The Demand for Money

In the previous chapter we learned about the various types of monetary aggregates: M1, the most commonly used definition of the money supply, consists of currency in circulation (cash), plus checkable bank deposits, plus traveler’s checks; and M2, a broader definition of the money supply, consists of M1 plus deposits that can easily be transferred into checkable deposits. We also learned why people hold money—

The Opportunity Cost of Holding Money

Most economic decisions involve trade-

Individuals and firms find it useful to hold some of their assets in the form of money because of the convenience money provides: money can be used to make purchases directly, but other assets can’t. But there is a price to be paid for that convenience: money normally yields a lower rate of return than nonmonetary assets.

As an example of how convenience makes it worth incurring some opportunity costs, consider the fact that even today—

Even holding money in a checking account involves a trade-

So making sense of the demand for money is about understanding how individuals and firms trade off the benefit of holding cash—

Table 15-1 illustrates the opportunity cost of holding money in a specific month, June 2007. The first row shows the interest rate on one-

15-1

Selected Interest Rates, June 2007

|

One- |

5.30% |

|

Interest- |

2.30% |

|

Currency |

0 |

|

Source: Federal Reserve Bank of St. Louis. |

|

TABLE 15-

Table 15-1 shows the opportunity cost of holding money at one point in time, but the opportunity cost of holding money changes when the overall level of interest rates changes. Specifically, when the overall level of interest rates falls, the opportunity cost of holding money falls, too.

Table 15-2 illustrates this point by showing how selected interest rates changed between June 2007 and June 2008, a period when the Federal Reserve was slashing rates in an (unsuccessful) effort to fight off a rapidly worsening recession. A comparison between interest rates in June 2007 and June 2008 illustrates what happens when the opportunity cost of holding money falls sharply. Between June 2007 and June 2008, the federal funds rate, which is the rate the Fed controls most directly, fell by 3.25 percentage points. The interest rate on one-

15-2

Interest Rates and the Opportunity Cost of Holding Money

|

|

June 2007 |

June 2008 |

|---|---|---|

|

Federal funds rate |

5.25% |

2.00% |

|

One- |

5.30% |

2.50% |

|

Interest- |

2.30% |

1.24% |

|

Currency |

0 |

0 |

|

CDs minus interest- |

3.00 |

1.26 |

|

CDs minus currency (percentage points) |

5.30 |

2.50 |

|

Source: Federal Reserve Bank of St. Louis. |

||

TABLE 15-

Short-

As short-

These differences—

The fact that the federal funds rate in Table 15-2 and the interest rate on one-

Conversely, investors will move their wealth into any short-

Long-

Table 15-2 contains only short-

Moreover, it’s short-

The Money Demand Curve

Because the overall level of interest rates affects the opportunity cost of holding money, the quantity of money individuals and firms want to hold is, other things equal, negatively related to the interest rate. In Figure 15-1, the horizontal axis shows the quantity of money demanded and the vertical axis shows the interest rate, r, which you can think of as a representative short-

15-1

The Money Demand Curve

The money demand curve shows the relationship between the interest rate and the quantity of money demanded.

The relationship between the interest rate and the quantity of money demanded by the public is illustrated by the money demand curve, MD, in Figure 15-1. The money demand curve slopes downward because, other things equal, a higher interest rate increases the opportunity cost of holding money, leading the public to reduce the quantity of money it demands. For example, if the interest rate is very low—

