1.3 35The Federal Reserve System

WHAT YOU WILL LEARN

The structure of the Federal Reserve System

The structure of the Federal Reserve System

The history of the Federal Reserve System

The history of the Federal Reserve System

How the Federal Reserve has responded to major financial crises

How the Federal Reserve has responded to major financial crises

A central bank is an institution that oversees and regulates the banking system and controls the monetary base.

Who’s in charge of ensuring that banks maintain enough reserves? Who decides how large the monetary base will be? The answer, in the United States, is an institution known as the Federal Reserve (or, informally, as “the Fed”). The Federal Reserve is a central bank—an institution that oversees and regulates the banking system and controls the monetary base. Other central banks include the Bank of England, the Bank of Japan, and the European Central Bank, or ECB. The ECB acts as a common central bank for 18 European countries.

The Structure of the Fed

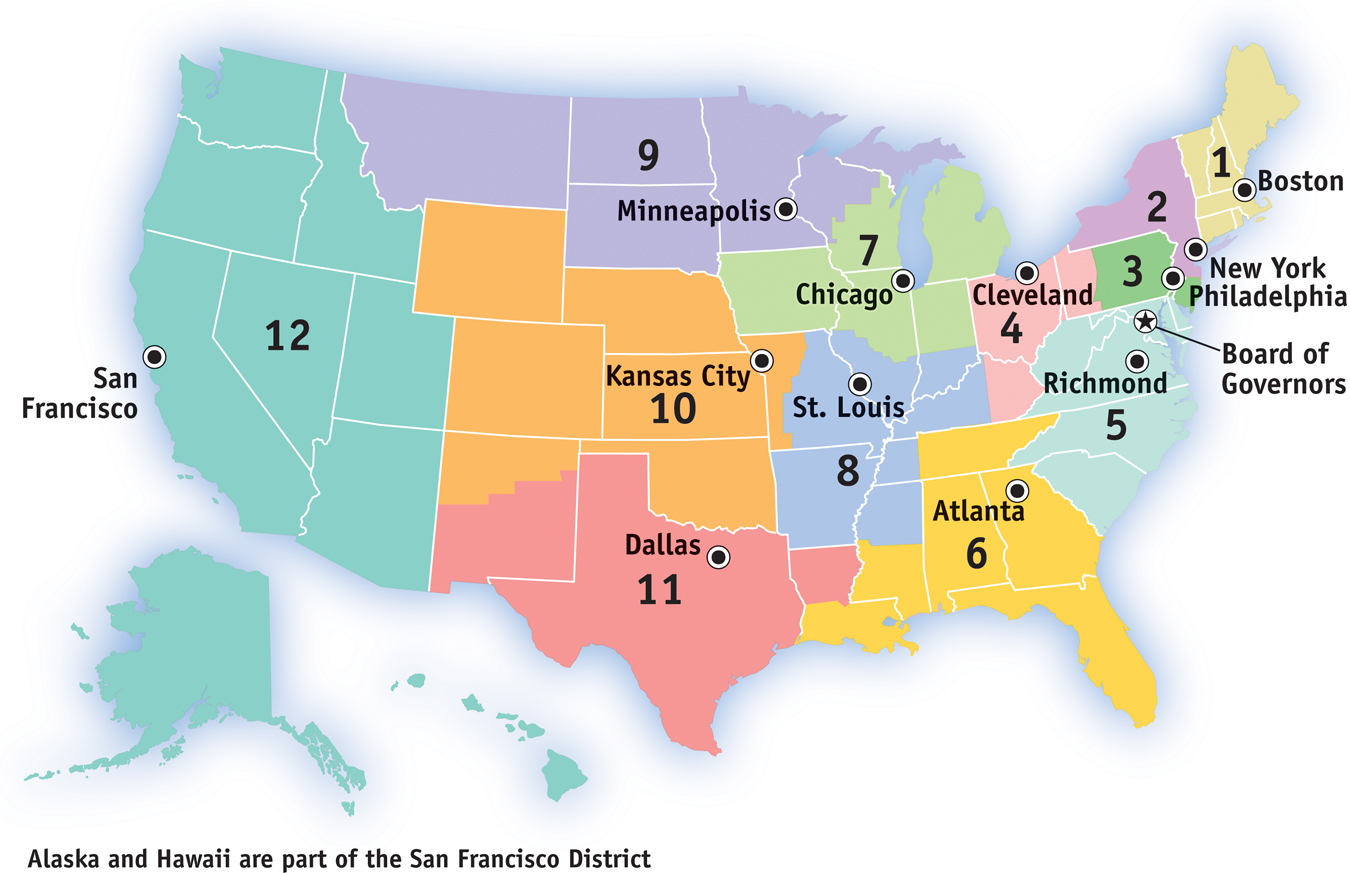

The legal status of the Fed, which was created in 1913, is unusual: it is not exactly part of the U.S. government, but it is not really a private institution either. Strictly speaking, the Federal Reserve System consists of two parts: the Board of Governors and the 12 regional Federal Reserve Banks.

