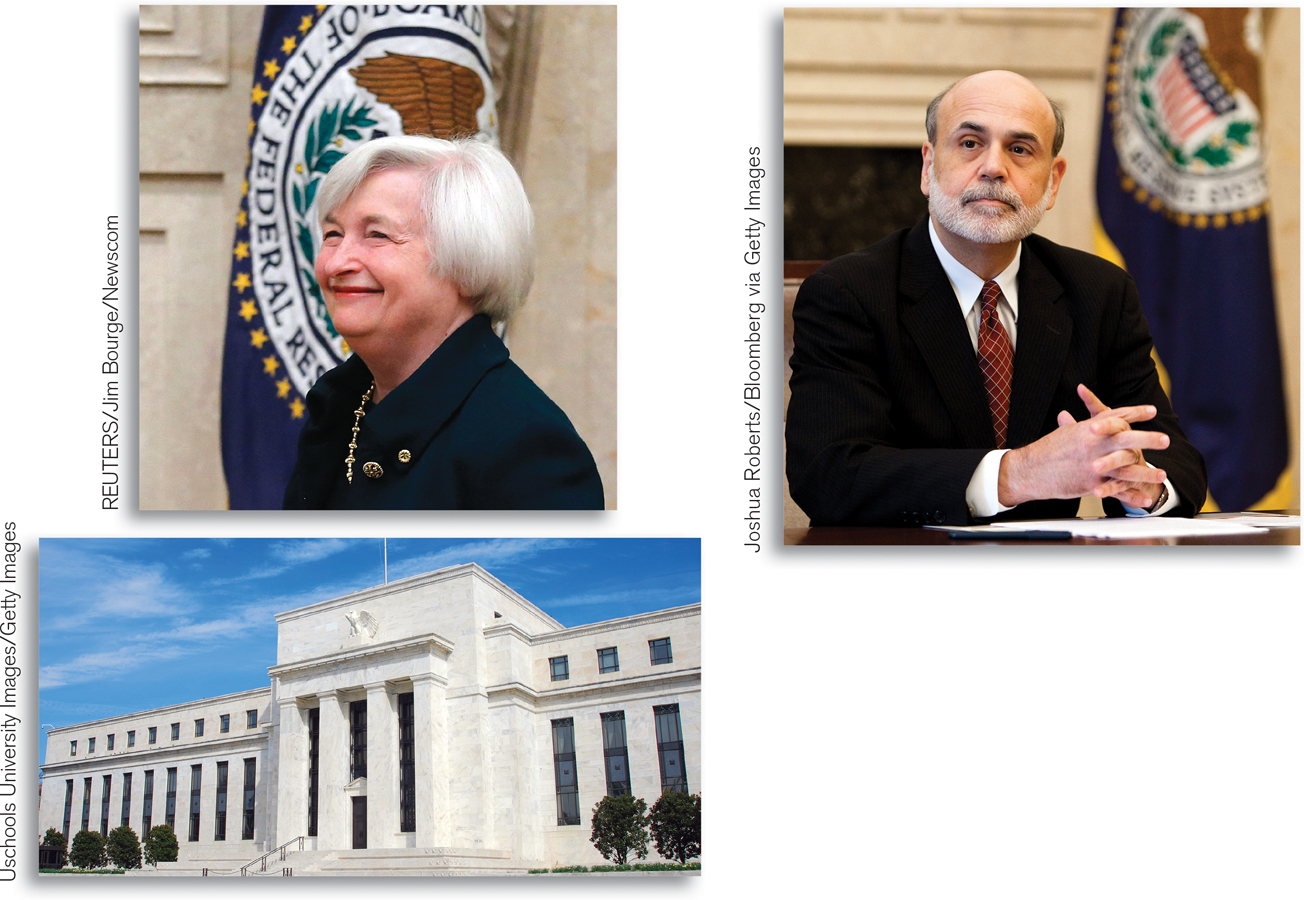

The answer, basically, is yes. Lemann visited the New York Fed as part of his work on a profile of Janet Yellen, who had recently been appointed chairwoman of the Fed’s Board of Governors. And that’s a very important position indeed. As Lemann wrote, “There is an old saw that the Fed chair is the most powerful person in government. In the aftermath of the financial crisis, that may actually be an understatement.”

People sometimes say that the head of the Fed decides how much money to print. That’s not quite true: for one thing, the Fed doesn’t literally print money, and beyond that, monetary decisions are made by a committee rather than by one person. But as we learned in Chapter 14, the Federal Reserve can use open-

And these actions matter a lot. Roughly half of the recessions the United States has experienced since World War II can be attributed, at least in part, to the decisions of the Federal Reserve to tighten money to fight inflation. In a number of other cases, the Fed played a key role in fighting slumps and promoting recovery. The financial crisis of 2008 put the Fed at center stage. Its aggressive response to the crisis inspired both praise and condemnation. In 2009 Time magazine declared Ben Bernanke, Janet Yellen’s predecessor, “Person of the Year.” The next year an open letter from a number of prominent Wall Street figures and economists accused him of “debasing” the dollar.

The power of the Fed chair comes from the ability of the Board of Governors to direct the actions of people like those working in those two small rooms in New York. For what the Fed does, mainly, is set monetary policy. Monetary policy in action isn’t much to look at, but it’s crucially important—

In this chapter we’ll learn how monetary policy works—