1.1 4Demand

WHAT YOU WILL LEARN

What a competitive market is and how it is described by the supply and demand model

What a competitive market is and how it is described by the supply and demand model

What the demand curve is

What the demand curve is

The difference between movements along the demand curve and changes in demand

The difference between movements along the demand curve and changes in demand

The factors that shift the demand curve

The factors that shift the demand curve

Supply and Demand: A Model of a Competitive Market

A competitive market is a market in which there are many buyers and sellers of the same good or service, none of whom can influence the price at which the good or service is sold.

Cotton sellers and cotton buyers constitute a market—a group of producers and consumers who exchange a good or service for payment. In this section, we’ll focus on a particular type of market known as a competitive market. Roughly, a competitive market is a market in which there are many buyers and sellers of the same good or service. More precisely, the key feature of a competitive market is that no individual’s actions have a noticeable effect on the price at which the good or service is sold. It’s important to understand, however, that this is not an accurate description of every market.

For example, it’s not an accurate description of the market for cola beverages. That’s because in the market for cola beverages, Coca-

It’s a little hard to explain why competitive markets are different from other markets until we’ve seen how a competitive market works. For now, let’s just say that it’s easier to model competitive markets than other markets. When taking an exam, it’s always a good strategy to begin by answering the easier questions. In this book, we’re going to do the same thing. So we will start with competitive markets.

The supply and demand model is a model of how a competitive market works.

When a market is competitive, its behavior is well described by the supply and demand model. Because many markets are competitive, the supply and demand model is a very useful one indeed.

There are five key elements in this model:

- The demand curve

- The supply curve

- The set of factors that cause the demand curve to shift and the set of factors that cause the supply curve to shift

- The market equilibrium, which includes the equilibrium price and equilibrium quantity

- The way the market equilibrium changes when the supply curve or demand curve shifts

To explain the supply and demand model, we will examine each of these elements in turn. In this module we begin with demand.

The Demand Curve

How many pounds of cotton, packaged in the form of blue jeans, do consumers around the world want to buy in a given year? You might at first think that we can answer this question by looking at the total number of pairs of blue jeans purchased around the world each day, multiply that number by the amount of cotton it takes to make a pair of jeans, and then multiply by 365. But that’s not enough to answer the question, because how many pairs of jeans—

When the price of cotton rises, as it did in 2010, some people will respond to the higher price of cotton clothing by buying fewer cotton garments or, perhaps, by switching completely to garments made from other materials, such as synthetics or linen. In general, the quantity of cotton clothing, or of any good or service that people want to buy, depends on the price. The higher the price, the less of the good or service people want to purchase; alternatively, the lower the price, the more they want to purchase.

So the answer to the question “How many pounds of cotton do consumers want to buy?” depends on the price of a pound of cotton. If you don’t yet know what the price will be, you can start by making a table of how many pounds of cotton people would want to buy at a number of different prices. Such a table is known as a demand schedule. This, in turn, can be used to draw a demand curve, which is one of the key elements of the supply and demand model.

The Demand Schedule and the Demand Curve

A demand schedule shows how much of a good or service consumers will want to buy at different prices.