The Board of Governors, which oversees the entire system from its offices in Washington, D.C., is constituted like a government agency: its seven members are appointed by the president and must be approved by the Senate. However, they are appointed for 14-

Although the chair is appointed more frequently—

The 12 Federal Reserve Banks each serve a region of the country, providing various banking and supervisory services. One of their jobs, for example, is to audit the books of private-

Source: Board of Governors of the Federal Reserve System.

Decisions about monetary policy are made by the Federal Open Market Committee, which consists of the Board of Governors plus five of the regional bank presidents. The president of the Federal Reserve Bank of New York is always on the committee, and the other four seats rotate among the 11 other regional bank presidents. The chair of the Board of Governors normally also serves as the chair of the Federal Open Market Committee.

The effect of this complex structure is to create an institution that is ultimately accountable to the voting public because the Board of Governors is chosen by elected officials. But the long terms served by board members, as well as the indirectness of their appointment process, largely insulate them from short-

The Evolution of the American Banking System

Up to this point in the section, we have been describing the U.S. banking system and how it works. To fully understand that system, however, it is helpful to understand how and why it was created—

The Crisis in American Banking at the Turn of the Twentieth Century

The creation of the Federal Reserve System in 1913 marked the beginning of the modern era of American banking. From 1864 until 1913, American banking was dominated by a federally regulated system of national banks. They alone were allowed to issue currency, and the currency notes they issued were printed by the federal government with uniform size and design.

How much currency a national bank could issue depended on its capital. Although this system was an improvement on the earlier period in which banks issued their own notes with no uniformity and virtually no regulation, the national banking regime still suffered numerous bank failures and major financial crises—

The main problem afflicting the system was that the money supply was not sufficiently responsive: it was difficult to shift currency around the country to respond quickly to local economic changes. (In particular, there was often a tug-

As we’ve seen, rumors that a bank had insufficient currency to satisfy demands for withdrawals would quickly lead to a bank run. A bank run would then spark a contagion, setting off runs at nearby banks, sowing widespread panic and devastation in the local economy. In response, bankers in some locations pooled resources to create local clearinghouses that would guarantee a member’s liabilities in the event of a panic, and some state governments began offering deposit insurance on their banks’ deposits.

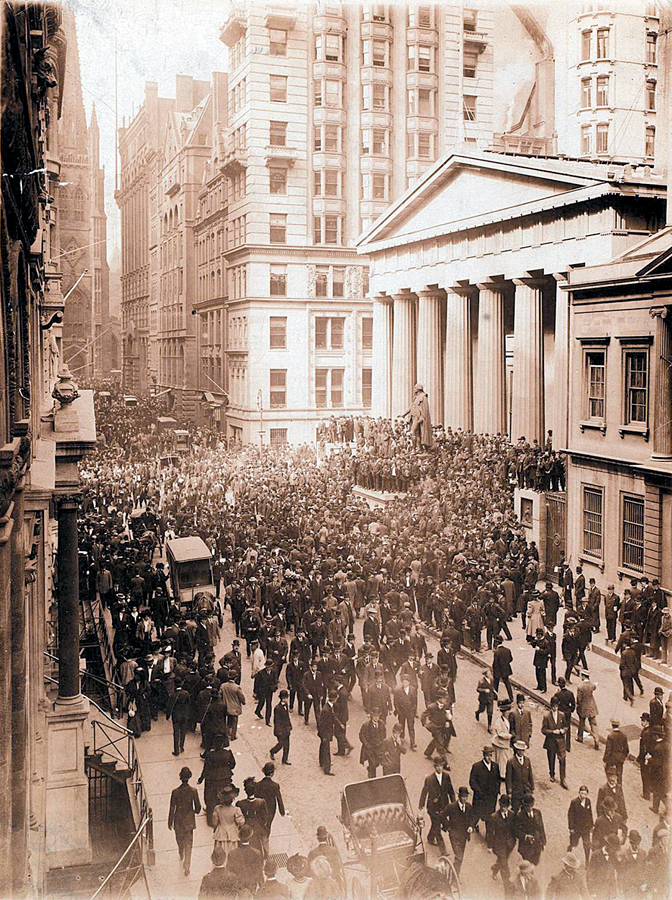

However, the cause of the Panic of 1907 was different from those of previous crises; in fact, its cause was eerily similar to the roots of the 2008 crisis. Ground zero of the 1907 panic was New York City, but the consequences devastated the entire country, leading to a deep four-

