1.1 63Aggregate Demand

WHAT YOU WILL LEARN

How the aggregate demand curve illustrates the relationship between the aggregate price level and the quantity of aggregate output demanded in the economy

How the aggregate demand curve illustrates the relationship between the aggregate price level and the quantity of aggregate output demanded in the economy

How the wealth effect and interest rate effect explain the aggregate demand curve’s negative slope

How the wealth effect and interest rate effect explain the aggregate demand curve’s negative slope

How the aggregate demand curve can be derived from the income–

How the aggregate demand curve can be derived from the income–expenditure model  What factors can shift the aggregate demand curve

What factors can shift the aggregate demand curve

The Aggregate Demand Curve

The aggregate demand curve shows the relationship between the aggregate price level and the quantity of aggregate output demanded by households, businesses, the government, and the rest of the world.

The Great Depression, the great majority of economists agree, was the result of a massive negative demand shock. What does that mean? When economists talk about a fall in the demand for a particular good or service, they’re referring to a leftward shift of the demand curve. Similarly, when economists talk about a negative demand shock to the economy as a whole, they’re referring to a leftward shift of the aggregate demand curve, a curve that shows the relationship between the aggregate price level and the quantity of aggregate output demanded by households, firms, the government, and the rest of the world.

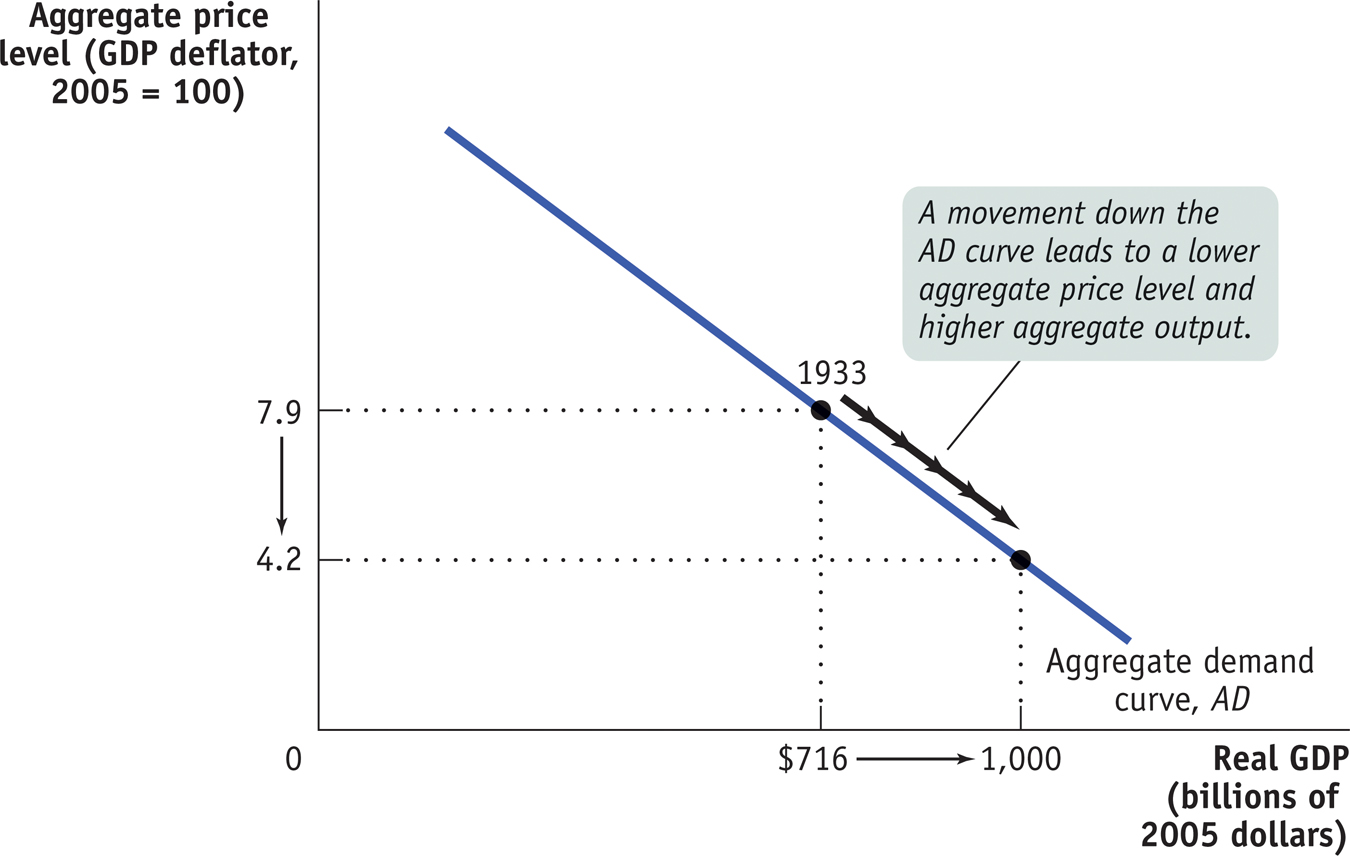

Figure 63-1 shows what the aggregate demand curve may have looked like in 1933, at the end of the 1929–

