1.3 51The Costs of Inflation

WHAT YOU WILL LEARN

The economic costs of inflation

The economic costs of inflation

How inflation creates winners and losers

How inflation creates winners and losers

The difference between real and nominal values of income, wages, and interest rates

The difference between real and nominal values of income, wages, and interest rates

The problems of deflation and disinflation

The problems of deflation and disinflation

The Inflation Rate

Why do policy makers get anxious when they see the inflation rate moving upward? Why is inflation something to worry about? The answer to both questions is that inflation can impose costs on the economy—

The Level of Prices Doesn’t Matter…

The most common complaint about inflation, an increase in the price level, is that it makes everyone poorer—

An example of this kind of currency conversion happened in 2002, when France, like a number of other European countries, replaced its national currency, the franc, with the new Pan-

You could imagine doing the same thing here, replacing the dollar with a “new dollar” at a rate of exchange of, say, 7 to 1. If you owed $140,000 on your home, that would become a debt of 20,000 new dollars. If you had a wage rate of $14 an hour, it would become 2 new dollars an hour, and so on. This would bring the overall U.S. price level back to about what it was when John F. Kennedy was president.

The real wage is the wage rate divided by the price level.

So would everyone be richer as a result because prices would be only one-

Real income is income divided by the price level.

Conversely, the rise in prices that has actually taken place since the early 1960s hasn’t made America poorer, because it has also raised incomes by the same amount: real income—income divided by the price level—

The moral of this story is that the level of prices doesn’t matter: the United States would be no richer than it is now if the overall level of prices were still as low as it was in 1961; conversely, the rise in prices over the past 50 years hasn’t made us poorer.

…But the Rate of Change of Prices Does

The conclusion that the level of prices doesn’t matter might seem to imply that the inflation rate doesn’t matter either. But that’s not true.

The inflation rate is the percent change per year in a price index—

To see why, it’s crucial to distinguish between the level of prices and the inflation rate. In the next module, we will discuss precisely how the level of prices in the economy is measured using price indexes such as the consumer price index. For now, let’s look at the inflation rate, the percent increase in the overall level of prices per year. The inflation rate is calculated as follows:

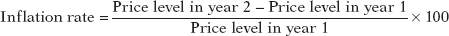

Figure 51-1 highlights the difference between the price level and the inflation rate in the United States since 1960, with the price level measured along the left vertical axis and the inflation rate measured along the right vertical axis. In the 2000s, the overall level of prices in the United States was much higher than it was in 1960—

The Economic Costs of High Inflation

Economists believe that high rates of inflation impose significant economic costs. The most important of these costs are shoe-