The crisis originated in institutions in New York known as trusts, bank-

However, as the American economy boomed during the first decade of the twentieth century, trusts began speculating in real estate and the stock market, areas forbidden to national banks. Less regulated than national banks, trusts were able to pay their depositors higher returns. Yet trusts took a free ride on national banks’ reputation for soundness, with depositors considering them equally safe.

As a result, trusts grew rapidly: by 1907, the total assets of trusts in New York City were as large as those of national banks. Meanwhile, the trusts declined to join the New York Clearinghouse, a consortium of New York City national banks that guaranteed one another’s soundness; that would have required the trusts to hold higher cash reserves, reducing their profits.

The Panic of 1907 began with the failure of the Knickerbocker Trust, a large New York City trust that failed when it suffered massive losses in unsuccessful stock market speculation. Quickly, other New York trusts came under pressure, and frightened depositors began queuing in long lines to withdraw their funds. The New York Clearinghouse declined to step in and lend to the trusts, and even healthy trusts came under serious assault.

Within two days, a dozen major trusts had gone under. Credit markets froze, the stock market fell dramatically as stock traders were unable to get credit to finance their trades, and business confidence evaporated.

Fortunately, one of New York City’s wealthiest men, the banker J. P. Morgan, quickly stepped in to stop the panic. Understanding that the crisis would spread and soon engulf healthy institutions, trusts and banks alike, he worked with other bankers, wealthy men such as John D. Rockefeller, and the U.S. Secretary of the Treasury to shore up the reserves of banks and trusts to withstand the onslaught of withdrawals. Once people were assured that they could withdraw their money, the panic ceased.

Although the panic itself lasted little more than a week, it and the stock market collapse decimated the economy. A four-

Responding to Banking Crises: The Creation of the Federal Reserve

Concerns over frequent banking crises and the unprecedented role of J. P. Morgan in saving the financial system prompted the federal government to initiate banking reform. In 1913 the national banking system was eliminated and the Federal Reserve System was created as a way to compel all deposit-

The Panic of 1907 convinced many that the time for centralized control of bank reserves had come. In addition, the Federal Reserve was given the sole right to issue currency in order to make the money supply sufficiently responsive to satisfy economic conditions around the country.

The Effectiveness of The Federal Reserve SystemAlthough the Federal Reserve System standardized and centralized the holding of bank reserves, it did not eliminate the potential for bank runs because banks’ reserves were still less than the total value of their deposits. The potential for more bank runs became a reality during the Great Depression. Plunging commodity prices hit American farmers particularly hard, precipitating a series of bank runs in 1930, 1931, and 1933, each of which started at midwestern banks and then spread throughout the country.

After the failure of a particularly large bank in 1930, federal officials realized that the economy-

Also, the Glass-

During the midst of the catastrophic bank run of 1933, the new U.S. president, Franklin Delano Roosevelt, was inaugurated. He immediately declared a “bank holiday,” closing all banks until regulators could get a handle on the problem.

In March 1933, emergency measures were adopted that gave the RFC extraordinary powers to stabilize and restructure the banking industry by providing capital to banks either by loans or by outright purchases of bank shares. With the new regulations, regulators closed nonviable banks and recapitalized viable ones by allowing the RFC to buy preferred shares in banks (shares that gave the U.S. government more rights than regular shareholders) and by greatly expanding banks’ ability to borrow from the Federal Reserve.

By 1933, the RFC had invested over $17 billion (2013 dollars) in bank capital—

Economic historians uniformly agree that the banking crises of the early 1930s greatly exacerbated the severity of the Great Depression, rendering monetary policy ineffective as the banking sector broke down and currency, withdrawn from banks and stashed under beds, reduced the money supply.

A commercial bank accepts deposits and is covered by deposit insurance.

An investment bank trades in financial assets and is not covered by deposit insurance.

