Taxes, Purchases of Goods and Services, Government Transfers, and Borrowing

In Figure 7-1 we showed the circular flow of income and spending in the economy as a whole. One of the sectors represented in that figure was the government. Funds flow into the government in the form of taxes and government borrowing; funds flow out in the form of government purchases of goods and services and government transfers to households.

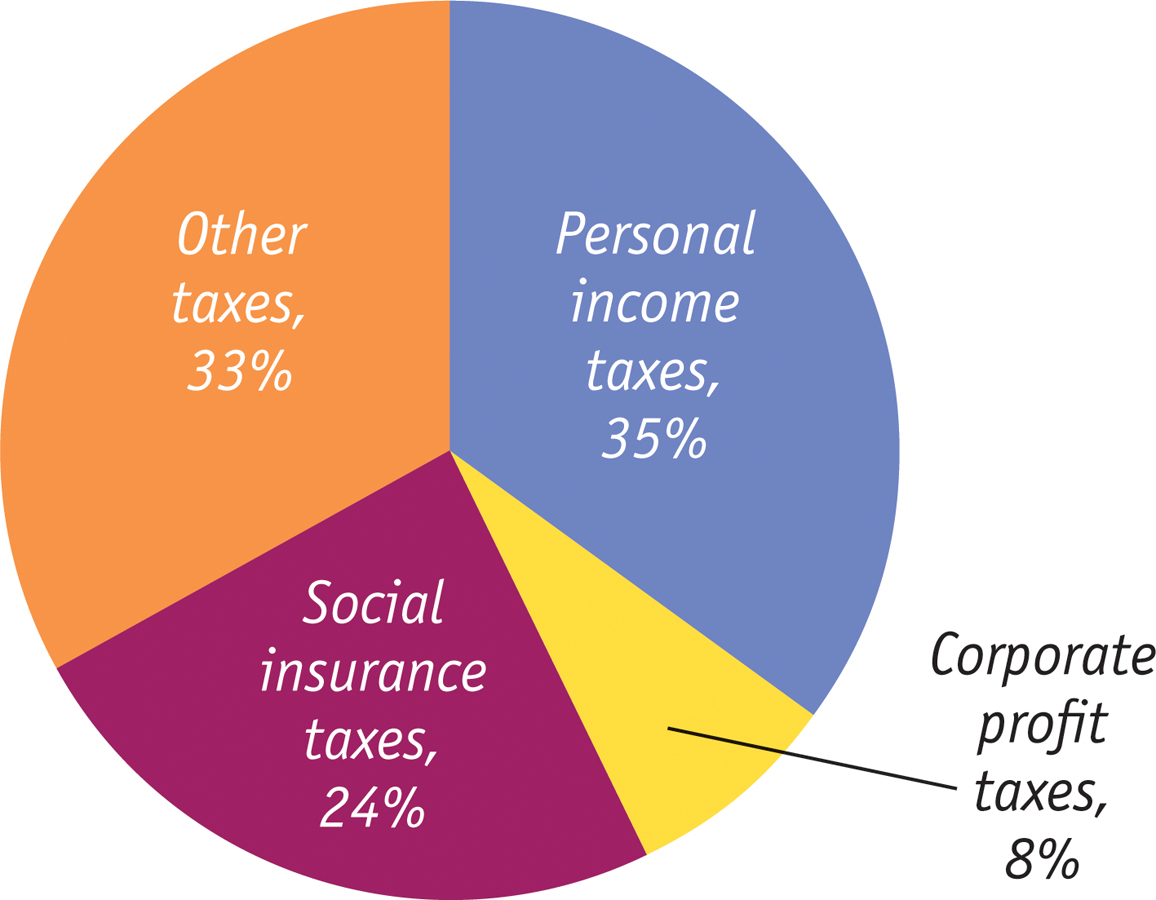

What kinds of taxes do Americans pay, and where does the money go? Figure 13-2 shows the composition of U.S. tax revenue in 2013. Taxes, of course, are required payments to the government. In the United States, taxes are collected at the national level by the federal government; at the state level by each state government; and at local levels by counties, cities, and towns. At the federal level, the taxes that generate the greatest revenue are income taxes on both personal income and corporate profits as well as social insurance taxes, which we’ll explain shortly. At the state and local levels, the picture is more complex: these governments rely on a mix of sales taxes, property taxes, income taxes, and fees of various kinds.

Overall, taxes on personal income and corporate profits accounted for 43% of total government revenue in 2013; social insurance taxes accounted for 24%; and a variety of other taxes, collected mainly at the state and local levels, accounted for the rest.