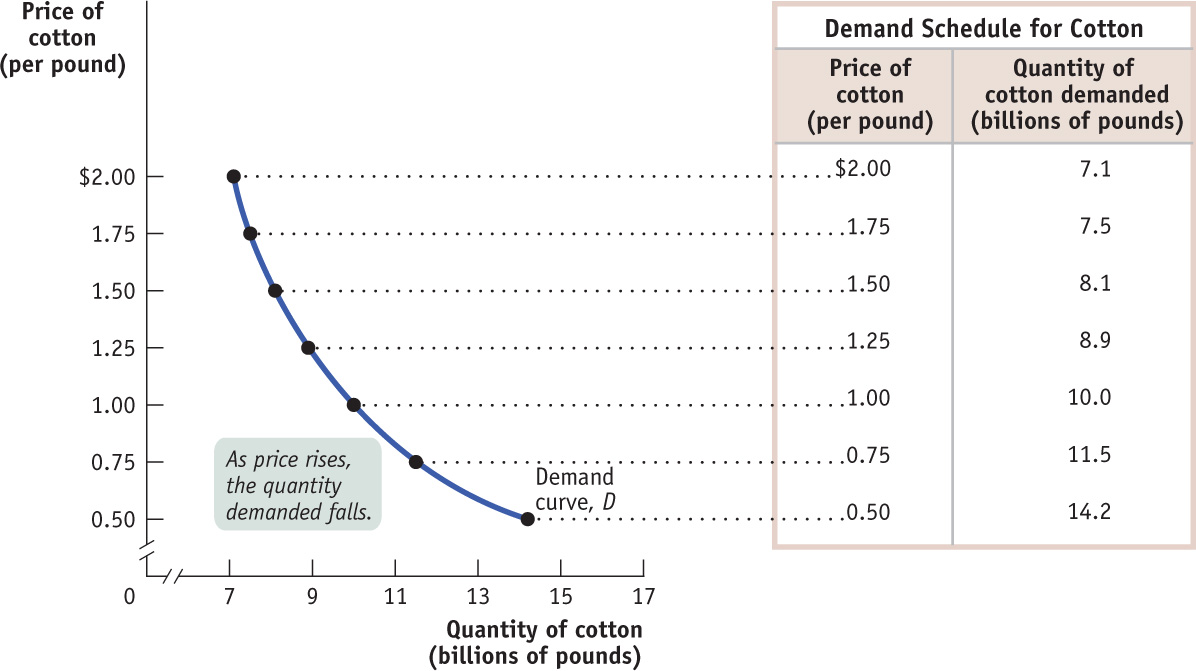

A demand schedule is a table showing how much of a good or service consumers will want to buy at different prices. On the right side of Figure 4-1, we show a hypothetical demand schedule for cotton. It’s hypothetical in that it doesn’t use actual data on the world demand for cotton and it assumes that all cotton is of equal quality.

The quantity demanded is the actual amount of a good or service consumers are willing to buy at some specific price.

According to the table, if a pound of cotton costs $1, consumers around the world will want to purchase 10 billion pounds of cotton over the course of a year. If the price is $1.25 a pound, they will want to buy only 8.9 billion pounds; if the price is only $0.75 a pound, they will want to buy 11.5 billion pounds; and so on. So, the higher the price, the fewer pounds of cotton consumers will want to purchase. In other words, as the price rises, the quantity demanded of cotton—

A demand curve is a graphical representation of the demand schedule. It shows the relationship between quantity demanded and price.

The graph in Figure 4-1 is a visual representation of the information in the table. (For a refresher on graphs in economics, see Appendix A at the back of the book.) The vertical axis shows the price of a pound of cotton and the horizontal axis shows the quantity of cotton in pounds. Each point on the graph corresponds to one of the entries in the table. The curve that connects these points is a demand curve. A demand curve is a graphical representation of the demand schedule, another way of showing the relationship between the quantity demanded and the price.

The law of demand says that a higher price for a good or service, all other things being equal, leads people to demand a smaller quantity of that good or service.

Note that the demand curve shown in Figure 4-1 slopes downward. This reflects the general proposition that a higher price reduces the quantity demanded. For example, jeans-

Shifts of the Demand Curve

Even though cotton prices in 2010 were higher than they had been in 2007, total world consumption of cotton was higher in 2010. How can we reconcile this fact with the law of demand, which says that a higher price reduces the quantity demanded, all other things being equal?