The Glass-

Regulation Q prevented commercial banks from paying interest on checking accounts, in the belief that this would promote unhealthy competition between banks. In addition, investment banks were much more lightly regulated than commercial banks. The most important measure for the prevention of bank runs, however, was the adoption of federal deposit insurance (with an original limit of $2,500 per deposit).

These measures were clearly successful, and the United States enjoyed a long period of financial and banking stability. As memories of the bad old days dimmed, Depression-

The Savings and Loan Crisis of the 1980s

A savings and loan (thrift) is another type of deposit-

Along with banks, the banking industry also included savings and loans (also called S&Ls or thrifts), institutions designed to accept savings and turn them into long-

In order to improve S&Ls’ competitive position vis-

Unfortunately, during the late 1970s and early 1980s, political interference from Congress kept insolvent S&Ls open when a bank in a comparable situation would have been quickly shut down by regulators. By the early 1980s, many S&Ls had failed. Because accounts were covered by federal deposit insurance, the liabilities of a failed S&L became liabilities of the federal government, and depositors had to be paid from taxpayer funds. From 1986 through 1995, the government closed over 1,000 failed S&Ls, costing U.S. taxpayers over $124 billion dollars.

In a classic case of shutting the barn door after the horse has escaped, in 1989 Congress put in place comprehensive oversight of S&L activities. It also empowered Fannie Mae and Freddie Mac to take over much of the home mortgage lending previously done by S&Ls. Fannie Mae and Freddie Mac are quasi-

Back to the Future: The Financial Crisis of 2008

The financial crisis of 2008 shared features of previous crises. Like the Panic of 1907 and the S&L crisis, it involved institutions that were not as strictly regulated as deposit-

A financial institution engages in leverage when it finances its investments with borrowed funds.

Long-

LTCM was also heavily involved in derivatives, complex financial instruments that are constructed—

However, LTCM’s computer models hadn’t factored in a series of financial crises in Asia and in Russia during 1997 and 1998. Through its large borrowing, LTCM had become such a big player in global financial markets that attempts to sell its assets depressed the prices of what it was trying to sell. As the markets fell around the world and LTCM’s panic-

The balance sheet effect is the reduction in a firm’s net worth from falling asset prices.

The Federal Reserve realized that allowing LTCM’s remaining assets to be sold at panic-

A vicious cycle of deleveraging takes place when asset sales to cover losses produce negative balance sheet effects on other firms and force creditors to call in their loans, forcing sales of more assets and causing further declines in asset prices.

Moreover, falling asset prices meant the value of assets held by borrowers on their balance sheet would fall below a critical threshold, leading to a default on the terms of their credit contracts and forcing creditors to call in their loans. This in turn would lead to more sales of assets as borrowers tried to raise cash to repay their loans, more credit defaults, and more loans called in, creating a vicious cycle of deleveraging.

The Federal Reserve Bank of New York arranged a $3.625 billion bailout of LTCM in 1998, in which other private institutions took on shares of LTCM’s assets and obligations, liquidated them in an orderly manner, and eventually turned a small profit. Quick action by the Federal Reserve Bank of New York prevented LTCM from sparking a contagion, yet virtually all of LTCM’s investors were wiped out.

Subprime Lending and The Housing BubbleAfter the LTCM crisis, U.S. financial markets stabilized. They remained more or less stable even as stock prices fell sharply from 2000 to 2002 and the U.S. economy went into recession. During the recovery from the 2001 recession, however, the seeds for another financial crisis were planted.

The story begins with low interest rates: by 2003, U.S. interest rates were at historically low levels, partly because of Federal Reserve policy and partly because of large inflows of capital from other countries, especially China. These low interest rates helped cause a boom in housing, which in turn led the U.S. economy out of recession. As housing boomed, however, financial institutions began taking on growing risks—

Subprime lending is lending to home buyers who don’t meet the usual criteria for being able to afford their payments.

Traditionally, people were able to borrow money to buy homes only if they had sufficient income to meet the mortgage payments. Making home loans to people who didn’t meet the usual criteria for borrowing, called subprime lending, was only a minor part of overall lending. But in the booming housing market of 2003–

In securitization a pool of loans is assembled and shares of that pool are sold to investors.