By contrast, if the interest rate is relatively high—

You might ask why we draw the money demand curve with the interest rate—

Shifts of the Money Demand Curve

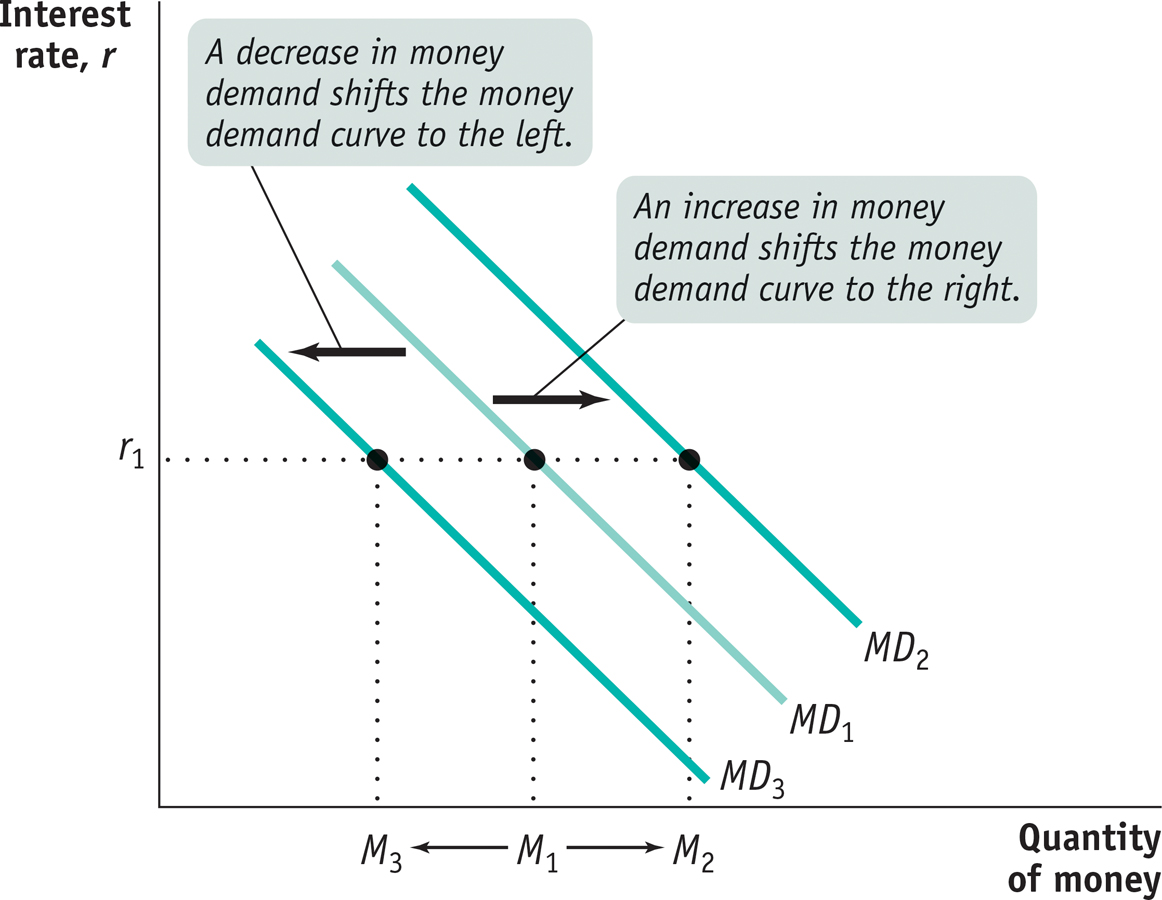

A number of factors other than the interest rate affect the demand for money. When one of these factors changes, the money demand curve shifts. Figure 15-2 shows shifts of the money demand curve: an increase in the demand for money corresponds to a rightward shift of the MD curve, raising the quantity of money demanded at any given interest rate; a decrease in the demand for money corresponds to a leftward shift of the MD curve, reducing the quantity of money demanded at any given interest rate.

15-2

Increases and Decreases in the Demand for Money

The most important factors causing the money demand curve to shift are changes in the aggregate price level, changes in real GDP, changes in credit markets and banking technology, and changes in institutions.

Changes in the Aggregate Price Level Americans keep a lot more cash in their wallets and funds in their checking accounts today than they did in the 1950s. One reason is that they have to if they want to be able to buy anything: almost everything costs more now than it did when you could get a burger, fries, and a drink at McDonald’s for 45 cents and a gallon of gasoline for 29 cents. So, other things equal, higher prices increase the demand for money (a rightward shift of the MD curve), and lower prices decrease the demand for money (a leftward shift of the MD curve).

