Monopoly and Public Policy

It’s good to be a monopolist, but it’s not so good to be a monopolist’s customer. A monopolist, by reducing output and raising prices, benefits at the expense of consumers. But buyers and sellers always have conflicting interests. Is the conflict of interest under monopoly any different than it is under perfect competition?

The answer is yes, because monopoly is a source of inefficiency: the losses to consumers from monopoly behavior are larger than the gains to the monopolist. Because monopoly leads to net losses for the economy, governments often try either to prevent the emergence of monopolies or to limit their effects. In this section, we will see why monopoly leads to inefficiency and examine the policies governments adopt in an attempt to prevent this inefficiency.

Welfare Effects of Monopoly

By restricting output below the level at which marginal cost is equal to the market price, a monopolist increases its profit but hurts consumers. To assess whether this is a net benefit or loss to society, we must compare the monopolist’s gain in profit to the loss in consumer surplus. And what we learn is that the loss in consumer surplus is larger than the monopolist’s gain. Monopoly causes a net loss for society.

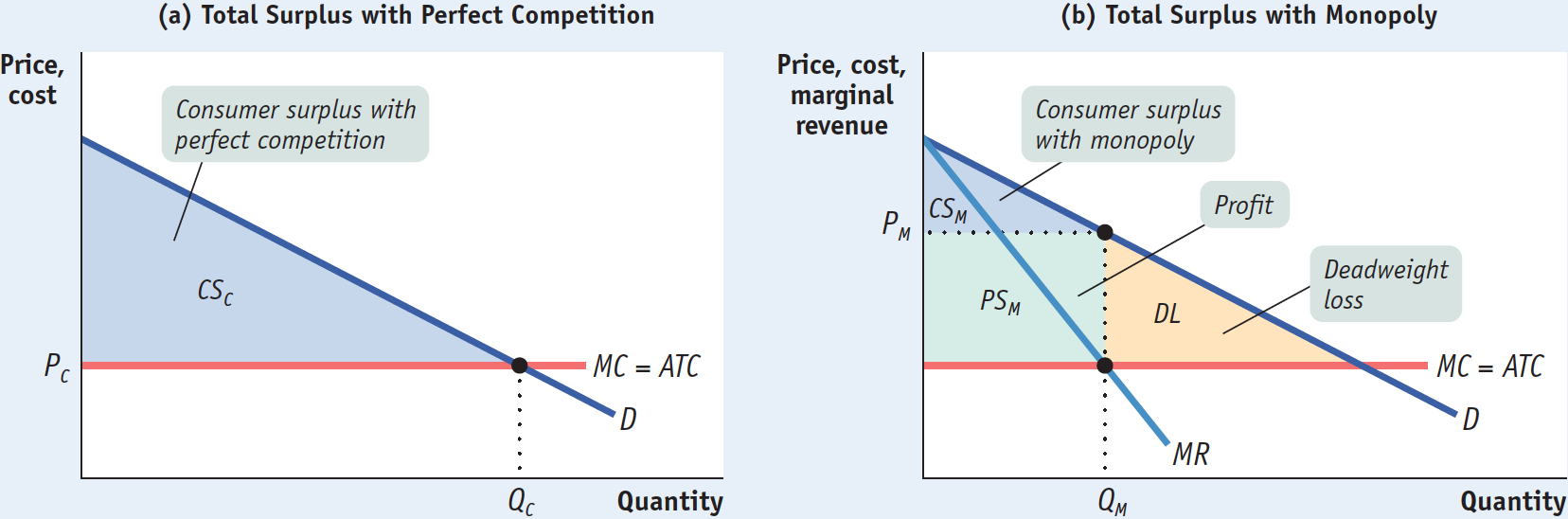

To see why, let’s return to the case where the marginal cost curve is horizontal, as shown in the two panels of Figure 13-8. Here the marginal cost curve is MC, the demand curve is D, and, in panel (b), the marginal revenue curve is MR.

13-8

Monopoly Causes Inefficiency

Panel (a) shows what happens if this industry is perfectly competitive. Equilibrium output is QC; the price of the good, PC, is equal to marginal cost, and marginal cost is also equal to average total cost because there is no fixed cost and marginal cost is constant. Each firm is earning exactly its average total cost per unit of output, so there is no profit and no producer surplus in this equilibrium.