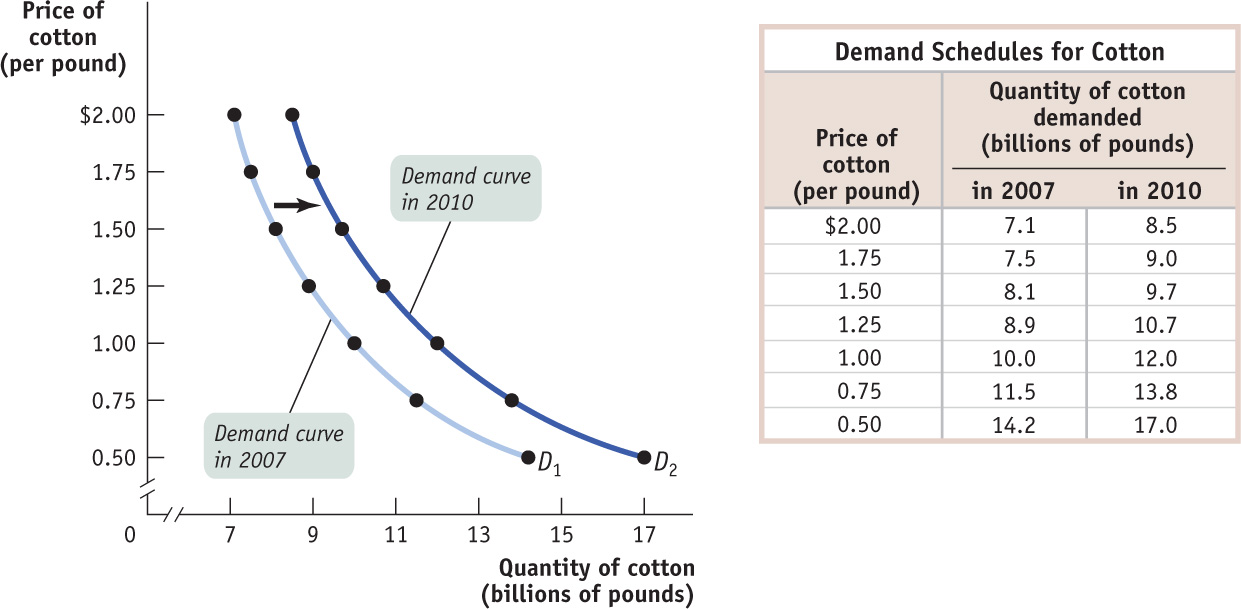

The answer lies in the crucial phrase all other things being equal. In this case, all other things weren’t equal: the world had changed between 2007 and 2010, in ways that increased the quantity of cotton demanded at any given price. For one thing, the world’s population, and therefore the number of potential cotton clothing wearers, increased. In addition, the growing popularity of cotton clothing, as well as higher incomes in countries like China that allowed people to buy more clothing than before, led to an increase in the quantity of cotton demanded at any given price. Figure 4-2 illustrates this phenomenon using the demand schedule and demand curve for cotton. (As before, the numbers in Figure 4-2 are hypothetical.)

The table in Figure 4-2 shows two demand schedules. The first is the demand schedule for 2007, the same as shown in Figure 4-1. The second is the demand schedule for 2010. It differs from the 2007 demand schedule due to factors such as a larger population and the increased popularity of cotton clothing, factors that led to an increase in the quantity of cotton demanded at any given price. So at each price the 2010 schedule shows a larger quantity demanded than the 2007 schedule. For example, the quantity of cotton consumers wanted to buy at a price of $1 per pound increased from 10 billion to 12 billion pounds per year, the quantity demanded at $1.25 per pound went from 8.9 billion to 10.7 billion, and so on.

A change in demand is a shift of the demand curve, which changes the quantity demanded at any given price.

What is clear from this example is that the changes that occurred between 2007 and 2010 generated a new demand schedule, one in which the quantity demanded was greater at any given price than in the original demand schedule. The two curves in Figure 4-2 show the same information graphically. As you can see, the demand schedule for 2010 corresponds to a new demand curve, D2, that is to the right of the demand schedule for 2007, D1. This change in demand shows the increase in the quantity demanded at any given price, represented by the shift in position of the original demand curve D1 to its new location at D2.

A movement along the demand curve is a change in the quantity demanded of a good that is the result of a change in that good’s price.