Shoe-

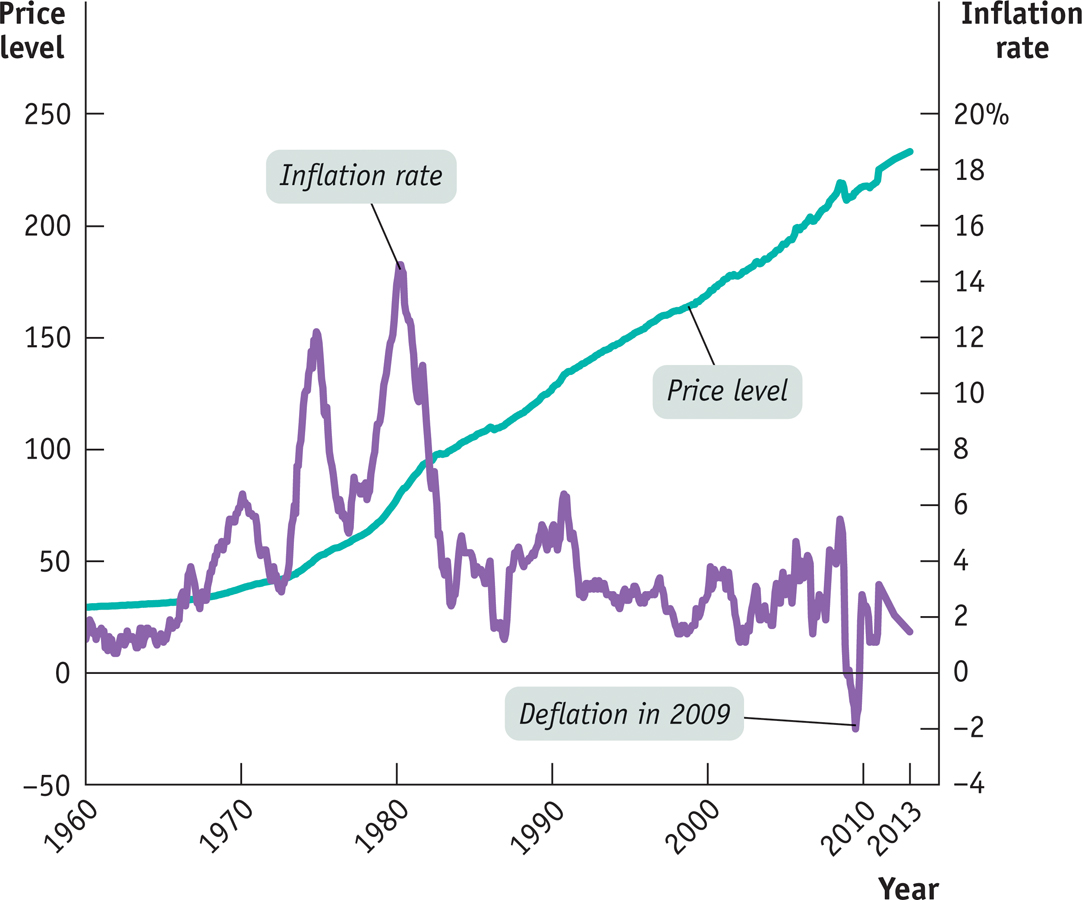

During the most famous of all inflations, the German hyperinflation of 1921–

In addition, Brazil experienced hyperinflation during the early 1990s; during that episode, the Brazilian banking sector grew so large that it accounted for 15% of GDP, more than twice the size of the financial sector in the United States measured as a share of GDP. The large increase in the Brazilian banking sector that was needed to cope with the consequences of inflation represented a loss of real resources to its society.

Shoe-

Increased costs of transactions caused by inflation are known as shoe-

ISRAEL’S EXPERIENCE WITH INFLATION

It’s hard to see the costs of inflation clearly because serious inflation is often associated with other problems that disrupt the economy and life in general, notably war or political instability (or both). In the mid-

As it happens, one of the authors spent a month visiting Tel Aviv University at the height of the inflation, so we can give a first-

First, the shoe-

Second, although menu costs weren’t that visible to a visitor, what you could see were the efforts businesses made to minimize them. For example, restaurant menus often didn’t list prices. Instead, they listed numbers that you had to multiply by another number, written on a chalkboard and changed every day, to figure out the price of a dish.

Finally, it was hard to make decisions because prices changed so much and so often. It was a common experience to walk out of a store because prices were 25% higher than at one’s usual shopping destination, only to discover that prices had just been increased 25% there, too.

Menu costs are the real costs of changing listed prices.

Menu CostsIn a modern economy, most of the things we buy have a listed price. There’s a price listed under each item on a supermarket shelf, a price printed on the front page of your newspaper, a price listed for each dish on a restaurant’s menu. Changing a listed price has a real cost, called a menu cost. For example, to change a price in a supermarket may require a clerk to change the price listed under the item on the shelf and a worker to change the price associated with the item’s UPC code in the store’s computer. In the face of inflation, of course, firms are forced to change prices more often than they would if the price level were more or less stable. This means higher costs for the economy as a whole.

In times of very high inflation rates, menu costs can be substantial. During the Brazilian inflation of the early 1990s, for instance, supermarket workers reportedly spent half of their time replacing old price stickers with new ones. When the inflation rate is high, merchants may decide to stop listing prices in terms of the local currency and use either an artificial unit—

Menu costs are also present in low-

Unit-

Unit-

This role of the dollar as a basis for contracts and calculation is called the unit-

Unit-

During the 1970s, when the United States had a relatively high inflation rate, the distorting effects of inflation on the tax system were a serious problem. Some businesses were discouraged from productive investment spending because they found themselves paying taxes on phantom gains. Meanwhile, some unproductive investments became attractive because they led to phantom losses that reduced tax bills. When the inflation rate fell in the 1980s—

Winners and Losers from Inflation

As we’ve just learned, a high inflation rate imposes overall costs on the economy. In addition, inflation can produce winners and losers within the economy. The main reason inflation sometimes helps some people while hurting others is that economic transactions, such as loans, often involve contracts that extend over a period of time and these contracts are normally specified in nominal—

In the case of a loan, the borrower receives a certain amount of funds at the beginning, and the loan contract specifies how much he or she must repay at some future date. But what that dollar repayment is worth in real terms—

The interest rate on a loan is the percentage of the loan amount that the borrower must pay to the lender, typically on an annual basis, in addition to the repayment of the loan amount itself. Economists summarize the effect of inflation on borrowers and lenders by distinguishing between nominal interest rates and real interest rates.

