1.3 45Exchange Rate Policy

WHAT YOU WILL LEARN

The difference between fixed exchange rates and floating exchange rates

The difference between fixed exchange rates and floating exchange rates

Considerations that lead countries to choose different exchange rate regimes

Considerations that lead countries to choose different exchange rate regimes

Exchange Rate Regimes

As we saw in the previous module, the nominal exchange rate, like other prices, is determined by supply and demand. Unlike the price of wheat or oil, however, the exchange rate is the price of a country’s money (in terms of another country’s money). Money isn’t a good or service produced by the private sector; it’s an asset whose quantity is determined by government policy. As a result, governments have much more power to influence nominal exchange rates than they have to influence ordinary prices.

The nominal exchange rate is a very important price for many countries: the exchange rate determines the price of imports; it determines the price of exports; in economies where exports and imports are large relative to GDP, movements in the exchange rate can have major effects on aggregate output and the aggregate price level. What do governments do with their power to influence this important price?

An exchange rate regime is a rule governing policy toward the exchange rate.

The answer is, it depends. At different times and in different places, governments have adopted a variety of exchange rate regimes. An exchange rate regime is a rule governing policy toward the exchange rate. Let’s talk about these regimes, how they are enforced, and how governments choose a regime. (From now on, we’ll adopt the convention that we mean the nominal exchange rate when we refer to the exchange rate.)

Fixed and Floating Exchange Rates

A country has a fixed exchange rate when the government keeps the exchange rate against some other currency at or near a particular target.

A country has a floating exchange rate when the government lets the exchange rate go wherever the market takes it.

There are two main kinds of exchange rate regimes. A country has a fixed exchange rate when the government keeps the exchange rate against some other currency at or near a particular target. For example, Hong Kong has an official policy of setting an exchange rate of HK$7.80 per US$1. A country has a floating exchange rate when the government lets the exchange rate go wherever the market takes it. This is the policy followed by Britain, Canada, and the United States.

Fixed exchange rates and floating exchange rates aren’t the only possibilities. At various times, countries have adopted compromise policies that lie somewhere between fixed and floating exchange rates. These include exchange rates that are fixed at any given time but are adjusted frequently, exchange rates that aren’t fixed but are “managed” by the government to avoid wide swings, and exchange rates that float within a “target zone” but are prevented from leaving that zone. In this book, however, we’ll focus on the two main exchange rate regimes.

The immediate question about a fixed exchange rate is how it is possible for governments to fix the exchange rate when the exchange rate is determined by supply and demand.

How Can an Exchange Rate Be Held Fixed?

To understand how it is possible for a country to fix its exchange rate, let’s consider a hypothetical country, Genovia, which for some reason has decided to fix the value of its currency, the geno, at US$1.50.

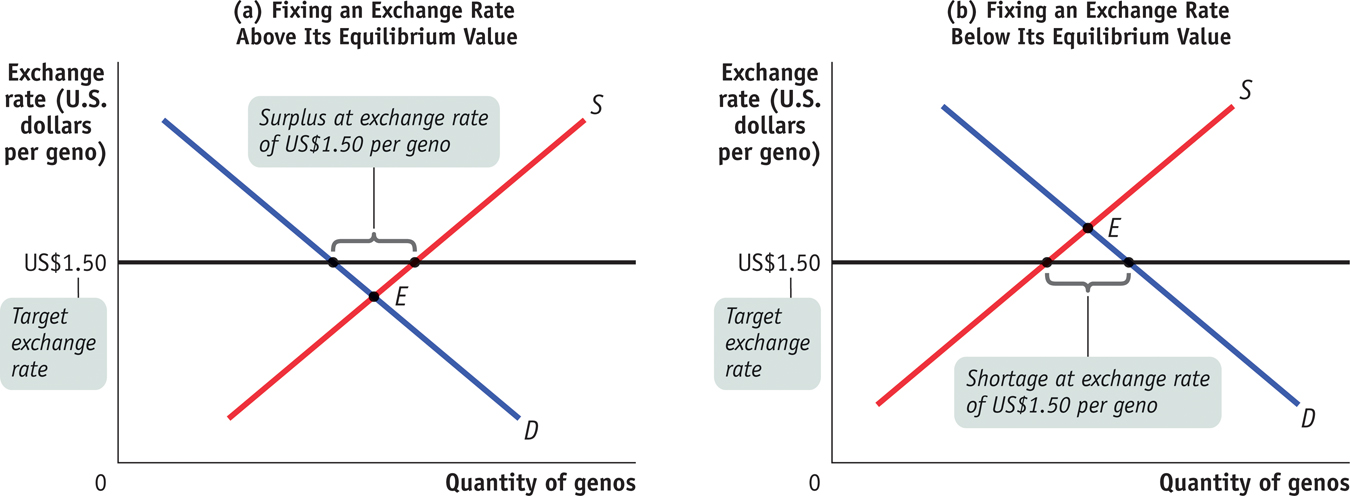

The obvious problem is that $1.50 may not be the equilibrium exchange rate in the foreign exchange market: the equilibrium rate may be either higher or lower than the target exchange rate. Figure 45-1 shows the foreign exchange market for genos, with the quantities of genos supplied and demanded on the horizontal axis and the exchange rate of the geno, measured in U.S. dollars per geno, on the vertical axis. Panel (a) shows the case in which the equilibrium value of the geno is below the target exchange rate. Panel (b) shows the case in which the equilibrium value of the geno is above the target exchange rate.