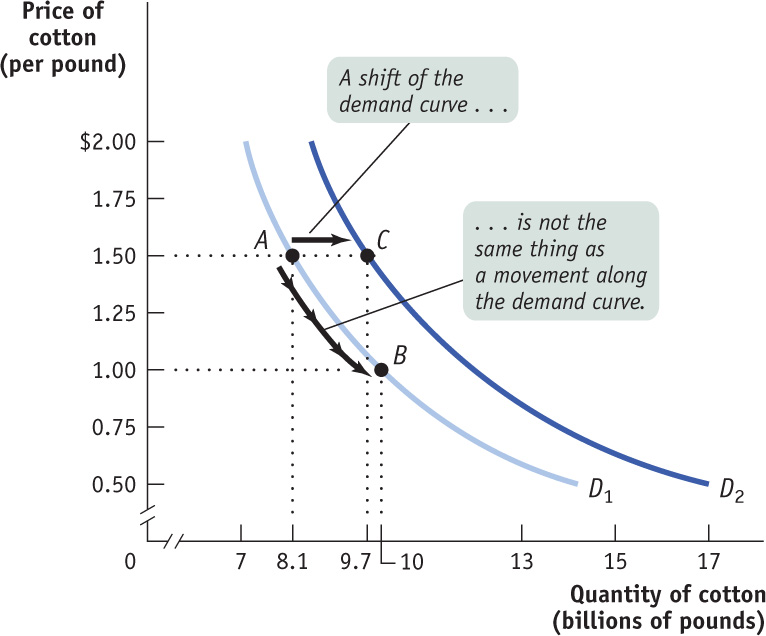

It’s crucial to make the distinction between such changes in demand and movements along the demand curve, changes in the quantity demanded of a good that result from a change in that good’s price. Figure 4-3 illustrates the difference.

The movement from point A to point B is a movement along the demand curve: the quantity demanded rises due to a fall in price as you move down D1. Here, a fall in the price of cotton from $1.50 to $1 per pound generates a rise in the quantity demanded from 8.1 billion to 10 billion pounds per year. But the quantity demanded can also rise when the price is unchanged if there is an increase in demand—a rightward shift of the demand curve. This is illustrated in Figure 4-3 by the shift of the demand curve from D1 to D2. Holding the price constant at $1.50 a pound, the quantity demanded rises from 8.1 billion pounds at point A on D1 to 9.7 billion pounds at point C on D2.

When economists talk about a “change in demand,” saying for example “the demand for X increased” or “the demand for Y decreased,” they mean that the demand curve for X or Y shifted—