Who was making these subprime loans? For the most part, it wasn’t traditional banks lending out depositors’ money. Instead, most of the loans were made by “loan originators,” who quickly sold mortgages to other investors. These sales were made possible by a process known as securitization: financial institutions assembled pools of loans and sold shares in the income from these pools. These shares were considered relatively safe investments since it was considered unlikely that large numbers of home-

But that’s exactly what happened. The housing boom turned out to be a bubble, and when home prices started falling in late 2006, many subprime borrowers were unable either to meet their mortgage payments or sell their houses for enough to pay off their mortgages. As a result, investors in securities backed by subprime mortgages started taking heavy losses. Many of the mortgage-

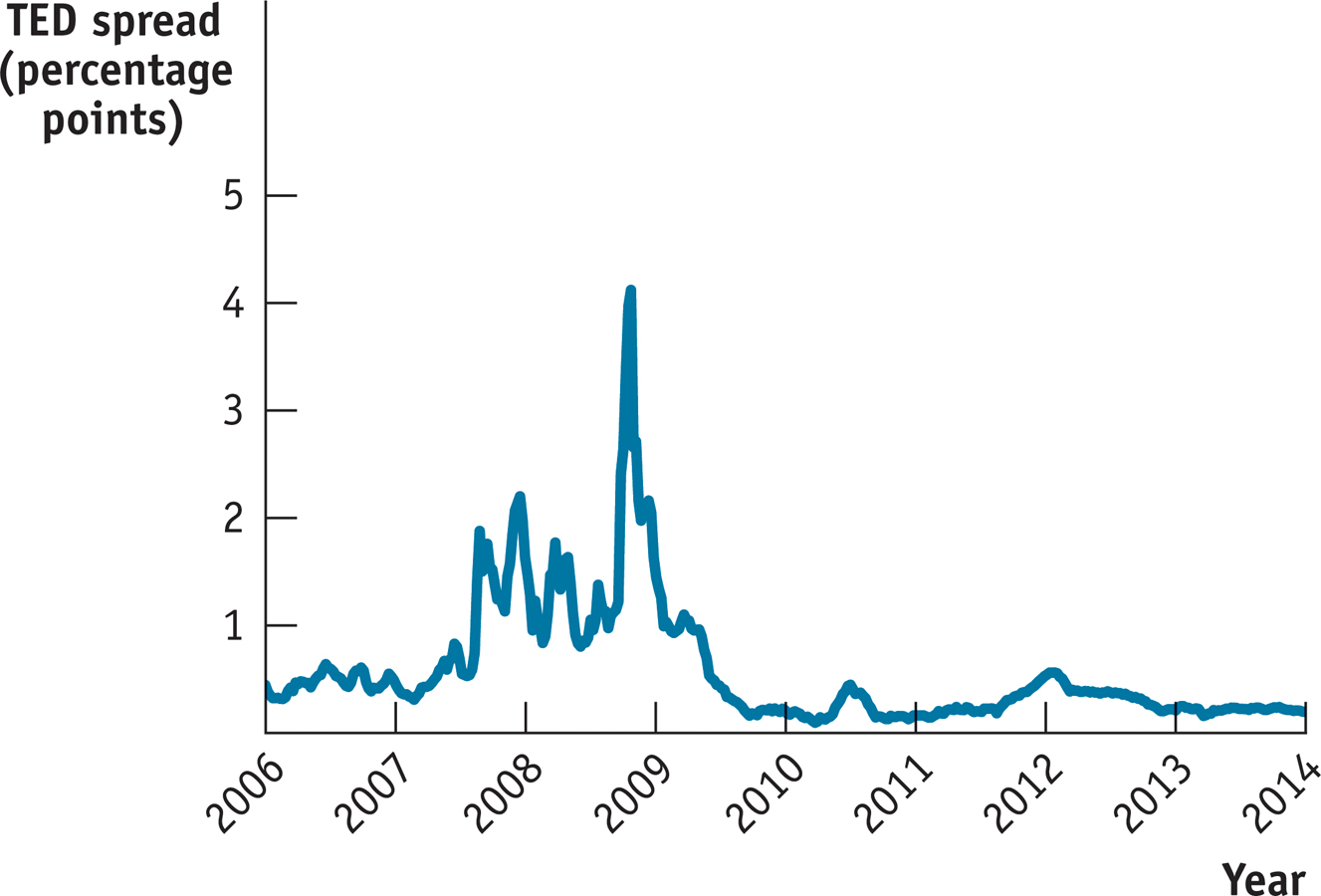

Figure 35-2 shows one measure of this loss of trust: the TED spread, which is the difference between the interest rate on three-

Source: Federal Reserve Bank of St. Louis.

