7-9

The Deadweight Loss of a Tax

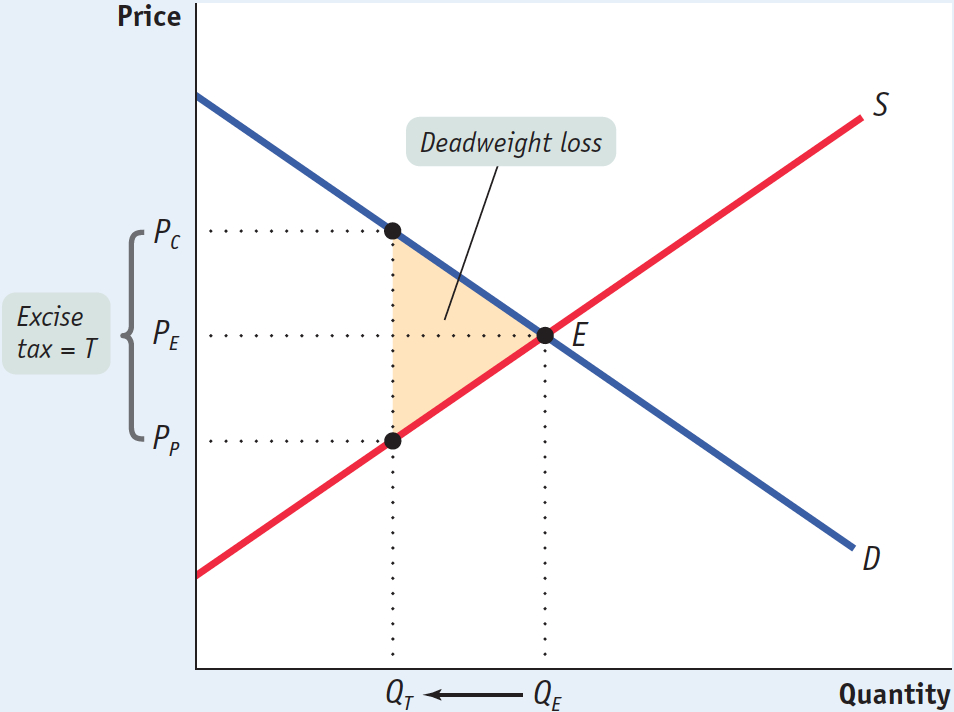

The Deadweight Loss of a Tax A tax leads to a deadweight loss because it creates inefficiency: some mutually beneficial transactions never take place because of the tax- namely, the transactions PE – QT. The yellow area here represents the value of the deadweight loss: it is the total surplus that would have been gained from the PE – PT transactions. If the tax had not discouraged transactions— had the number of transactions remained at PE because of either perfectly inelastic supply or perfectly inelastic demand— no deadweight loss would have been incurred.