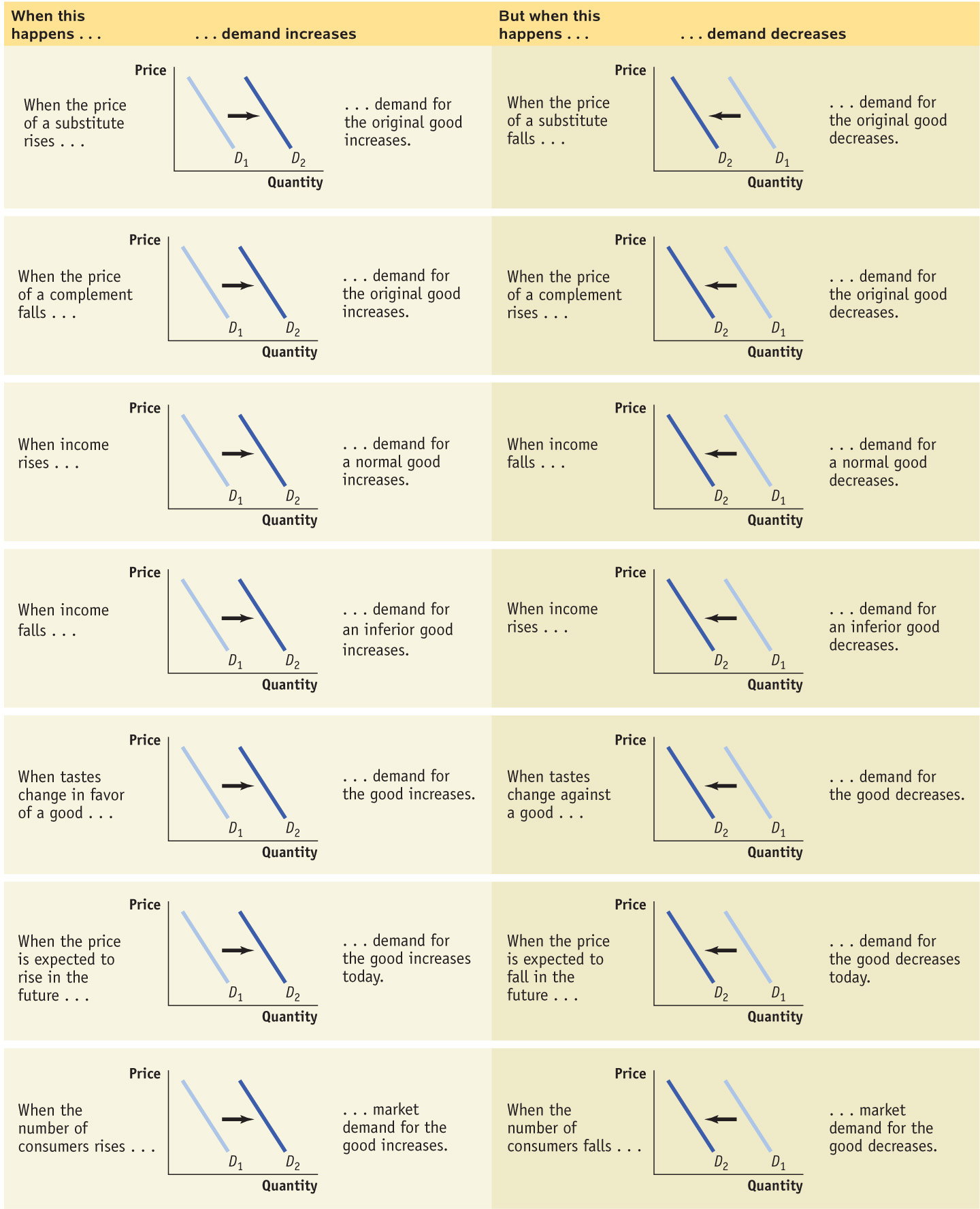

Understanding Shifts of the Demand Curve

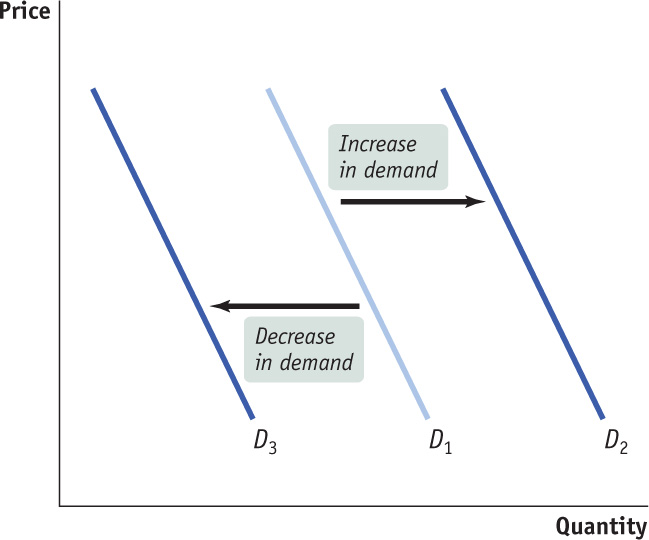

Figure 4-4 illustrates the two basic ways in which demand curves can shift. When economists talk about an “increase in demand,” they mean a rightward shift of the demand curve: at any given price, consumers demand a larger quantity of the good or service than before. This is shown by the rightward shift of the original demand curve D1 to D2. And when economists talk about a “decrease in demand,” they mean a leftward shift of the demand curve: at any given price, consumers demand a smaller quantity of the good or service than before. This is shown by the leftward shift of the original demand curve D1 to D3.

What caused the demand curve for cotton to shift? We have already mentioned two reasons: changes in population and a change in the popularity of cotton clothing. If you think about it, you can come up with other things that would be likely to shift the demand curve for cotton. For example, suppose that the price of polyester rises. This will induce some people who previously bought polyester clothing to buy cotton clothing instead, increasing the demand for cotton.

Economists believe that there are five principal factors that shift the demand curve for a good or service:

- Changes in the prices of related goods or services

- Changes in income

- Changes in tastes

- Changes in expectations

- Changes in the number of consumers

Although this is not an exhaustive list, it contains the five most important factors that can shift demand curves. So when we say that the quantity of a good or service demanded falls as its price rises, all other things being equal, we are in fact stating that the factors that shift demand are remaining unchanged. Let’s now explore, in more detail, how those factors shift the demand curve.