The consumer surplus generated by the market is equal to the area of the blue-

Panel (b) shows the results for the same market, but this time assuming that the industry is a monopoly. The monopolist produces the level of output QM, at which marginal cost is equal to marginal revenue, and it charges the price PM. The industry now earns profit—

By comparing panels (a) and (b), we see that in addition to the redistribution of surplus from consumers to the monopolist, another important change has occurred: the sum of profit and consumer surplus—

This net loss arises because some mutually beneficial transactions do not occur. There are people for whom an additional unit of the good is worth more than the marginal cost of producing it but who don’t consume it because they are not willing to pay PM.

If you recall our discussion of the deadweight loss from taxes you will notice that the deadweight loss from monopoly looks quite similar. Indeed, by driving a wedge between price and marginal cost, monopoly acts much like a tax on consumers and produces the same kind of inefficiency.

So monopoly hurts the welfare of society as a whole and is a source of market failure. Is there anything government policy can do about it?

Preventing Monopoly

Policy toward monopoly depends crucially on whether or not the industry in question is a natural monopoly, one in which increasing returns to scale ensure that a bigger producer has lower average total cost. If the industry is not a natural monopoly, the best policy is to prevent monopoly from arising or break it up if it already exists. Let’s focus on that case first, then turn to the more difficult problem of dealing with natural monopoly.

The De Beers monopoly on diamonds didn’t have to happen. Diamond production is not a natural monopoly: the industry’s costs would be no higher if it consisted of a number of independent, competing producers (as is the case, for example, in gold production).

So if the South African government had been worried about how a monopoly would have affected consumers, it could have blocked Cecil Rhodes in his drive to dominate the industry or broken up his monopoly after the fact. Today, governments often try to prevent monopolies from forming and break up existing ones.

De Beers is a rather unique case. For complicated historical reasons, it was allowed to remain a monopoly. But over the last century, most similar monopolies have been broken up. The most celebrated example in the United States is Standard Oil, founded by John D. Rockefeller in 1870. By 1878 Standard Oil controlled almost all U.S. oil refining; but in 1911 a court order broke the company into a number of smaller units, including the companies that later became Exxon and Mobil (and more recently merged to become ExxonMobil).

The government policies used to prevent or eliminate monopolies are known as antitrust policies, which we will discuss in the next chapter.

Dealing with Natural Monopoly

Breaking up a monopoly that isn’t natural is clearly a good idea: the gains to consumers outweigh the loss to the producer. But it’s not so clear whether a natural monopoly, one in which a large producer has lower average total costs than small producers, should be broken up, because this would raise average total cost. For example, a town government that tried to prevent a single company from dominating local gas supply—

Yet even in the case of a natural monopoly, a profit-

What can public policy do about this? There are two common answers.

In public ownership of a monopoly, the good is supplied by the government or by a firm owned by the government.

1. Public Ownership In many countries, the preferred answer to the problem of natural monopoly has been public ownership. Instead of allowing a private monopolist to control an industry, the government establishes a public agency to provide the good and protect consumers’ interests. In Britain, for example, telephone service was provided by the state-

There are some examples of public ownership in the United States. Passenger rail service is provided by the public company Amtrak; regular mail delivery is provided by the U.S. Postal Service; some cities, including Los Angeles, have publicly owned electric power companies.

The advantage of public ownership, in principle, is that a publicly owned natural monopoly can set prices based on the criterion of efficiency rather than profit maximization. In a perfectly competitive industry, profit-

Experience suggests, however, that public ownership as a solution to the problem of natural monopoly often works badly in practice. One reason is that publicly owned firms are often less eager than private companies to keep costs down or offer high-

Price regulation limits the price that a monopolist is allowed to charge.

2. Regulation In the United States, the more common answer has been to leave the industry in private hands but subject it to regulation. In particular, most local utilities like electricity, land line telephone service, natural gas, and so on are covered by price regulation that limits the prices they can charge.

We saw in Chapter 5 that imposing a price ceiling on a competitive industry is a recipe for shortages, black markets, and other nasty side effects. Doesn’t imposing a limit on the price that, say, a local gas company can charge have the same effects?

