Market Baskets and Price Indexes

Suppose that a frost in Florida destroys most of the citrus harvest. As a result, the price of an orange rises from $0.20 to $0.40, the price of a grapefruit rises from $0.60 to $1.00, and the price of a lemon rises from $0.25 to $0.45. How much has the price of citrus fruit increased?

One way to answer that question is to state three numbers—

A market basket is a hypothetical set of consumer purchases of goods and services.

To measure average price changes for consumer goods and services, economists track changes in the cost of a typical consumer’s consumption bundle—

Table 7-3 shows the pre-

7-3

Calculating the Cost of a Market Basket

|

|

Pre- |

Post- |

|---|---|---|

|

Price of orange |

$0.20 |

$0.40 |

|

Price of grapefruit |

0.60 |

1.00 |

|

Price of lemon |

0.25 |

0.45 |

|

Cost of market basket (200 oranges, 50 grapefruit, 100 lemons) |

(200 × $0.20) + (50 × $0.60) + (100 × $0.25) = $95.00 |

(200 × $0.40) + (50 × $1.00) + (100 × $0.45) = $175.00 |

TABLE 7-

Economists use the same method to measure changes in the overall price level: they track changes in the cost of buying a given market basket. In addition, they perform another simplification in order to avoid having to keep track of the information that the market basket cost—

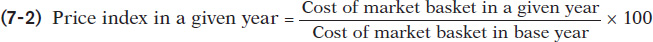

A price index measures the cost of purchasing a given market basket in a given year, where that cost is normalized so that it is equal to 100 in the selected base year.

In our example, the citrus fruit market basket cost $95 in the base year, the year before the frost. So by Equation 7-

Thus, the price index makes it clear that the average price of citrus has risen 84.2% as a consequence of the frost. Because of its simplicity and intuitive appeal, the method we’ve just described is used to calculate a variety of price indexes to track average price changes among a variety of different groups of goods and services. For example, the consumer price index, which we’ll discuss shortly, is the most widely used measure of the aggregate price level, the overall price level of final consumer goods and services across the economy.

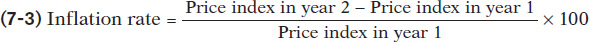

The inflation rate is the percent change per year in a price index—

Price indexes are also the basis for measuring inflation. The inflation rate is the annual percent change in an official price index. The inflation rate from year 1 to year 2 is calculated using the following formula, where we assume that year 1 and year 2 are consecutive years.

Typically, a news report that cites “the inflation rate” is referring to the annual percent change in the consumer price index.