As drawn in Figure 63-1, the aggregate demand curve is downward sloping, indicating a negative relationship between the aggregate price level and the quantity of aggregate output demanded. A higher aggregate price level, other things equal, reduces the quantity of aggregate output demanded; a lower aggregate price level, other things equal, increases the quantity of aggregate output demanded. According to Figure 63-1, if the price level in 1933 had been 4.2 instead of 7.9, the total quantity of domestic final goods and services demanded would have been $1,000 billion in 2005 dollars instead of $716 billion.

The first key question about the aggregate demand curve is: why should the curve be downward sloping?

Why Is the Aggregate Demand Curve Downward Sloping?

In Figure 63-1, the curve AD is downward sloping. Why? Recall the basic equation of national income accounting:

(63-

where C is consumer spending, I is investment spending, G is government purchases of goods and services, X is exports to other countries, and IM is imports. If we measure these variables in constant dollars—

You might think that the downward slope of the aggregate demand curve is a natural consequence of the law of demand. That is, since the demand curve for any one good is downward sloping, isn’t it natural that the demand curve for aggregate output is also downward sloping? This turns out, however, to be a misleading parallel. The demand curve for any individual good shows how the quantity demanded depends on the price of that good, holding the prices of other goods and services constant. The main reason the quantity of a good demanded falls when the price of that good rises—

But when we consider movements up or down the aggregate demand curve, we’re considering a simultaneous change in the prices of all final goods and services. Furthermore, changes in the composition of goods and services in consumer spending aren’t relevant to the aggregate demand curve: if consumers decide to buy fewer clothes but more cars, this doesn’t necessarily change the total quantity of final goods and services they demand.

Why, then, does a rise in the aggregate price level lead to a fall in the quantity of all domestically produced final goods and services demanded? There are two main reasons: the wealth effect and the interest rate effect of a change in the aggregate price level.

The Wealth EffectAn increase in the aggregate price level, other things equal, reduces the purchasing power of many assets. Consider, for example, someone who has $5,000 in a bank account. If the aggregate price level were to rise by 25%, what used to cost $5,000 would now cost $6,250, and would no longer be affordable. And what used to cost $4,000 would now cost $5,000, so that the $5,000 in the bank account would now buy only as much as $4,000 would have bought previously. With the loss in purchasing power, the owner of that bank account would probably scale back his or her consumption plans. Millions of other people would respond the same way, leading to a fall in spending on final goods and services, because a rise in the aggregate price level reduces the purchasing power of everyone’s bank account.

The wealth effect of a change in the aggregate price level is the effect on consumer spending caused by the effect of a change in the aggregate price level on the purchasing power of consumers’ assets.

Correspondingly, a fall in the aggregate price level increases the purchasing power of consumers’ assets and leads to more consumer demand. The wealth effect of a change in the aggregate price level is the effect on consumer spending caused by the effect of a change in the aggregate price level on the purchasing power of consumers’ assets. Because of the wealth effect, consumer spending, C, falls when the aggregate price level rises, leading to a downward-

The Interest Rate EffectEconomists use the term money in its narrowest sense to refer to cash and bank deposits on which people can write checks. People and firms hold money because it reduces the cost and inconvenience of making transactions. An increase in the aggregate price level, other things equal, reduces the purchasing power of a given amount of money holdings. To purchase the same basket of goods and services as before, people and firms now need to hold more money. So, in response to an increase in the aggregate price level, the public tries to increase its money holdings, either by borrowing more or by selling assets such as bonds. This reduces the funds available for lending to other borrowers and drives interest rates up.

The interest rate effect of a change in the aggregate price level is the effect on consumer spending and investment spending caused by the effect of a change in the aggregate price level on the purchasing power of consumers’ and firms’ money holdings.