Two goods are substitutes if a rise in the price of one of the goods leads to an increase in the demand for the other good.

Changes in the Prices of Related Goods or ServicesWhile there’s nothing quite like a comfortable pair of all-

Two goods are complements if a rise in the price of one good leads to a decrease in the demand for the other good.

But sometimes a rise in the price of one good makes consumers less willing to buy another good. Such pairs of goods are known as complements. Complements are usually goods that in some sense are consumed together: computers and software, cappuccinos and croissants, cars and gasoline. Because consumers like to consume a good and its complement together, a change in the price of one of the goods will affect the demand for its complement. In particular, when the price of one good rises, the demand for its complement decreases, shifting the demand curve for the complement to the left. So, for example, when the price of gasoline rises, the demand for gas-

Changes in IncomeWhen individuals have more income, they are normally more likely to purchase a good at any given price. For example, if a family’s income rises, it is more likely to take that long-

When a rise in income increases the demand for a good—

When a rise in income decreases the demand for a good, it is an inferior good.

Why do we say “most goods,” not “all goods”? Most goods are normal goods—the demand for them increases when consumer income rises. However, the demand for some products falls when income rises. Goods for which demand decreases when income rises are known as inferior goods. Usually an inferior good is one that is considered less desirable than more expensive alternatives—

One example of the distinction between normal and inferior goods that has drawn considerable attention in the business press is the difference between so-

Changes in TastesWhy do people want what they want? Fortunately, we don’t need to answer that question—

For example, once upon a time men wore hats. Up until around World War II, a respectable man wasn’t fully dressed unless he wore a dignified hat along with his suit. But the returning GIs adopted a more informal style, perhaps due to the rigors of the war. And President Eisenhower, who had been supreme commander of Allied Forces before becoming president, often went hatless. After World War II, it was clear that the demand curve for hats had shifted leftward, reflecting a decrease in the demand for hats.

Economists have relatively little to say about the forces that influence consumers’ tastes. (Marketers and advertisers, however, have plenty to say about them!) However, a change in tastes has a predictable impact on demand. When tastes change in favor of a good, more people want to buy it at any given price, so the demand curve shifts to the right. When tastes change against a good, fewer people want to buy it at any given price, so the demand curve shifts to the left.

Changes in ExpectationsWhen consumers have some choice about when to make a purchase, current demand for a good is often affected by expectations about its future price. For example, savvy shoppers often wait for seasonal sales—

Expected changes in future income can also lead to changes in demand: if you expect your income to rise in the future, you will typically borrow today and increase your demand for certain goods; if you expect your income to fall in the future, you are more likely to save today and reduce your demand for some goods.

Changes in the Number of ConsumersAs we’ve already noted, one of the reasons for rising cotton demand between 2007 and 2010 was a growing world population. Because of population growth, overall demand for cotton would have risen even if the demand of each individual wearer of cotton clothing had remained unchanged.

