War of the Earthmovers

Visit a construction site almost anywhere in the world, and odds are that the earthmoving equipment you see—

Caterpillar and Komatsu both rely heavily on exports, rather than selling only to their domestic markets, and have been fierce competitors for three decades, with first one company, then the other, seemingly on the ropes.

Ask the companies’ leaders to explain the course of this see-

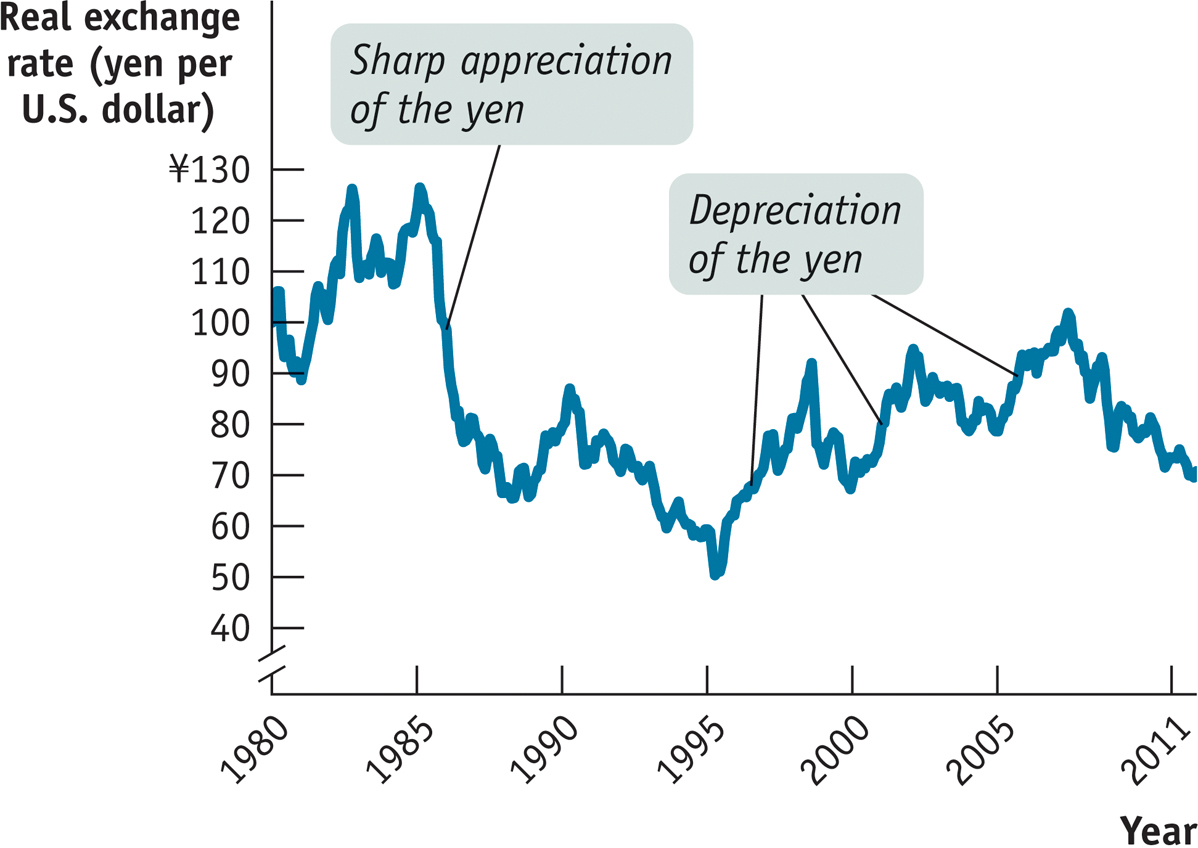

But is this the whole story? Not exactly. Management decisions were no doubt crucial to both firms, but so were movements in the exchange rate. The accompanying figure shows the real exchange rate between the United States and Japan, using consumer prices, from 1980 to 2011.

The figure immediately suggests one reason Caterpillar was able to recover from the shock of competition in the 1980s: a sharp appreciation of the Japanese yen beginning in 1985. And Komatsu’s ability to survive Caterpillar’s resurgence was surely helped by the slide in the yen after 1995, and especially after 2000.

Recently, the two companies seem to have settled into relatively stable positions, with Caterpillar the bigger firm but Komatsu also doing well thanks in part to rapid growth in demand from China. But Japanese executives at Komatsu (and other firms) are always on the alert for signs that the yen is once again on the rise.

Questions for Thought

Question

1.Why does the yen–

Question

2.Why does the figure present the real rather than the nominal exchange rate? Do you think this makes an important difference to the story?

Question

3.In 2011, Japanese policy makers were discussing possible sales of yen on the foreign exchange market. How would this affect the Caterpillar/Komatsu rivalry?