Fiscal Policy: The Basics

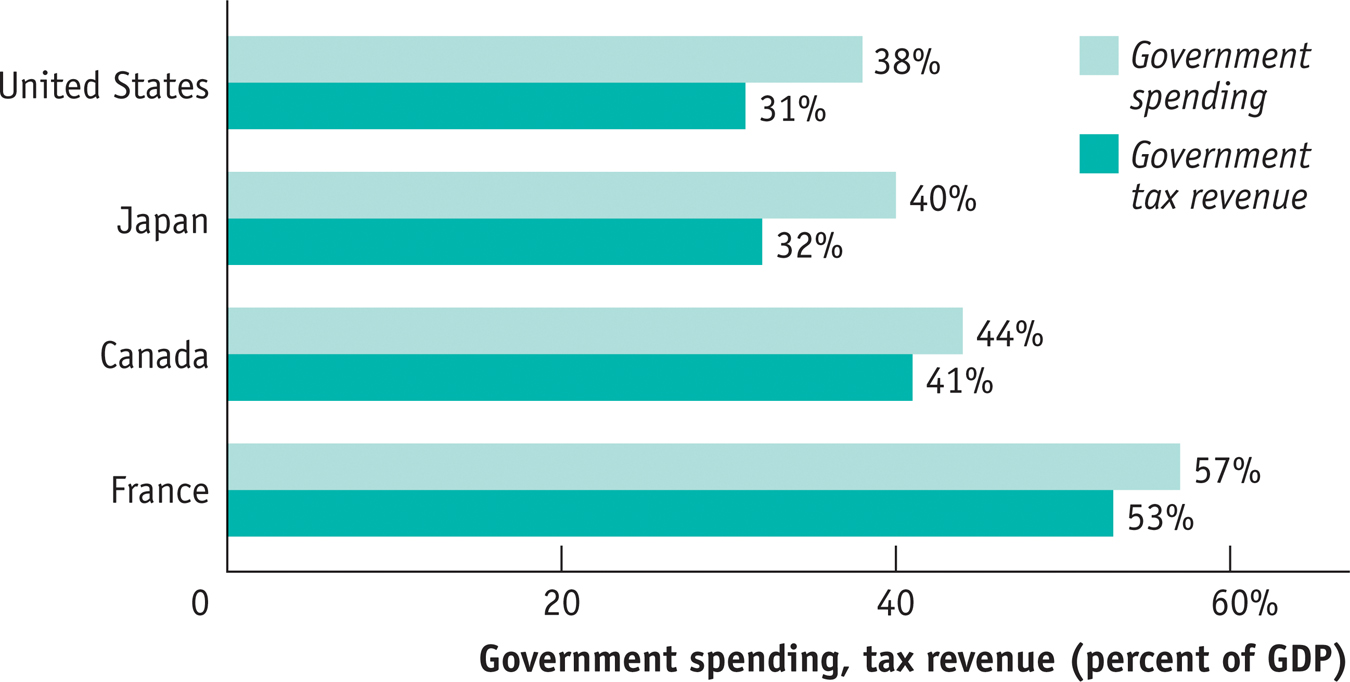

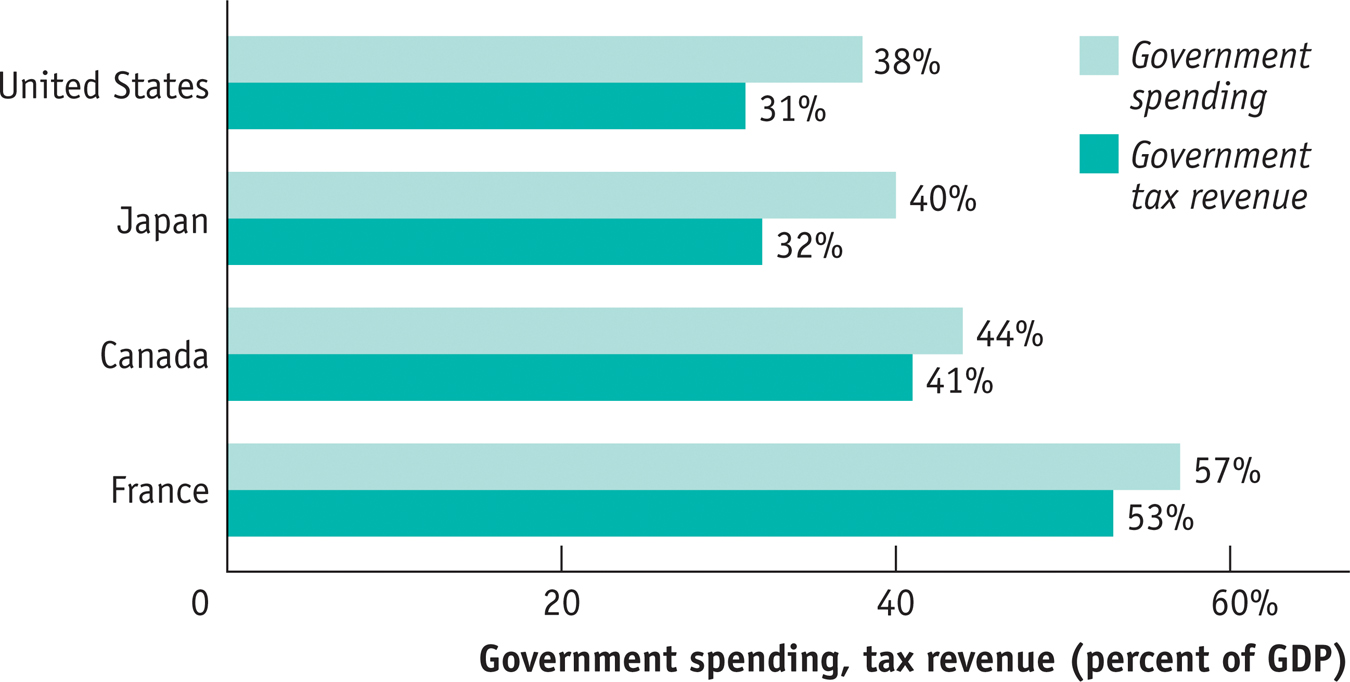

Let’s begin with the obvious: modern governments in economically advanced countries spend a great deal of money and collect a lot in taxes. Figure 13-1 shows government spending and tax revenue as percentages of GDP for a selection of high-income countries in 2013. As you can see, the French government sector is relatively large, accounting for more than half of the French economy. The government of the United States plays a smaller role in the economy than those of Canada or most European countries. But that role is still sizable, with the government playing a major role in the U.S. economy. As a result, changes in the federal budget—changes in government spending or in taxation—can have large effects on the American economy.

Government Spending and Tax Revenue for Some High-Income Countries in 2013 Government spending and tax revenue are represented as a percentage of GDP. France has a particularly large government sector, representing more than half of its GDP. The U.S. government sector, although sizable, is smaller than those of Canada and most European countries. Source: OECD.

To analyze these effects, we begin by showing how taxes and government spending affect the economy’s flow of income. Then we can see how changes in spending and tax policy affect aggregate demand.