Government purchases or sales of currency in the foreign exchange market constitute exchange market intervention.

Foreign exchange reserves are stocks of foreign currency that governments maintain to buy their own currency on the foreign exchange market.

Consider first the case in which the equilibrium value of the geno is below the target exchange rate. As panel (a) shows, at the target exchange rate there is a surplus of genos in the foreign exchange market, which would normally push the value of the geno down. How can the Genovian government support the value of the geno to keep the rate where it wants? There are three possible ways the Genovian government can support the geno, all of which have been used by governments at some point.

- It can “soak up” the surplus of genos by buying its own currency in the foreign exchange market. Government purchases or sales of currency in the foreign exchange market are called exchange market intervention. To buy genos in the foreign exchange market, of course, the Genovian government must have U.S. dollars to exchange for genos. In fact, most countries maintain foreign exchange reserves, stocks of foreign currency (usually U.S. dollars or euros) that they can use to buy their own currency to support its price.

- The Genovian government can try to shift the supply and demand curves for the geno in the foreign exchange market. Governments usually do this by changing monetary policy. For example, to support the geno, the Genovian central bank can raise the Genovian interest rate. This will increase capital flows into Genovia, increasing the demand for genos, at the same time that it reduces capital flows out of Genovia, reducing the supply of genos. So, other things equal, an increase in a country’s interest rate will increase the value of its currency.

- It can reduce the supply of genos to the foreign exchange market by requiring domestic residents who want to buy foreign currency to get a license and giving these licenses only to people engaging in approved transactions (such as the purchase of imported goods the Genovian government thinks are essential). Licensing systems that limit the right of individuals to buy foreign currency are called foreign exchange controls. Other things equal, foreign exchange controls increase the value of a country’s currency.

We mentioned earlier that an important part of international capital flows is the result of purchases and sales of foreign assets by governments and central banks. Now we can see why governments sell foreign assets: they are supporting their currency through exchange market intervention. As we’ll see in a moment, governments that keep the value of their currency down through exchange market intervention must buy foreign assets. First, however, let’s talk about the other ways governments fix exchange rates.

Foreign exchange controls are licensing systems that limit the right of individuals to buy foreign currency.

So far we’ve been discussing a situation in which the government is trying to prevent a depreciation of the geno. Suppose, instead, that the situation is as shown in panel (b) of Figure 45-1, where the equilibrium value of the geno is above the target exchange rate and there is a shortage of genos.

To maintain the target exchange rate, the Genovian government can apply the same three basic options in the reverse direction. It can intervene in the foreign exchange market, in this case selling genos and acquiring U.S. dollars, which it can add to its foreign exchange reserves. It can reduce interest rates to increase the supply of genos and reduce the demand. Or it can impose foreign exchange controls that limit the ability of foreigners to buy genos. All of these actions, other things equal, will reduce the value of the geno.

As we said, all three techniques have been used to manage fixed exchange rates. But we haven’t said whether fixing the exchange rate is a good idea. In fact, the choice of exchange rate regime poses a dilemma for policy makers because fixed and floating exchange rates each have both advantages and disadvantages.

The Exchange Rate Regime Dilemma

Few questions in macroeconomics produce as many arguments as that of whether a country should adopt a fixed or a floating exchange rate. The reason there are so many arguments is that both sides have a case.

To understand the case for a fixed exchange rate, consider for a moment how easy it is to conduct business across state lines in the United States. There are a number of things that make interstate commerce trouble-

By contrast, a dollar isn’t a dollar in transactions between New York City and Toronto. The exchange rate between the Canadian dollar and the U.S. dollar fluctuates, sometimes widely. If a U.S. firm promises to pay a Canadian firm a given number of U.S. dollars a year from now, the value of that promise in Canadian currency can vary by 10% or more. This uncertainty has the effect of deterring trade between the two countries. So one benefit of a fixed exchange rate is certainty about the future value of a currency.