The nominal interest rate is the interest rate actually paid for a loan.

The real interest rate is the nominal interest rate minus the rate of inflation.

The nominal interest rate is the interest rate that is actually paid for a loan, unadjusted for the effects of inflation. For example, the interest rates advertised on student loans and every interest rate you see listed by a bank is a nominal rate. The real interest rate is the nominal interest rate adjusted for inflation. This adjustment is achieved by simply subtracting the inflation rate from the nominal interest rate. For example, if a loan carries a nominal interest rate of 8%, but the inflation rate is 5%, the real interest rate is 8% − 5% = 3%.

When a borrower and a lender enter into a loan contract, the contract normally specifies a nominal interest rate. But each party has an expectation about the future rate of inflation and therefore an expectation about the real interest rate on the loan. If the actual inflation rate is higher than expected, borrowers gain at the expense of lenders: borrowers will repay their loans with funds that have a lower real value than had been expected—

Historically, the fact that inflation creates winners and losers has sometimes been a major source of political controversy. In 1896 William Jennings Bryan electrified the Democratic presidential convention with a speech in which he declared, “You shall not crucify mankind on a cross of gold.” What he was actually demanding was an inflationary policy. At the time, the U.S. dollar had a fixed value in terms of gold. Bryan wanted the U.S. government to abandon the gold standard and print more money, which would have raised the level of prices and, he believed, helped the nation’s farmers who were deeply in debt.

In modern America, home mortgages (loans for the purchase of homes) are the most important source of gains and losses from inflation. Americans who took out mortgages in the early 1970s quickly found their real payments reduced by higher-

Because gains for some and losses for others result from inflation that is either higher or lower than expected, yet another problem arises: uncertainty about the future inflation rate discourages people from entering into any form of long-

A falling overall level of prices is deflation.

One last point: unexpected deflation—a surprise fall in the price level—

Inflation Is Easy; Disinflation Is Hard

Disinflation is the process of bringing the inflation rate down.

There is not much evidence that a rise in the inflation rate from, say, 2% to 5% would do a great deal of harm to the economy. Still, policy makers generally move forcefully to bring inflation back down when it creeps above 2% or 3%. Why? Because experience shows that bringing the inflation rate down—