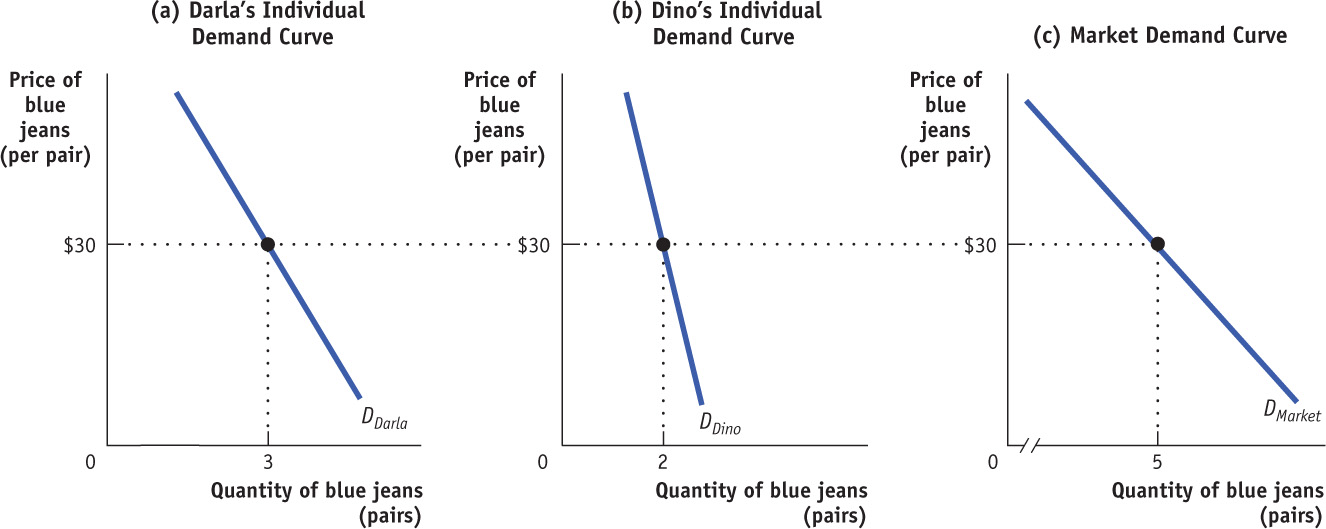

An individual demand curve illustrates the relationship between quantity demanded and price for an individual consumer.

Let’s introduce a new concept: the individual demand curve, which shows the relationship between quantity demanded and price for an individual consumer. For example, suppose that Darla is a consumer of cotton blue jeans; also suppose that all pairs of jeans are the same, so they sell for the same price. Panel (a) of Figure 4-5 shows how many pairs of jeans she will buy per year at any given price. Then DDarla is Darla’s individual demand curve.

The market demand curve shows how the combined quantity demanded by all consumers depends on the market price of that good. (Most of the time, when economists refer to the demand curve, they mean the market demand curve.) The market demand curve is the horizontal sum of the individual demand curves of all consumers in that market.

To see what we mean by the term horizontal sum, assume for a moment that there are only two consumers of blue jeans, Darla and Dino. Dino’s individual demand curve, DDino, is shown in panel (b). Panel (c) shows the market demand curve. At any given price, the quantity demanded by the market is the sum of the quantities demanded by Darla and Dino. For example, at a price of $30 per pair, Darla demands 3 pairs of jeans per year and Dino demands 2 pairs per year. So the quantity demanded by the market is 5 pairs per year.

Clearly, the quantity demanded by the market at any given price is larger with Dino present than it would be if Darla were the only consumer. The quantity demanded at any given price would be even larger if we added a third consumer, then a fourth, and so on. So an increase in the number of consumers leads to an increase in demand.

For a review of the factors that shift demand, see Table 4-1.

4-1

Factors That Shift Demand

BEATING THE TRAFFIC

All big cities have traffic problems, and many local authorities try to discourage driving in the crowded city center. If we think of an auto trip to the city center as a good that people consume, we can use the economics of demand to analyze anti-

One common strategy is to reduce the demand for auto trips by lowering the prices of substitutes. Many metropolitan areas subsidize bus and rail service, hoping to lure commuters out of their cars. An alternative is to raise the price of complements: several major U.S. cities impose high taxes on commercial parking garages and impose short time limits on parking meters, both to raise revenue and to discourage people from driving into the city.

A few major cities—

The current daily cost of driving in London ranges from £8 to £10 (about $13 to $16). And drivers who don’t pay and are caught pay a fine of £120 (about $195) for each transgression.

Not surprisingly, studies have shown that after the implementation of congestion pricing, traffic does indeed decrease. In the 1990s, London had some of the worst traffic in Europe. The introduction of its congestion charge in 2003 immediately reduced traffic in the London city center by about 15%, with overall traffic falling by 21% between 2002 and 2006. And there was increased use of substitutes, such as public transportation, bicycles, motorbikes, and ride-

In the United States, the U.S. Department of Transportation has implemented pilot programs to study congestion pricing. The programs were so successful that congestion pricing has become policy in some states. Other states, taking suggestions from traffic experts, are trying variable congestion prices, raising prices during peak commuting hours. So even though congestion pricing has been controversial, it appears to be gaining acceptance.