Not necessarily: a price ceiling on a monopolist need not create a shortage—

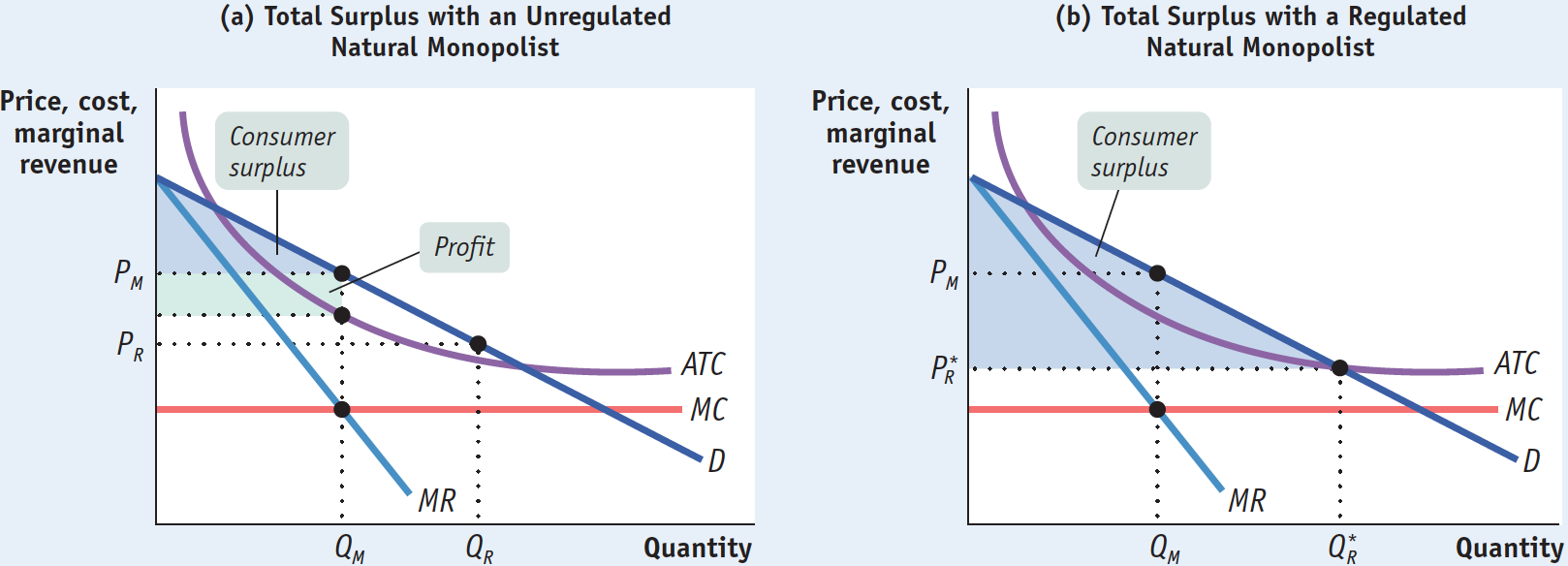

Figure 13-9 shows an example of price regulation of a natural monopoly—

13-9

Unregulated and Regulated Natural Monopoly

. Output expands to

. Output expands to  , and consumer surplus is now the entire blue area. The monopolist makes zero profit. This is the greatest total surplus possible when the monopolist is allowed to at least break even, making

, and consumer surplus is now the entire blue area. The monopolist makes zero profit. This is the greatest total surplus possible when the monopolist is allowed to at least break even, making  the best regulated price.

the best regulated price.The average total cost curve is the downward-

Panel (a) illustrates a case of natural monopoly without regulation. The unregulated natural monopolist chooses the monopoly output QM and charges the price PM. Since the monopolist receives a price greater than its average total cost, it earns a profit. This profit is exactly equal to the producer surplus in this market, represented by the green-

Now suppose that regulators impose a price ceiling on local gas deliveries—

Does the company have an incentive to produce that quantity? Yes. If the price at which the monopolist can sell its product is fixed by regulators, the firm’s output no longer affects the market price—

Of course, the monopolist will not be willing to produce at all if the imposed price means producing at a loss. That is, the price ceiling has to be set high enough to allow the firm to cover its average total cost. Panel (b) shows a situation in which regulators have pushed the price down as far as possible, at the level where the average total cost curve crosses the demand curve.

At any lower price the firm loses money. The price here,  , is the best regulated price: the monopolist is just willing to operate and produces

, is the best regulated price: the monopolist is just willing to operate and produces  , the quantity demanded at that price. Consumers and society gain as a result.

, the quantity demanded at that price. Consumers and society gain as a result.