There is also, in some cases, an additional benefit to adopting a fixed exchange rate: by committing itself to a fixed rate, a country is also committing not to engage in inflationary policies because such policies would destabilize the exchange rate. For example, in 1991, Argentina, which has a long history of irresponsible policies leading to severe inflation, adopted a fixed exchange rate of US$1 per Argentine peso in an attempt to commit itself to non-

The point is that there is some economic value in having a stable exchange rate. Indeed, the presumed benefits of stable exchange rates motivated the international system of fixed exchange rates created after World War II. It was also a major reason for the creation of the euro.

However, there are also costs to fixing the exchange rate.

- To stabilize an exchange rate through intervention, a country must keep large quantities of foreign currency on hand, and that currency is usually a low-

return investment. Furthermore, even large reserves can be quickly exhausted when there are large capital flows out of a country. - If a country chooses to stabilize an exchange rate by adjusting monetary policy rather than through intervention, it must divert monetary policy from other goals, notably stabilizing the economy and managing the inflation rate.

- Finally, foreign exchange controls, like import quotas and tariffs, distort incentives for importing and exporting goods and services. They can also create substantial costs in terms of red tape and corruption.

So there’s a dilemma. Should a country let its currency float, which leaves monetary policy available for macroeconomic stabilization but creates uncertainty for everyone affected by trade? Or should it fix the exchange rate, which eliminates the uncertainty but means giving up monetary policy, adopting exchange controls, or both?

Different countries reach different conclusions at different times. Most European countries, except for Britain, have long believed that exchange rates among major European economies, which do most of their international trade with each other, should be fixed. But Canada seems happy with a floating exchange rate with the United States, even though the United States accounts for most of Canada’s trade.

In the next module we’ll consider macroeconomic policy under each type of exchange rate regime.

