Long-Run Economic Growth

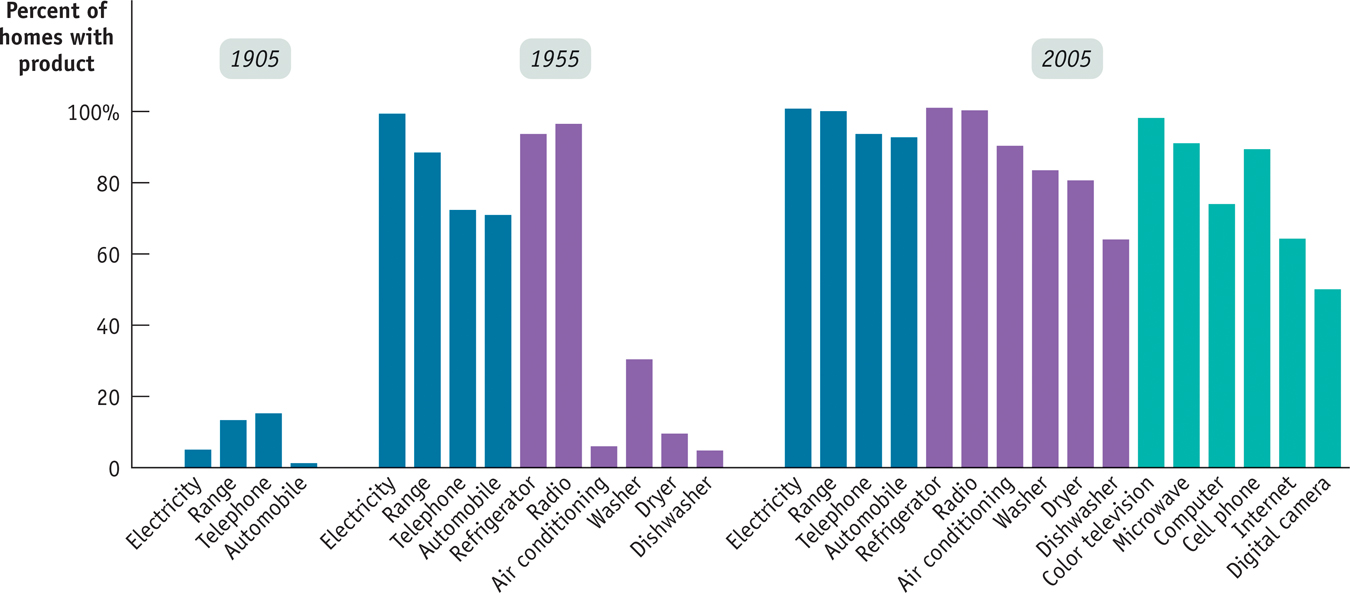

In 1955, Americans were delighted with the nation’s prosperity. The economy was expanding, consumer goods that had been rationed during World War II were available for everyone to buy, and most Americans believed, rightly, that they were better off than the citizens of any other nation, past or present. Yet by today’s standards, Americans were quite poor in 1955. Figure 6-6 shows the percentage of American homes equipped with a variety of appliances in 1905, 1955, and 2005: in 1955 only 37% of American homes contained washing machines and hardly anyone had air conditioning. And if we turn the clock back another half-

6-6

The Fruits of Long-

Why are the vast majority of Americans today able to afford conveniences that many Americans lacked in 1955? The answer is long-