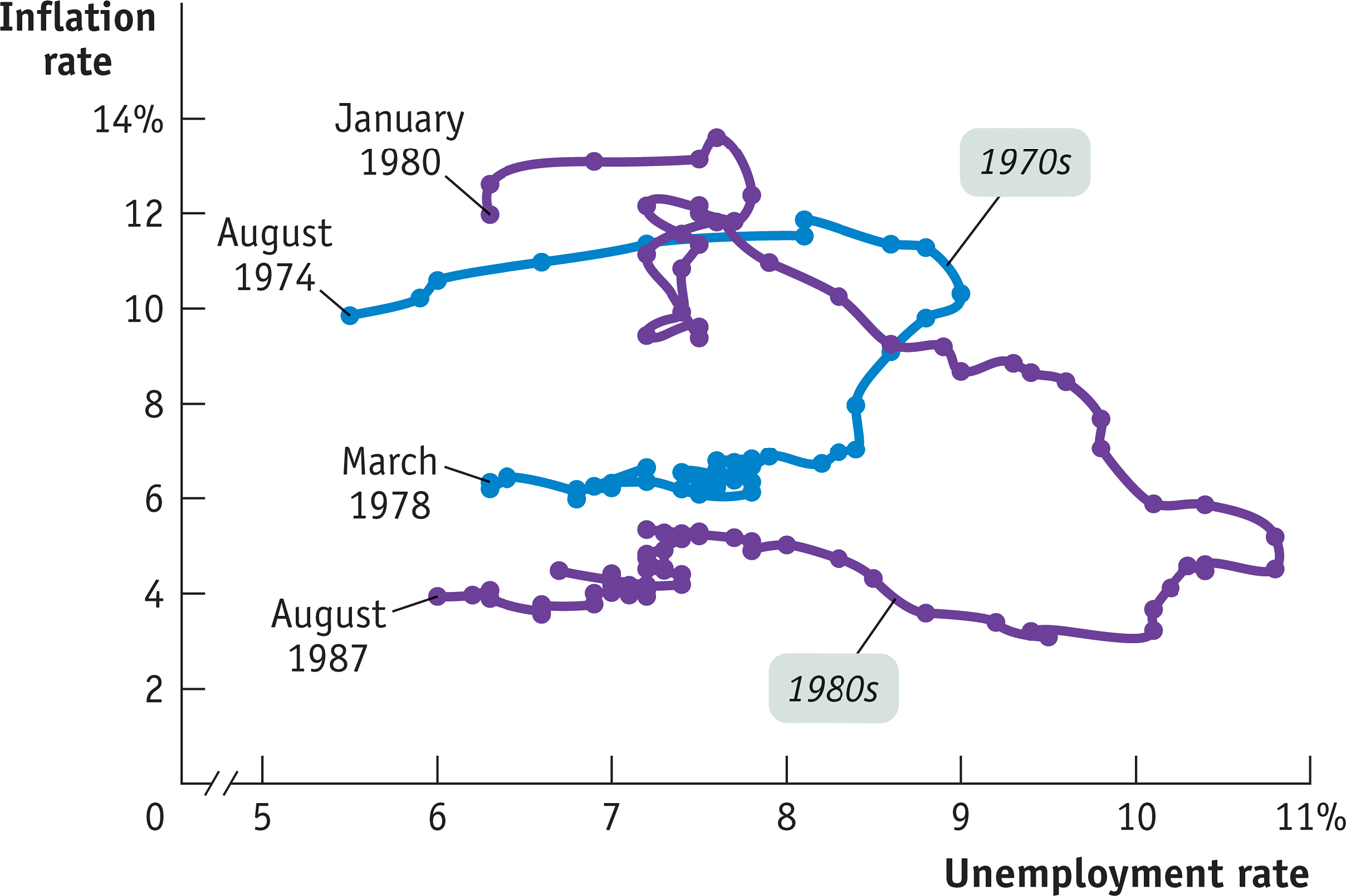

Figure 51-2 shows what happened during two major episodes of disinflation in the United States, in the mid-

Many economists believe that these periods of high unemployment are necessary, because they are the only way to reduce inflation that has become deeply embedded in the economy. The best way to avoid having to put the economy through a wringer to reduce inflation, however, is to avoid having a serious inflation problem in the first place. So, policy makers respond forcefully to signs that inflation may be accelerating as a form of preventive medicine for the economy.

51

Solutions appear at the back of the book.

Check Your Understanding

The widespread use of technology has revolutionized the banking industry, making it much easier for customers to access and manage their assets. Does this mean that the shoe-

leather costs of inflation are higher or lower than they used to be? Explain. Shoe-leather costs as a result of inflation will be lower because it is now less costly for individuals to manage their assets in order to economize on their money holdings. ATM machines, for example, give customers 24-hour access to cash in thousands of locations. This reduction in the cost of obtaining money translates into lower shoe-leather costs.Most Americans have grown accustomed to a modest inflation rate of around 2–

3%. Who would gain and who would lose if inflation came to a complete stop for several years? Explain. If inflation came to a complete stop for several years, the inflation rate of zero would be less than the expected inflation rate of 2–3%. Because the real interest rate is the nominal interest rate minus the inflation rate, the real interest rates on loans would be higher than expected, and lenders would gain at the expense of borrowers. Borrowers would have to repay their loans with funds that had a higher real value than had been expected.

Multiple-

Question

Which of the following is true regarding prices in an economy?

I. An increase in the price level is called inflation.

II. The level of prices doesn’t matter.

III. The rate of change in prices matters.A. B. C. D. E. Question

If your nominal wage doubles at the same time as prices double, your real wage will

A. B. C. D. E. Question

If inflation causes people to frequently convert their dollars into other assets, the economy experiences what type of cost?

A. B. C. D. E. Question

Because dollars are used as the basis for contracts, inflation leads to which type of cost?

A. B. C. D. E. Question

Changing the listed price when inflation leads to a price increase is an example of which type of cost?

A. B. C. D. E.

Critical-

You borrow $1,000 for one year at 5% interest to buy a couch. Although you did not anticipate any inflation, there is unexpected inflation of 5% over the life of your loan.

What was the real interest rate on your loan?

0%Explain how you gained from the inflation.

You borrowed enough money to buy a couch and paid back just enough to buy the same couch (after inflation). Therefore, you gained the benefit of the loan without paying any real interest for it.Who lost as a result of the situation described? Explain.

Whoever gave you the loan lost. The loan was paid back after prices unexpectedly increased, so the lender received a real interest rate of 0% for letting you use the money for a year.