CHINA PEGS THE YUAN

In the early years of the twenty-

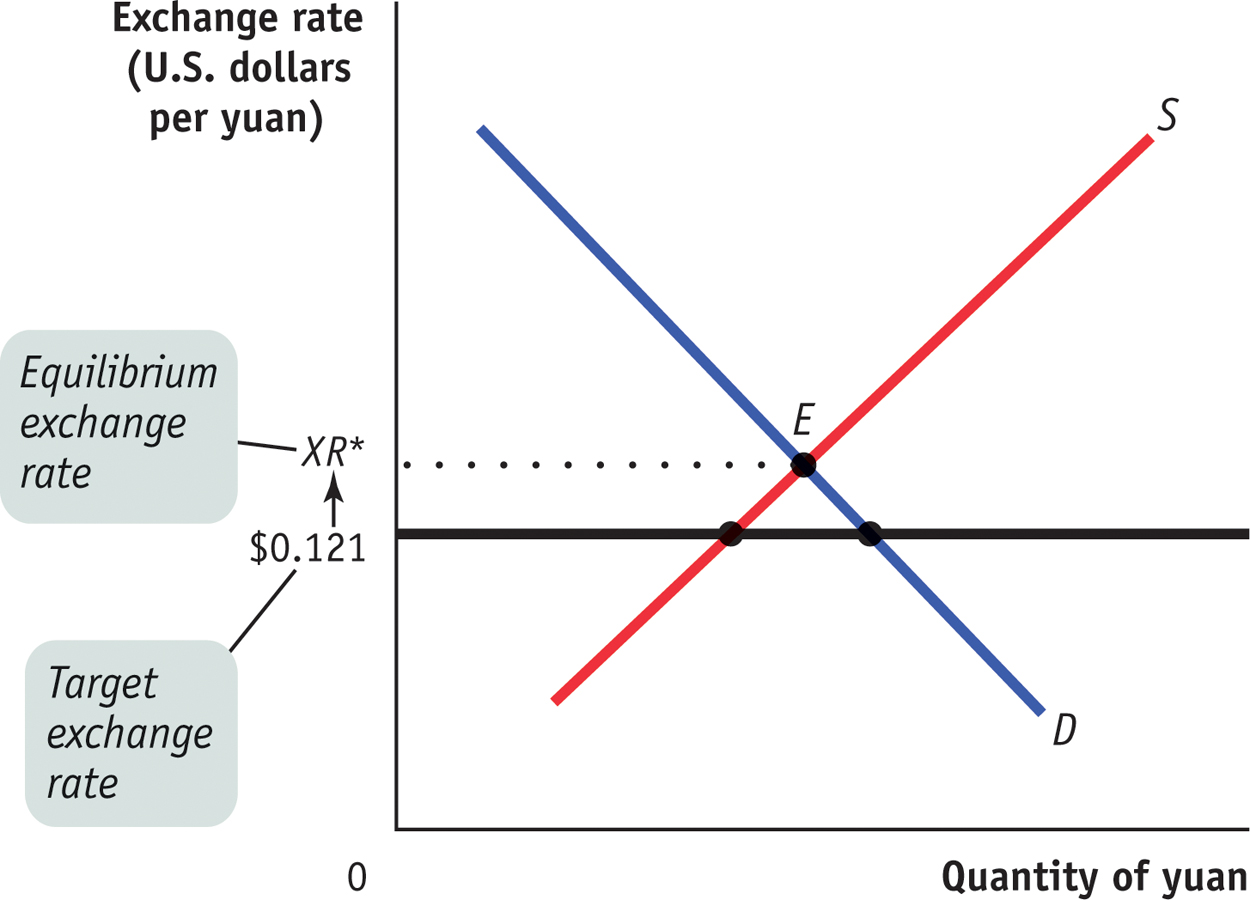

As a result of the current account surplus and private capital inflows, China found itself in the position described by panel (b) of Figure 45-1: at the target exchange rate, the demand for yuan exceeded the supply. Yet the Chinese government was determined to keep the exchange rate fixed at a value below its equilibrium level.

To keep the rate fixed, China had to engage in large-

To get a sense of how big these totals are, in 2010 China’s GDP was approximately $5.9 trillion. This means that in 2010 China bought U.S. dollars and other currencies equal to about 7½% of its GDP, making its accumulated reserves equal to more than half its GDP. That’s as if the U.S. government had bought well over $1 trillion worth of yen and euros in a single year, even though it was already sitting on an $8 trillion pile of foreign currencies. Not surprisingly, China’s exchange rate policy has led to some friction with its trading partners who feel that it has had the effect of subsidizing Chinese exports.

Since late 2011, China has significantly reduced its intervention in the foreign exchange market. In fact, in 2013, the International Monetary Fund declared the yuan to be only moderately undervalued, a big change from past years.

45

Solutions appear at the back of the book.

Check Your Understanding

Draw a diagram, similar to Figure 45-1, representing the foreign exchange situation of China when it kept the exchange rate fixed at a target rate of $0.121 per yuan and the market equilibrium rate was higher than the target rate. Then show with a diagram how each of the following policy changes might eliminate the disequilibrium in the market.

-

a. allowing the exchange rate to float more freely

If the exchange rate were allowed to float more freely, the U.S. dollar price of the exchange rate would move toward the equilibrium exchange rate (labeled XR* in the accompanying diagram). This would occur as a result of the shortage, when buyers of the yuan would bid up its U.S. dollar price. As the exchange rate increased, the quantity of yuan demanded would fall and the quantity of yuan supplied would increase. If the exchange rate were allowed to increase to XR*, the disequilibrium would be entirely eliminated.

-

b. placing restrictions on foreigners who want to invest in China

Placing restrictions on foreigners who want to invest in China would reduce the demand for the yuan, causing the demand curve to shift in the accompanying diagram from D1 to something like D2. This would cause a reduction in the shortage of the yuan. If demand fell to D3, the disequilibrium would be completely eliminated.

-

c. removing restrictions on Chinese who want to invest abroad

Removing restrictions on Chinese who wish to invest abroad would cause an increase in the supply of the yuan and a rightward shift of the supply curve. This increase in supply would reduce the size of the shortage. If, for example, supply increased from S1 to S2, the disequilibrium would be eliminated completely, as shown in the accompanying diagram.

-

d. imposing taxes on Chinese exports, such as clothing

Imposing a tax on exports (Chinese goods sold to foreigners) would raise the price of these goods and decrease the amount of Chinese goods purchased. This would also decrease the demand for yuan with which to purchase those goods. The graphical analysis here is virtually identical to that found in the figure accompanying part b.

-

Multiple-

Question

Which of the following methods can be used to fix a country’s exchange rate at a predetermined level?

I. using foreign exchange reserves to buy its own currency

II. using monetary policy to change interest rates

III. implementing foreign exchange controlsA. B. C. D. E. Question

Changes in exchange rates affect which of the following?

A. B. C. D. E. Question

The United States has which of the following exchange rate regimes?

A. B. C. D. E. Question

Which of the following interventions would be required to keep a country’s exchange rate fixed if the equilibrium exchange rate in the foreign exchange market were below the fixed exchange rate (measured as units of foreign currency per unit of domestic currency)? The government/central bank

A. B. C. D. E. Question

Which of the following is a benefit of a fixed exchange rate regime?

A. B. C. D. E.

Critical-

List three tools used to fix exchange rates and explain the major costs resulting from their use.

- 1) Use foreign exchange reserves. To stabilize an exchange rate through exchange market intervention (e.g., buying its own currency), a country must keep large quantities of foreign currency on hand, which is usually a low-return investment. And large reserves can be quickly exhausted when there are large capital flows out of a country.

- 2) Shifting supply and demand curves for currency through monetary policy. If a country chooses to stabilize an exchange rate by adjusting monetary policy rather than through intervention, it must divert monetary policy from other goals, notably stabilizing the economy and managing the inflation rate.

- 3) Foreign exchange controls. These regulations distort incentives for importing and exporting goods and services. They can also create substantial costs in terms of red tape and corruption.