The welfare effects of this regulation can be seen by comparing the shaded areas in the two panels of Figure 13-9. Consumer surplus is increased by the regulation, with the gains coming from two sources. First, profits are eliminated and added instead to consumer surplus. Second, the larger output and lower price lead to an overall welfare gain—

This all looks terrific: consumers are better off, profits are eliminated, and overall welfare increases. Unfortunately, things are rarely that easy in practice. The main problem is that regulators don’t have the information required to set the price exactly at the level at which the demand curve crosses the average total cost curve. Sometimes they set it too low, creating shortages; at other times they set it too high. Also, regulated monopolies, like publicly owned firms, tend to exaggerate their costs to regulators and to provide inferior quality to consumers.

Sometimes the cure is worse than the disease. Some economists have argued that the best solution, even in the case of natural monopoly, may be to live with it. The case for doing nothing is that attempts to control monopoly will, one way or another, do more harm than good—

The upcoming Economics in Action describes the case of broadband, a natural monopoly that has been alternately regulated and deregulated as politicians change their minds about the appropriate policy.

A monopsony exists when there is only one buyer of a good. A monopsonist is a firm that is the sole buyer in a market.

Monopsony Is it possible for the buyer and not the seller to have market power? Put another way, is it possible to have a market in which there is only one buyer but many sellers, so that the buyer can use its power to capture surplus from the sellers? The answer is yes, and that market is called a monopsony.

Like a monopolist, a monopsonist will distort the competitive market outcome in order to capture more of the surplus, except that the monopsonist will do this through quantity purchased and price paid for goods rather than through quantity sold and price charged for goods.

Monopsony, although it does exist, is rarer than monopoly. The classic example is a single employer in a small town—

Just as a monopolist creates a deadweight loss by producing too little of the output, a monopsonist creates a deadweight loss by hiring too few workers (and thereby producing too little output as well).

Monopsony seems to occur most frequently in markets in which workers have a specialized skill, and there is only one employer who hires based on that skill. For example, physicians have often complained that in some parts of the country where most patients are insured by one or two insurance companies, the companies act as monopsonists in setting the reimbursements rates they pay for medical procedures.

And in 2014, when the two largest cable providers, Time Warner Cable and Comcast, announced their intention to merge, questions of monopoly and monopsony arose: monopoly, because the combined company would cover 30 million subscribers, an overwhelming proportion of Americans with cable access; and monopsony because the combined company would be virtually the only purchaser of programming by companies that produce shows for broadcast. At the time of writing, whether the FCC will allow the merger was an open question.

So although monopsony may be rare, it can be an important phenomenon.

What to Do About Monopoly? As our discussion has made clear, managing monopoly (and monopsony) can be tricky because trade-

In the case of a regulated natural monopoly like power generation, how can power producers invest in cost-

Economists and policy makers have struggled with these questions for decades because the best answer is often found through trial and error—

And there is always the danger of what is called regulatory capture: because vast sums of money are at stake, regulators can be unduly influenced by the companies they are supposed to oversee.

Perhaps, in dealing with monopolies, the best answer is for economists and policy makers to remain vigilant and admit that sometimes midcourse policy corrections are needed.

!worldview! ECONOMICS in Action: Why Is Your Broadband So Slow? And Why Does It Cost So Much?

Why Is Your Broadband So Slow? And Why Does It Cost So Much?