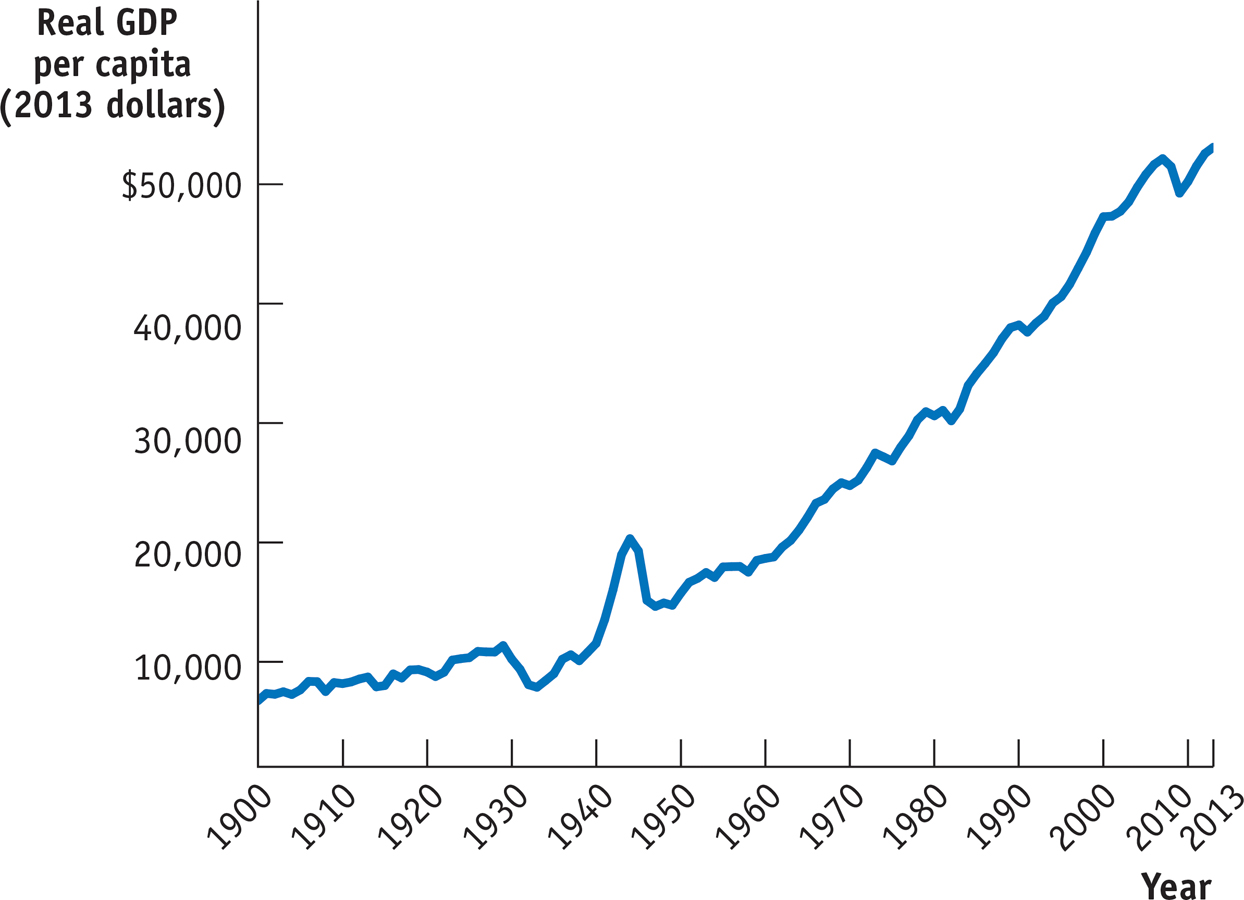

6-7

American Growth, the Long View

Sources: Angus Maddison, Statistics on World Population, GDP, and Per Capita GDP, 1–

Long-

Part of the long-

Long-

More broadly, the public’s sense that the country is making progress depends crucially on success in achieving long-

When Did Long-Run Growth Start?

Today, the United States is a much richer country than it was in 1955; in 1955 it was much richer than it had been in 1905. But how did 1855 compare with 1805? Or 1755? How far back does long-

The answer is that long-

Economic stagnation meant unchanging living standards. For example, information on prices and wages from sources such as monastery records shows that workers in England weren’t significantly better off in the early eighteenth century than they had been five centuries earlier. And it’s a good bet that they weren’t much better off than Egyptian peasants in the age of the pharaohs. However, long-

Long-

As we’ll see, macroeconomists don’t use the same models to think about long-

!worldview! ECONOMICS in Action: A Tale of Two Countries

A Tale of Two Countries

Many countries have experienced long-

From today’s vantage point, it’s surprising to realize that Canada and Argentina looked rather similar before World War I. Both were major exporters of agricultural products; both attracted large numbers of European immigrants; both also attracted large amounts of European investment, especially in the railroads that opened up their agricultural hinterlands. Economic historians believe that the average level of per capita income was about the same in the two countries as late as the 1930s.

After World War II, however, Argentina’s economy performed poorly, largely due to political instability and bad macroeconomic policies. Argentina experienced several periods of extremely high inflation, during which the cost of living soared. Meanwhile, Canada made steady progress. Thanks to the fact that Canada has achieved sustained long-

Quick Review

Because the U.S. economy has achieved long-

run economic growth, Americans live much better than they did a half-century or more ago. Long-

run economic growth is crucial for many economic concerns, such as a higher standard of living or financing government programs. It’s especially crucial for poorer countries.

6-3

Question 6.5

Many poor countries have high rates of population growth. What does this imply about the long-

run growth rates of overall output that they must achieve in order to generate a higher standard of living per person? Countries with high rates of population growth will have to maintain higher growth rates of overall output than countries with low rates of population growth in order to achieve an increased standard of living per person because aggregate output will have to be divided among a larger number of people.

Question 6.6

Argentina used to be as rich as Canada; now it’s much poorer. Does this mean that Argentina is poorer than it was in the past? Explain.

No, Argentina is not poorer than it was in the past. Both Argentina and Canada have experienced long-run growth. However, after World War II, Argentina did not make as much progress as Canada, perhaps because of political instability and bad macroeconomic policies. Canada’s economy grew much faster than Argentina’s. Although Canada is now about three times as rich as Argentina, Argentina still had long-run growth of its economy.

Solutions appear at back of book.