Monetary Policy

Monetary Policy

SECTION11

- Module 36: The Federal Reserve and Monetary Policy

- Module 37: The Money Market

- Module 38: Monetary Policy and the Interest Rate

- Module 39: Money, Output, and Prices in the Long Run

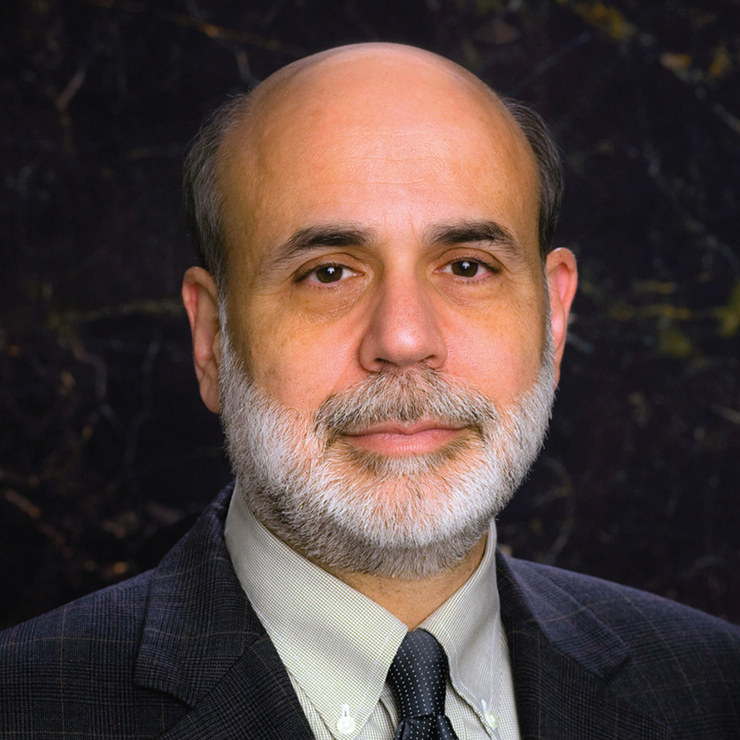

PERSON OF THE YEAR

“A bald man with a gray beard and tired eyes is sitting in his oversize Washington office, talking about the economy. He doesn’t have a commanding presence. He isn’t a mesmerizing speaker. He has none of the look-

So began Time magazine’s profile of Ben Bernanke, whom the magazine named Person of the Year for 2009. Who is this mild-

People sometimes say that the Fed chair decides how much money to print. That’s not quite true: for one thing, the Fed doesn’t literally print money, and beyond that, monetary decisions are actually made by a committee rather than by one person. But, as we will see, the Federal Reserve can use open-

And these actions matter a lot. Roughly half of the recessions the United States has experienced since World War II can be attributed, at least in part, to the decisions of the Federal Reserve to tighten policy to fight inflation.

In a number of other cases, the Fed has played a key role in fighting slumps and promoting recovery. The financial crisis of 2008 put the Fed at center stage. Bernanke’s aggressive response to the crisis included a tripling of the monetary base, inspiring both praise (including his designation as Person of the Year) and condemnation.

In this section we’ll learn how monetary policy works—