We have already learned that a rise in the interest rate reduces investment spending because it makes the cost of borrowing higher. It also reduces consumer spending because households save more of their disposable income. So a rise in the aggregate price level depresses investment spending, I, and consumer spending, C, through its effect on the purchasing power of money holdings, an effect known as the interest rate effect of a change in the aggregate price level. This also leads to a downward-

We’ll have a lot more to say about interest rates in upcoming sections. For now, the important point to remember is that the aggregate demand curve is downward sloping due to both the wealth effect and the interest rate effect of a change in the aggregate price level.

The Aggregate Demand Curve and the Income–Expenditure Model

In the preceding section we introduced the income–

Recall that one of the assumptions of the income–

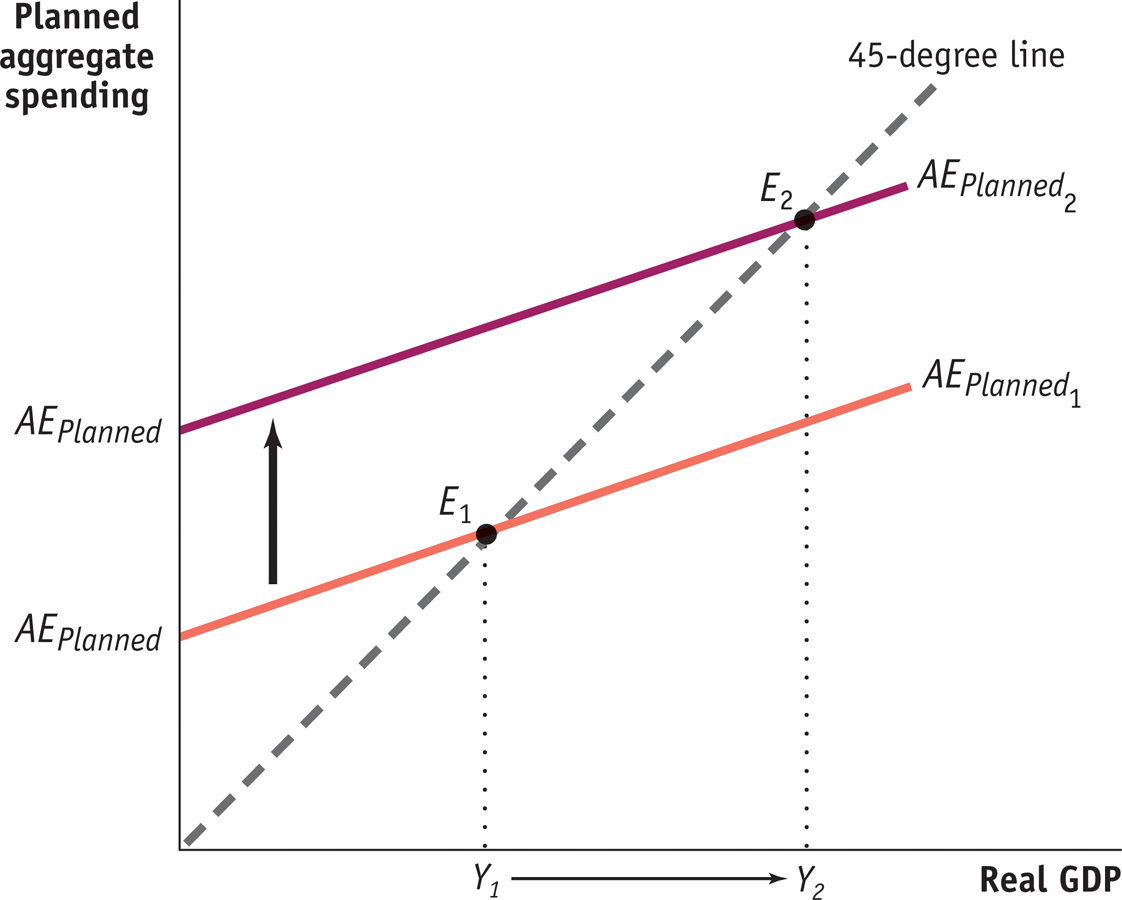

Figure 63-2 shows, once again, how income– and

and  . Income–

. Income– is the relationship between real GDP and planned aggregate spending, then income–

is the relationship between real GDP and planned aggregate spending, then income–

to

to  , leading to a rise in income–

, leading to a rise in income–We’ve just seen, however, that changes in the aggregate price level change the level of planned aggregate spending at any given level of real GDP. This means that when the aggregate price level changes, the AEPlanned curve shifts. For example, suppose that the aggregate price level falls. As a result of both the wealth effect and the interest rate effect, the fall in the aggregate price level will lead to higher planned aggregate spending at any given level of real GDP. So the AEPlanned curve will shift up, as illustrated in Figure 63-2 by the shift from  to

to  . The increase in planned aggregate spending leads to a multiplier process that moves the income–