4

Solutions appear at the back of the book.

Check Your Understanding

Explain whether each of the following events represents (i) a change in demand (a shift of the demand curve) or (ii) a change in the quantity demanded (a movement along the demand curve).

-

a. A store owner finds that customers are willing to pay more for umbrellas on rainy days.

The quantity of umbrellas demanded is higher at any given price on a rainy day than on a dry day. This is a rightward shift of the demand curve, since at any given price the quantity demanded rises. This implies that any specific quantity can now be sold at a higher price. -

b. When XYZ Telecom, a long-

distance telephone service provider, offered reduced rates on weekends, its volume of weekend calling increased sharply. The quantity of weekend calls demanded rises in response to a price reduction. This is a movement along the demand curve for weekend calls. -

c. People buy more long-

stem roses the week of Valentine’s Day, even though the prices are higher than at other times during the year. The demand for roses increases the week of Valentine’s Day. This is a rightward shift of the demand curve. -

d. A sharp rise in the price of gasoline leads many commuters to join carpools in order to reduce their gasoline purchases.

The quantity of gasoline demanded falls in response to a rise in price. This is a movement along the demand curve.

-

Multiple-

Question

Which of the following would increase demand for a normal good? A decrease in

A. B. C. D. E. Question

A decrease in the price of butter would most likely decrease the demand for

A. B. C. D. E. Question

If an increase in income leads to a decrease in demand, the good is

A. B. C. D. E. Question

Which of the following will occur if consumers expect the price of a good to fall in the coming months?

A. B. C. D. E. Question

Which of the following will increase the demand for disposable diapers?

A. B. C. D. E.

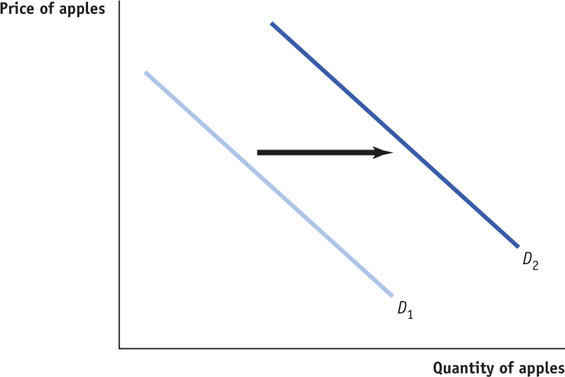

Critical-

Draw a correctly labeled graph showing the demand for apples. On your graph, illustrate what happens to the demand for apples if a new report from the Surgeon General finds that an apple a day really does keep the doctor away.

DEMAND VERSUS QUANTITY DEMANDED

Consider how the term demand is used in the following sentence. Why is the sentence incorrect?

Consider how the term demand is used in the following sentence. Why is the sentence incorrect?

If the price of the good goes up then people will buy less and this will lead to a fall in demand which shifts the demand curve to the left.

THIS STATEMENT MISTAKES A CHANGE IN QUANTITY DEMANDED FOR A CHANGE IN DEMAND. WHEN DOING ECONOMIC ANALYSIS, IT IS IMPORTANT TO MAKE THE DISTINCTION BETWEEN CHANGES IN DEMAND, WHICH MEAN SHIFTS OF THE DEMAND CURVE, AND CHANGES IN QUANTITY DEMANDED. When economists say “an increase in demand,” they mean a rightward shift of the demand curve, and when they say “a decrease in demand,” they mean a leftward shift of the demand curve—

THIS STATEMENT MISTAKES A CHANGE IN QUANTITY DEMANDED FOR A CHANGE IN DEMAND. WHEN DOING ECONOMIC ANALYSIS, IT IS IMPORTANT TO MAKE THE DISTINCTION BETWEEN CHANGES IN DEMAND, WHICH MEAN SHIFTS OF THE DEMAND CURVE, AND CHANGES IN QUANTITY DEMANDED. When economists say “an increase in demand,” they mean a rightward shift of the demand curve, and when they say “a decrease in demand,” they mean a leftward shift of the demand curve—

To learn more, see Figure 4.3 for an illustration of a movement along the demand curve versus a shift of the demand curve.