We can actually be more specific than this: other things equal, the demand for money is proportional to the price level. That is, if the aggregate price level rises by 20%, the quantity of money demanded at any given interest rate, such as r1 in Figure 15-2, also rises by 20%—the movement from M1 to M2. Why? Because if the price of everything rises by 20%, it takes 20% more money to buy the same basket of goods and services. And if the aggregate price level falls by 20%, at any given interest rate the quantity of money demanded falls by 20%—shown by the movement from M1 to M3 at the interest rate r1. As we’ll see later, the fact that money demand is proportional to the price level has important implications for the long-

Changes in Real GDP Households and firms hold money as a way to facilitate purchases of goods and services. The larger the quantity of goods and services they buy, the larger the quantity of money they will want to hold at any given interest rate. So an increase in real GDP—

Changes in Credit Markets and Banking Technology Credit cards are used everywhere in America today, but it wasn’t always so. The first credit card that allowed customers to carry a balance from month to month (called a revolving balance) was issued in 1959. Before then, people had to either pay for purchases in cash or pay off their balance every month. The invention of revolving-

Changes in Institutions Changes in institutions can increase or decrease the demand for money. For example, until Regulation Q was eliminated in 1980, U.S. banks weren’t allowed to offer interest on checking accounts. So the interest you would forgo by holding funds in a checking account instead of an interest-

!worldview! ECONOMICS in Action: A Yen for Cash

A Yen for Cash

Japan, say financial experts, is still a “cash society.” Visitors from the United States or Europe are surprised at how little use the Japanese make of credit cards and how much cash they carry around in their wallets. Yet Japan is one of the most economically and technologically advanced countries, and superior to the United States in some areas such as transportation. So why do the citizens of this economic powerhouse still do business the way Americans and Europeans did a generation ago? The answer highlights the factors affecting the demand for money.

One reason the Japanese use cash so much is that their institutions never made the switch to heavy reliance on plastic. For complex reasons, Japan’s retail sector is still dominated by small mom-

But there’s another reason the Japanese hold so much cash: there’s little opportunity cost to doing so. Short-

Quick Review

Money offers a lower rate of return than other financial assets. We usually compare the rate of return on money with short-

term , not long-term, interest rates .Holding money provides liquidity but incurs an opportunity cost that rises with the interest rate, leading to the downward slope of the money demand curve.

Changes in the aggregate price level, real GDP, credit markets and banking technology, and institutions shift the money demand curve. An increase in the demand for money shifts the money demand curve rightward; a decrease in the demand for money shifts the money demand curve leftward.

15-1

Question 15.1

Explain how each of the following would affect the quantity of money demanded. Does the change cause a movement along the money demand curve or a shift of the money demand curve?

Short-

term interest rates rise from 5% to 30%. By increasing the opportunity cost of holding money, a high interest rate reduces the quantity of money demanded. This is a movement up and to the left along the money demand curve.

All prices fall by 10%.

A 10% fall in prices reduces the quantity of money demanded at any given interest rate, shifting the money demand curve leftward.

New wireless technology automatically charges supermarket purchases to credit cards, eliminating the need to stop at the cash register.

This technological change reduces the quantity of money demanded at any given interest rate. So it shifts the money demand curve leftward.

In order to avoid paying a sharp increase in taxes, residents of Laguria shift their assets into overseas bank accounts. These accounts are harder for tax authorities to trace but also harder for their owners to tap and convert funds into cash.

This will increase the demand for money at any given interest rate. With more of the economy’s assets in overseas bank accounts that are difficult to access, people will want to hold more cash to finance purchases.

Question 15.2

Which of the following will increase the opportunity cost of holding cash? Reduce it? Have no effect? Explain.

Merchants charge a 1% fee on debit/credit card transactions for purchases of less than $50.

A 1% processing fee on debit/credit card transactions for purchases less than $50 reduces the opportunity cost of holding cash because consumers will save money by paying with cash.

To attract more deposits, banks raise the interest paid on six-

month CDs. An increase in the interest paid on six-month CDs raises the opportunity cost of holding cash because holding cash requires forgoing the higher interest paid.

It’s the holiday shopping season and retailers have temporarily slashed prices to unexpectedly low levels.

This reduces the opportunity cost of holding cash because it can now be used to fund purchases at very low prices, compensating its owner for any interest forgone by holding cash.

The cost of food rises significantly.

Because many purchases of food are made in cash, a significant increase in the cost of food reduces the opportunity cost of holding cash.

Solutions appear at back of book.