. The increase in planned aggregate spending leads to a multiplier process that moves the income–

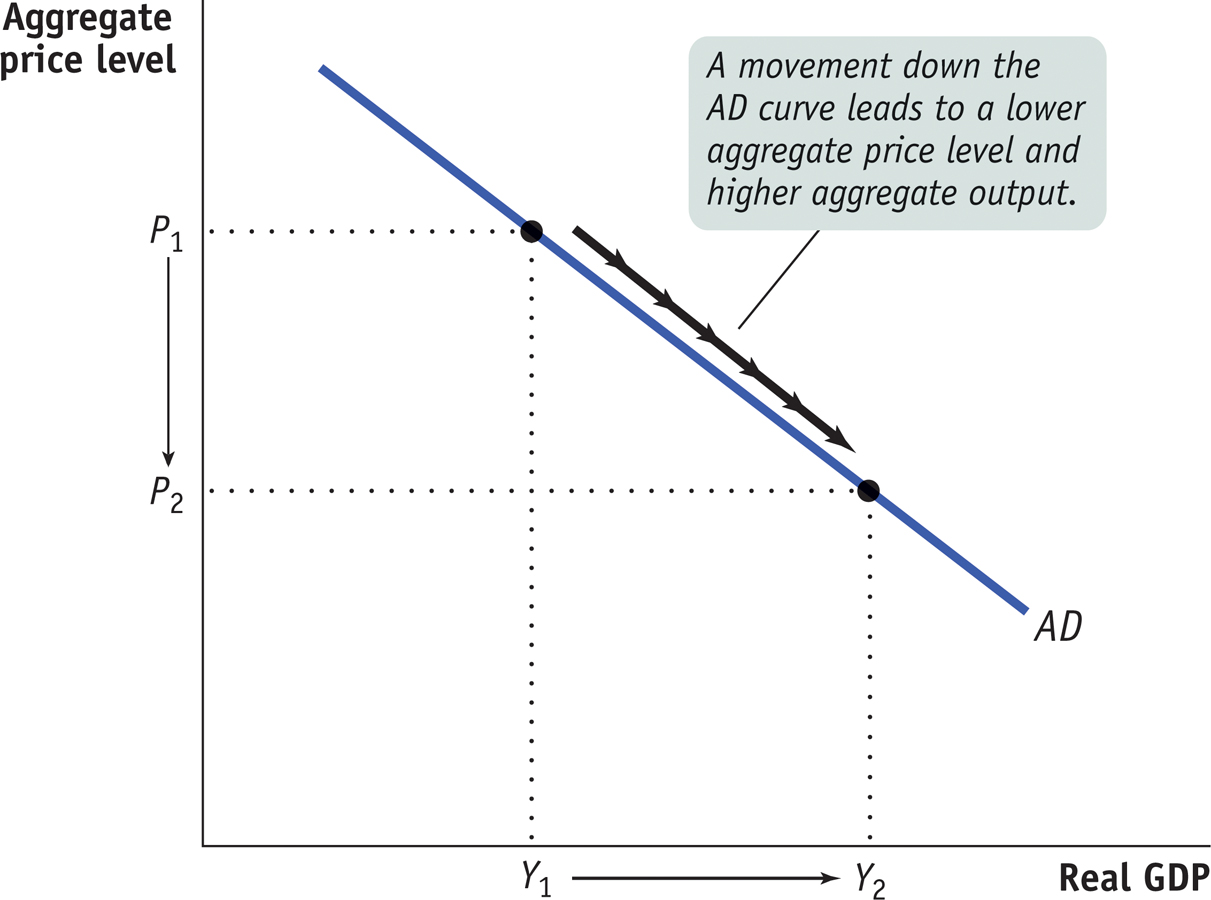

Figure 63-3 shows how this result can be used to derive the aggregate demand curve. In this figure, we show a fall in the aggregate price level from P1 to P2. We saw in Figure 63-2 that a fall in the aggregate price level would lead to an upward shift of the AEPlanned curve and hence a rise in real GDP. You can see this same result in Figure 63-3 as a movement along the AD curve: as the aggregate price level falls, real GDP rises from Y1 to Y2.

So the aggregate demand curve doesn’t replace the income–

In practice, economists often use the income–

Shifts of the Aggregate Demand Curve

In Section 2, where we introduced the analysis of supply and demand in the market for an individual good, we stressed the importance of the distinction between movements along the demand curve and shifts of the demand curve. The same distinction applies to the aggregate demand curve. Figure 63-1 shows a movement along the aggregate demand curve, a change in the aggregate quantity of goods and services demanded as the aggregate price level changes.

