Problems

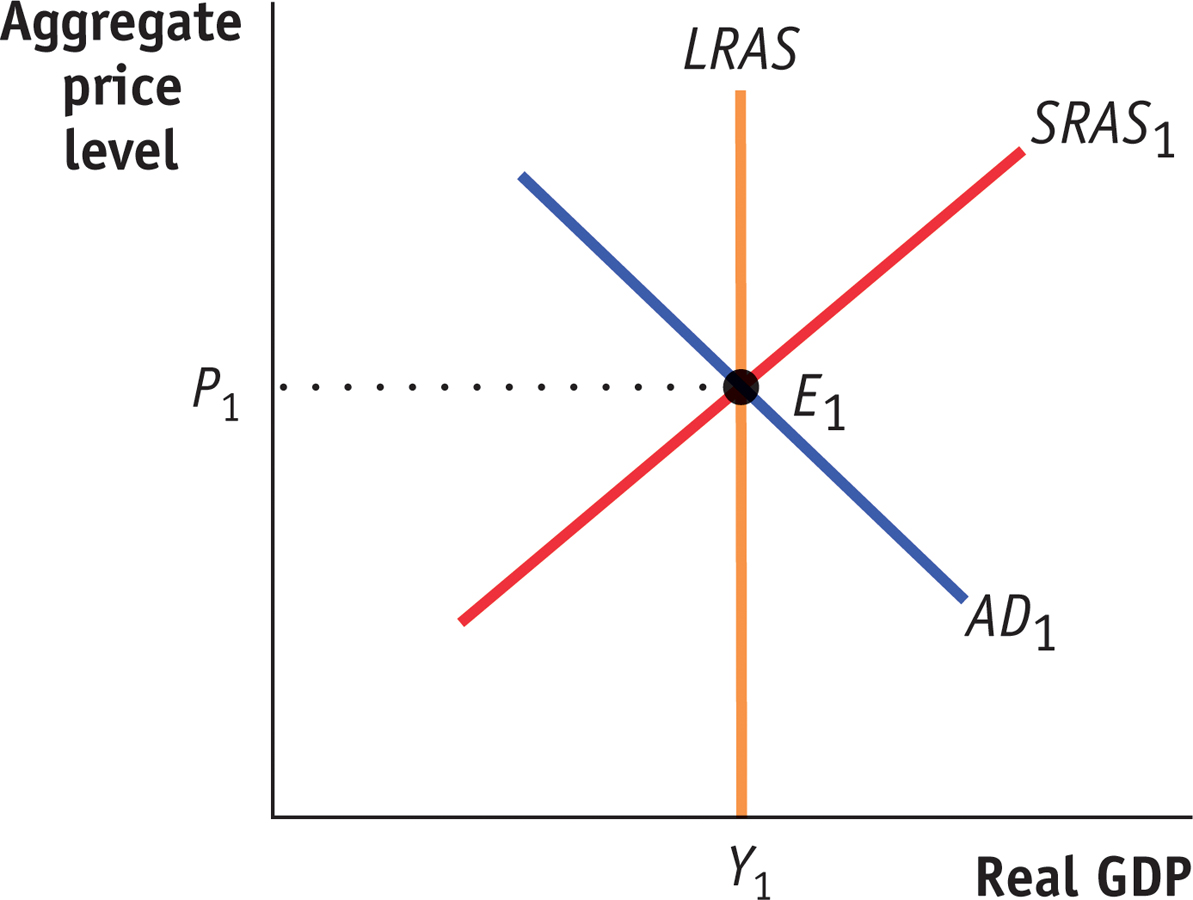

1.In the economy of Scottopia, policy makers want to lower the unemployment rate and raise real GDP by using monetary policy. Using the accompanying diagram, show why this policy will ultimately result in a higher aggregate price level but no change in real GDP.

2.In the following examples, would the classical model of the price level be relevant?

There is a great deal of unemployment in the economy and no history of inflation.

The economy has just experienced five years of hyper-

inflation. Although the economy experienced inflation in the 10% to 20% range three years ago, prices have recently been stable and the unemployment rate has approximated the natural rate of unemployment.

3.Answer the following questions about the (real) inflation tax, assuming that the price level starts at 1.

Maria Moneybags keeps $1,000 in her sock drawer for a year. Over the year, the inflation rate is 10%. What is the real inflation tax paid by Maria for this year?