Crisis and ResponseThe collapse of trust in the financial system, combined with the large losses suffered by financial firms, led to a severe cycle of deleveraging and a credit crunch for the economy as a whole. Firms found it difficult to borrow, even for short-

Overall, the negative economic effect of the financial crisis bore a distinct and troubling resemblance to the effects of the banking crisis of the early 1930s, which helped cause the Great Depression. Policy makers noticed the resemblance and tried to prevent a repeat performance. Beginning in August 2007, the Federal Reserve engaged in a series of efforts to provide cash to the financial system, lending funds to a widening range of institutions and buying private-

In September 2008, however, policy makers decided that one major investment bank, Lehman Brothers, could be allowed to fail. They quickly regretted the decision. Within days of Lehman’s failure, widespread panic gripped the financial markets, as illustrated by the late surge in the TED spread shown in Figure 35-2. In response to the intensified crisis, the U.S. government intervened further to support the financial system, as the U.S. Treasury began “injecting” capital into banks. Injecting capital, in practice, meant that the U.S. government would supply cash to banks in return for shares—

The crisis of 2008 led to major changes in the financial system, the largest changes since the 1930s. The crisis raised new questions about the appropriate scope of safety nets and regulations and, like the crises preceding it, exerted a powerful negative effect on the rest of the economy. There is a detailed discussion of the crisis and its impact in Module 42.

REGULATION AFTER THE 2008 CRISIS

In 2010, President Obama signed the Wall Street Reform and Consumer Protection Act—

For the most part, it left regulation of traditional deposit-

The major changes came in the regulation of financial institutions other than banks—

The new law gave a special government committee, the Financial Stability Oversight Council, the right to designate certain institutions as “systemically important” even if they weren’t ordinary deposit-

Beyond this, the law established new rules on the trading of derivatives: most derivatives would have to be bought and sold on exchanges, where everyone could observe their prices and the volume of transactions. The idea was to make the risks taken by financial institutions more transparent. Will Dodd-

35

Solutions appear at the back of the book.

Check Your Understanding

What are the similarities between the Panic of 1907, the S&L crisis, and the crisis of 2008?

The Panic of 1907, the S&L crisis, and the crisis of 2008 all involved losses by financial institutions that were less regulated than banks. In the crises of 1907 and 2008, there was a widespread loss of confidence in the financial sector and collapse of credit markets. Like the crisis of 1907 and the S&L crisis, the crisis of 2008 exerted a powerful negative effect on the economy.Why did the creation of the Federal Reserve fail to prevent the bank runs of the Great Depression? What measures did stop the bank runs?

The creation of the Federal Reserve failed to prevent bank runs because it did not eradicate the fears of depositors that a bank collapse would cause them to lose their money. The bank runs eventually stopped after federal deposit insurance was instituted and the public came to understand that their deposits were protected.Describe the balance sheet effect. Describe the vicious cycle of deleveraging. Why is it necessary for the government to step in to halt a vicious cycle of deleveraging?

The balance sheet effect occurs when asset sales cause declines in asset prices, which then reduce the value of other firms’ net worth as the value of the assets on their balance sheets declines. In the vicious cycle of deleveraging, the balance sheet effect on firms forces their creditors to call in their loan contracts, forcing the firms to sell assets to pay back their loans, leading to further asset sales and price declines. Because the vicious cycle of deleveraging occurs across different firms and no single firm can stop it, it is necessary for the government to step in to stop it.

Multiple-

Question

Which of the following contributed to the creation of the Federal Reserve System?

I. the bank panic of 1907

II. the Great Depression

III. the savings and loan crisis of the 1980sA. B. C. D. E. Question

Which of the following is a part of both the Federal Reserve System and the federal government?

A. B. C. D. E. Question

Which of the following is NOT a role of the Federal Reserve System?

A. B. C. D. E. Question

Who oversees the Federal Reserve System?

A. B. C. D. E. Question

Which of the following contributed to the financial crisis of 2008?

A. B. C. D. E.

Critical-

Answer the following questions about the Board of Governors of the Federal Reserve System.

What does the Board of Governors of the Federal Reserve System do?

oversee the Federal Reserve System and serve on the Federal Open Market CommitteeHow many members serve on the group?

7Who appoints members?

the president of the United StatesHow long do members serve?

14-year termsWhy do they serve a term of this length?

to insulate appointees from political pressureHow long does the chair serve?

4 years; may be reappointed