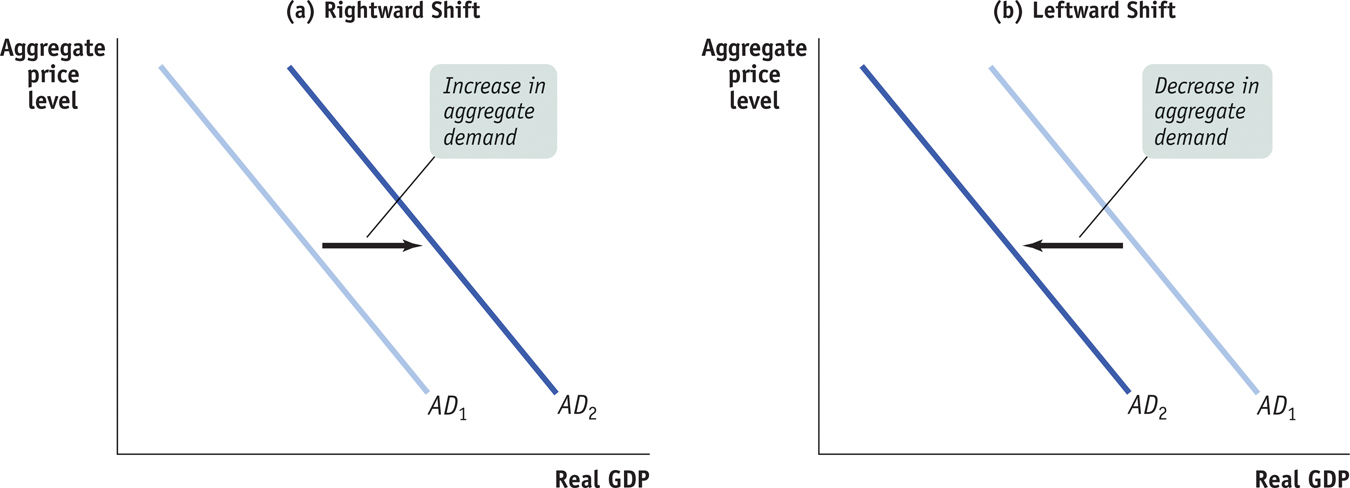

But there can also be shifts of the aggregate demand curve, changes in the quantity of goods and services demanded at any given price level, as shown in Figure 63-4. When we talk about an increase in aggregate demand, we mean a shift of the aggregate demand curve to the right, as shown in panel (a) by the shift from AD1 to AD2. A rightward shift occurs when the quantity of aggregate output demanded increases at any given aggregate price level. A decrease in aggregate demand means that the AD curve shifts to the left, as in panel (b). A leftward shift implies that the quantity of aggregate output demanded falls at any given aggregate price level.