Maria continues to keep the $1,000 in her drawer for a second year. What is the real value of this $1,000 at the beginning of the second year? Over the year, the inflation rate is again 10%. What is the real inflation tax paid by Maria for the second year?

For a third year, Maria keeps the $1,000 in the drawer. What is the real value of this $1,000 at the beginning of the third year? Over the year, the inflation rate is again 10%. What is the real inflation tax paid by Maria for the third year?

After three years, what is the cumulative real inflation tax paid?

Redo parts a through d with an inflation rate of 25%. Why is hyperinflation such a problem?

4.Concerned about the crowding-

5.After experiencing a recession for the past two years, the residents of Albernia were looking forward to a decrease in the unemployment rate. Yet after six months of strong positive economic growth, the unemployment rate has fallen only slightly below what it was at the end of the recession. How can you explain why the unemployment rate did not fall as much although the economy was experiencing strong economic growth?

6.Due to historical differences, countries often differ in how quickly a change in actual inflation is incorporated into a change in expected inflation. In a country such as Japan, which has had very little inflation in recent memory, it will take longer for a change in the actual inflation rate to be reflected in a corresponding change in the expected inflation rate. In contrast, in a country such as Zimbabwe, which has recently had very high inflation, a change in the actual inflation rate will immediately be reflected in a corresponding change in the expected inflation rate. What does this imply about the short-

7.

Go to www.bls.gov. Click on “Subject Areas”; on the left, under “Inflation & Prices,” click on the link “Consumer Price Index.” Scroll down to the section “CPI Tables,” and find the link under the head that reads “Table Containing History of CPI-

U U.S.” and click on it. What is the value of the percent change in the CPI from 2008 to 2009? Now go to www.treasury.gov and click on “Resource Center.” From there, click on “Data and Charts Center.” Then click on “Interest Rate Statistics.” In the scroll-

down windows, select “Daily Treasury Bill Rates” and “2009.” Examine the data in “4 Weeks Bank Discount.” What is the maximum? The minimum? Then do the same for 2007. How do the data for 2009 and 2007 compare? How would you relate this to your answer in part (a)? From the data on Treasury bill interest rates, what would you infer about the level of the inflation rate in 2007 compared to 2009? (You can check your answer by going back to the www.bls.gov website to find the percent change in the CPI from 2006 to 2007.) How would you characterize the change in the U.S. economy from 2007 to 2009?

8.The economy of Brittania has been suffering from high inflation with an unemployment rate equal to its natural rate. Policy makers would like to disinflate the economy with the lowest economic cost possible. Assume that the state of the economy is not the result of a negative supply shock. How can they try to minimize the unemployment cost of disinflation? Is it possible for there to be no cost of disinflation?

9.Who are the winners and losers when a mortgage company lends $100,000 to the Miller family to buy a house worth $105,000 and during the first year prices unexpectedly fall by 10%? What would you expect to happen if the deflation continued over the next few years? How would continuing deflation affect borrowers and lenders throughout the economy as a whole?

10.Which of the following are examples of debt overhang? Which examples are likely to lead to a cutback in spending? Explain.

Your uncle starts a restaurant, borrowing to fund his investment. The restaurant fails, and your uncle must shut down but still must pay his debt.

Your parents take out a loan to buy a house. Your father is transferred to a new city, and now your parents must sell the house. The value of the house has gone up during the time your family has lived there.

Your friend’s parents take out a loan to buy her a condo to live in while she is at college. Meanwhile, the housing market plummets. By the time your friend leaves college, the condo is worth significantly less than the value of the loan.

You finish college with an honors degree in a field with many good job prospects and with $25,000 in student loans that you must repay.

11.Which of the following are not examples of a vicious cycle of deleveraging? Explain.

Your university decides to sell several commercial buildings in the middle of town in order to upgrade buildings on campus.

A company decides to sell its large and valuable art collection because other asset prices on its balance sheet have fallen below a critical level, forcing creditors to call in their loans to the company because of provisions written into the original loan contract.

A company decides to issue more stock in order to voluntarily pay off some of its debt.

A shadow bank must sell its holdings of corporate bonds because falling asset prices have led to a default on the terms of its loans with some creditors.

12.Figure 42-1 tracks the unemployment rate in the years before and after the Panic of 1893 in the United States and the banking crisis of 1991 in Sweden.

In Figure 42-1, how many years after the Panic of 1893 did unemployment peak in the United States?

In Figure 42-1, how many years after the banking crisis of 1991 did unemployment peak in Sweden?

13.In 2007–