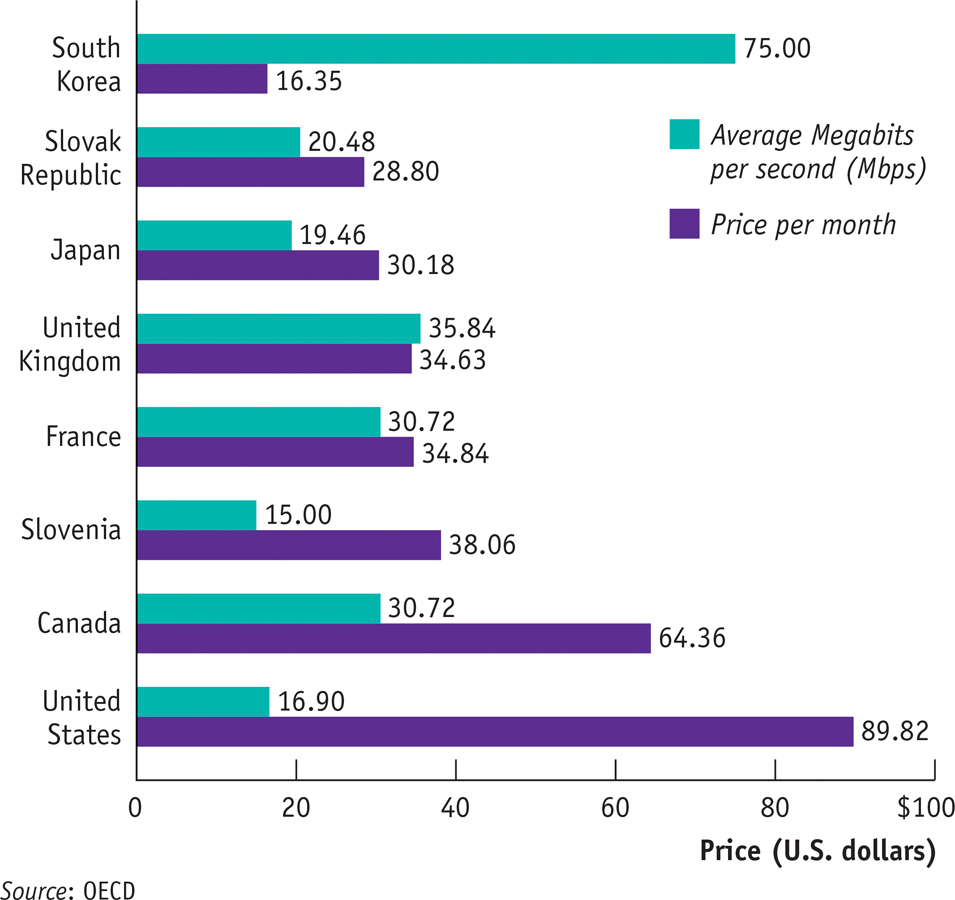

Consider this: In the United States, high-

13-10

Comparing Broadband Speed and Price Across Select Countries

Why do we pay so much? Many observers conclude that the United States has been especially bad at regulating the cable companies that provide broadband to more than two-

However, a decade ago Congress deregulated high-

But how did broadband consumers in other countries escape that same fate, given that cable is a natural monopoly? Regulators there imposed a common carriage rule on their industries, stipulating that cable companies must rent their cable capacity to internet service providers, who then compete to deliver internet access to consumers.

Without such a rule, the vast majority of Americans—

Quick Review

By reducing output and raising price above marginal cost, a monopolist captures some of the consumer surplus as profit and causes deadweight loss. To avoid deadweight loss, government policy attempts to curtail monopoly behavior.

When monopolies are “created” rather than natural, governments should act to prevent them from forming and break up existing ones.

Natural monopoly poses a harder policy problem. One answer is public ownership, but publicly owned companies are often poorly run.

A common response in the United States is price regulation. A price ceiling imposed on a monopolist does not create shortages as long as it is not set too low.

There always remains the option of doing nothing; monopoly is a bad thing, but the cure may be worse than the disease.

A monopsony, when there is only one buyer of a good, also results in deadweight loss. The monopsonist can affect the price of the good it buys: it captures surplus from sellers by reducing how much it purchases and thereby lowers the price.

13-3

Question 13.6

What policy should the government adopt in the following cases? Explain.

Internet service in Anytown, Ohio, is provided by cable. Customers feel they are being overcharged, but the cable company claims it must charge prices that let it recover the costs of laying cable.

Cable Internet service is a natural monopoly. So the government should intervene only if it believes that price exceeds average total cost, where average total cost is based on the cost of laying the cable. In this case it should impose a price ceiling equal to average total cost. Otherwise, it should do nothing.The only two airlines that currently fly to Alaska need government approval to merge. Other airlines wish to fly to Alaska but need government-

allocated landing slots to do so. The government should approve the merger only if it fosters competition by transferring some of the company’s landing slots to another, competing airline.

Question 13.7

True or false? Explain your answer.

Society’s welfare is lower under monopoly because some consumer surplus is transformed into profit for the monopolist.

False. As can be seen from Figure 13-8, panel (b), the inefficiency arises from the fact that some of the consumer surplus is transformed into deadweight loss (the yellow area), not that it is transformed into profit (the green area).A monopolist causes inefficiency because there are consumers who are willing to pay a price greater than or equal to marginal cost but less than the monopoly price.

True. If a monopolist sold to all customers who have a valuation greater than or equal to marginal cost, all mutually beneficial transactions would occur and there would be no deadweight loss.