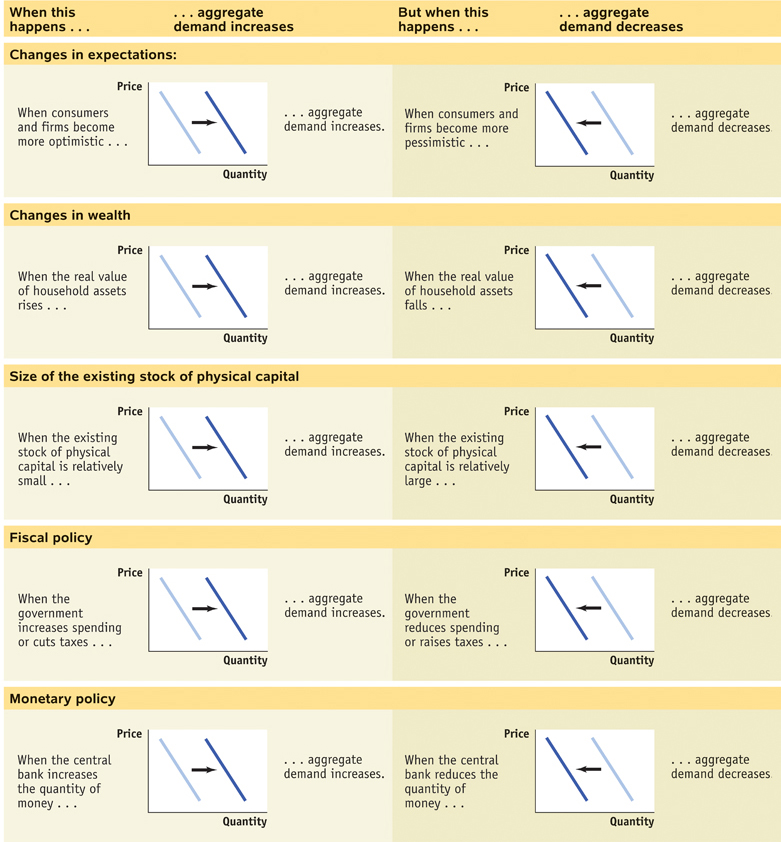

A number of factors can shift the aggregate demand curve. Among the most important factors are changes in expectations, changes in wealth, and the size of the existing stock of physical capital. In addition, both fiscal and monetary policy can shift the aggregate demand curve. All five factors set the multiplier process in motion. By causing an initial rise or fall in real GDP, they change disposable income, which leads to additional changes in aggregate spending, which lead to further changes in real GDP, and so on. For an overview of factors that shift the aggregate demand curve, see upcoming Table 63-1.

63-1

Factors That Shift Aggregate Demand

Changes in ExpectationsAs explained in the previous section, both consumer spending and planned investment spending depend in part on people’s expectations about the future. Consumers base their spending not only on the income they have now but also on the income they expect to have in the future. Firms base their planned investment spending not only on current conditions but also on the sales they expect to make in the future. As a result, changes in expectations can push consumer spending and planned investment spending up or down. If consumers and firms become more optimistic, aggregate spending rises; if they become more pessimistic, aggregate spending falls. In fact, short-

Changes in WealthConsumer spending depends in part on the value of household assets. When the real value of these assets rises, the purchasing power they embody also rises, leading to an increase in aggregate spending. For example, in the 1990s there was a significant rise in the stock market that increased aggregate demand. And when the real value of household assets falls—

Size of The Existing Stock of Physical CapitalFirms engage in planned investment spending to add to their stock of physical capital. Their incentive to spend depends in part on how much physical capital they already have: the more they have, the less they will feel a need to add more, other things equal. The same applies to other types of investment spending—

In fact, that’s part of the reason for the deep slump in residential investment spending that began in 2006. The housing boom of the previous few years had created an oversupply of houses: by spring 2009, the inventory of unsold houses on the market was equal to more than 14 months of sales, and prices of new homes had fallen more than 25% from their peak. This gave the construction industry little incentive to build even more homes.

Fiscal PolicyOne of the key insights of macroeconomics is that the government can have a powerful influence on aggregate demand and that, in some circumstances, this influence can be used to improve economic performance.

One of the ways government can influence the aggregate demand curve is through fiscal policy, which, as we learned earlier, is the use of either government spending—

The effect of government purchases of final goods and services, G, on the aggregate demand curve is direct because government purchases are themselves a component of aggregate demand. So an increase in government purchases shifts the aggregate demand curve to the right and a decrease shifts it to the left. History’s most dramatic example of how increased government purchases affect aggregate demand was the effect of wartime government spending during World War II. Because of the war, U.S. federal purchases surged 400%. This increase in purchases is usually credited with ending the Great Depression. Similarly, in 2009, the United States began spending more than $100 billion on infrastructure projects such as improving highways, bridges, public transportation, and more, to stimulate overall spending in the face of a slumping economy.

In contrast, changes in either tax rates or government transfers influence the economy indirectly through their effect on disposable income. A lower tax rate means that consumers get to keep more of what they earn, increasing their disposable income. An increase in government transfers also increases consumers’ disposable income. In either case, this increases consumer spending and shifts the aggregate demand curve to the right. A higher tax rate or a reduction in transfers reduces the amount of disposable income received by consumers. This reduces consumer spending and shifts the aggregate demand curve to the left.

Monetary PolicyAnother way the government can influence the aggregate demand curve is through monetary policy. In the section-

But what happens if the quantity of money in the hands of households and firms changes? In modern economies, the quantity of money in circulation is largely determined by the decisions of a central bank created by the government. As we’ll learn in upcoming sections, the Federal Reserve, the U.S. central bank, is a special institution that is neither exactly part of the government nor exactly a private institution.

When the central bank increases the quantity of money in circulation, households and firms have more money, which they are willing to lend out. The effect is to drive the interest rate down at any given aggregate price level, leading to higher investment spending and higher consumer spending. That is, increasing the quantity of money shifts the aggregate demand curve to the right. Reducing the quantity of money has the opposite effect: households and firms have less money holdings than before, leading them to borrow more and lend less. This raises the interest rate, reduces investment spending and consumer spending, and shifts the aggregate demand curve to the left.