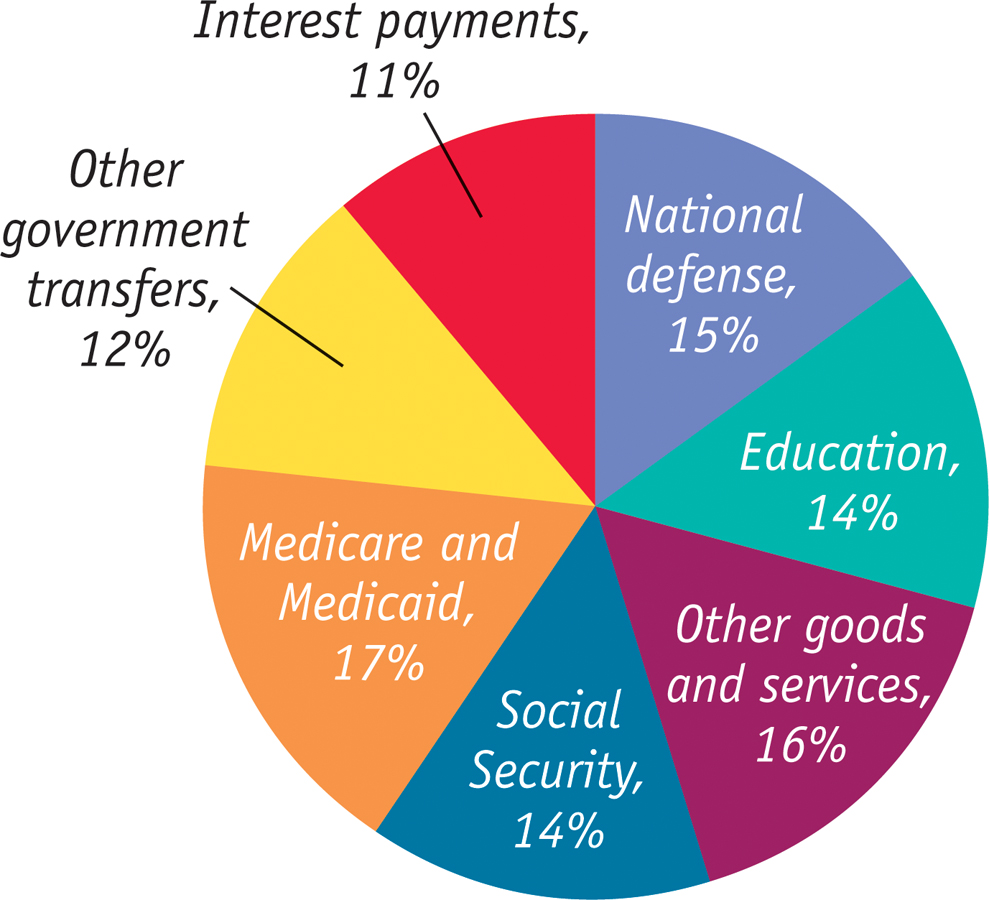

Figure 13-3 shows the composition of total U.S. government spending in 2013, which takes two broad forms. One form is purchases of goods and services. This includes everything from ammunition for the military to the salaries of public school teachers (who are treated in the national accounts as providers of a service—

The other form of government spending is government transfers, which are payments by the government to households for which no good or service is provided in return. In the modern United States, as well as in Canada and Europe, government transfers represent a very large proportion of the budget. Most U.S. government spending on transfer payments is accounted for by three big programs:

Social Security, which provides guaranteed income to older Americans, disabled Americans, and the surviving spouses and dependent children of deceased or retired beneficiaries

Medicare, which covers much of the cost of health care for Americans over age 65

Medicaid, which covers much of the cost of health care for Americans with low incomes

Social insurance programs are government programs intended to protect families against economic hardship.

The term social insurance is used to describe government programs that are intended to protect families against economic hardship. These include Social Security, Medicare and Medicaid as well as smaller programs such as unemployment insurance and food stamps. And in 2014, the Affordable Care Act, or ACA, was implemented. Created to ensure that every American is covered by health insurance, the ACA works through a system of regulated private insurance markets, subsidies, and an expansion of Medicaid eligibility. In the United States, social insurance programs are largely paid for with special, dedicated taxes on wages—

But how do tax policy and government spending affect the economy? The answer is that taxation and government spending have a strong effect on total aggregate spending in the economy.