Question 13.8

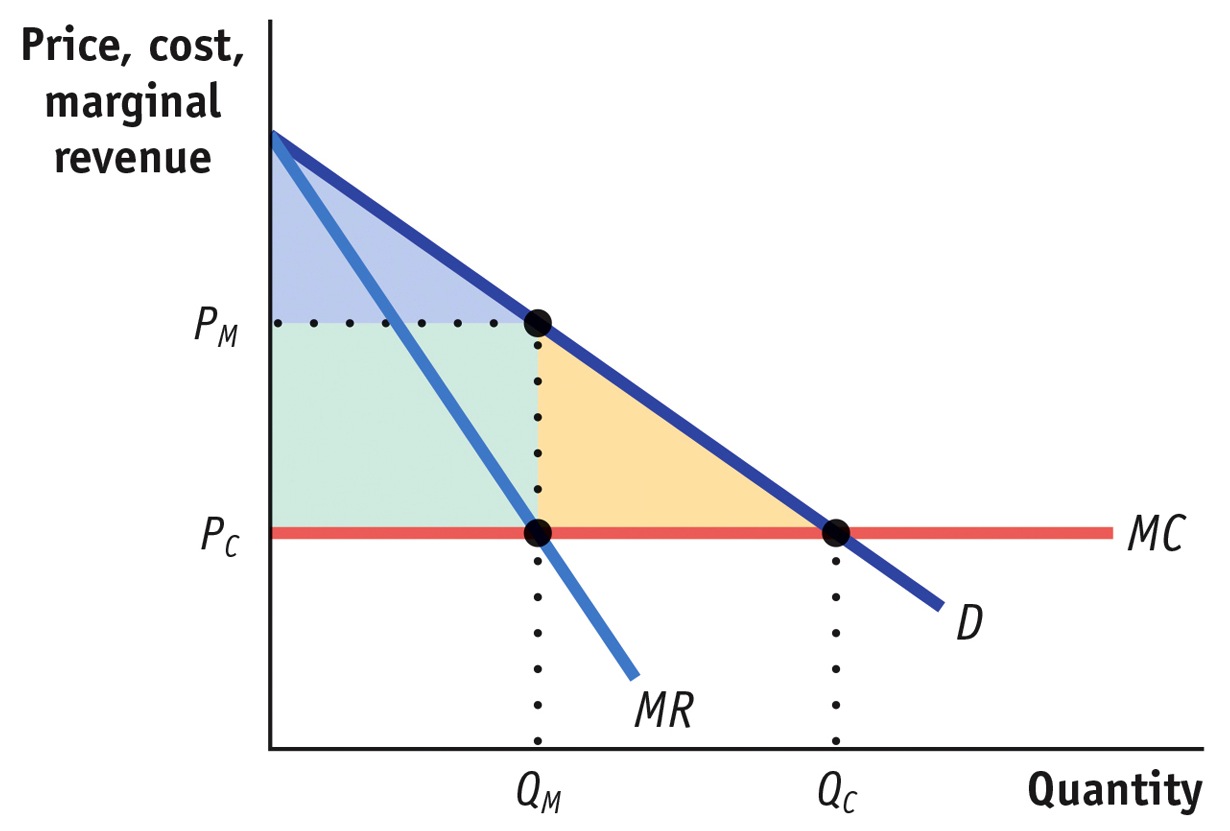

Suppose a monopolist mistakenly believes that its marginal revenue is always equal to the market price. Assuming constant marginal cost and no fixed cost, draw a diagram comparing the level of profit, consumer surplus, total surplus, and deadweight loss for this misguided monopolist compared to a smart monopolist.

As shown in the accompanying diagram, a profit-maximizing monopolist produces QM, the output level at which MR = MC. A monopolist who mistakenly believes that P = MR produces the output level at which P = MC (when, in fact, P > MR, and at the true profit-maximizing level of output, P > MR = MC). This misguided monopolist will produce the output level QC, where the demand curve crosses the marginal cost curve—the same output level produced if the industry were perfectly competitive. It will charge the price PC, which is equal to marginal cost, and make zero profit. The entire shaded area is equal to the consumer surplus, which is also equal to total surplus in this case (since the monopolist receives zero producer surplus). There is no deadweight loss since every consumer who is willing to pay as much as or more than marginal cost gets the good. A smart monopolist, however, will produce the output level QM and charge the price PM. Profit equals the green area, consumer surplus corresponds to the blue area, and total surplus is equal to the sum of the green and blue areas. The yellow area is the deadweight loss generated by the monopolist.

Solutions appear at back of book.