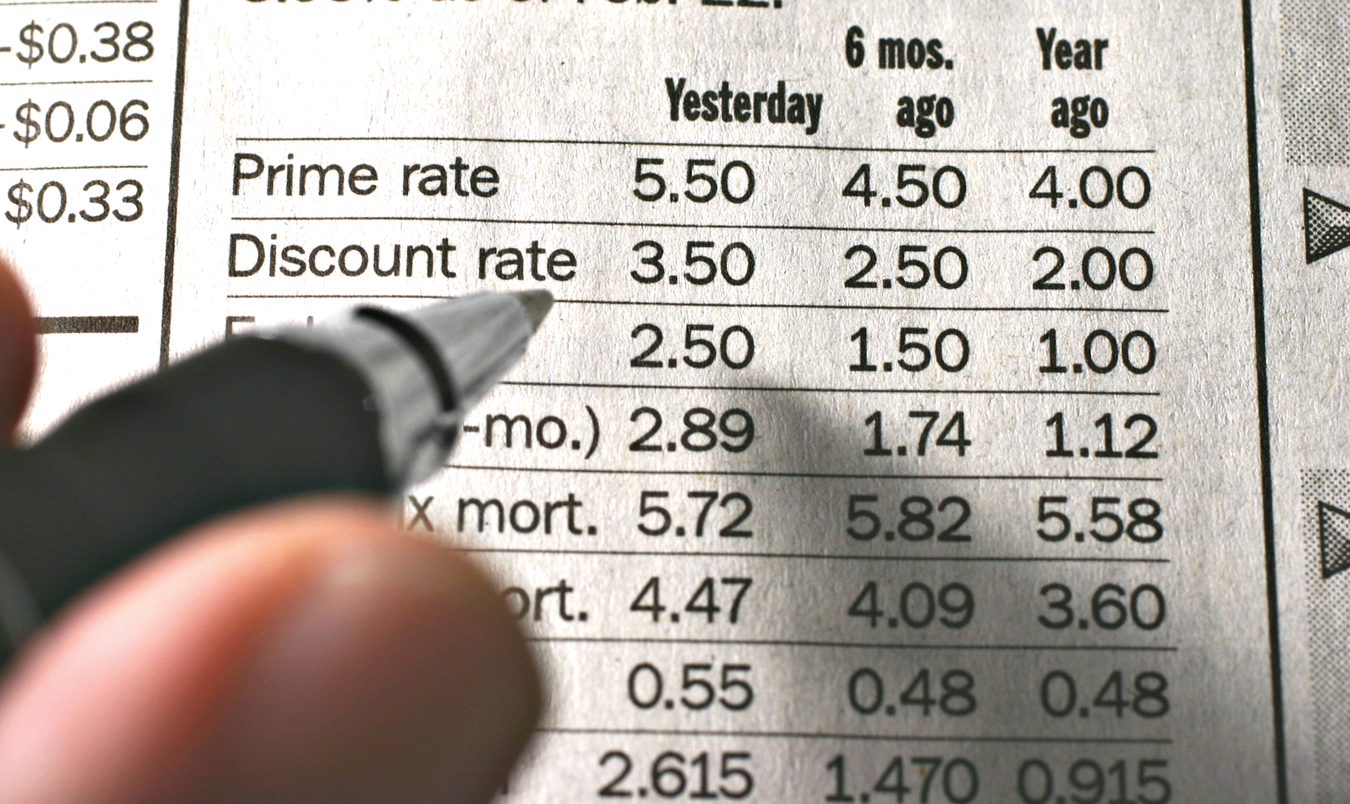

MOVING ALONG THE AGGREGATE DEMAND CURVE, 1979–1980

When looking at data, it’s often hard to distinguish between changes in spending that represent movements along the aggregate demand curve and shifts of the aggregate demand curve. One telling exception, however, is what happened right after the oil crisis of 1979 (which we mention in the section-

This led to an increase in the demand for borrowing and a surge in interest rates. The prime rate, which is the interest rate banks charge their best customers, climbed above 20%. High interest rates, in turn, caused both consumer spending and investment spending to fall: in 1980 purchases of durable consumer goods like cars fell by 5.3% and real investment spending fell by 8.9%.

In other words, in 1979–

63

Solutions appear at the back of the book.

Check Your Understanding

Determine the effect on aggregate demand of each of the following events. Explain whether it represents a movement along the aggregate demand curve (up or down) or a shift of the curve (leftward or rightward).

-

a. a rise in the interest rate caused by a change in monetary policy

This is a shift of the aggregate demand curve. A decrease in the quantity of money raises the interest rate, since people now want to borrow more and lend less. A higher interest rate reduces investment and consumer spending at any given aggregate price level, so the aggregate demand curve shifts to the left. -

b. a fall in the real value of money in the economy due to a higher aggregate price level

This is a movement up along the aggregate demand curve. As the aggregate price level rises, the real value of money holdings falls. This is the interest rate effect of a change in the aggregate price level: as the value of money falls, people want to hold more money. They do so by borrowing more and lending less. This leads to a rise in the interest rate and a reduction in consumer and investment spending. So it is a movement along the aggregate demand curve. -

c. news of a worse-

than- expected job market next year This is a shift of the aggregate demand curve. Expectations of a poor job market, and so lower average disposable incomes, will reduce people’s consumer spending today at any given aggregate price level. So the aggregate demand curve shifts to the left. -

d. a fall in tax rates

This is a shift of the aggregate demand curve. A fall in tax rates raises people’s disposable income. At any given aggregate price level, consumer spending is now higher. So the aggregate demand curve shifts to the right. -

e. a rise in the real value of assets in the economy due to a lower aggregate price level

This is a movement down along the aggregate demand curve. As the aggregate price level falls, the real value of assets rises. This is the wealth effect of a change in the aggregate price level: as the value of assets rises, people will increase their consumption plans. This leads to higher consumer spending. So it is a movement along the aggregate demand curve. -

f. a rise in the real value of assets in the economy due to a surge in real estate values

This is a shift of the aggregate demand curve. A rise in the real value of assets in the economy due to a surge in real estate values raises consumer spending at any given aggregate price level. So the aggregate demand curve shifts to the right.

-

Multiple-

Question

Which of the following explains the slope of the aggregate demand curve?

I. the wealth effect of a change in the aggregate price level

II. the interest rate effect of a change in the aggregate price level

III. the product-substitution effect of a change in the aggregate price level A. B. C. D. E. Question

Which of the following will shift the aggregate demand curve to the right?

A. B. C. D. E. Question

The Consumer Confidence Index is used to measure which of the following?

A. B. C. D. E. Question

Decreases in the stock market decrease aggregate demand by decreasing which of the following?

A. B. C. D. E. Question

Which of the following government policies will shift the aggregate demand curve to the left?

A. B. C. D. E.

Critical-

Question 1.1

Identify the two effects that cause the aggregate demand curve to have a downward slope. Explain each.

The two effects that cause the aggregate demand curve to have a downward slope are the wealth effect and the interest rate effect of a change in the aggregate price level.

The wealth effect: When the price level increases, the purchasing power of money decreases, causing consumers to scale back on spending. Because consumer spending is a component of aggregate demand, increases in the aggregate price level lead to decreases in the quantity of aggregate output demanded. The opposite is true for decreases in the price level. This negative relationship between the price level and the quantity of aggregate output demanded results in a downward-sloping aggregate demand curve.

The interest rate effect: Increases in the aggregate price level cause people to want to hold more money, which increases the demand for money and drives interest rates up. Higher interest rates reduce investment spending because it costs more to borrow money. Thus, a rise in the price level leads to less investment spending, which is a component of aggregate demand, and causes the quantity of aggregate output demanded to decrease (and vice versa). The result is a downward-sloping aggregate demand curve.

CHANGES IN WEALTH: A MOVEMENT ALONG VERSUS A SHIFT OF THE AGGREGATE DEMAND CURVE

Does a change in wealth move the economy along the AD curve or does it shift the AD curve?

Does a change in wealth move the economy along the AD curve or does it shift the AD curve?

The answer is that it does both, depending on the source of the change in wealth. A movement along the AD curve occurs when a change in the aggregate price level changes the purchasing power of consumers’ existing wealth (the real value of their assets). For example, a fall in the aggregate price level increases the purchasing power of consumers’ assets and leads to a movement down the AD curve. In contrast, a change in wealth independent of a change in the aggregate price level shifts the AD curve. For example, a rise in the stock market or a rise in real estate values leads to an increase in the real value of consumers’ assets at any given aggregate price level. In this case, the aggregate demand curve shifts to the right as consumers increase their spending due to the increase in wealth.

The answer is that it does both, depending on the source of the change in wealth. A movement along the AD curve occurs when a change in the aggregate price level changes the purchasing power of consumers’ existing wealth (the real value of their assets). For example, a fall in the aggregate price level increases the purchasing power of consumers’ assets and leads to a movement down the AD curve. In contrast, a change in wealth independent of a change in the aggregate price level shifts the AD curve. For example, a rise in the stock market or a rise in real estate values leads to an increase in the real value of consumers’ assets at any given aggregate price level. In this case, the aggregate demand curve shifts to the right as consumers increase their spending due to the increase in wealth.

To learn more, see pages 276–